Pennsylvania Correction Pa For Sale

Description

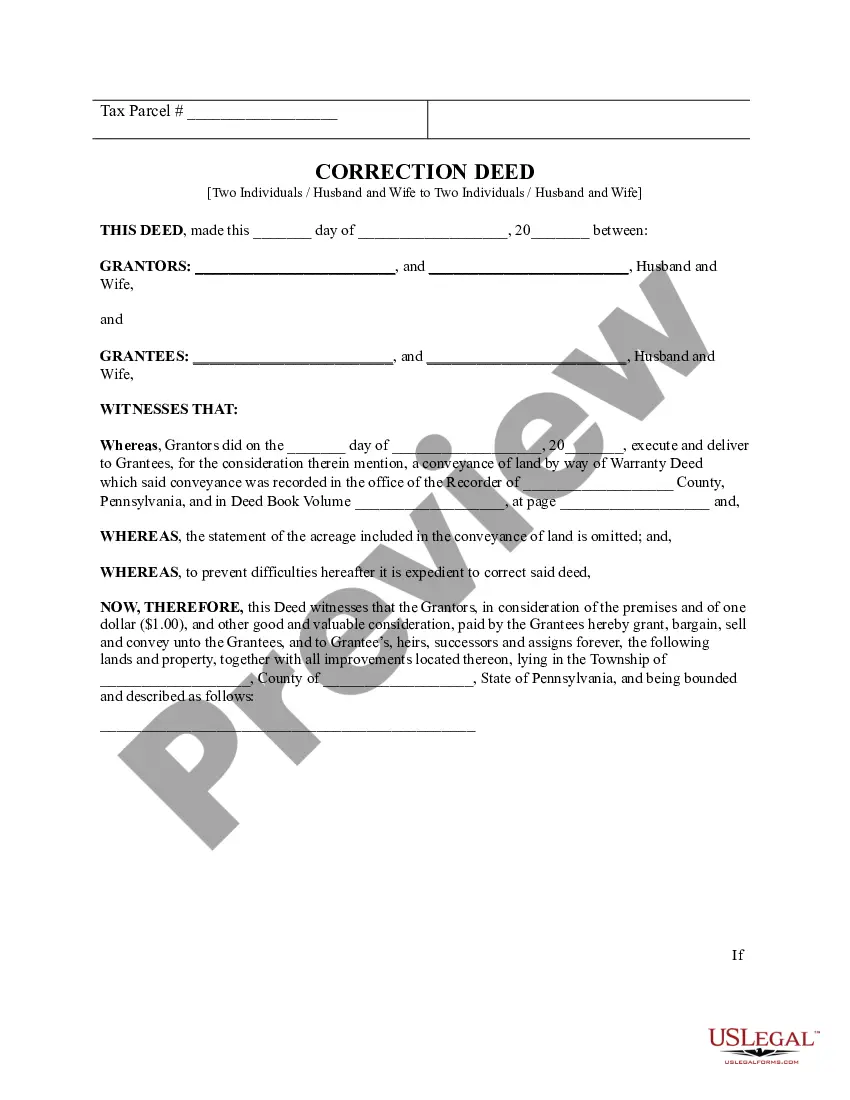

How to fill out Pennsylvania Correction Deed -?

Managing legal documents can be daunting, even for the most adept professionals.

When seeking a Pennsylvania Correction Pa For Sale and lacking the time to dedicate to finding the accurate and current version, the tasks can become taxing.

For members, Log In to your US Legal Forms account, search for the form, and download it.

Visit the My documents tab to review the documents you've previously obtained and manage your folders according to your preference.

Leverage the US Legal Forms online library, backed by 25 years of experience and reliability. Transform your daily document management into a straightforward and user-friendly process today.

- Verify that this is the correct form by previewing it and reviewing its description.

- Ensure that the sample is accepted in your state or county.

- Choose Buy Now when you are ready.

- Select a monthly subscription option.

- Choose the format you desire, and Download, complete, eSign, print and send your documents.

