Mineral Rights Deed Transfer Form For Texas

Description

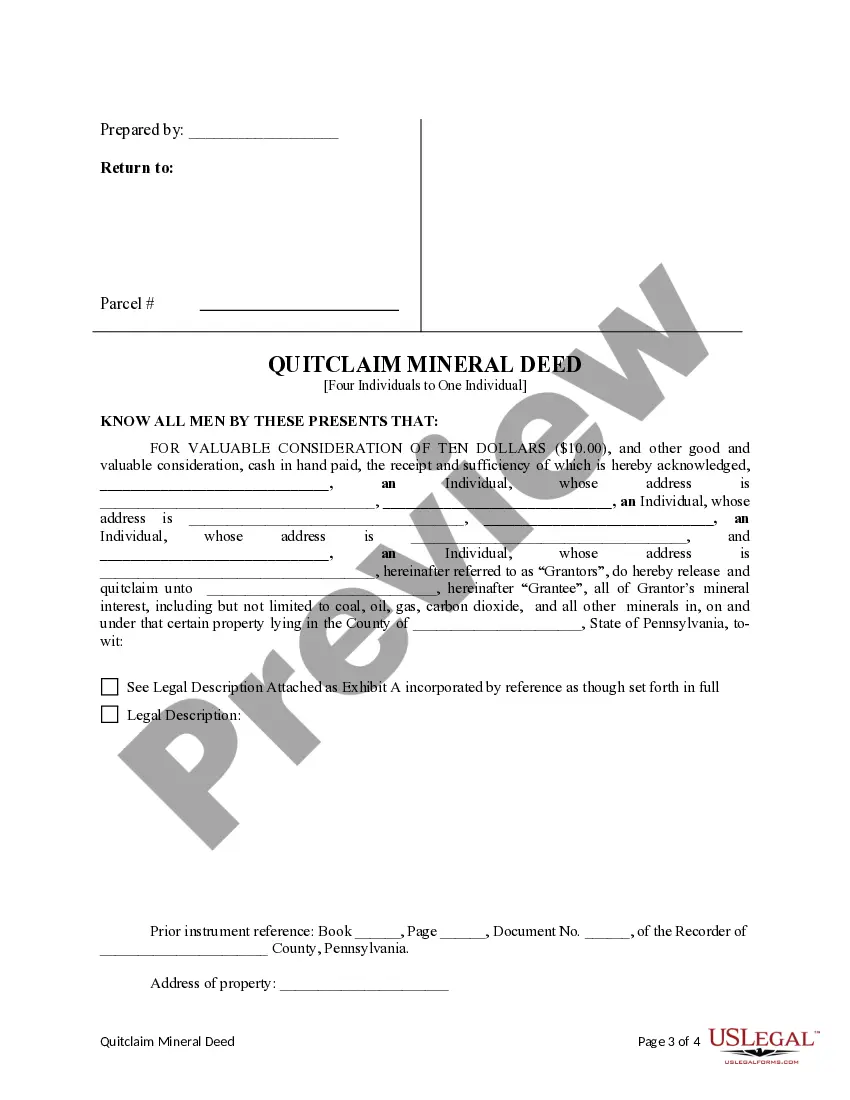

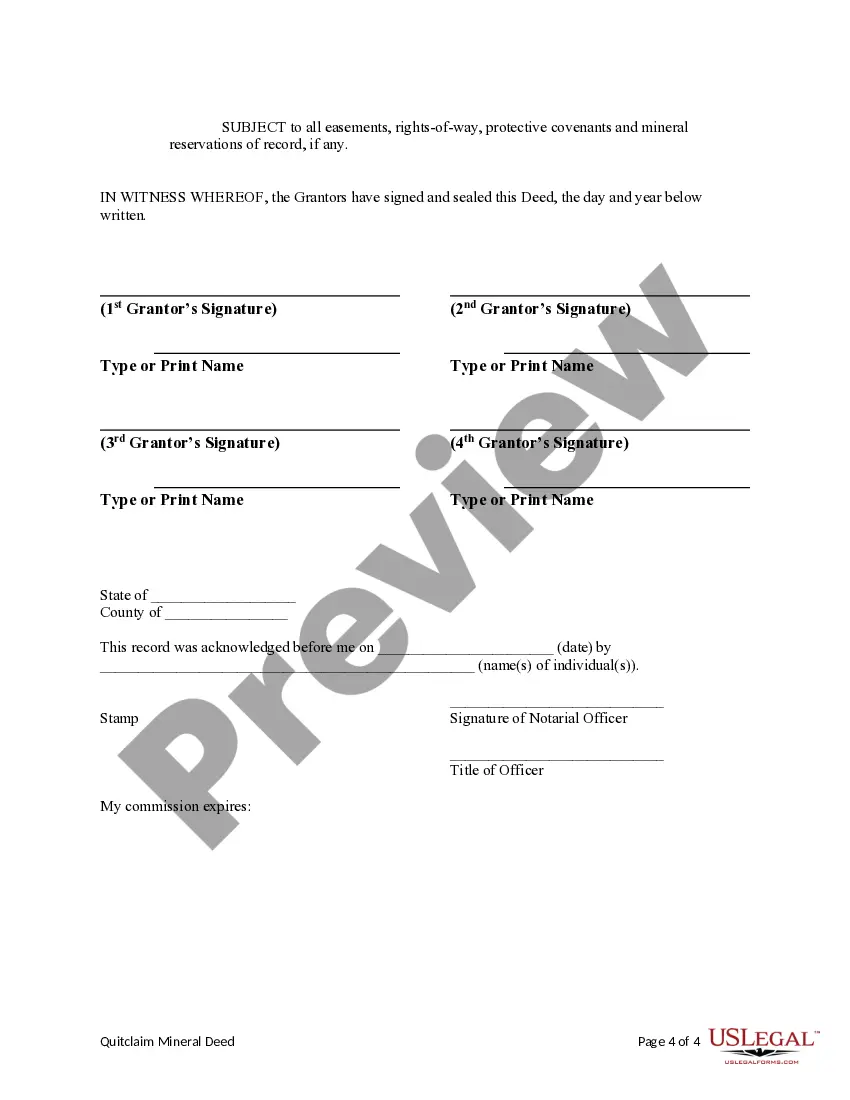

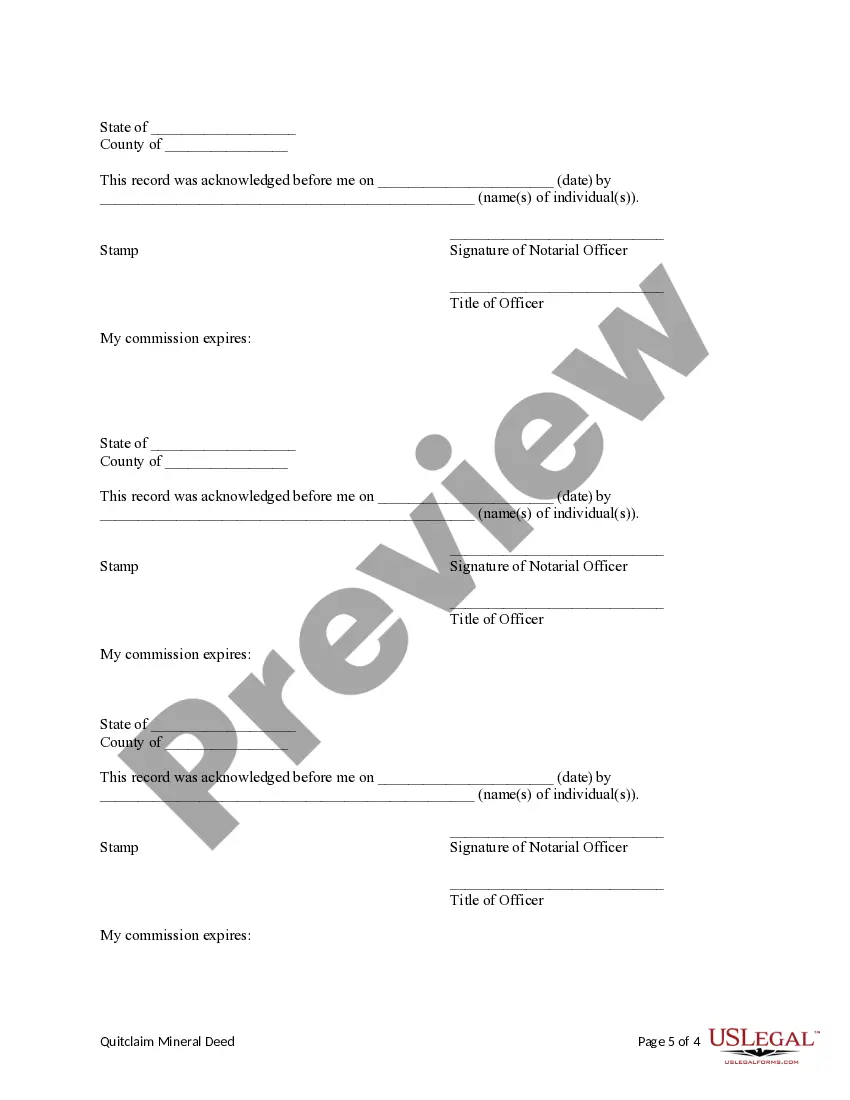

How to fill out Pennsylvania Quitclaim Mineral Deed - Four Individuals To One Individual?

The Mineral Rights Deed Transfer Document for Texas displayed on this site is a reusable official template crafted by experienced attorneys in accordance with federal and state statutes and guidelines.

For over 25 years, US Legal Forms has delivered individuals, enterprises, and legal practitioners with over 85,000 validated, state-specific documents for any commercial and personal circumstance. It’s the fastest, most direct, and most reliable method to acquire the files you require, as the service ensures the utmost level of data protection and malware defense.

Subscribe to US Legal Forms to have authenticated legal templates for all of life's scenarios at your fingertips.

- Search for the document you require and review it.

- Examine the file you sought and preview it or assess the form description to verify it meets your requirements. If it doesn’t, utilize the search feature to find the right one. Click Buy Now once you have identified the template you need.

- Register and Log In to your account.

- Select the subscription plan that best fits you and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and confirm your subscription to proceed.

- Acquire the fillable document.

- Choose the format you prefer for your Mineral Rights Deed Transfer Document for Texas (PDF, Word, RTF) and download the example onto your device.

- Complete and sign the document.

- Print the template to finalize it manually. Alternatively, use an online versatile PDF editor to swiftly and accurately complete and sign your form using an eSignature.

- Redownload your documents.

- Use the same document again whenever required. Access the My documents tab in your account to retrieve any previously saved documents.

