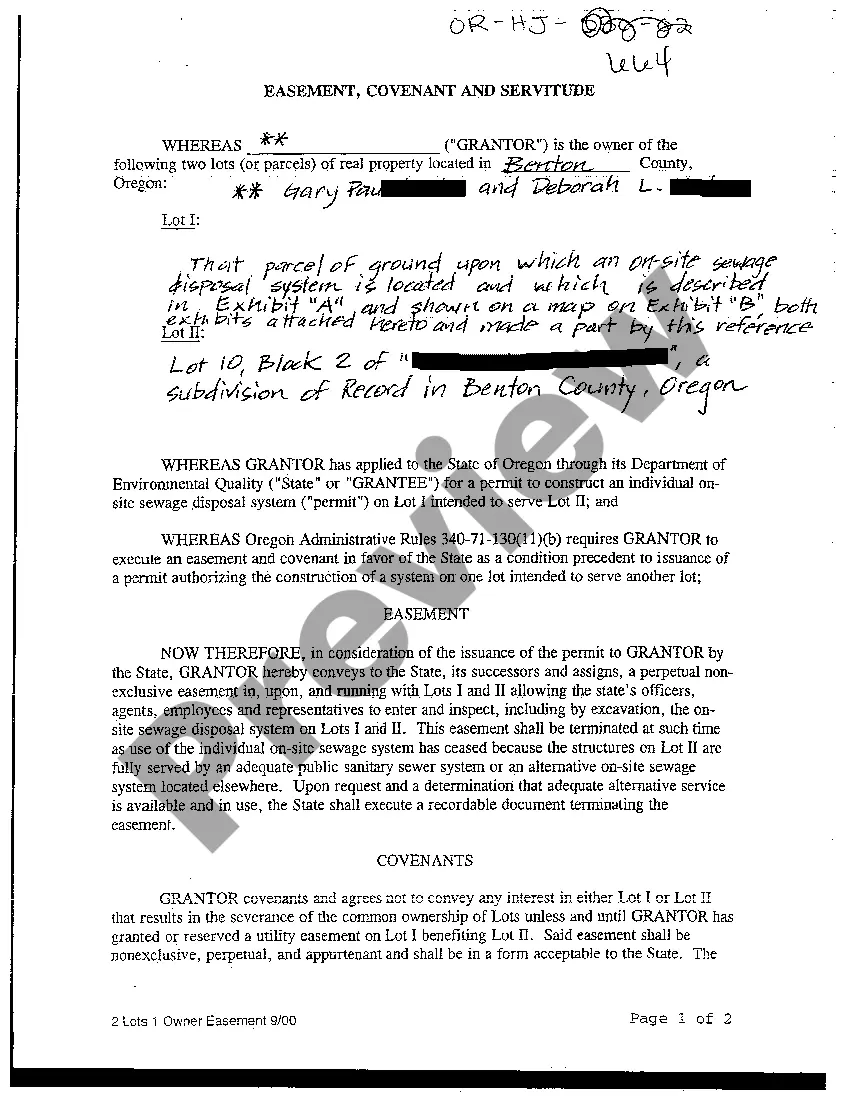

Easement Covenant And Servitude Form For Oregon Withholding

Description

How to fill out Oregon Easement, Covenant And Servitude?

There's no longer a requirement to squander hours searching for legal documents to comply with your local state laws.

US Legal Forms has consolidated all of them in a single location and made them easily accessible.

Our site offers over 85k templates for any business and personal legal situations organized by state and area of use.

Utilize the search bar above to find another template if the current one does not suit your needs.

- All forms are expertly drafted and validated for legitimacy, ensuring you receive an up-to-date Easement Covenant And Servitude Form For Oregon Withholding.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before acquiring any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all obtained documents whenever necessary by accessing the My documents tab in your profile.

- If you have not interacted with our service before, the process will require a few additional steps to finalize.

- Here’s how new users can locate the Easement Covenant And Servitude Form For Oregon Withholding in our catalog.

- Thoroughly read the page content to ensure it contains the sample you require.

- To do so, make use of the form description and preview options if available.

Form popularity

FAQ

To file the Form WR electronically, as required under ORS 316.202 and ORS 314.360, you must do so using Department of Revenue's system, Revenue Online by going to this link: .

HB 2119 (2019) requires employers to withhold income tax at a rate of eight (8) percent of employee wages if the employee hasn't provided a withholding statement or exception certificate. Continue withholding at the eight percent rate until the employee submits a withholding statement or exemption certificate.

HB 2119 (2019) requires employers to withhold income tax at a rate of eight (8) percent of employee wages if the employee hasn't provided a withholding statement or exception certificate. Continue withholding at the eight percent rate until the employee submits a withholding statement or exemption certificate.

You must use Oregon's Form OR-W-4 instead. How often does Form OR-W-4 have to be submitted? Complete and submit a new Form OR-W-4 when you start a new job and whenever your tax situation changes. This includes changes in your income, marital status, and number of dependents.

Oregon Form 40 is used by full-year residents to file their state income tax return. The purpose of Form 40 is to determine your tax liability for the state of Oregon. Nonresident and part-year resident filers will complete Oregon Form OR-40-N or Form OR-40-P instead.