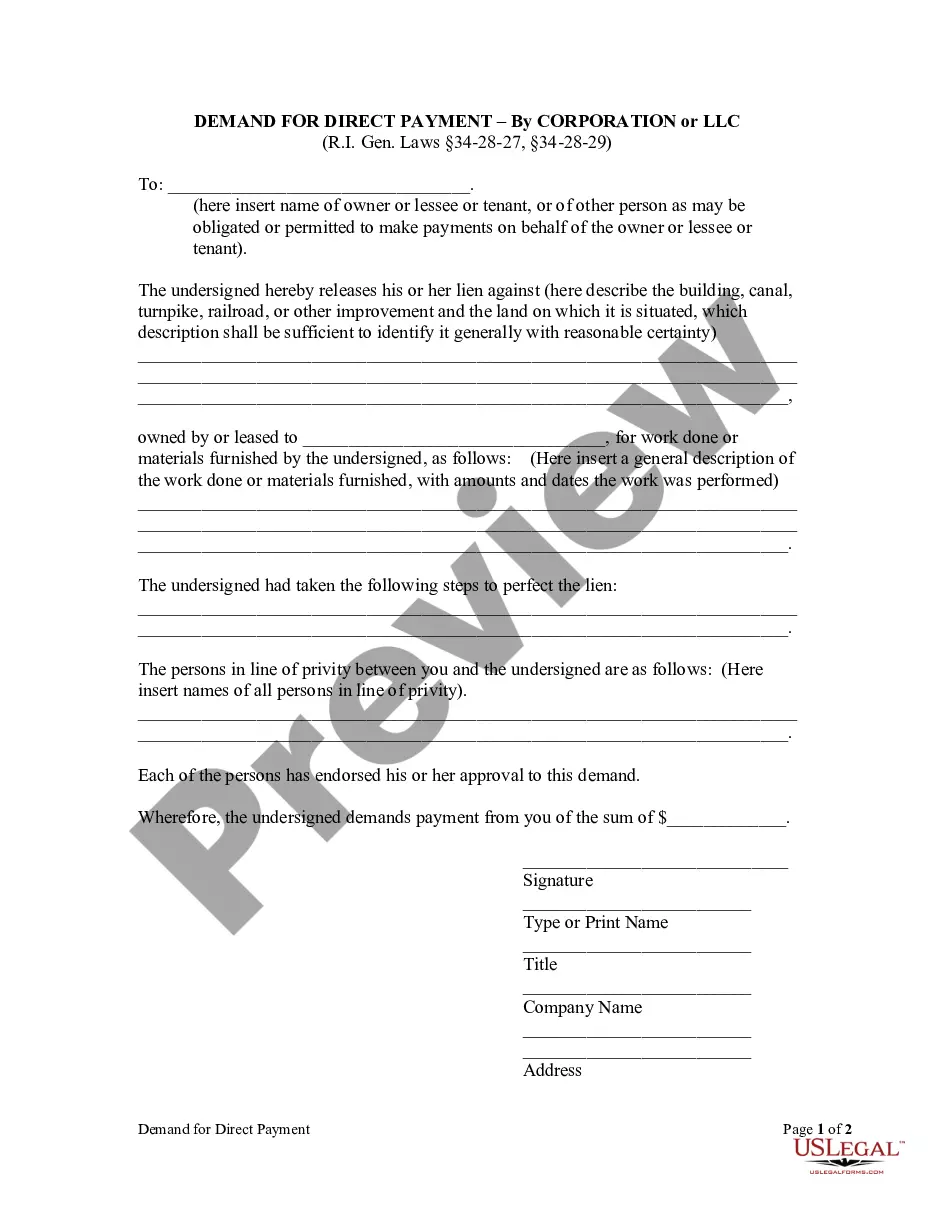

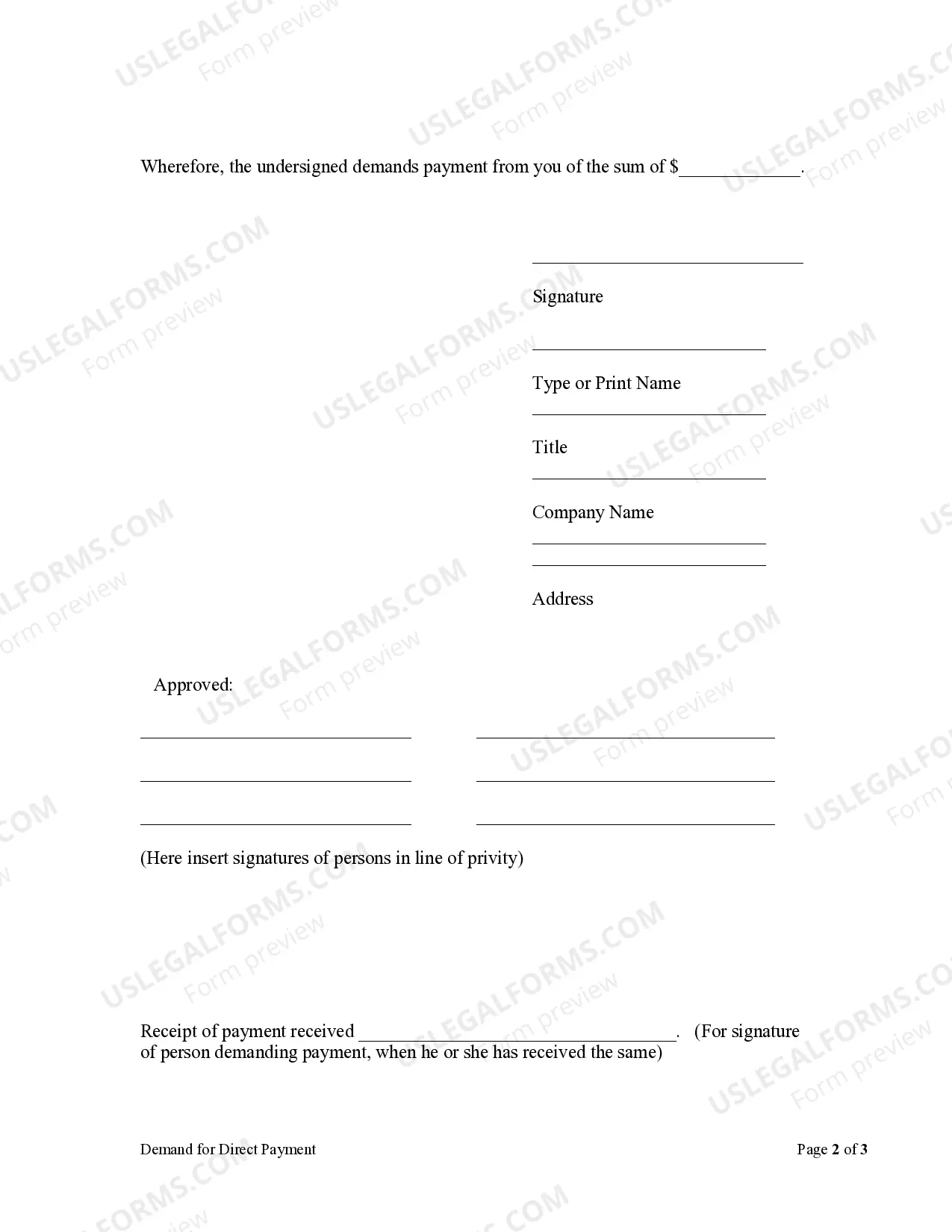

Any person entitled to any lien under § 34-28-1, 34-28-2 or 34-28-3 who releases the lien before receiving payment for the work done or materials furnished forming the basis of the lien, shall be entitled to demand and receive direct payment therefor from the owner or lessee or tenant or other person as may be obligated or permitted to make the payment on behalf of the owner or lessee or tenant, provided that the person entitled to the lien first obtains the written consent of all persons in line of privity between him or her and the owner or other person; on presentation of a proper demand for the payment, the owner or lessee or tenant or other person shall, if satisfied as to the amount thereof, make payment, on proper receipt therefor, and credit shall be given therefor by all persons in line of privity between the owner or other person and the person releasing the lien.

Form Llc In Rhode Island Withholding

Description

Form popularity

FAQ

Forming an LLC in Rhode Island can take anywhere from a few days to a couple of weeks, depending on your method. If you file online through US Legal Forms, you can expedite the process significantly. This platform helps you prepare your forms quickly and accurately, minimizing delays. Overall, using a reliable service can help you efficiently form an LLC in Rhode Island withholding.

The simplest way to form an LLC in Rhode Island is to use an online service like US Legal Forms. This platform simplifies the process by providing the necessary documentation, step-by-step guidance, and support. You can fill out the required forms efficiently, ensuring you meet all state requirements. By choosing US Legal Forms, you streamline your journey to successfully form an LLC in Rhode Island withholding.

The best number of deductions to claim on your W4 depends on your personal financial situation, including dependents and expenses. Generally, you should aim to balance your withholdings to avoid owing taxes or receiving a large refund. Understanding the Form LLC in Rhode Island withholding rules can help you make informed decisions. Utilizing resources from USLegalForms can guide you in determining the right strategy for your circumstances.

