Lien And Claim Waiver

Description

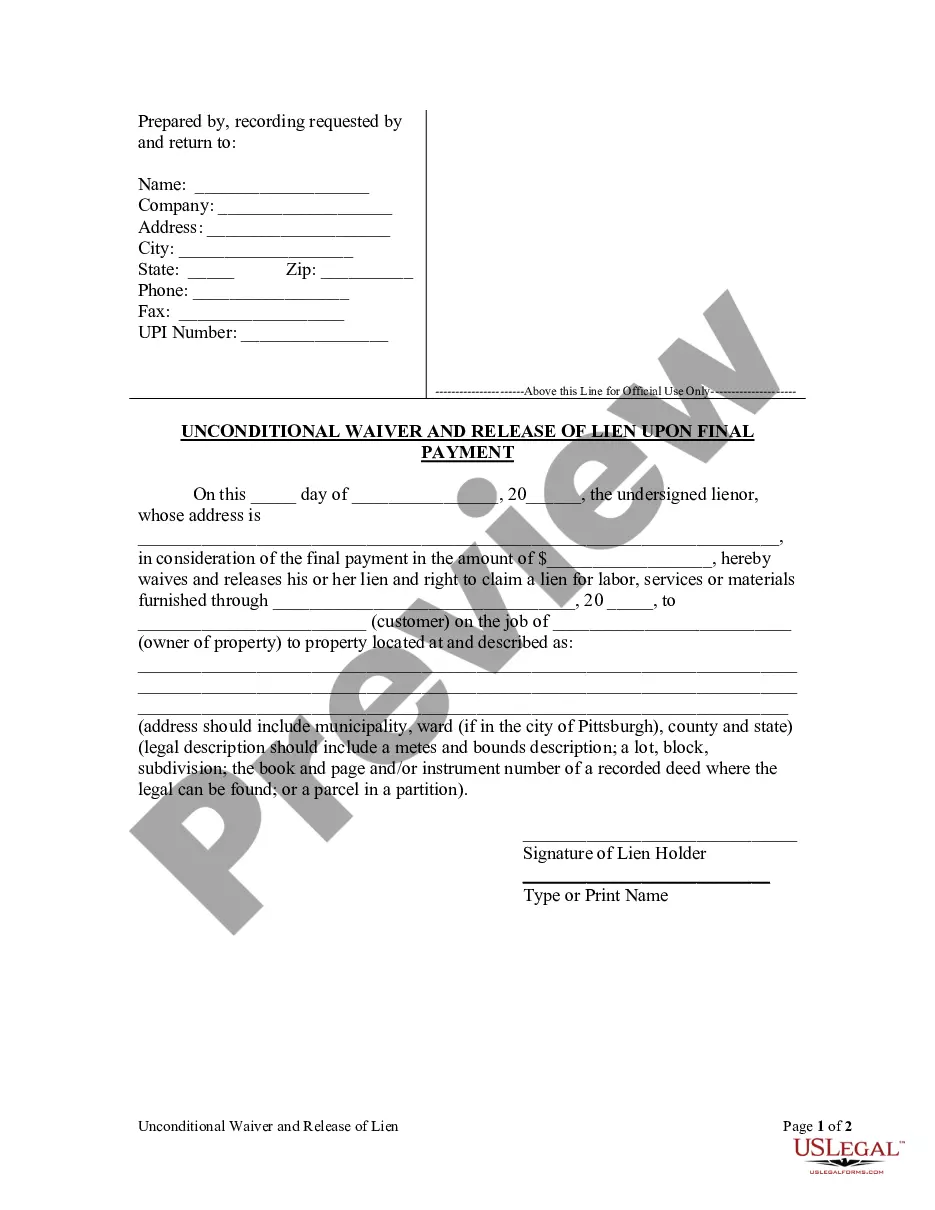

How to fill out Pennsylvania Unconditional Waiver And Release Of Claim Of Lien Upon Final Payment?

- Log in to your US Legal Forms account if you already have one, or create a new account to get started.

- Browse through the extensive library and locate the lien and claim waiver form that fits your needs. Use the preview mode to check it against your local jurisdiction requirements.

- If you need a different template, utilize the search function to find other relevant forms.

- Once you have the correct document, click on the 'Buy Now' button to select your subscription plan, and follow the registration prompt if applicable.

- Complete your purchase by entering your payment details using either a credit card or PayPal.

- Download your lien and claim waiver form onto your device and access it anytime from the 'My Forms' section of your account.

Following these steps will allow you to quickly and efficiently obtain your lien and claim waiver through US Legal Forms, making your documentation process straightforward.

Don't wait any longer—get started today and access all the legal forms you need with ease!

Form popularity

FAQ

A waiver claim serves to eliminate any future claims related to the matter specified in the waiver. This means that once a waiver claim is executed, the signer cannot make claims based on the agreed conditions, protecting both parties from future litigation. Utilizing tools like uslegalforms can streamline the process by providing easy access to properly structured waivers.

To waive a claim means that a party gives up their right to seek compensation or pursue a legal remedy for a particular issue. This can vary by situation, but generally, it involves formal documentation that acknowledges the relinquishment of that right. Understanding the implications of waiving a claim is essential for all parties involved in an agreement.

