Power Attorney For Bank Account

Description

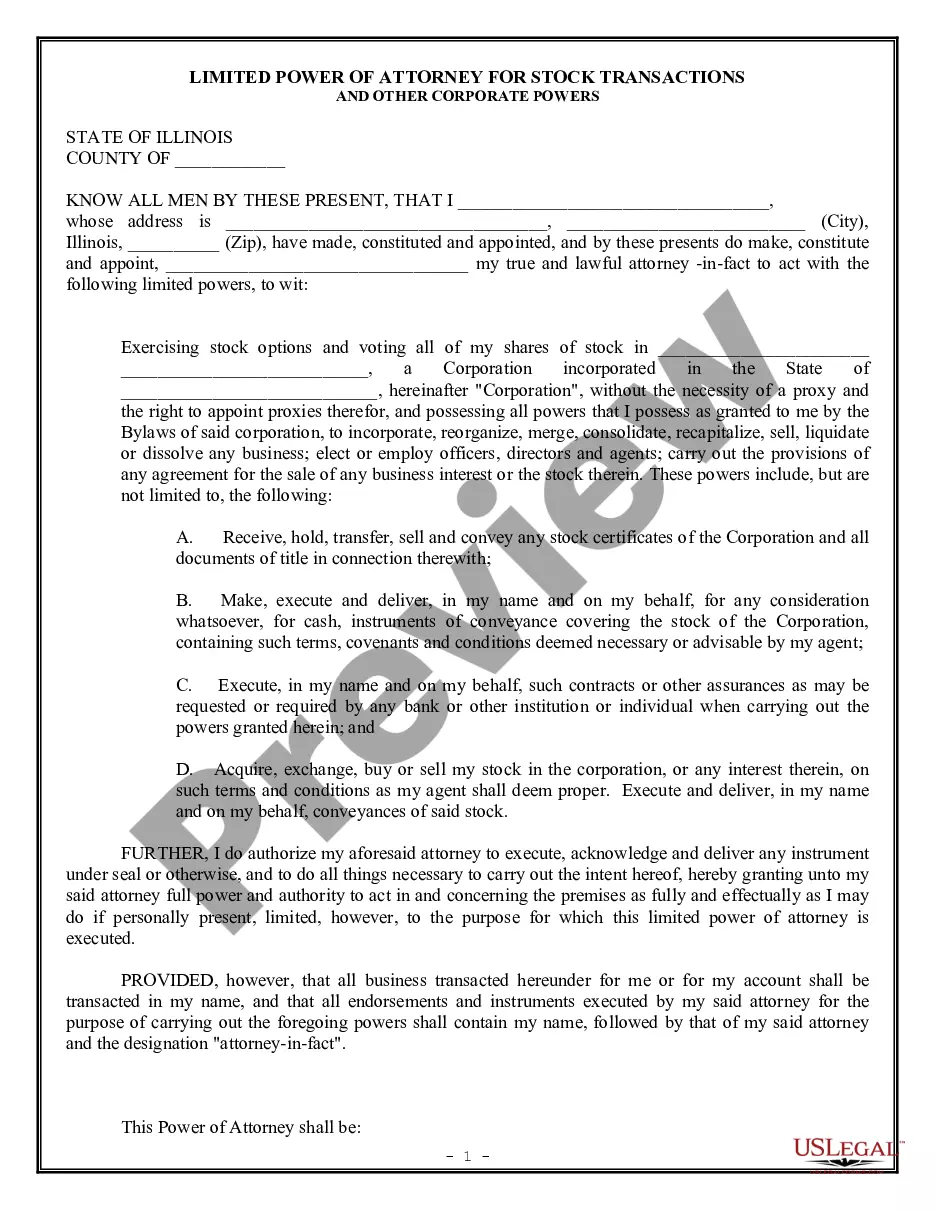

How to fill out Pennsylvania Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- If you are a returning user, log into your account and select the needed template to download it onto your device. Verify that your subscription is active; renew it if it has expired.

