Limited Partnership Form Agreement With The Us

Description

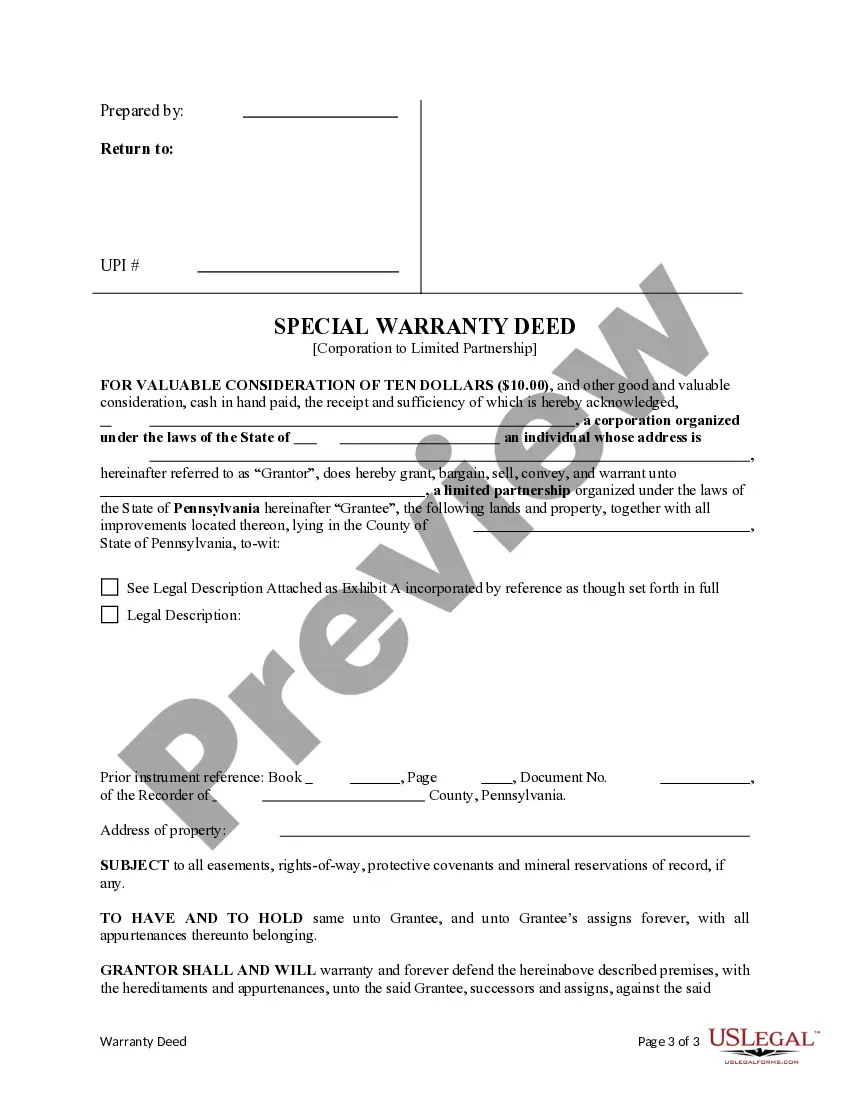

How to fill out Pennsylvania Special Warranty Deed From Corporation To Limited Partnership?

- Begin by logging into your US Legal Forms account. Make sure your subscription is active to access your documents.

- If you're new to US Legal Forms, browse the available options in Preview mode. Check the description of the limited partnership form to ensure it meets your specific requirements.

- Search for additional templates if needed. Utilize the search feature to refine your results until you find the appropriate form.

- Once you confirm the correct document, click on the Buy Now button. Select the subscription plan that best suits your needs, and register to create an account.

- After registering, proceed to checkout. Enter your payment details using a credit card or PayPal to finalize your purchase.

- Finally, download your form onto your device. You can access it anytime through the My Forms section in your profile.

US Legal Forms provides a comprehensive library of over 85,000 fillable and editable legal documents, ensuring you find the right form for any situation. With this service, you also gain access to premium expertise, ensuring that your documents are completed accurately and in compliance with the law.

Take the first step toward solidifying your partnership by using US Legal Forms today. Visit the website and explore the extensive resources available!

Form popularity

FAQ

A US limited partnership is a business entity that consists of at least one general partner and one limited partner. The general partner manages the business and holds unlimited liability, while the limited partner's liability is limited to their investment in the partnership. This structure offers flexibility in management and liability, making it an attractive option for investors. To establish one, you'll need to file a limited partnership form agreement with the US, outlining each partner's roles and responsibilities.

Limited partnerships in the USA typically enjoy pass-through taxation, which means that the income is reported on the individual partners' tax returns rather than at the partnership level. This structure allows partners to avoid double taxation on the partnership's profits. However, certain states may impose specific taxes, so it's vital to consult a tax professional. When creating your limited partnership form agreement with the US, ensure you understand the tax implications to make informed decisions.

