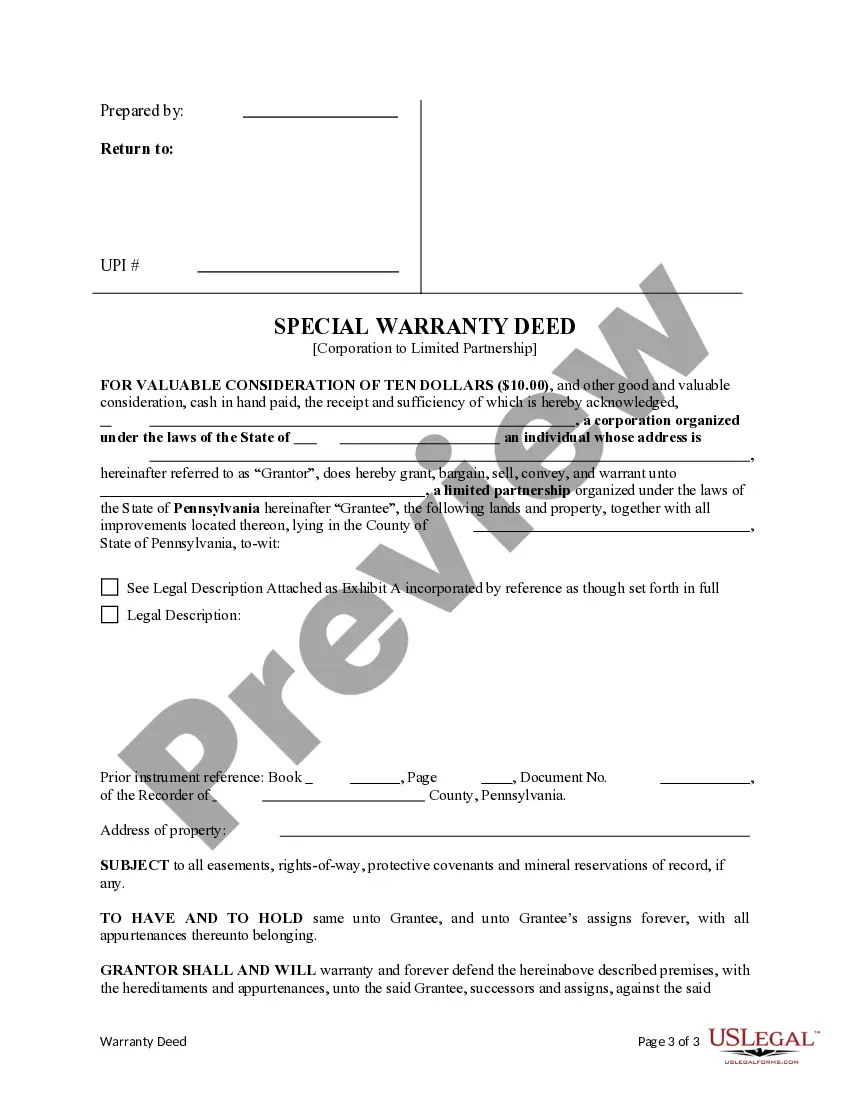

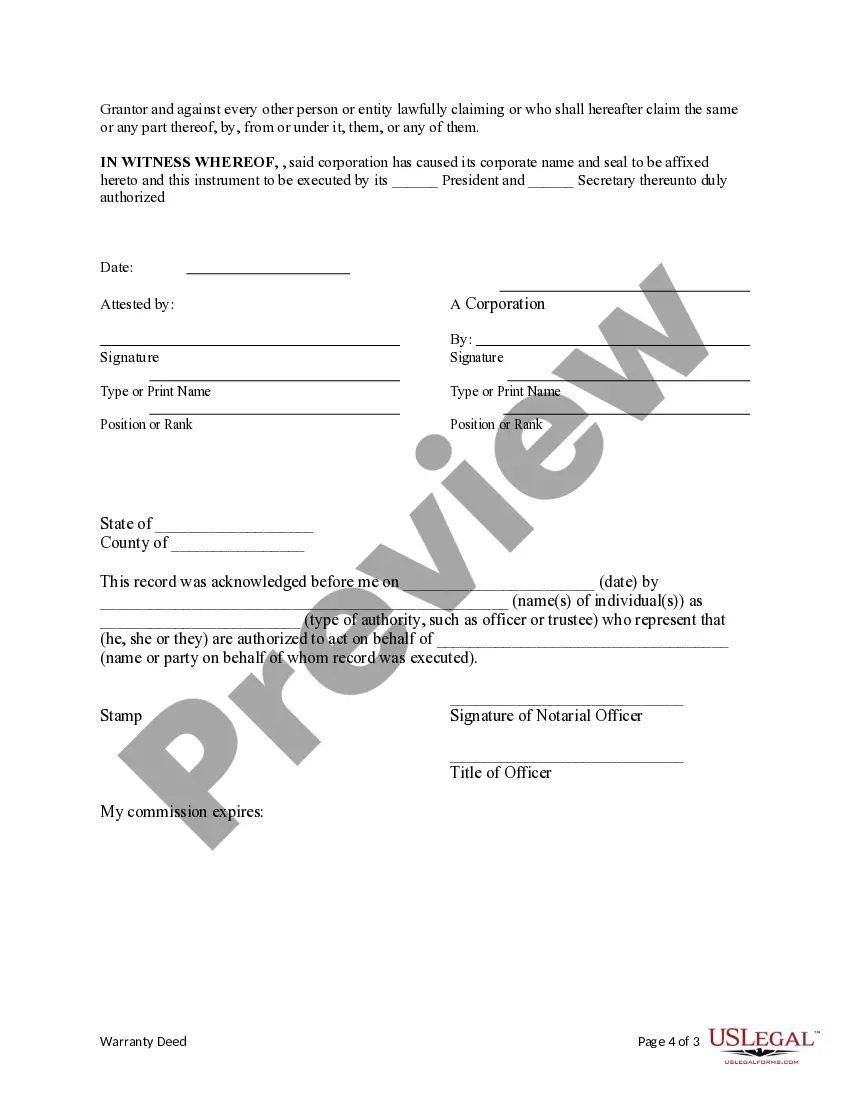

This form is a Special Warranty Deed where the Grantor is a corporation and the Grantee is a limited partnership. Grantor conveys and specially warrants the described property to the Grantee. The Grantor only warrants and will defend the property only as to claims of persons claiming by, through or under Grantor, but not otherwise. This deed complies with all state statutory laws.

Special Warranty Deed

Description

How to fill out Pennsylvania Special Warranty Deed From Corporation To Limited Partnership?

- If you're an existing user, log into your account and click the Download button to save your form template, ensuring your subscription is active. If it’s not, renew your plan.

- For first-time users, begin by reviewing the Preview mode and form description to confirm it's suitable for your needs and adheres to your local laws.

- If the selected template doesn't meet your requirements, utilize the Search tab to find an appropriate alternative.

- Once you identify the correct document, click on the Buy Now button and select your preferred subscription plan. Registration is necessary to access the complete library.

- Proceed to make your purchase by entering your credit card information or connecting your PayPal account to finalize the subscription.

- Download your form and save it on your device. You can revisit it anytime through the My Forms section of your account.

By following these straightforward steps, you can efficiently procure a special warranty deed tailored to your legal needs.

Experience the benefits of US Legal Forms today and ensure your legal documents are precise and reliable.

Form popularity

FAQ

The main risks of a special warranty deed include limited liability for undisclosed issues before the seller's ownership. If any title defects arise from prior owners, you may not have recourse against the seller. To mitigate these risks, it's wise to conduct a title search and consult resources like US Legal Forms for assistance. This way, you can better protect your investment.

Accepting a special warranty deed can be beneficial if you're aware of its limitations. Unlike a general warranty deed, it only guarantees that the seller holds the title during their ownership. Before accepting, consider consulting with a legal professional or uslegalforms to understand the implications. This will help you make an informed decision.

Yes, you can file a special warranty deed yourself, but it's important to understand the process. You need to ensure that you complete the deed correctly and file it with the appropriate county office. Using a platform like US Legal Forms can help simplify this process by providing you with templates and guidance. This can reduce the risk of errors and ensure compliance with local laws.