- For new users, begin by exploring the Preview mode of the available form. Review its description to confirm that it suits your needs and complies with your local regulations.

- If the form does not meet your requirements, use the Search tab to find a more appropriate template before proceeding to the next step.

- To purchase the document, click on the Buy Now button and select your preferred subscription plan. You’ll need to create an account to gain full access to the library.

- Complete your purchase by entering your credit card details or opting for payment via PayPal.

- Finally, download your completed form to your device, allowing you to fill it out and access it anytime from the My Forms section of your profile.

By utilizing US Legal Forms, you’re tapping into a vast resource that empowers individuals and attorneys alike to navigate legal requirements effortlessly. With over 85,000 editable legal forms and access to expert guidance, you can ensure that your documents are both accurate and compliant.

Get started today and simplify your legal processes with US Legal Forms!

Form popularity

FAQ

Yes, you can give someone permission to access your bank account by using a power of attorney for bank account purposes. This legal document allows you to designate a trusted individual to manage your financial affairs on your behalf. It's essential to ensure that the power of attorney is properly drafted and executed to avoid any issues later. At US Legal Forms, you can find templates and resources to help you create a power of attorney that meets your needs.

To get power of attorney for a bank account, start by choosing a trusted individual to act on your behalf. Next, you need to create the power of attorney document—this is where using a platform like USLegalForms can be invaluable, as it provides templates and guidance tailored for financial matters. After completing the document, you should sign it in the presence of a notary, if required by your state. Once that’s done, share copies with your bank to ensure they recognize the appointed person's authority.

Yes, you can give someone access to your bank account by setting up a power of attorney for a bank account. This legal document allows you to appoint an individual to manage your financial affairs when you are unable to do so. You can specify the extent of their access, ensuring they can only perform actions you allow. Using a service like USLegalForms can simplify the process, making it easier to create a customized power of attorney tailored to your needs.

Yes, a power of attorney can be added to a bank account, allowing someone you trust to manage your financial matters. Banks generally require a certified copy of the POA document to acknowledge the authority of the designated agent. This setup allows the agent to access and manage the account without needing your direct involvement. It's a practical solution, especially during times when you may not be able to handle your banking needs yourself.

To activate a power of attorney for finances, provide the appointed agent with a copy of the POA document. Make sure that the document meets your state's legal requirements. The agent can then present this document to financial institutions as needed to manage your accounts. If you remain uncertain, consider seeking help from professional services, such as those offered by uslegalforms.

The approval time for a power of attorney at a bank can vary, but typically it takes one to two business days. The process can be quicker if you have all required documents ready and if the bank has clear policies in place. If banks have questions or need additional information, it may take longer. Therefore, it's wise to stay in touch with the bank's representative during this time.

To add a power of attorney (POA) to your bank account, you must present the POA document to your bank. The bank will likely require copies of the document to verify its validity. Once approved, the person designated in the POA can access and manage the account on your behalf. This is especially useful if you want someone else to handle your banking needs while ensuring everything remains under your control.

To add someone to your bank account, visit your bank's local branch or access your online banking profile. You will typically need to provide identification and complete a form that includes the new account holder's information. Ensure that you communicate your wishes clearly, and remember that adding someone involves sharing financial responsibilities. For complex situations, consider using a power attorney for bank account to manage access.

Choosing between a power of attorney and a joint bank account depends on your specific needs. A power of attorney allows for focused authority without co-ownership, while a joint account means shared access and responsibility over the funds. Evaluate your situation to determine what fits best for both your financial management and future planning. Uslegalforms can help you navigate these options and make informed decisions.

To write a power of attorney letter for a bank, include your full name, the agent's name, and specific powers granted regarding the bank account. Clearly outline what actions your agent can take, such as making deposits, withdrawals, or closing accounts. Having a structured template can save you time and ensure all necessary details are included. Uslegalforms offers user-friendly templates to guide you through this process.