Pa Attorney Pennsylvania Without

Description

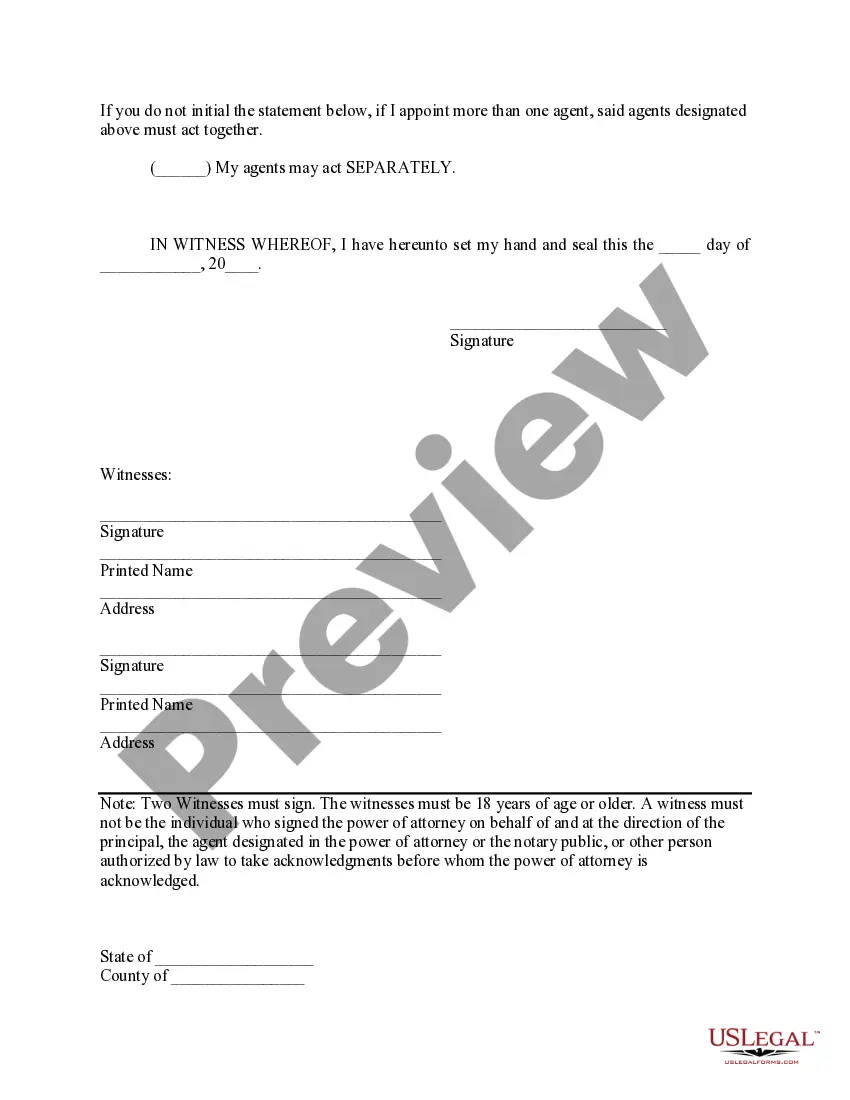

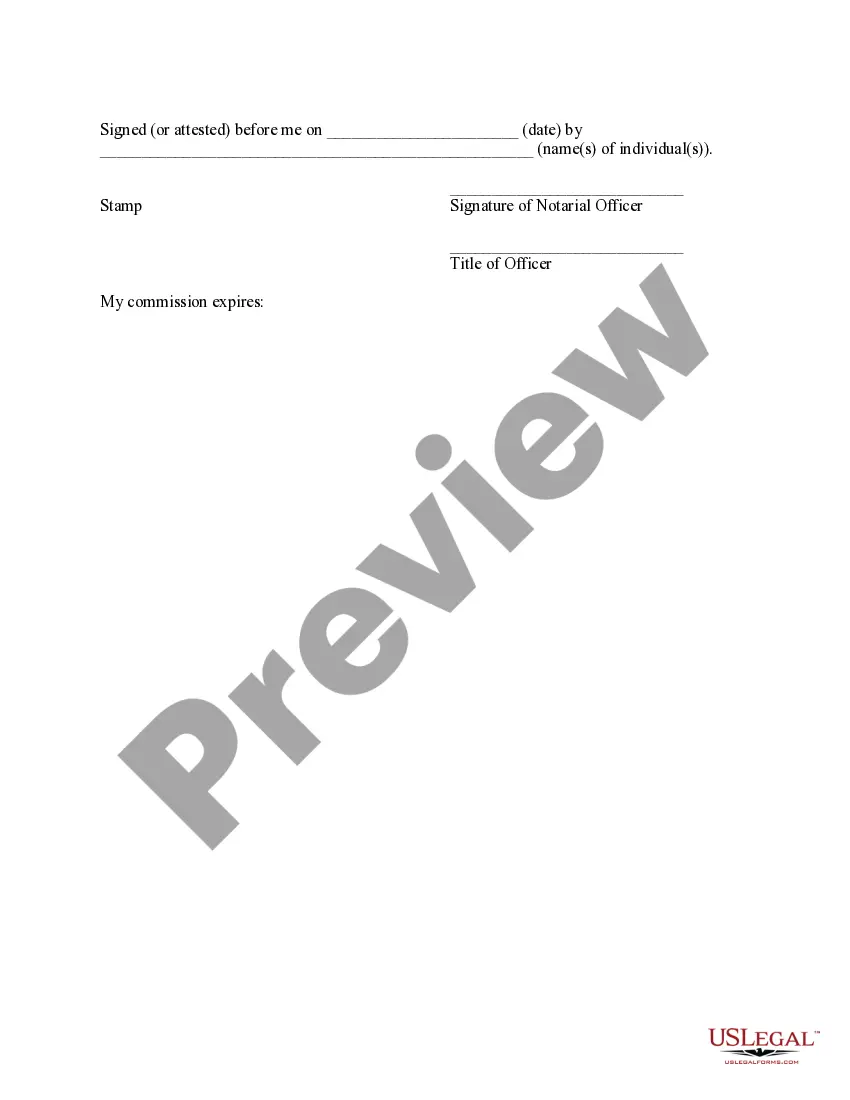

How to fill out Pennsylvania General Power Of Attorney?

Obtaining legal document examples that comply with federal and state regulations is essential, and the internet provides numerous alternatives to select from.

However, what is the benefit of spending time searching for the suitable Pa Attorney Pennsylvania Without sample online if the US Legal Forms digital library already houses such templates consolidated in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable documents created by attorneys for any professional and personal situation.

Review the template using the Preview feature or via the text outline to confirm it aligns with your specifications.

- They are simple to navigate with all documents classified by state and intended use.

- Our experts keep up with legal updates, ensuring that your documents are always current and compliant when acquiring a Pa Attorney Pennsylvania Without from our site.

- Acquiring a Pa Attorney Pennsylvania Without is straightforward and speedy for both existing and new customers.

- If you possess an account with a valid subscription, Log In and store the document sample you need in the correct format.

- If you are new to our platform, follow the instructions below.

Form popularity

FAQ

The Sole Proprietorship requires obtaining a PAN card for a proprietor, opening a bank account in the name of the business, a Certificate of Registration under the Shop and Establishment Act of the respective state and GST Registration.

There are also no fees involved with forming or maintaining this business type. If you want to operate an Arizona sole proprietorship, all you need to do is start working. However, just because it's so easy to get started doesn't mean there aren't some additional steps you should take along the way.

To establish a sole proprietorship in California, you need to register a business name with the county clerk or secretary of state and obtain any licenses or permits that may be required by your city or county.

You don't have to register your Sole Proprietorship with the Arizona Secretary of State. It simply exists once you decide to start a business and engage in business activities. However, if your Sole Proprietorship will use a DBA (aka Trade Name), then that needs to be filed with the Arizona Secretary of State.

You don't need to take any legal steps to form this type of business. If you are the only owner and begin conducting business, you automatically become a sole proprietorship. There is no need to formally file paperwork or submit anything at the federal, state, or local level to be recognized as such.