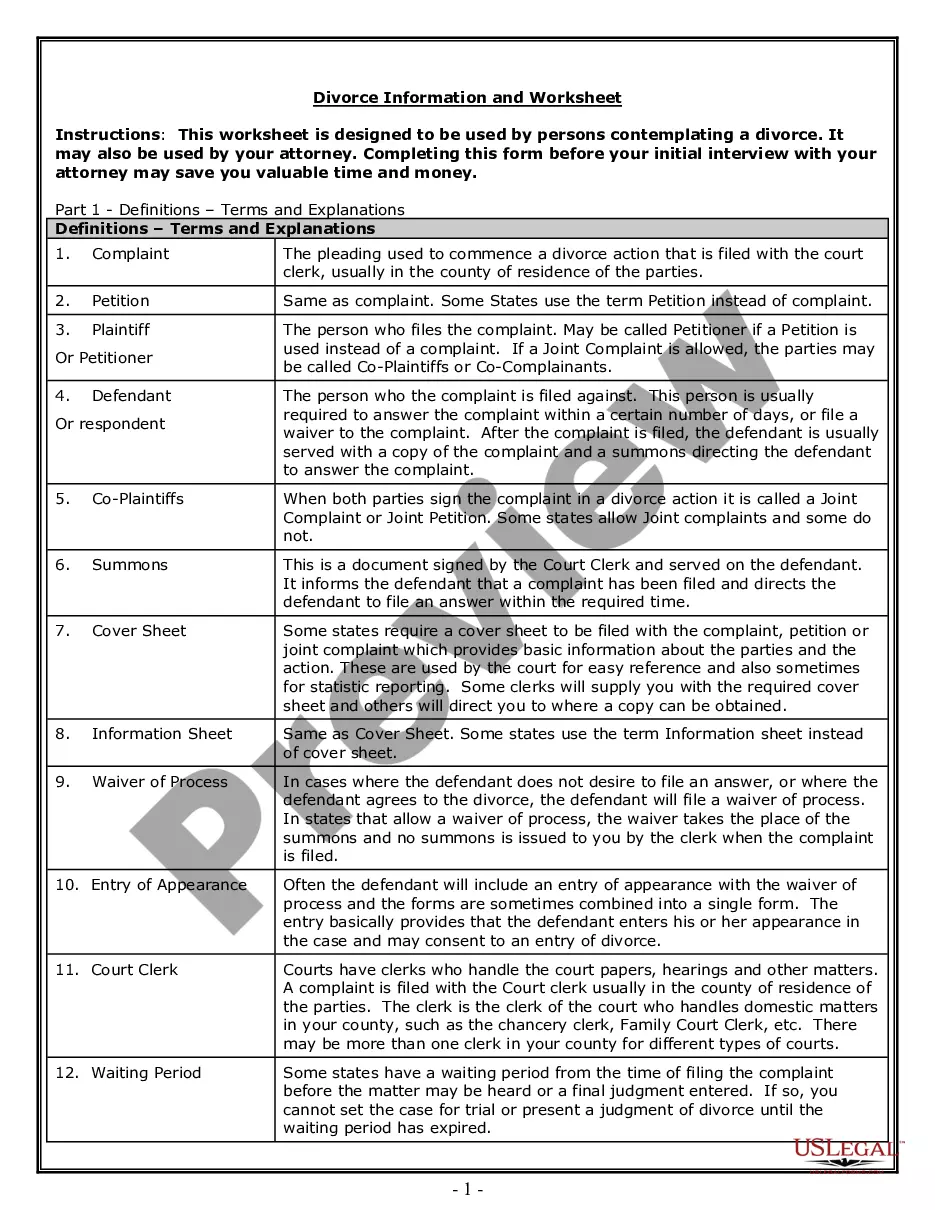

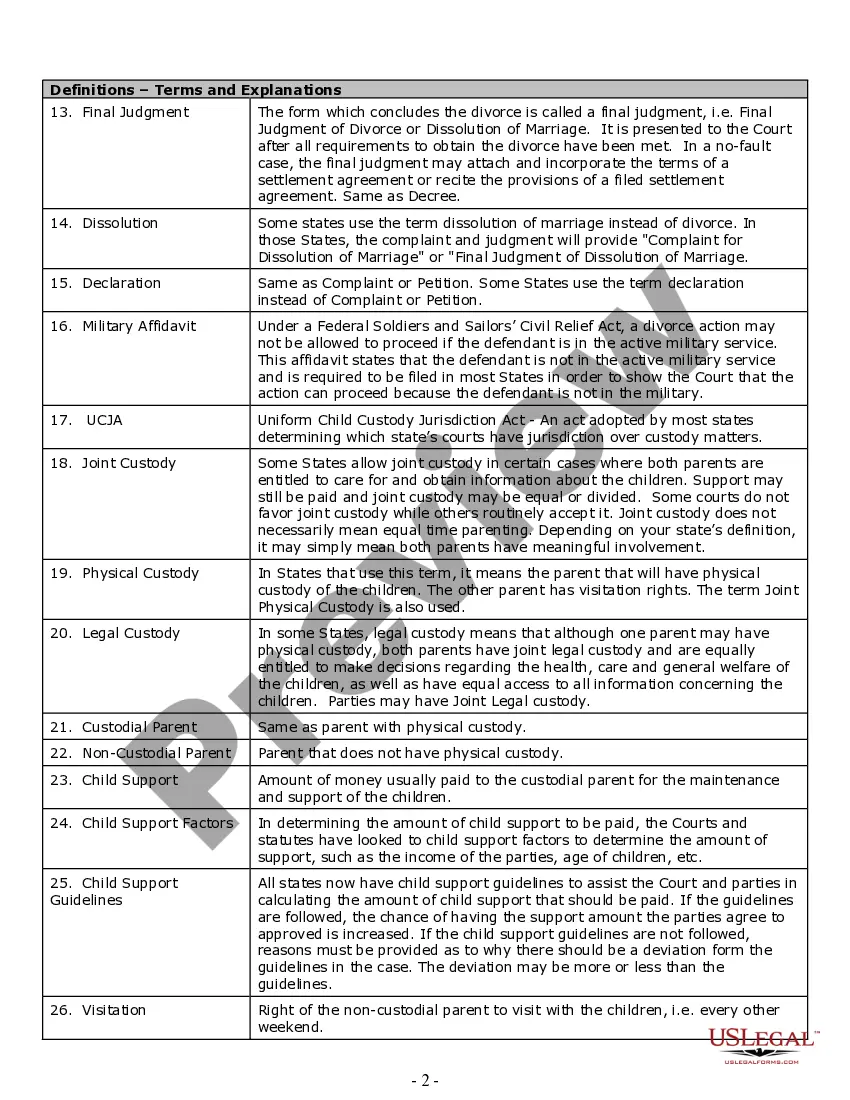

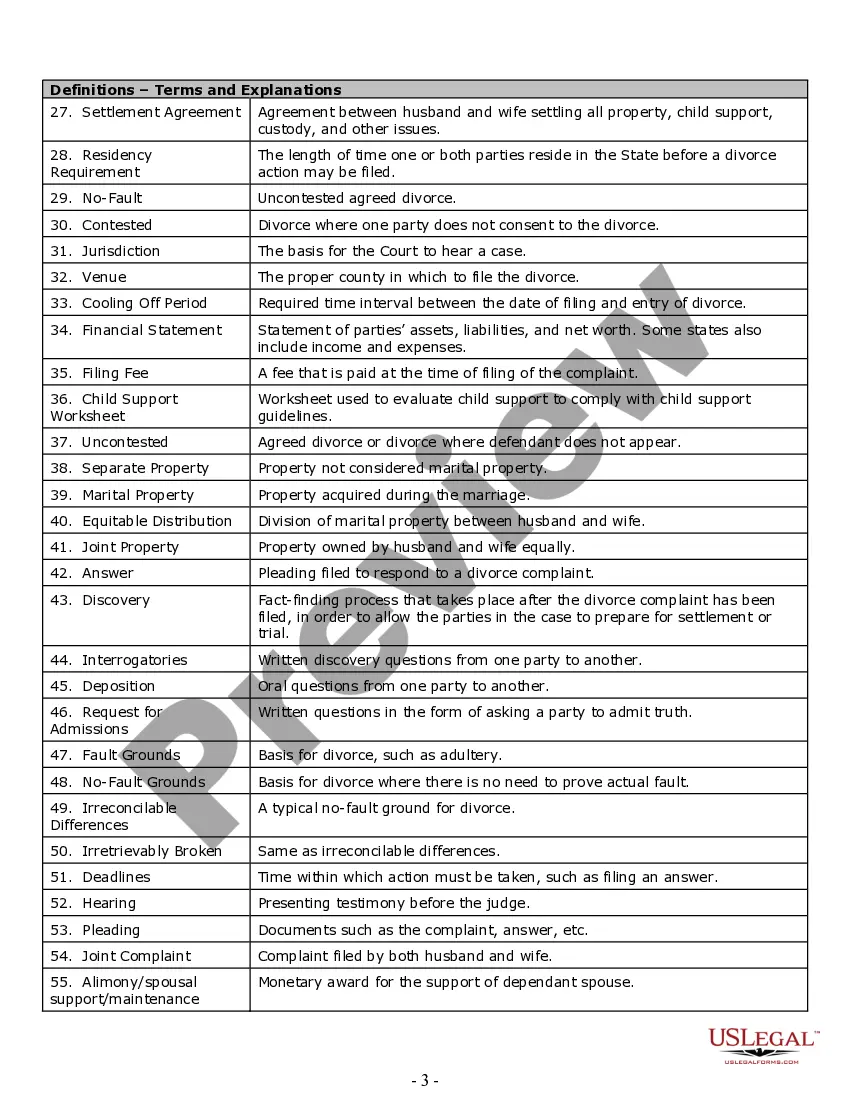

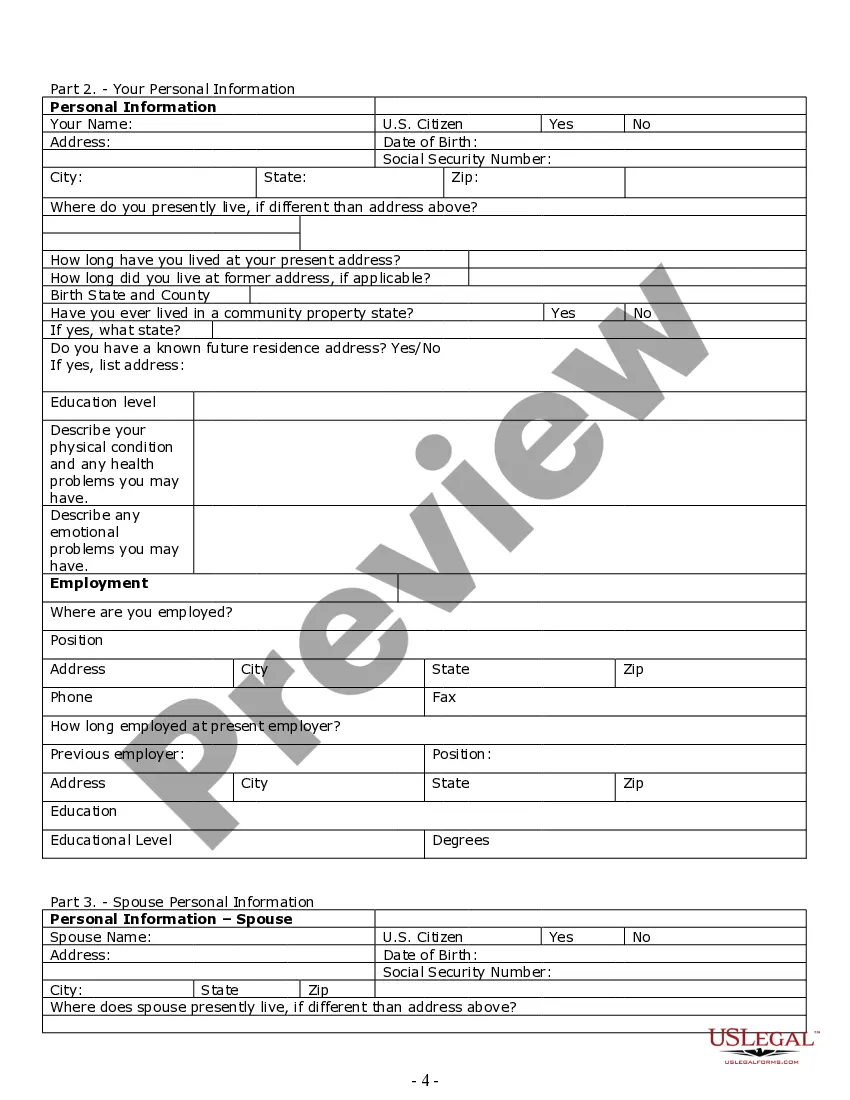

Pennsylvania Divorce and 401k: Understanding the Basics and Types Divorce is a complex and emotionally challenging process, and it becomes even more complicated when dealing with financial matters such as 401k plans. In Pennsylvania, as with other states, the division of assets including 401k plans is an essential part of the divorce process. Let's delve into the details of Pennsylvania divorce and 401k, and explore the different types of divorces that may affect the division of these retirement funds. A divorce in Pennsylvania refers to the legal dissolution of a marriage by a court, ending the marital union between two individuals. During this process, the division of assets, including any retirement savings, needs to be determined. A 401k is a common retirement plan that many individuals contribute to throughout their working years, offering tax advantages and potential employer matching contributions. When it comes to dividing a 401k during divorce, Pennsylvania follows the principle of equitable distribution. This means that the court will divide the marital property in a manner that it deems fair, but not necessarily equal. Pennsylvania's law considers any assets acquired during the marriage as marital property, subject to division. However, any portion of the 401k accumulated prior to the marriage or after the separation date may be considered separate property and not subject to division. In Pennsylvania, divorcing couples have a few options when it comes to splitting a 401k. The first and most common method is seeking an agreement through negotiation, where both parties decide how the account will be divided. This negotiation can be done directly between the spouses or with