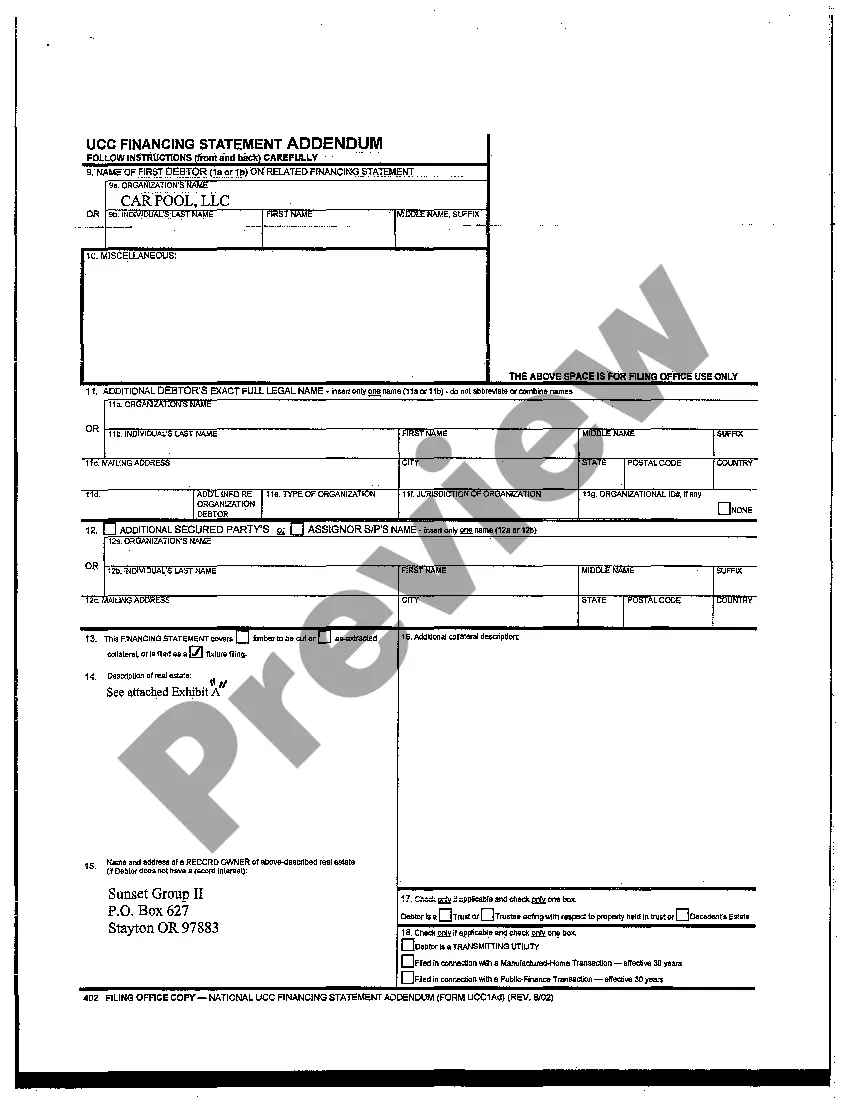

UCC-1 filing requirements refer to the rules and regulations established for submitting a Uniform Commercial Code (UCC) filing to perfect a security interest in personal property. The UCC is a set of standardized laws governing commercial transactions within the United States. Understanding UCC-1 filing requirements is crucial for creditors and lenders to protect their interests against potential defaults or bankruptcy situations. When filing a UCC-1 financing statement, certain requirements must be followed to ensure the filing's legality and effectiveness. Here are the key elements and components encompassing UCC-1 filing requirements: 1. Debtor Information: The UCC-1 must identify the debtor's legal name, address, and organizational details. This information helps verify the debtor's identity and ensures accurate records. 2. Creditor Information: The filing must also include the creditor's name and address. Providing accurate creditor details is vital for future references and notifications. 3. Collateral Description: A precise description of the collateral subject to the security interest must be provided in the UCC-1 filing. It should include details such as the item's type, make, model, serial number, and any other specific identifiers. 4. Uniform Commercial Code (UCC) Section: The UCC section under which the filing is made must be specified. The relevant UCC section varies according to the nature of the collateral, such as goods, intangible assets, or fixtures. 5. Filing Fees: An appropriate fee must be paid to the filing office along with the submission. The fee amount may vary depending on the jurisdiction or state. 6. Filing Office Procedures: Different states might have specific filing office requirements and procedures. It is crucial to follow the respective state's guidelines to ensure correct filing of the UCC-1 financing statement. Types of UCC-1 filings based on specific requirements: 1. Initial Financing Statement: This filing establishes the creditor's security interest in the debtor's collateral. It is typically the first step in securing the debtor's obligations. 2. Amendment Filing: An amendment filing is necessary when any changes occur to previously filed information. This may include updating debtor information, adding or removing collateral, or changing the secured party's details. 3. Termination Statement: When a debtor's obligation is fulfilled, a termination statement is filed to release the creditor's security interest. This filing ensures that the collateral is no longer encumbered by the security agreement. 4. Continuation Statement: To extend the effectiveness of a UCC-1 filing beyond its initial expiration period (commonly five years), a continuation statement must be filed. This filing allows the secured party to maintain its priority rights over the collateral. Understanding and adhering to UCC-1 filing requirements is essential for creditors to establish and protect their security interests. By complying with these requirements and filing the appropriate type of UCC-1 document, creditors can safeguard their financial investments and ensure proper legal remedies if a debtor defaults on their obligations.

