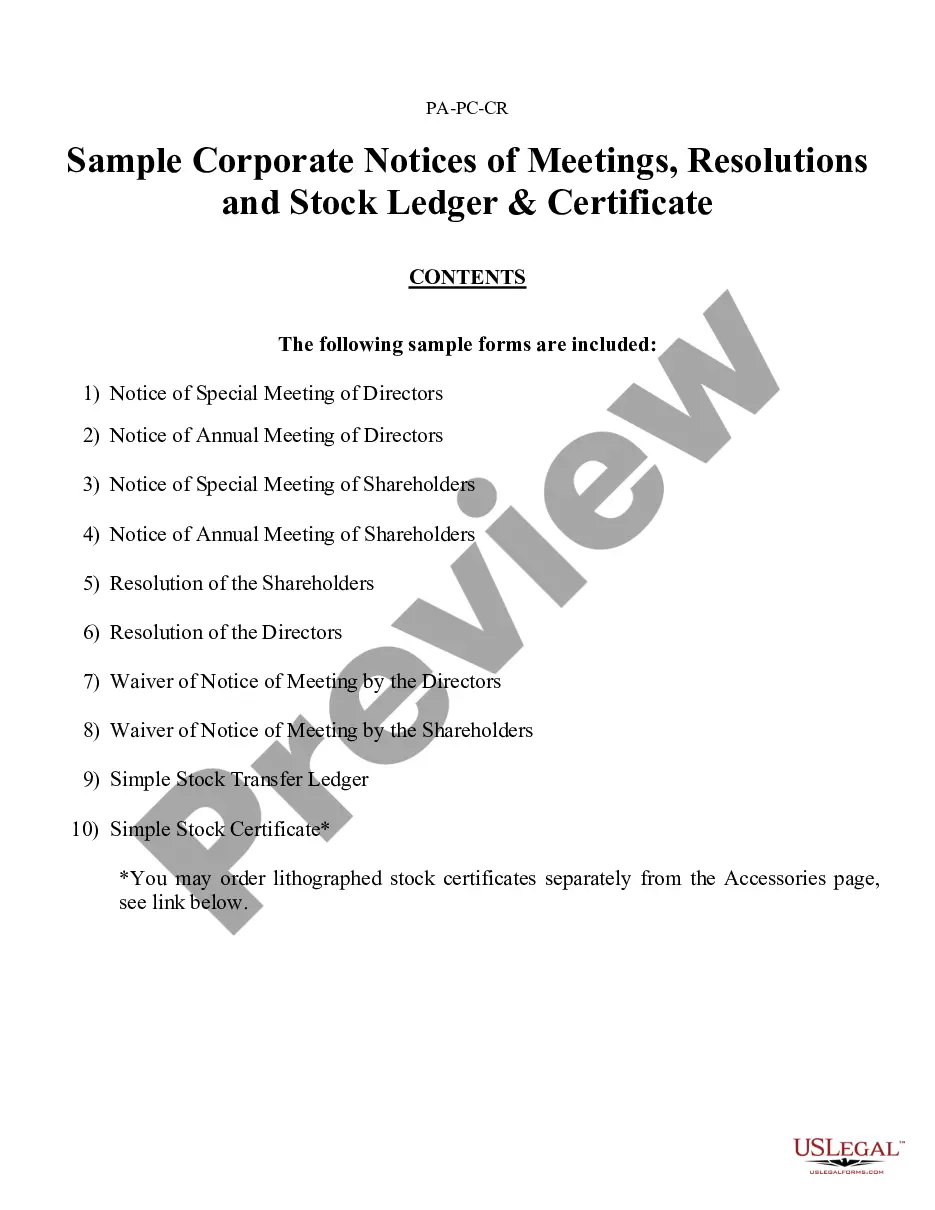

Form Stock Ledger For S Corp

Description

Form popularity

FAQ

To create a stock ledger, start by documenting essential details such as shareholder names, addresses, and the number of shares owned. Next, record any transactions, including stock issuances and transfers, maintaining clarity and accuracy at every step. Using resources like USLegalForms can simplify this process, helping you efficiently form stock ledger for S Corp and ensuring you meet all necessary legal standards.

An LLC typically does not have a stock ledger because it operates on a membership basis rather than issuing stock. However, it's important for LLCs to maintain records of ownership interests and member transactions. If your LLC is planning to convert to an S Corp or similar entity, understanding how to form stock ledger for S Corp becomes crucial for compliance and smooth transitions.