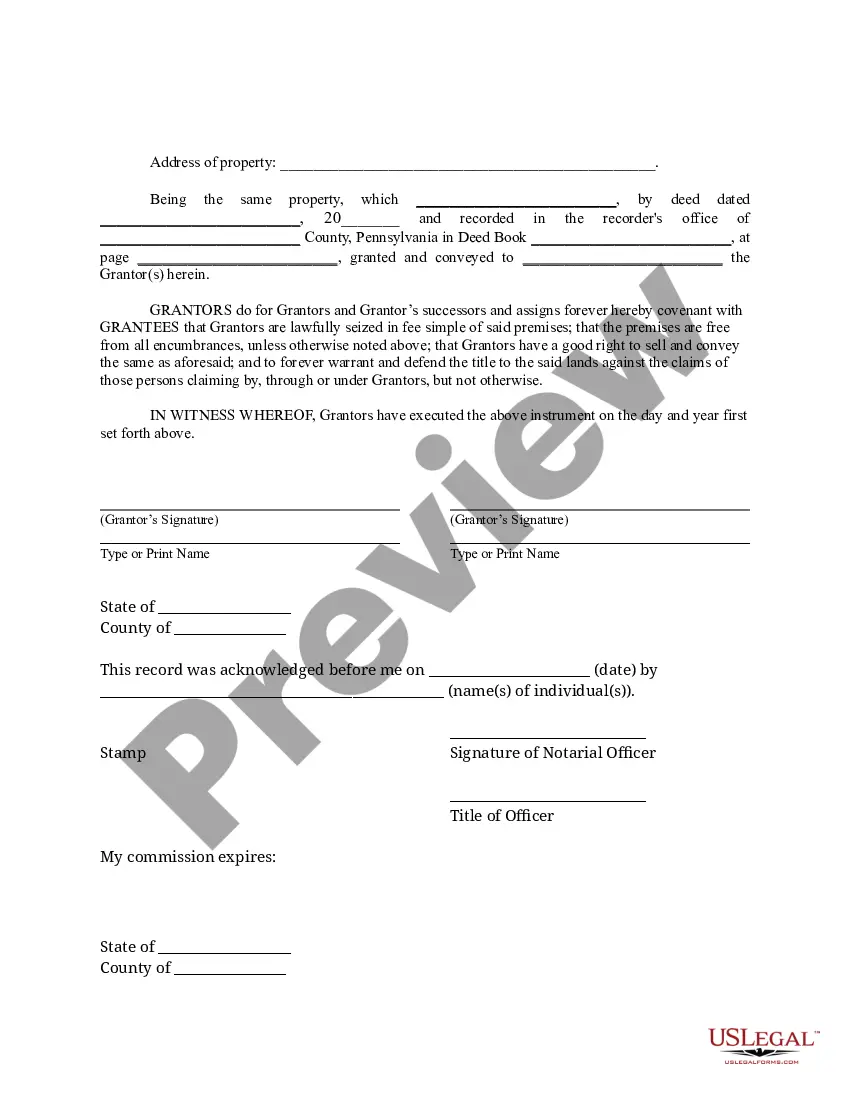

- Utilize advanced resources to complete and oversee your Pennsylvania Correction Pa For Sale.

- Access a valuable repository of articles, manuals, and references pertinent to your situation and needs.

- Conserve time and effort in locating the documents you require, and utilize US Legal Forms’ enhanced search and Preview tool to discover Pennsylvania Correction Pa For Sale and obtain it.

Form popularity

FAQ

Form PA-100 (Pennsylvania Enterprise Registration Form) is used by Pennsylvania businesses to register for certain tax accounts with the Pennsylvania Department of Revenue and the Pennsylvania Department of Labor and Industry. New businesses file PA-100 to set up state tax accounts.

How do I file a sales tax return? Log in to myPATH. If you have access to more than one taxpayer or client, you must select the Name hyperlink to file a return for a specific tax account. From the Summary tab, locate the Sales and Use Tax account panel. Select the File Now link to file for the current period.

Sales and use tax returns are filed via myPATH at mypath.pa.gov.

How to obtain a seller's permit in Pennsylvania. To obtain a seller's permit, you must file Pennsylvania Enterprise Registration Form (PA-100), which may be submitted either online or by printing out the form and mailing it to the Pennsylvania Department of Revenue.

Instructions for REV-1706 This form must be completed if the business was discontinued, sold or ceased operations in Pennsylvania.