the help of their attorneys or mediators. If an agreement cannot be reached, the court will step in and make the decision regarding the division of the 401k. There are two key types of divorces that can impact the division of a 401k in Pennsylvania: an uncontested divorce and a contested divorce. In an uncontested divorce, the couple agrees on all terms and submits a settlement agreement to the court, including how the 401k will be divided. This puts the decision-making power in the hands of the divorcing couple, giving them more control over the outcome. In contrast, a contested divorce occurs when the couple cannot agree on one or more key issues, such as the division of assets like the 401k. In these cases, the court will step in and make decisions based on Pennsylvania's equitable distribution laws. The court will consider factors such as the length of the marriage, each spouse's financial situation, and contributions to the 401k when determining a fair division. It is important to note that a Qualified Domestic Relations Order (QDR) may be required to officially divide a 401k during divorce. A QDR is a legal document that establishes each spouse's right to a portion of the retirement plan and ensures that it is transferred properly. This document allows for the tax-free transfer of funds between the spouses. In summary, Pennsylvania divorce and 401k division involves navigating the laws of equitable distribution in the state. Couples have the opportunity to negotiate the division of their 401k through an uncontested divorce or rely on the court's decision in a contested divorce. Regardless of the type of divorce, a QDR may be necessary to legally divide the 401k. Seeking professional legal advice is crucial to ensure a fair and smooth process throughout the divorce and division of assets, including retirement savings.

Pennsylvania Divorce And 401k