Form popularity

FAQ

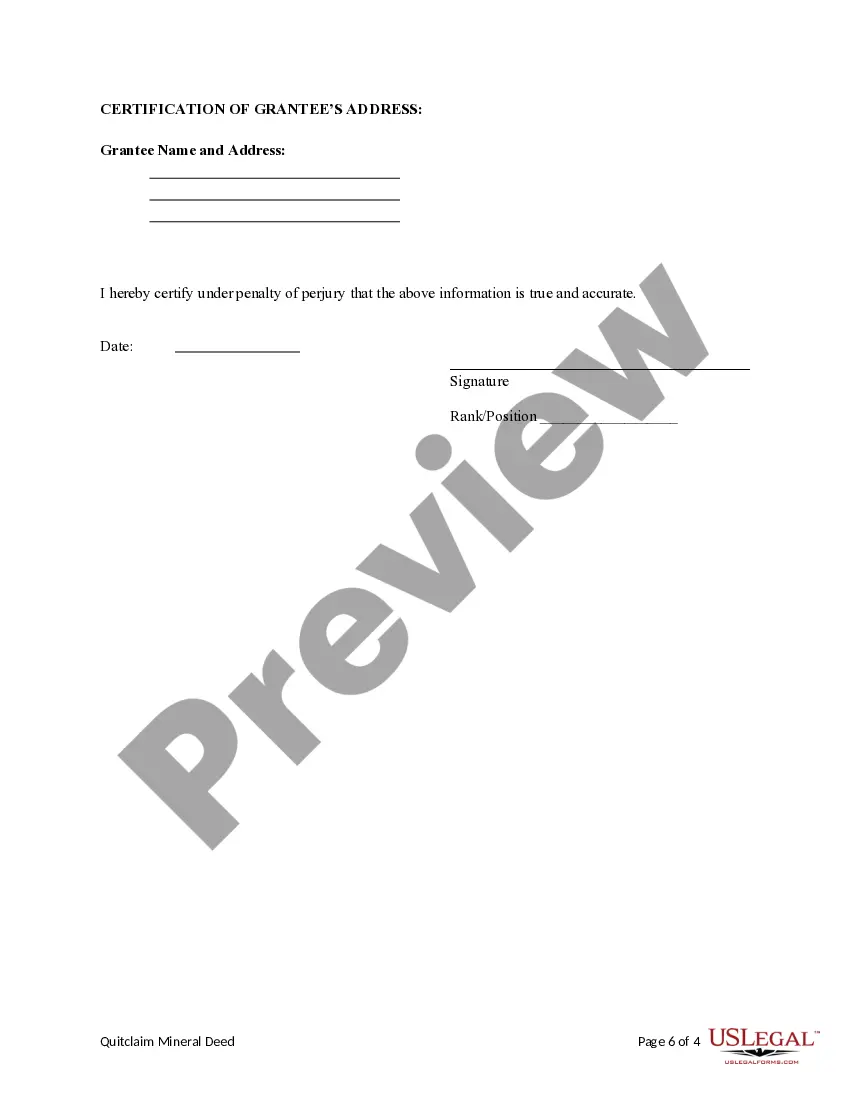

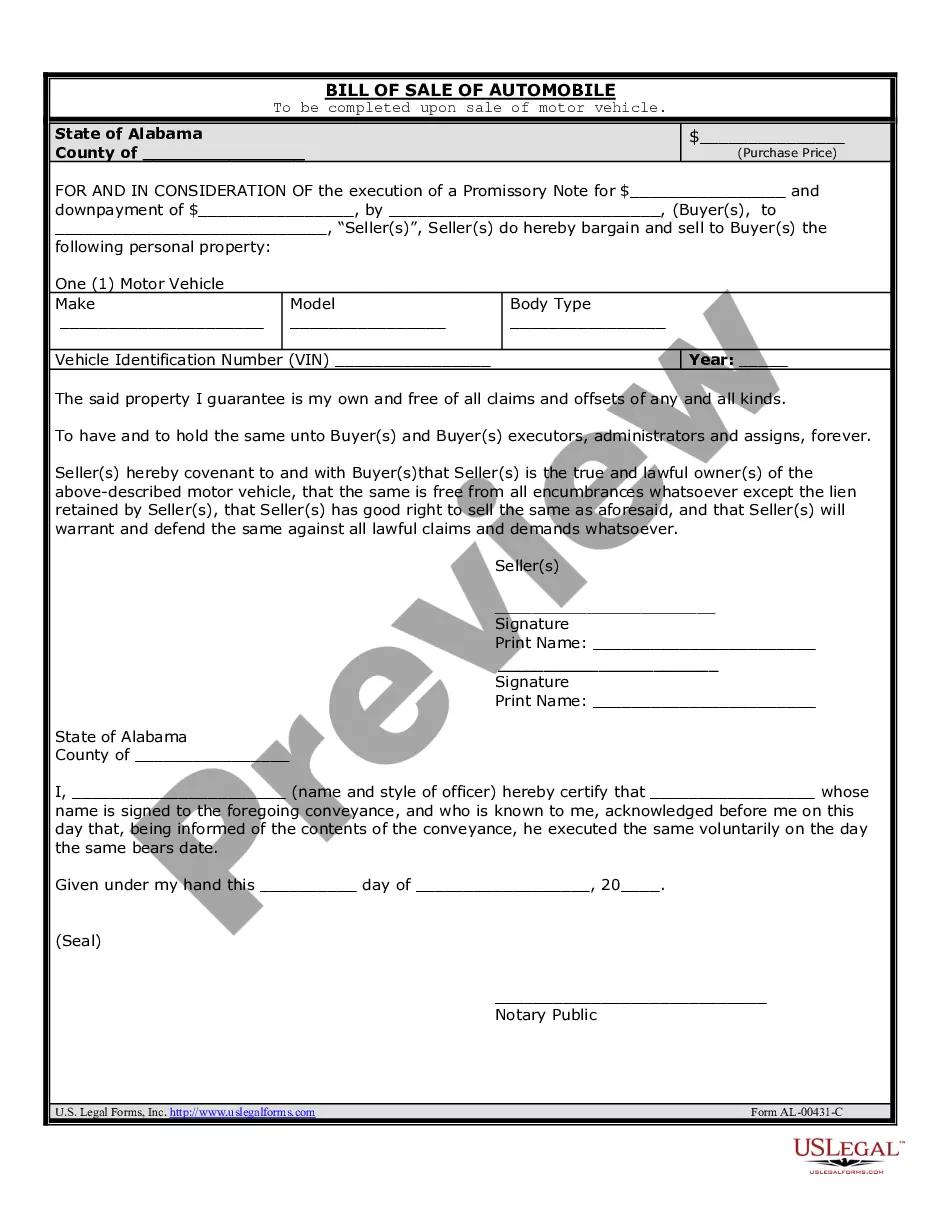

To transfer ownership of mineral rights in Texas, draft a mineral rights deed that specifies the terms and conditions of the transfer. Ensure both parties sign the document, and then file it with the county clerk where the property is located. You might want to use a mineral rights deed transfer form for Texas to streamline the process and ensure accuracy. Engaging with legal professionals can further help simplify your transfer experience.

To transfer mineral rights in Texas, you generally need to create a legal document known as a mineral rights deed. This deed outlines the specifics of the transfer and must be signed by the current owner. After completing the mineral rights deed transfer form for Texas, it is essential to file it with the appropriate county clerk's office. This process helps ensure that the new owner has clear title to the rights.

In Texas, mineral rights ownership typically belongs to the person who holds the title to the land. If you own land, you may own the mineral rights beneath it, but this isn't always the case. Many times, mineral rights are sold or leased separately. To determine who owns your mineral rights, review the property deed and consider using a mineral rights deed transfer form for Texas to clarify ownership.

Mineral rights are typically owned by the landowner, but this is not always the case. Ownership can be divided or sold over time, so checking the property deed is essential for clarity. If you discover you do not hold these rights, you may want to initiate a transfer using a mineral rights deed transfer form for Texas. This form can help you secure the rights you need to fully benefit from your property.

To obtain mineral rights on your property, you should first verify if the mineral rights are currently owned by you or someone else. You can check your property deed for information on mineral rights ownership. If you need to transfer these rights, consider using the mineral rights deed transfer form for Texas available on the US Legal Forms platform. This simple form can streamline the process and ensure all legal requirements are met.

