Creating An Llc In Pa Without An Llc

Description

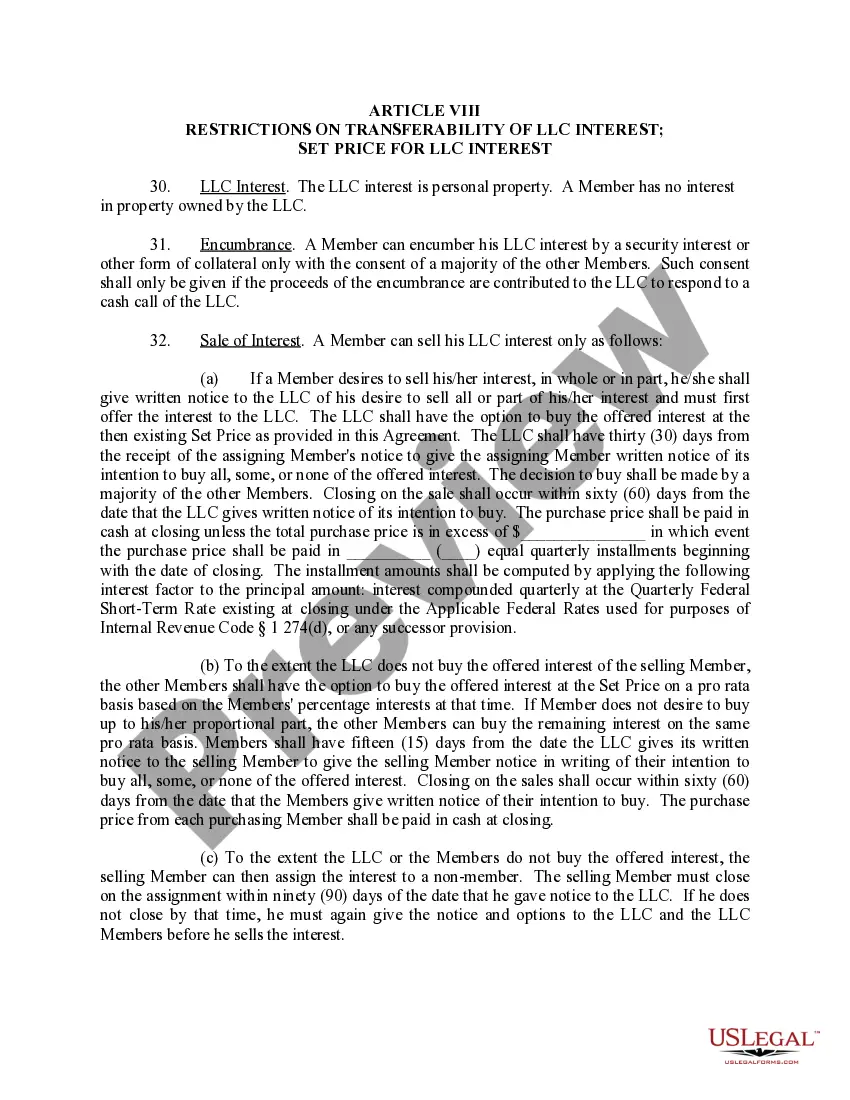

How to fill out Pennsylvania Limited Liability Company LLC Operating Agreement?

Accessing legal document samples that comply with federal and local regulations is a matter of necessity, and the internet offers many options to choose from. But what’s the point in wasting time looking for the appropriate Creating An Llc In Pa Without An Llc sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the largest online legal catalog with over 85,000 fillable templates drafted by attorneys for any business and personal situation. They are easy to browse with all papers collected by state and purpose of use. Our experts stay up with legislative updates, so you can always be sure your form is up to date and compliant when obtaining a Creating An Llc In Pa Without An Llc from our website.

Getting a Creating An Llc In Pa Without An Llc is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the preferred format. If you are new to our website, follow the steps below:

- Take a look at the template utilizing the Preview feature or via the text outline to make certain it meets your needs.

- Browse for a different sample utilizing the search tool at the top of the page if needed.

- Click Buy Now when you’ve located the suitable form and select a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Creating An Llc In Pa Without An Llc and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and complete earlier saved forms, open the My Forms tab in your profile. Take advantage of the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

However, by forming a single-member LLC, the sole owner of a business can retain the simplicity of a sole proprietorship while still obtaining the full liability shield afforded under Pennsylvania corporate law.

Contents Name your Pennsylvania LLC. Choose your registered office (a/k/a registered agent) Prepare and file Certificate of Organization. Get an Employer Identification Number. File a New Entity Docketing Statement with Certificate of Organization. Receive a certificate from the state. Create an operating agreement.

Pennsylvania's requirements include: Registered agent. LLCs must list the name and address of a registered agent with a physical address (no post office boxes) in Pennsylvania. The registered agent must be available during normal business hours to accept important legal and tax documents for the business.

Starting an LLC in Pennsylvania can be achieved through a process of nine steps or less, the steps of which are: 1. Choose an LLC name. All LLCs must have a name, and in Pennsylvania, this name must include the term ?Limited Liability Company,? ?Company,? or ?Limited,? or some variation of these.

Business owners in Pennsylvania are not legally required to write an operating agreement for their LLCs. However, most LLC managing members choose to do so, as it is a highly recommended practice.