Description

How to fill out Pennsylvania Divorce And 401k?

Legal papers managing can be mind-boggling, even for the most experienced specialists. When you are looking for a Pennsylvania Divorce And 401k and don’t get the a chance to spend searching for the correct and updated version, the operations might be nerve-racking. A strong web form library might be a gamechanger for anyone who wants to deal with these situations efficiently. US Legal Forms is a industry leader in online legal forms, with more than 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any demands you could have, from individual to business paperwork, all in one location.

- Utilize innovative resources to accomplish and manage your Pennsylvania Divorce And 401k

- Gain access to a resource base of articles, tutorials and handbooks and resources highly relevant to your situation and requirements

Save effort and time searching for the paperwork you need, and use US Legal Forms’ advanced search and Preview feature to discover Pennsylvania Divorce And 401k and download it. In case you have a membership, log in to the US Legal Forms account, look for the form, and download it. Take a look at My Forms tab to view the paperwork you previously downloaded as well as manage your folders as you see fit.

Should it be the first time with US Legal Forms, make a free account and have limitless access to all advantages of the library. Here are the steps to consider after downloading the form you want:

- Confirm it is the proper form by previewing it and looking at its information.

- Ensure that the sample is recognized in your state or county.

- Choose Buy Now when you are all set.

- Choose a monthly subscription plan.

- Pick the formatting you want, and Download, complete, sign, print out and send out your document.

