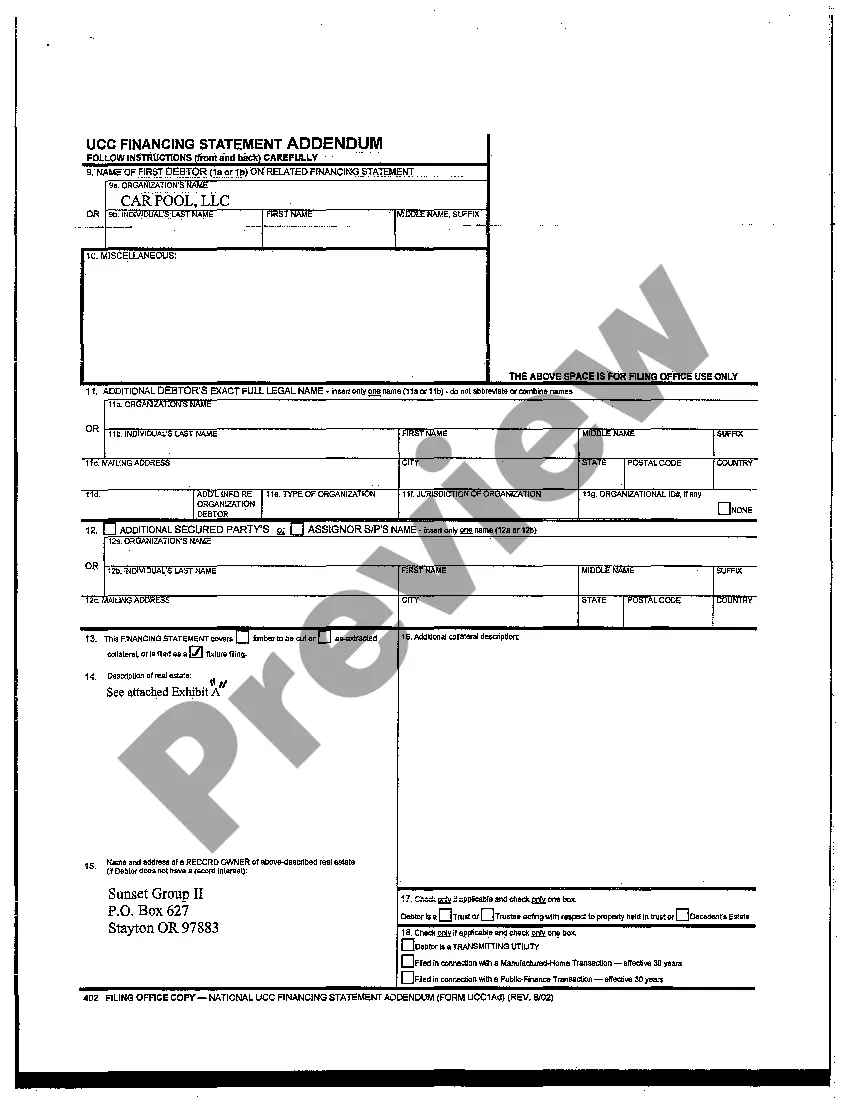

Oregon Ucc Withholding

Description

How to fill out Oregon UCC Financing Statement?

Identifying a reliable source to obtain the most updated and suitable legal documents is a significant part of navigating bureaucracy.

Finding the appropriate legal forms requires accuracy and careful consideration, which is why it is essential to obtain samples of Oregon Ucc Withholding solely from trustworthy providers, such as US Legal Forms. An incorrect document will squander your time and delay your current situation. With US Legal Forms, you have minimal concerns.

Eliminate the hassle associated with your legal documentation. Browse the extensive US Legal Forms collection where you can discover legal templates, assess their relevance to your situation, and download them instantly.

- Use the catalog navigation or search bar to find your template.

- Review the form’s details to ensure it meets the criteria of your state and locality.

- Check the form preview, if available, to confirm it is indeed the template you require.

- Return to the search and seek the correct template if the Oregon Ucc Withholding does not fulfill your needs.

- Once you are certain about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you do not have an account yet, click Buy now to purchase the form.

- Select the pricing option that aligns with your preferences.

- Proceed to sign up to complete your order.

- Finalize your purchase by choosing a payment option (credit card or PayPal).

- Select the file format for downloading Oregon Ucc Withholding.

- After you have the form on your device, you can edit it with the editor or print it and fill it out by hand.

Form popularity

FAQ

A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances.

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

Income Tax Brackets Head of HouseholdOregon Taxable IncomeRate$0 - $7,5004.75%$7,500 - $18,9006.75%$18,900 - $250,0008.75%1 more row