Ucc-1 Filing Requirements

Description

How to fill out Ucc-1 Filing Requirements?

The Ucc-1 Filing Requirements you see on this page is a reusable formal template drafted by professional lawyers in line with federal and local regulations. For more than 25 years, US Legal Forms has provided individuals, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, most straightforward and most trustworthy way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Obtaining this Ucc-1 Filing Requirements will take you just a few simple steps:

- Browse for the document you need and check it. Look through the sample you searched and preview it or check the form description to confirm it satisfies your requirements. If it does not, make use of the search option to find the right one. Click Buy Now when you have found the template you need.

- Sign up and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Acquire the fillable template. Pick the format you want for your Ucc-1 Filing Requirements (PDF, DOCX, RTF) and save the sample on your device.

- Fill out and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a valid.

- Download your papers one more time. Utilize the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier downloaded forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

Louisiana Advance Directive Forms. An advance directive is a legally binding document that gives instructions for your healthcare in the event that you are no longer able to make or communicate those decisions yourself.

Is the Five Wishes advance directive a legal document? Yes. It was written with the help of the American Bar Association's Commission on Law & Aging. It meets the legal requirements of 46 states, but is used widely in all 50, and a federal law requires medical care providers to honor patient wishes as expressed.

Five Wishes Paper is a traditional printed booklet to complete by hand. It meets requirements in nearly all states. If you live in one of only four states (New Hampshire, Kansas, Ohio, or Texas) you can still use the Five Wishes Paper but may need to take an extra step.

Ing to analysis by the American Bar Association's Commission on Law and Aging, Five Wishes currently meets the legal requirements for an advance directive in 46 states and the District of Columbia, including California.

Unlike medical power of attorney documents, Five Wishes goes beyond just medical and healthcare topics to express spiritual, emotional and personal wishes. It aims to be a more holistic way of planning for the end of life.

The most common types of advance directives are the living will and the durable power of attorney for health care (sometimes known as the medical power of attorney). There are many advance directive formats.

Each type of Living Will requires that the declaration be made in front of two witnesses. They must be competent adults who are not related to you by blood or marriage and who are not entitled to any part of your estate.

Fives Wishes is a living will that covers personal, spiritual, medical and legal wishes all in one document in clear, easy to understand terms.