Take advantage of the US Legal Forms web library, supported with 25 years of expertise and trustworthiness. Transform your day-to-day document managing in a smooth and intuitive process today.

Form popularity

FAQ

To register a work, you must submit a completed application form, the applicable filing fee, and a nonreturnable copy or copies of the work to be registered. In general, the term of copyright is the life of the author plus 70 years after the author's death (or last surviving author's death if a joint work).

Matthew Rossetti, founder and managing principal of Sentient Law, Ltd., cautions that online legal templates are an outright dangerous idea, and suggests businesses are better off drafting agreements of their own. ?Legal agreements are like prescription glasses.

EForms | The #1 website for free legal forms and documents.

Legal Templates has 2 pricing edition(s), from $0 to $95.88. A free trial of Legal Templates is also available.

There is nothing illegal about selling legal forms. Websites for companies like US Legal Forms and Small Business Legal Forms offer many, for very reasonable prices.

A free legal template is truly only free at the point of 'sale'. Free legal templates are great, until there is a dispute and you are in trouble. Then they are less than great.

Intellectual property (IP) is a term used to encompass a range of legal rights that protect the creations of the mind and creative effort. Patents, trademarks and registered designs are examples of IP, as is copyright. Copyright refers to the rights granted to the creators or copyright holders of original works.

Legal Templates headquartered in Greensboro, North Carolina equips businesses with tools to be their own legal advocates, using technology to create free legal documents simply and quickly. At LegalTemplates.net users find the form they need, choose their state, and can then customize the requested document.