Pennsylvania Correction Pa Form Pa-40

Description

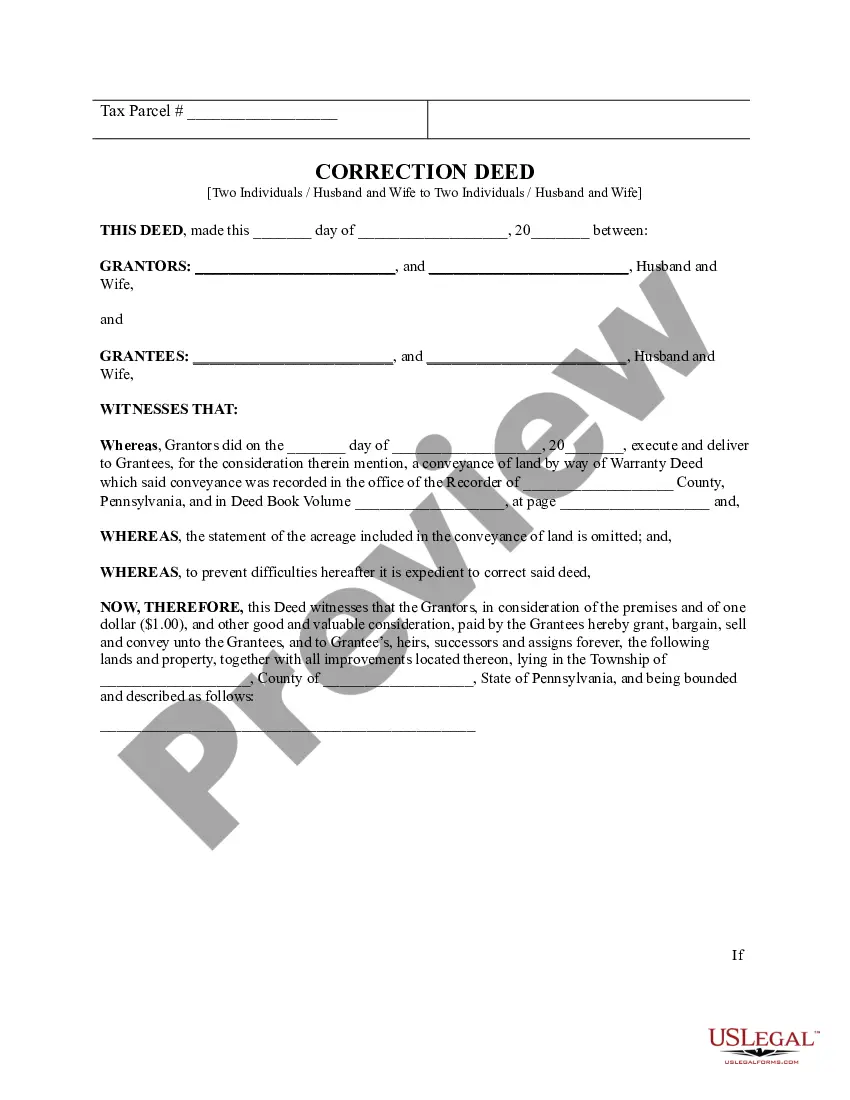

How to fill out Pennsylvania Correction Deed -?

Whether for commercial reasons or for personal matters, everyone must deal with legal issues at some point in their lives.

Completing legal documents requires meticulous care, beginning with choosing the appropriate form template.

With an extensive US Legal Forms catalog available, you no longer have to waste time searching for the right template across the web. Take advantage of the library’s straightforward navigation to find the correct form for any circumstance.

- Locate the template you require using the search box or catalog browsing.

- Review the form’s details to ensure it fits your situation, state, and locality.

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search tool to find the Pennsylvania Correction Pa Form Pa-40 template you need.

- Obtain the template when it satisfies your needs.

- If you possess a US Legal Forms account, click Log in to access previously stored documents in My documents.

- If you don’t have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: you can use a credit card or PayPal account.

- Choose the file format you prefer and download the Pennsylvania Correction Pa Form Pa-40.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

Amended Returns - Pennsylvania supports electronic filing for Schedule PA 40X.

If you are a PA resident, nonresident or a part-year PA resident, you must file a 2022 PA tax return if: ? You received total PA gross taxable income in excess of $33 during 2022, even if no tax is due with your PA return; and/or ? You incurred a loss from any transaction as an individual, sole proprietor, partner in a ...

PA-40 Schedule W-2S has been eliminated. All copies of Forms W-2, 1099-R, 1099-MISC, 1099-NEC and any other documents reporting compensation must be included with the tax return. Form 1099-R Filing Tips have been added to the compensation instructions for taxpayers required to include those documents.

All copies of Forms W-2, 1099-R, 1099-MISC, 1099-NEC and any other documents reporting compensation must be included with the tax return.

Description:Step 1: Select the Form PA-40 by Tax Year below. Step 2: Fill in the space next to to "Amended Return" on the upper right-hand corner to indicate that it's an amended return. Step 3: Download, Complete Schedule PA-40X as an explanation of your amended return. Attach it to your Form PA-40.