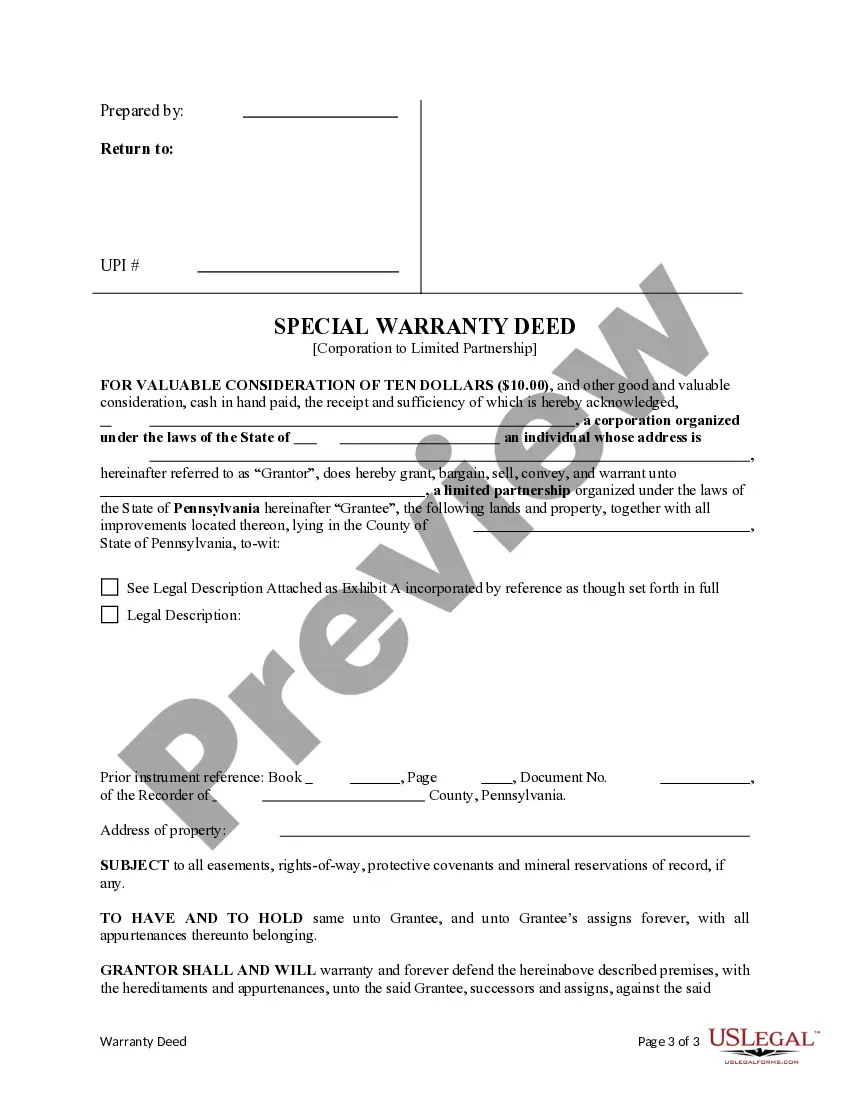

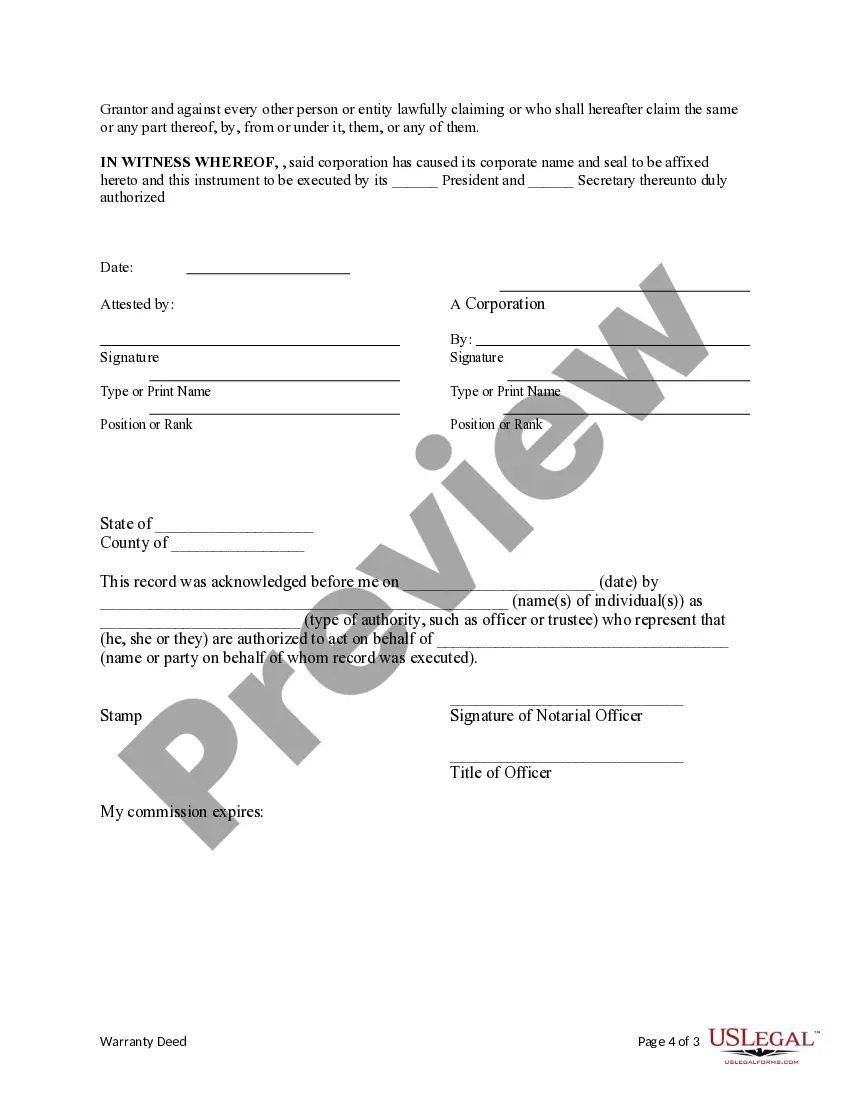

This form is a Special Warranty Deed where the Grantor is a corporation and the Grantee is a limited partnership. Grantor conveys and specially warrants the described property to the Grantee. The Grantor only warrants and will defend the property only as to claims of persons claiming by, through or under Grantor, but not otherwise. This deed complies with all state statutory laws.

Pennsylvania Limited Partnership With Significant Control

Description

Form popularity

FAQ

A limited partner in a Pennsylvania limited partnership with significant control cannot make significant operational decisions or bind the partnership to contracts. Their involvement should remain within the limits defined by partnership agreements to maintain their liability shield. By using platforms like uslegalforms, limited partners can better understand their roles and responsibilities while protecting their interests.

The limits of a Pennsylvania limited partnership with significant control include restrictions on the powers of limited partners. They typically cannot make binding decisions or manage operations without risking their limited liability status. This structure allows for a clear distinction between investors and managers, ensuring that the partnership functions smoothly while protecting the interests of limited partners.

Yes, a limited partner can be liable in a Pennsylvania limited partnership with significant control under specific circumstances. If they take part in managing the business or exceed their authority, they may lose their limited liability protection. It’s crucial for limited partners to understand their roles and ensure they do not engage in activities that could alter their liability status.

In a Pennsylvania limited partnership with significant control, a limited partner cannot participate in day-to-day management decisions. This limitation protects them from being classified as a general partner, which would expose them to unlimited liability. Additionally, their potential losses are generally limited to their investment in the partnership, making it a safer option for investors looking to minimize risk.

