Attorney Form Legal Withholding

Description

How to fill out Pennsylvania Power Of Attorney Forms Package?

Working with legal paperwork and operations can be a time-consuming addition to your day. Attorney Form Legal Withholding and forms like it often require you to look for them and understand how to complete them properly. Consequently, if you are taking care of financial, legal, or personal matters, using a thorough and practical web catalogue of forms when you need it will significantly help.

US Legal Forms is the best web platform of legal templates, featuring over 85,000 state-specific forms and a variety of tools to assist you complete your paperwork quickly. Explore the catalogue of relevant papers available to you with just one click.

US Legal Forms provides you with state- and county-specific forms available at any moment for downloading. Safeguard your document administration processes with a top-notch services that allows you to put together any form within minutes without having additional or hidden charges. Just log in to the account, locate Attorney Form Legal Withholding and acquire it right away in the My Forms tab. You may also access formerly downloaded forms.

Is it the first time using US Legal Forms? Sign up and set up your account in a few minutes and you’ll have access to the form catalogue and Attorney Form Legal Withholding. Then, stick to the steps below to complete your form:

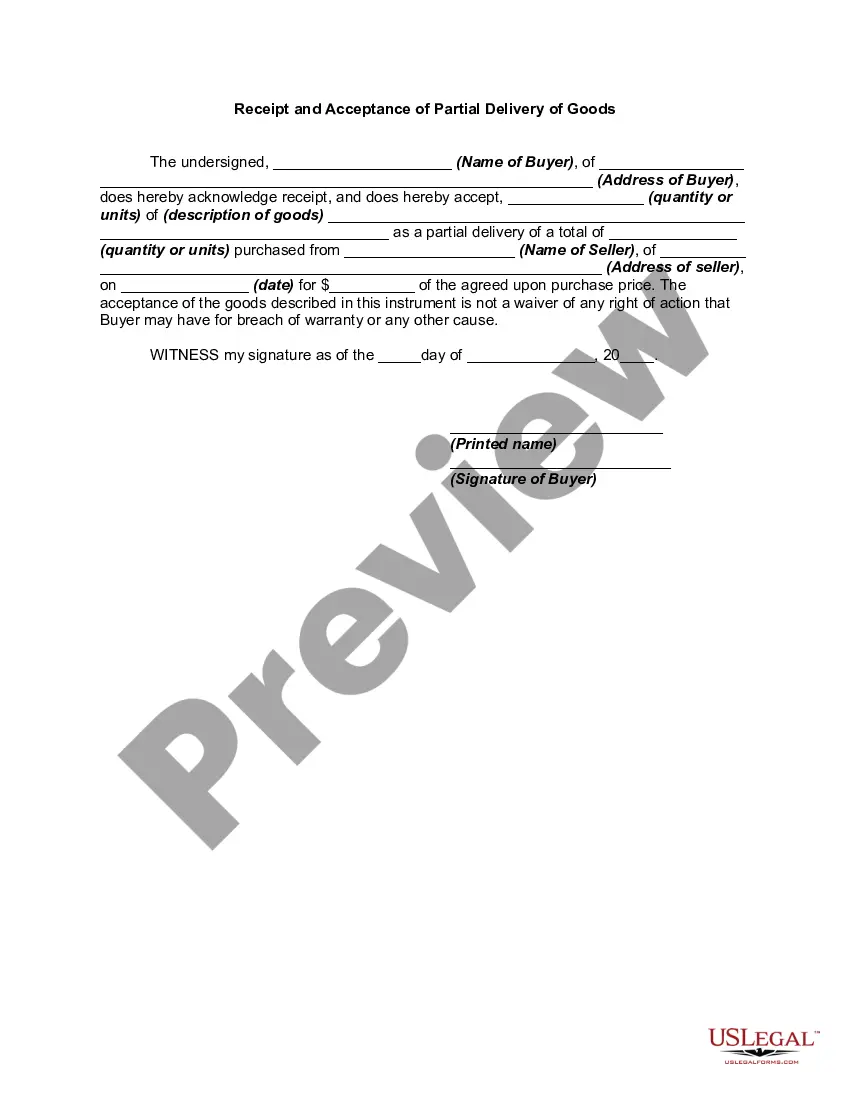

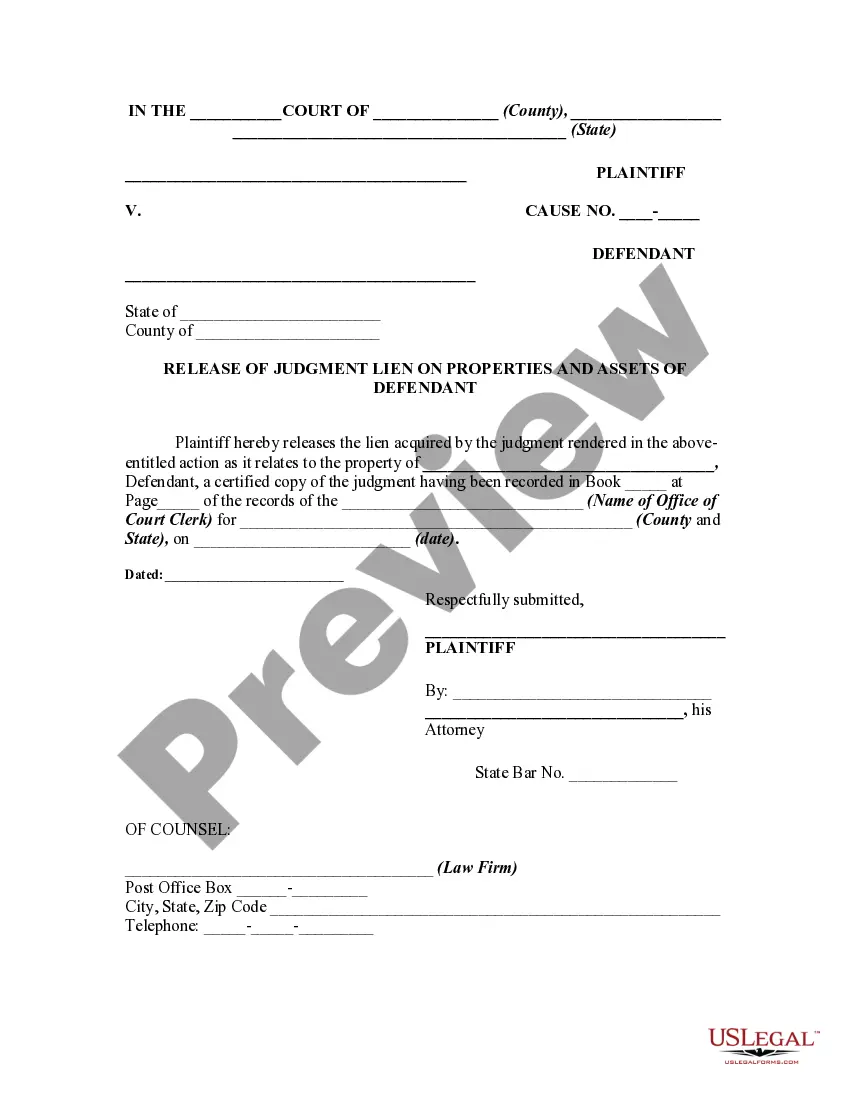

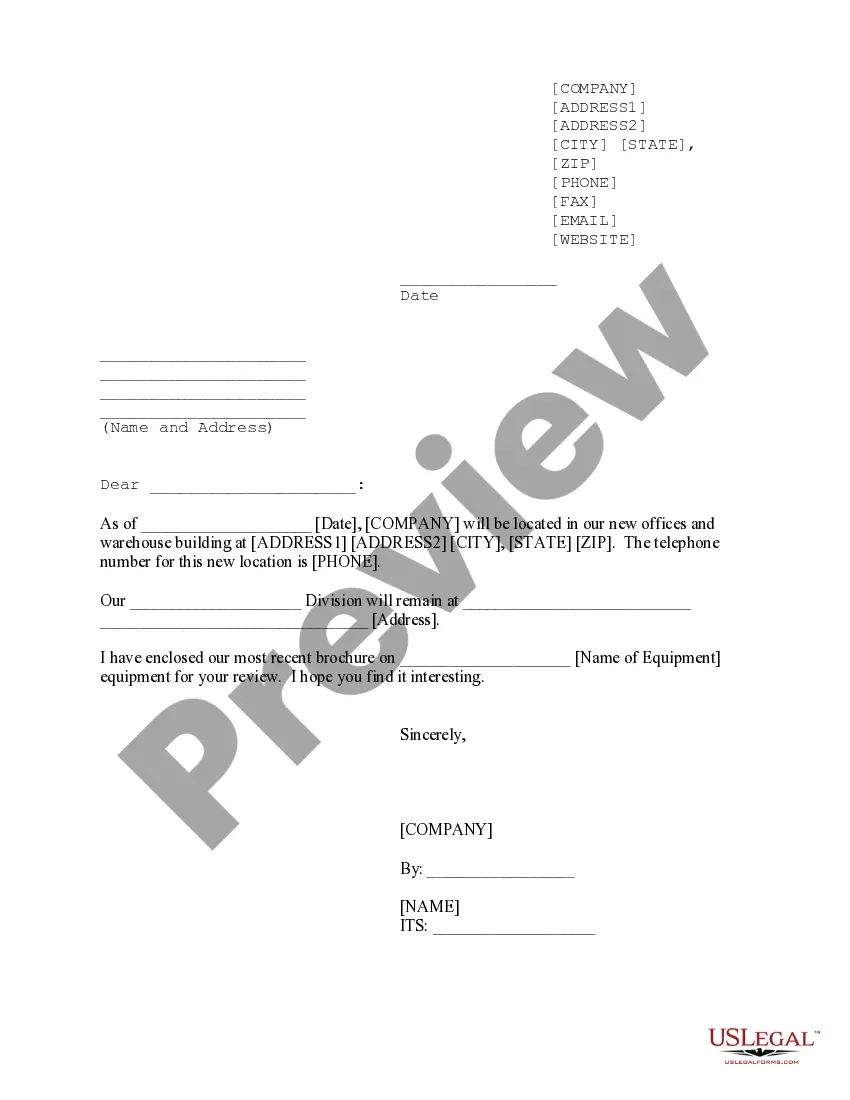

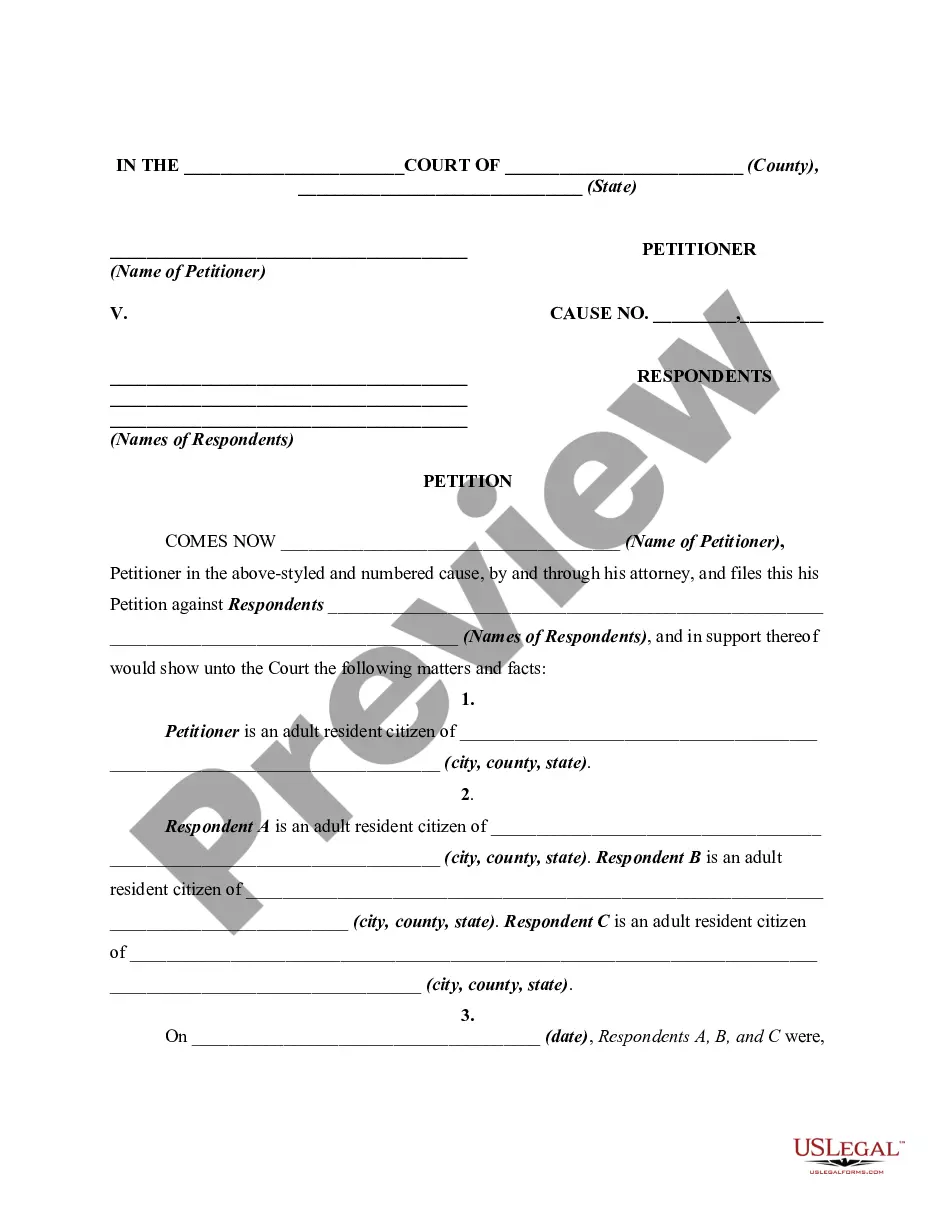

- Ensure you have found the right form by using the Review feature and reading the form description.

- Select Buy Now once ready, and choose the subscription plan that is right for you.

- Press Download then complete, sign, and print the form.

US Legal Forms has twenty five years of experience helping consumers control their legal paperwork. Obtain the form you require today and enhance any process without breaking a sweat.

Form popularity

FAQ

You must provide the taxpayer's name, address and Taxpayer Identification Number. If you plan to represent a married filing joint couple, you need to submit a separate Form 2848 for each spouse and finally, the last item listed on this slide, you can only enter one Tax Identification Number on Line 1.

Form 8821 authorizes the IRS to disclose your confidential tax information to the person you appoint. This form is provided for your convenience and its use is voluntary. The information is used by the IRS to determine what confidential tax information your appointee can inspect and/or receive.

If your representative wants to withdraw from representation, he or she must write ?WITHDRAW? across the top of the first page of the power of attorney with a current signature and date below the annotation.

Form 2848, Power of Attorney and Declaration of RepresentativePDF when you want to authorize an individual to represent you before the IRS, or. Form 8821, Tax Information AuthorizationPDF, when you want to name an individual to inspect confidential tax return information related to the bond issuance.

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.