Yes, Rhode Island does have a W4 form, which is used for withholding tax purposes. You need to complete this form to inform your employer how much tax to withhold from your paycheck. It's essential to ensure accuracy, especially when considering the Form LLC in Rhode Island withholding implications on your tax obligations. USLegalForms can simplify this process by providing the latest forms and guidance.

To file your LLC taxes by yourself, first gather all your financial records for the year. Use IRS Form 1065 to report your business income and expenses if you are a partnership, or Form 1120 if you're a corporation. Keep in mind the Form LLC in Rhode Island withholding requirements, as state laws may differ. You can explore resources on USLegalForms to help navigate this process effectively.

Your Rhode Island withholding account number is a unique identifier assigned to you by the Rhode Island Division of Taxation after you register for withholding tax. You can find this number on correspondence from the tax division or by contacting them directly. If you are planning to form an LLC in Rhode Island, obtaining this account number should be one of your priorities.

Yes, if you hire employees in Rhode Island, you are required to have Rhode Island withholding. This means that you need to deduct state taxes from your employees' wages and remit them to the state. Being aware of Rhode Island withholding is essential when you form an LLC in Rhode Island to ensure that you remain compliant.

To fill out the Rhode Island W4 form, start by entering your personal information such as your name, address, and Social Security number. Next, indicate your filing status and any allowances you wish to claim. It’s essential to calculate your withholding accurately, especially if you are planning to form an LLC in Rhode Island withholding taxes.

The withholding tax rate in Rhode Island varies depending on the amount of taxable income generated. It is essential to monitor these rates, especially if you form an LLC, as they influence the amount you will withhold from employee wages. Keeping up to date with state regulations ensures that your business remains compliant.

Form RI 941 is the Quarterly Employer's Tax Return used in Rhode Island. This form reports employee wages and taxes withheld from paychecks, including state income tax. As a business owner forming an LLC in Rhode Island, timely filing of this form is crucial to ensure compliance with payroll tax obligations.