To transfer ownership of mineral rights in Texas, you should complete a mineral rights deed transfer form for Texas. This form needs to be accurately filled out and signed by both the current owner and the recipient. Once completed, submit the form to the county clerk’s office to finalize the transfer legally, ensuring that the new owner has clear title to the rights.

If someone else owns your mineral rights, they have the legal right to explore, extract, and sell the minerals on your property. This ownership can affect your land's value and how you plan to use it. It's important to understand your property rights and consider using a mineral rights deed transfer form for Texas if you wish to reclaim or negotiate ownership.

No, mineral rights are not automatically transferred when you sell the surface land. Buyers need to obtain a mineral rights deed transfer form for Texas to ensure the rights are officially passed on. Without this formal transfer, the mineral rights may remain with the original owner, leading to potential disputes.

To transfer mineral rights to another person, you need to fill out a mineral rights deed transfer form for Texas. This legal document outlines the terms of the transfer and must be signed by both parties. Make sure to file the completed form with the county clerk where the property is located to ensure the transfer is recorded and legally recognized.

To transfer mineral rights in Texas, you should use the Mineral Rights Deed Transfer Form for Texas. This form facilitates the legal transfer of ownership from one party to another, ensuring all necessary details are documented properly. Utilizing the correct form helps prevent future disputes and clarifies rights to the mineral interests involved. You can find this form on platforms like US Legal Forms, which provide reliable resources for your legal needs.