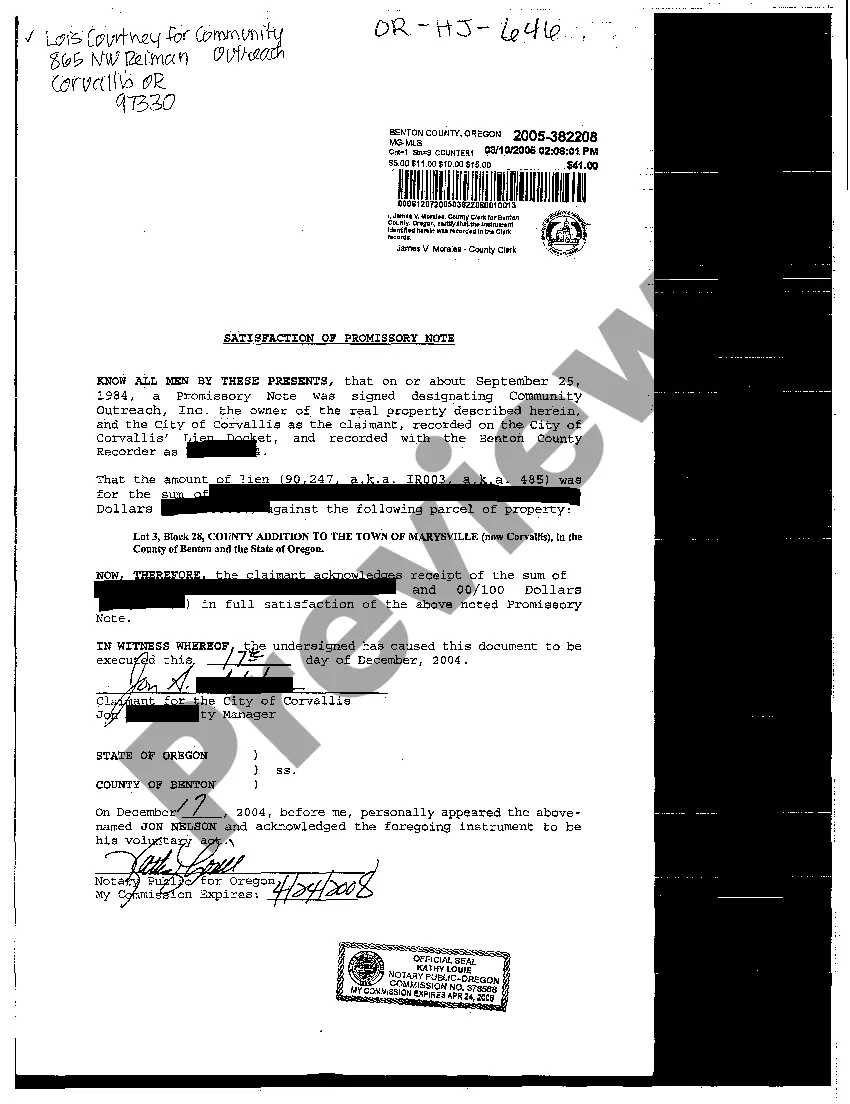

Satisfaction Of Promissory Note With Personal Guarantee Template

Description

How to fill out Oregon Satisfaction Of Promissory Note?

There’s no longer a reason to squander hours searching for legal documents to comply with your local state laws.

US Legal Forms has assembled all of them in a single location and enhanced their availability.

Our platform offers over 85k templates for any business and personal legal situations classified by state and area of application.

Use the Search field above to look for another sample if the previous one didn’t suit you. Click Buy Now next to the template name when you discover the appropriate one. Choose the most suitable pricing plan and register for an account or Log In. Process the payment for your subscription with a credit card or through PayPal to continue. Select the file format for your Satisfaction Of Promissory Note With Personal Guarantee Template and download it to your device. Print your document to fill it out in writing or upload the sample if you choose to complete it in an online editor. Preparing official documents in compliance with federal and state regulations is quick and simple with our library. Explore US Legal Forms today to keep your documentation organized!

- All forms are expertly drafted and verified for validity, allowing you to be confident in obtaining a current Satisfaction Of Promissory Note With Personal Guarantee Template.

- If you are acquainted with our service and already possess an account, you must ensure your subscription is active before acquiring any templates.

- Log In to your account, select the document, and click Download.

- You can also retrieve all previously acquired documents at any time by accessing the My documents tab in your profile.

- If you are a first-time user of our service, the process will require a few additional steps to complete.

- Here’s how new users can find the Satisfaction Of Promissory Note With Personal Guarantee Template in our library.

- Examine the page content closely to confirm it features the sample you require.

- To assist you, use the form description and preview options, if available.

Form popularity

FAQ

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

A guarantor's form should include a space to fill in the home address, work address, phone number, and email address. The contact details are what will be used to contact the guarantor in the future if the principal fails to meet agreement terms. This is a very important feature of the guarantor's form.

Personal Guarantee: Taking Responsibility A promissory note alone may not be enough to secure the loan your business needs. That's why your promissory note could include a personal guarantee. Since a promissory note is basically just an IOU, a lender will want some kind of collateral to secure the loan.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

How to Write a Personal Guarantee?Information About the Parties.Information About the Loan.Subject of the Guarantee.Terms and Conditions.Contact Information.Signatures.Witness.