Pennsylvania Correction Pa Form Pa-40es

Description

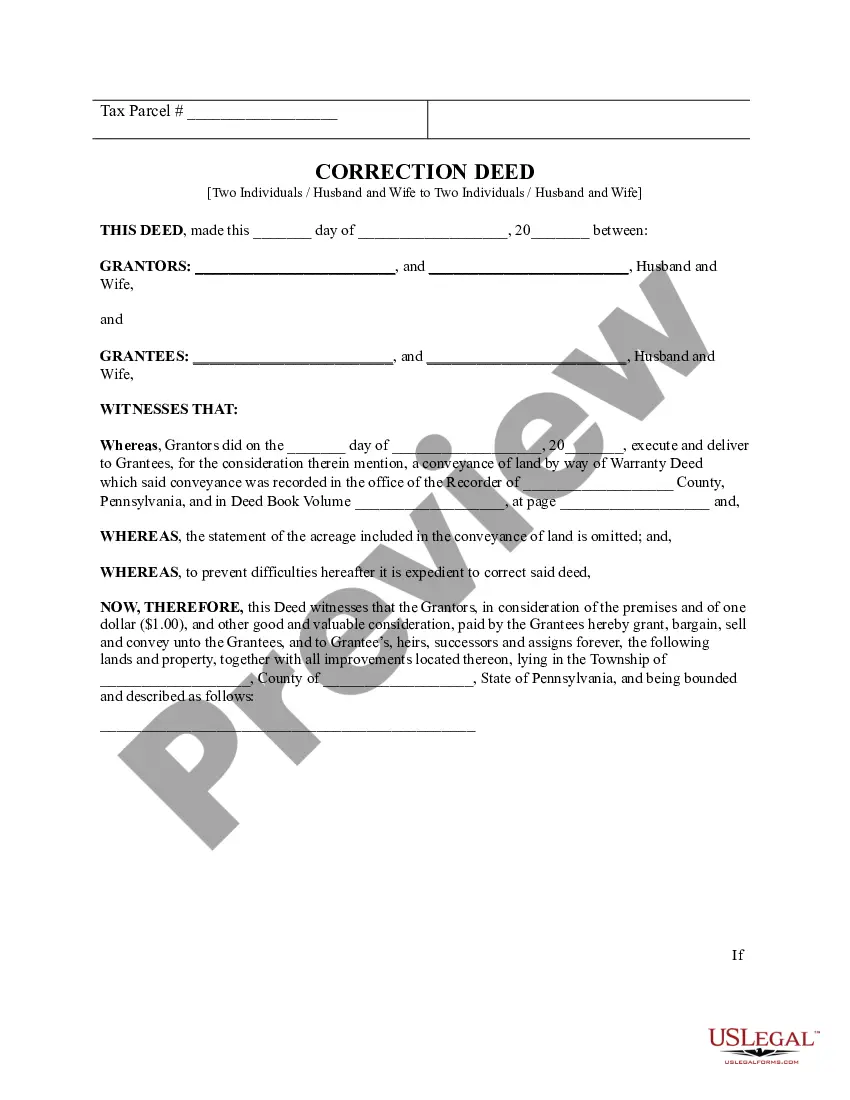

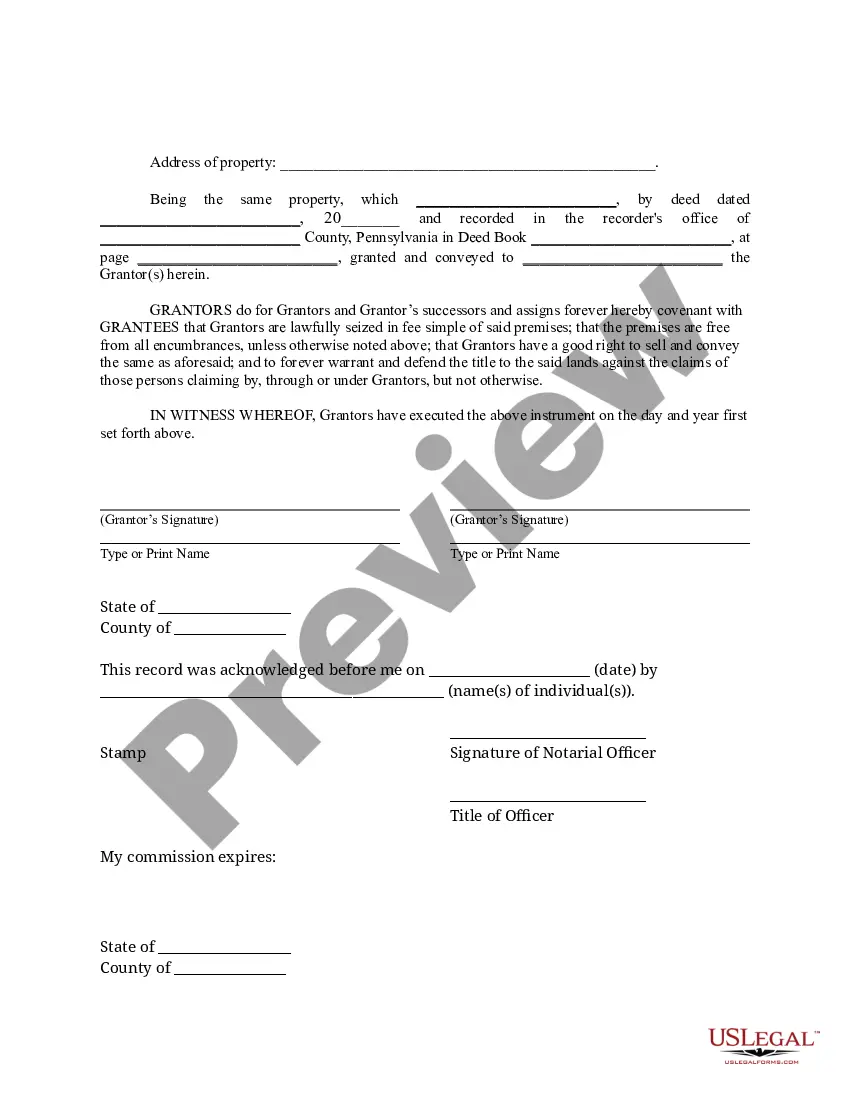

How to fill out Pennsylvania Correction Deed -?

Acquiring legal templates that adhere to federal and regional regulations is vital, and the internet provides numerous choices.

However, what is the use of spending time searching for the suitable Pennsylvania Correction Pa Form Pa-40es example online when the US Legal Forms online repository already has such templates gathered in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 fillable forms crafted by lawyers for any professional and personal situation.

Explore the template using the Preview function or through the text outline to ensure it fulfills your needs.

- They are easy to navigate, with all documents categorized by state and intended use.

- Our experts keep up with legislative changes, ensuring you can always be assured that your documentation is current and compliant when acquiring a Pennsylvania Correction Pa Form Pa-40es from our site.

- Obtaining a Pennsylvania Correction Pa Form Pa-40es is straightforward and quick for both existing and new users.

- If you already possess an account with an active subscription, Log In to download the sample document you require in the appropriate format.