Certainly, you can sell a house using a special warranty deed. Be transparent with prospective buyers about what this type of deed entails. Explain that it provides limited assurances regarding the property's title history. Working with legal documents from US Legal Forms can help make this process clearer for both you and the buyer.

When considering land purchased with a special warranty deed, perform due diligence to avoid potential pitfalls. This type of deed may offer limited protection against past claims. Make sure to investigate any title issues thoroughly before making your decision. Utilizing resources from US Legal Forms can also aid in your research.

Yes, you can sell your house with a special warranty deed. However, it's important to clearly communicate this to potential buyers. They should understand the limitations of the deed, specifically that it only covers claims arising during your ownership. Collaborating with a legal professional or using US Legal Forms can streamline the process and ensure transparency.

The safest type of deed is typically considered a general warranty deed. This deed provides the most comprehensive protection for the buyer against any claims. It guarantees the title is clear throughout its entire history, not just during the seller's ownership. When possible, opting for this type of deed can greatly reduce your risks.

Buying a house with a special warranty deed requires careful consideration. Ensure to perform a thorough title search to unveil any potential issues. While this type of deed can be acceptable, it’s wise to proceed with caution if you uncover any red flags. Consulting with a real estate professional or using platforms like US Legal Forms can provide valuable insights.

A special warranty deed is a legal document used to transfer ownership of property. Unlike a general warranty deed, it only guarantees the title against claims that arose during the seller's period of ownership. This means it provides limited assurance to the buyer regarding the property’s history. It’s essential to understand these limitations when considering such a deed.

A special warranty deed serves as proof of ownership, but it comes with limitations. It guarantees that the seller has not done anything to harm the title during their ownership. However, it does not provide protection against issues that may have existed prior to the seller's ownership. Therefore, while it offers some assurance, you may still want to conduct a title search.