A cap table, or capitalization table, summarizes a company's ownership structure and funding rounds. In contrast, a stock ledger is a detailed record of stock ownership, transactions, and transfers specific to individual shareholders. While both documents are important for tracking equity, a stock ledger provides more granular details for each stockholder, making it essential for businesses, especially when you need to form stock ledger for S Corp.

A ledger is a broader financial record that tracks all transactions within the company, while a shareholder register specifically documents ownership information regarding shareholders. The shareholder register will typically be a subset of the ledger, focusing solely on shares. By understanding how to form stock ledger for s corp, you can establish clear, organized records that benefit both your corporation and its shareholders.

To fill out a stock ledger, start by listing the names of shareholders, followed by their respective share ownership, and add columns for transaction dates and certificate numbers. Make sure to update this document every time shares are issued or transferred. For ease and accuracy, consider learning how to form stock ledger for s corp, so you can streamline this important task.

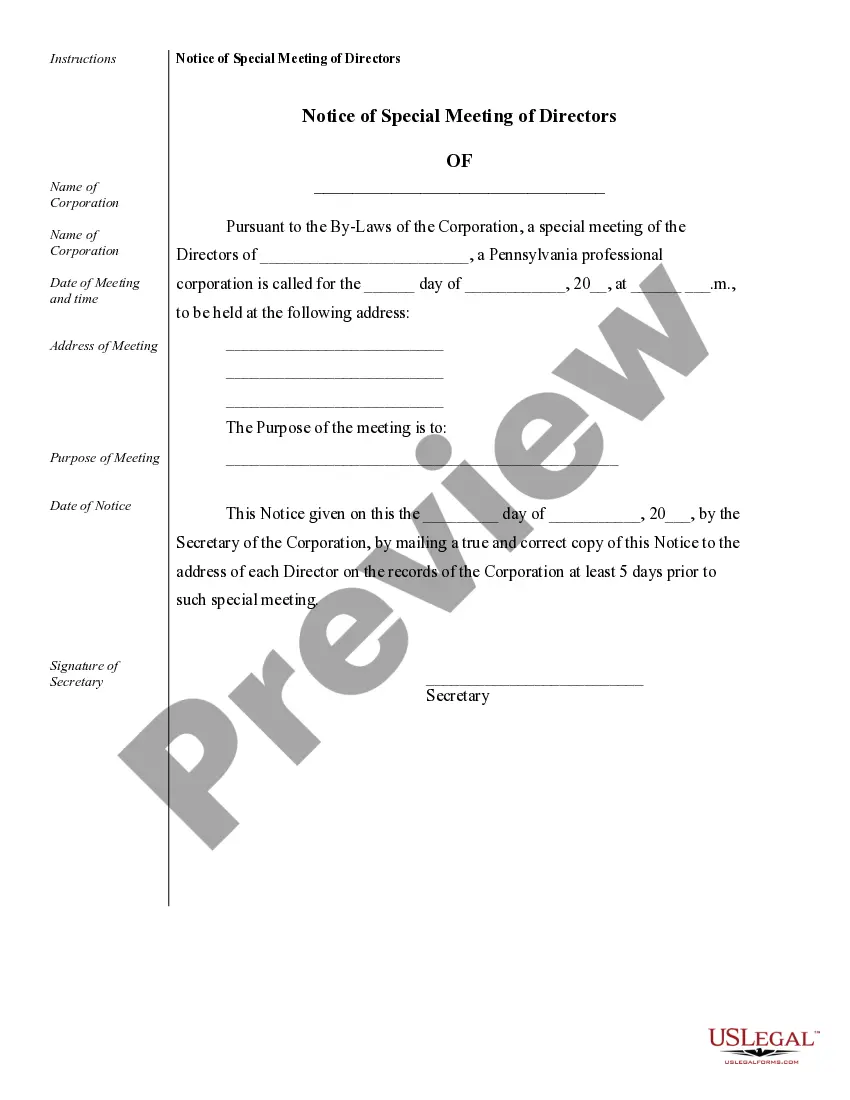

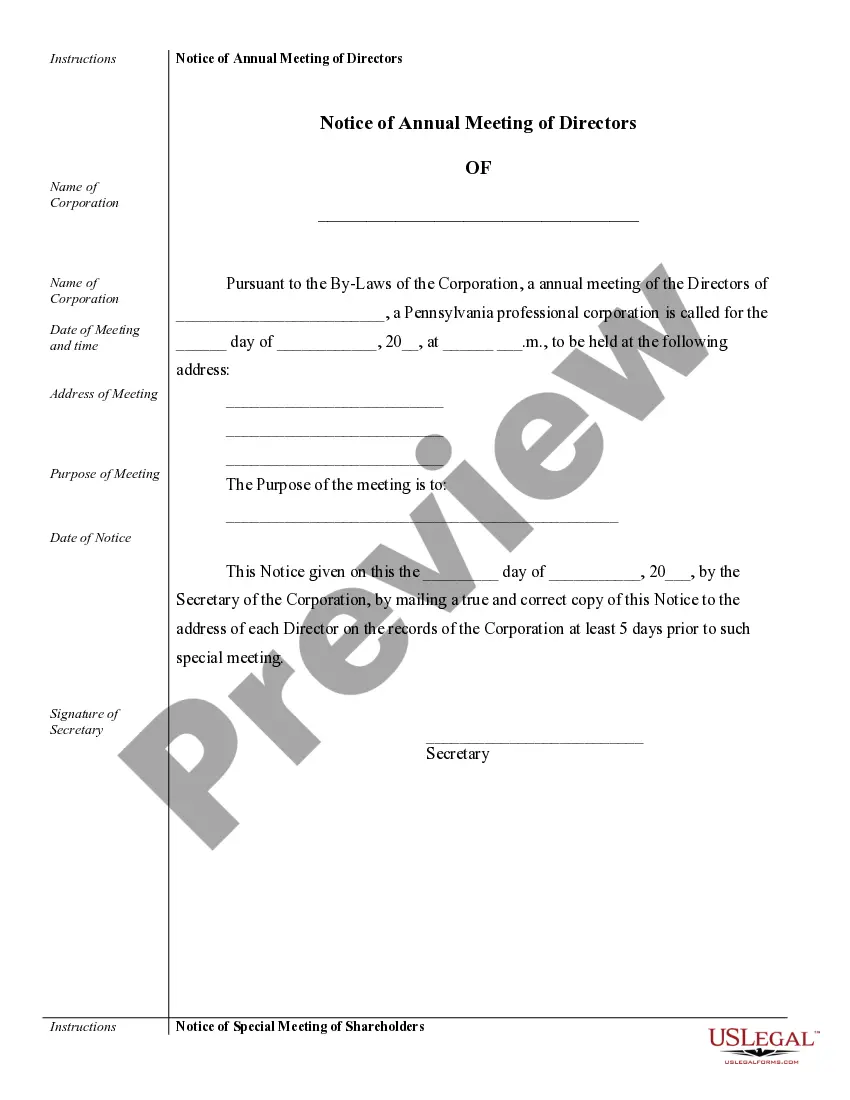

A shareholder certificate usually features the corporation’s name, a unique certificate number, and details about the number of shares owned. It often includes security features to prevent fraud and may display the company’s logo. Understanding how to form stock ledger for s corp integrates this documentation into your overall management system for enhanced clarity and traceability.

Filling out a corporate stock certificate involves entering the corporation's name, the shareholder's name, the amount of shares issued, and the date of issuance. You also need to include signatures from corporate officers to validate the document. Learning how to accurately form stock ledger for s corp will complement your stock certificates, ensuring all associated records are synchronized.

A stock ledger is typically a document or digital file that lists all shareholders, detailed shareholdings, and transaction history. It includes columns for shareholder names, addresses, number of shares owned, and dates of transactions. For your business, knowing how to form stock ledger for s corp is crucial, as this ensures you maintain proper ownership records and comply with regulations.

A shareholder ledger is a formal record of a corporation's shareholders and their respective ownership interests. This ledger tracks the issuance and transfer of shares, helping maintain accurate ownership documentation. To effectively manage your ownership records, consider how to form stock ledger for s corp. This lays the foundation for clear communication and compliance with legal requirements.

A corporation stock ledger is a record of the ownership of shares in a corporation. It documents each shareholder's details—who owns the shares, how many shares are held, and when shares were transferred. If you want to confidently handle shareholder records, consider using a tool to help you form a stock ledger for S Corp efficiently.