A landlord lien waiver is used specifically in rental agreements, where a landlord waives their right to place a lien on a tenant’s property for unpaid rent. This helps tenants feel secure about their possessions while ensuring that landlords receive proper payments without fear of financial loss. Both parties benefit from clear communication regarding payment expectations and responsibilities.

A claim waiver is similar to a lien waiver but focuses specifically on relinquishing the right to make any claims against another party. This might apply in various contexts, including employment agreements or settlement conditions. By understanding the implications of a claim waiver, parties can help to avoid future legal disputes.

The purpose of a lien and claim waiver is to provide security and clarity in contractual agreements. By signing a waiver, parties ensure that all received payments are acknowledged, which helps to prevent claims against a property. It streamlines the payment process and establishes clear expectations between contractors and property owners, thereby reducing disputes.

Signing a lien and claim waiver does not necessarily mean you cannot sue. It typically means that the party waives their right to claim a lien for unpaid debts related to specific work or materials. However, parties may still pursue legal action for other issues, so it’s important to read the waiver carefully and consider your rights.

A lien waiver is a document that relinquishes an individual's or company's right to place a lien on a property for a payment owed. This means that once a lien waiver is signed, the party gives up the right to make a claim against the property for unpaid services or materials. Understanding lien waivers is crucial in real estate transactions, as they often serve to protect property owners from unexpected claims.

Filling out a conditional waiver of a lien involves several straightforward steps. First, identify the parties involved, including the claimant and the property owner. Write the amount being owed and specify the condition, usually tied to receiving payment. Make sure to include all required details and sign the document. Our templates at US Legal Forms can help you navigate this process efficiently.

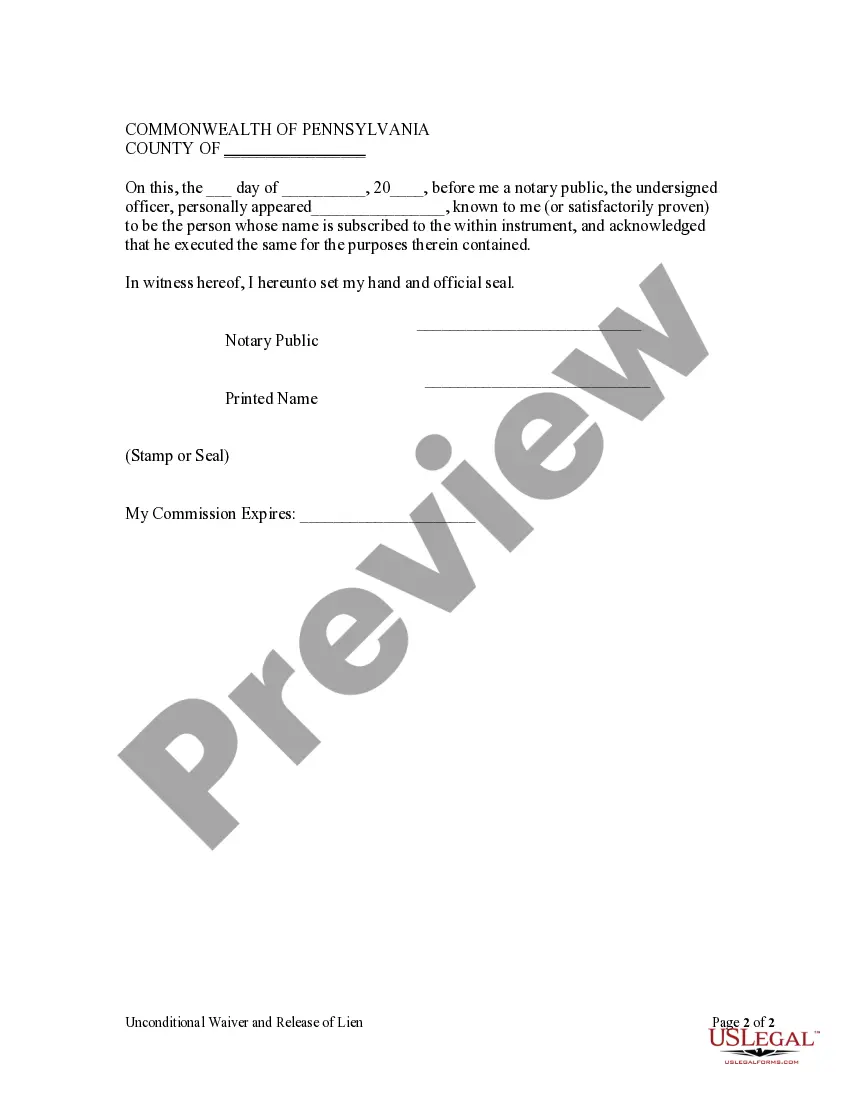

In Illinois, to create a lien waiver, you need to provide the full names of the parties, a description of the property, and the amount being waived. It is critical to state whether the waiver is conditional or unconditional. Depending on the specifics of the situation, you may also need to include notarization or witness signatures. Utilizing US Legal Forms can help ensure that you meet all legal requirements for lien waivers in your state.

The best time to sign a lien waiver is upon receipt of payment for services rendered or materials supplied. This document should ideally be signed before any final payments or when the contract closes. By securing a lien and claim waiver early, you prevent any disputes and misunderstandings in the future. Ensure to keep records as proof of the waiver.