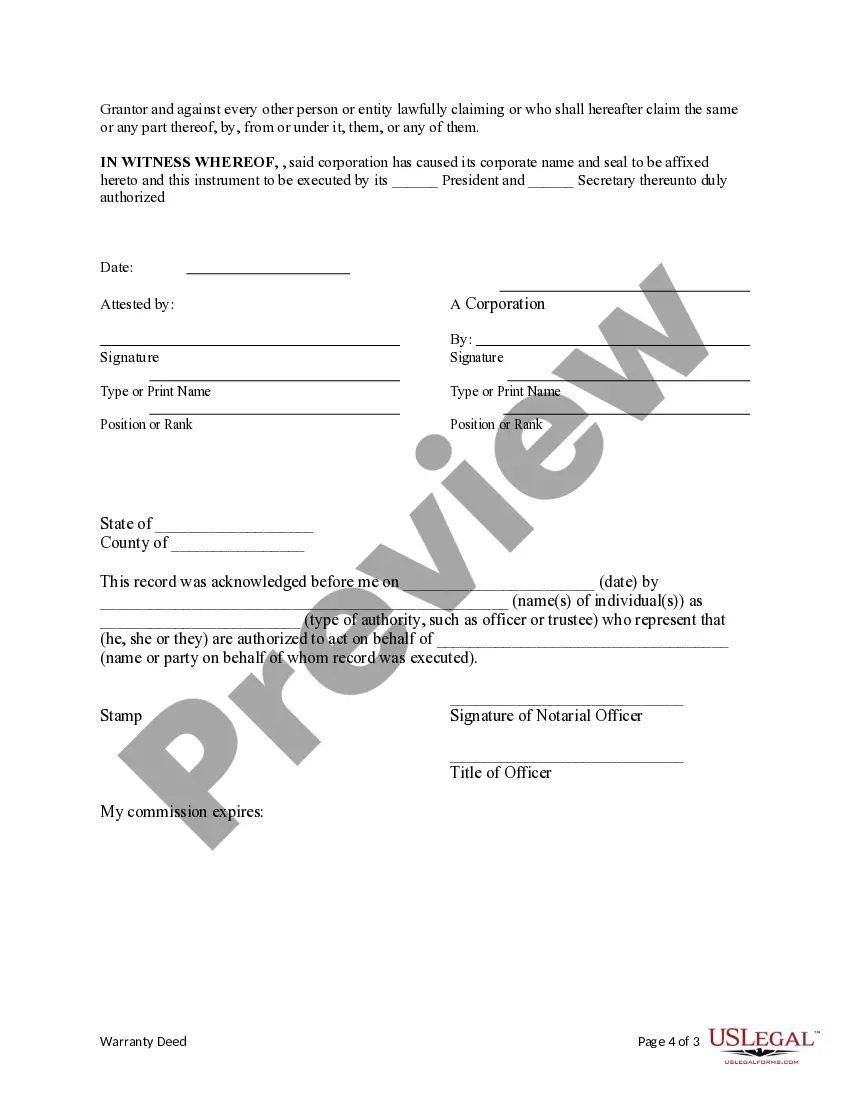

The limited partnership agreement is the primary document that governs a limited partnership in the US. This agreement outlines the rights, responsibilities, and financial contributions of each partner. It serves as a binding contract that can help resolve disputes and clarify expectations among partners. When creating your limited partnership form agreement with the US, it is essential to include detailed provisions to protect all parties involved.

To set up a limited partnership (LP), start by drafting a limited partnership agreement that outlines the roles of each partner. Next, file the certificate of limited partnership with your state's business filing office. Utilizing a limited partnership form agreement with the US can streamline this process, ensuring all legal requirements are met for a successful partnership launch.

A certificate of limited partnership is the key document that creates a limited partnership. This certificate includes essential information like the names of general and limited partners and the nature of the business. Additionally, a limited partnership form agreement with the US complements this certificate by detailing the operational terms and conditions, which is crucial for effective management.

Yes, a limited company can enter into a partnership agreement, especially when forming a limited partnership. Such agreements define how the limited company interacts with other partners. A limited partnership form agreement with the US provides structure and clarity in these relationships, ensuring compliance with local laws.

A limited partnership must have at least one general partner and one limited partner, who contributes capital but does not participate in management. Additionally, the partnership must be registered in the state where it operates, usually requiring a limited partnership form agreement with the US to be compliant. Lastly, the partnership should have a clear agreement detailing the profit distribution and decision-making processes.

Yes, a limited partnership must have a partnership agreement to establish the structure of the partnership. This agreement outlines the roles of general partners and limited partners. By using a limited partnership form agreement with the US, you ensure that important provisions are legally recognized, providing clarity and security for all parties involved.

A limited partnership typically requires a partnership agreement to define the relationships among partners clearly. This document lays out the rights and duties of both general and limited partners, minimizing potential conflicts. Having a limited partnership form agreement with the US respects the legal requirements and facilitates smoother operations.

Yes, it's possible to have a partnership without a formal partnership agreement. However, it is highly recommended to have a written agreement to outline each partner's roles and responsibilities. This helps to avoid misunderstandings or disputes later on. A limited partnership form agreement with the US clarifies the terms and protects the interests of all partners involved.