- For new users to our site, follow the guidance below.

Form popularity

FAQ

Description:Step 1: Select the Form PA-40 by Tax Year below. Step 2: Fill in the space next to to "Amended Return" on the upper right-hand corner to indicate that it's an amended return. Step 3: Download, Complete Schedule PA-40X as an explanation of your amended return. Attach it to your Form PA-40.

Where do I mail my personal income tax (PA-40) forms? For RefundsPA DEPT OF REVENUE REFUND OR CREDIT REQUESTED 3 REVENUE PLACE HARRISBURG PA 17129-0003For Balance DuePA DEPT OF REVENUE PAYMENT ENCLOSED 1 REVENUE PLACE HARRISBURG PA 17129-00012 more rows ?

Use PA-40 Schedule O to report the amount of deductions for contributions to Medical Savings or Health Savings Ac- counts and/or the amount of contributions to an IRC Section 529 Qualified Tuition Program and/or IRC Section 529A Pennsylvania ABLE Savings Program by the taxpayer and/or spouse.

PERSONAL INCOME TAX (PA-40 ES) Use the 2023 Form PA-40 ES-I to make your quarterly estimated payment of tax owed.

Use PA-40 Schedule E to report the amount of net income (loss) from rents royalties, patents and copyrights for indi- vidual or fiduciary (estate or trust) taxpayers. Refer to the PA Personal Income Tax Guide ? Net Income (Loss) from Rents, Royalties, Copyrights and Patents sec- tion for additional information.