In a Pennsylvania limited partnership with significant control, the general partners hold operational control. They are responsible for daily decision-making and management. Limited partners, however, typically do not involve themselves in operations, which allows them to limit their liability to their investment.

A Pennsylvania limited partnership with significant control encompasses three critical elements: an agreement, shared profits, and a business purpose. All partners must agree on how the business operates and split profits. Moreover, they should define a clear business purpose to guide their operations and decisions.

To create a limited partnership in Pennsylvania, start by identifying your partners and defining their roles. Next, draft a partnership agreement outlining partnership details. Finally, file the Certificate of Limited Partnership with the Pennsylvania Department of State to formalize your limited partnership with significant control.

Forming a Pennsylvania limited partnership with significant control requires specific essentials. You need to draft a partnership agreement that clarifies the roles of general and limited partners. Also, you must register by submitting the Certificate of Limited Partnership to the state's Department of State, ensuring compliance with local laws.

In Pennsylvania, to establish a limited partnership, you need at least one general partner and one limited partner. The partners must create and sign a partnership agreement detailing the terms of the partnership. Finally, you must file the appropriate paperwork, particularly the Certificate of Limited Partnership, to register your business officially.

To form a Pennsylvania limited partnership with significant control, you need a formal agreement that outlines roles and responsibilities. You must file a Certificate of Limited Partnership with the Pennsylvania Department of State. Additionally, it is essential to comply with local business regulations and obtain any necessary permits for your business operations.