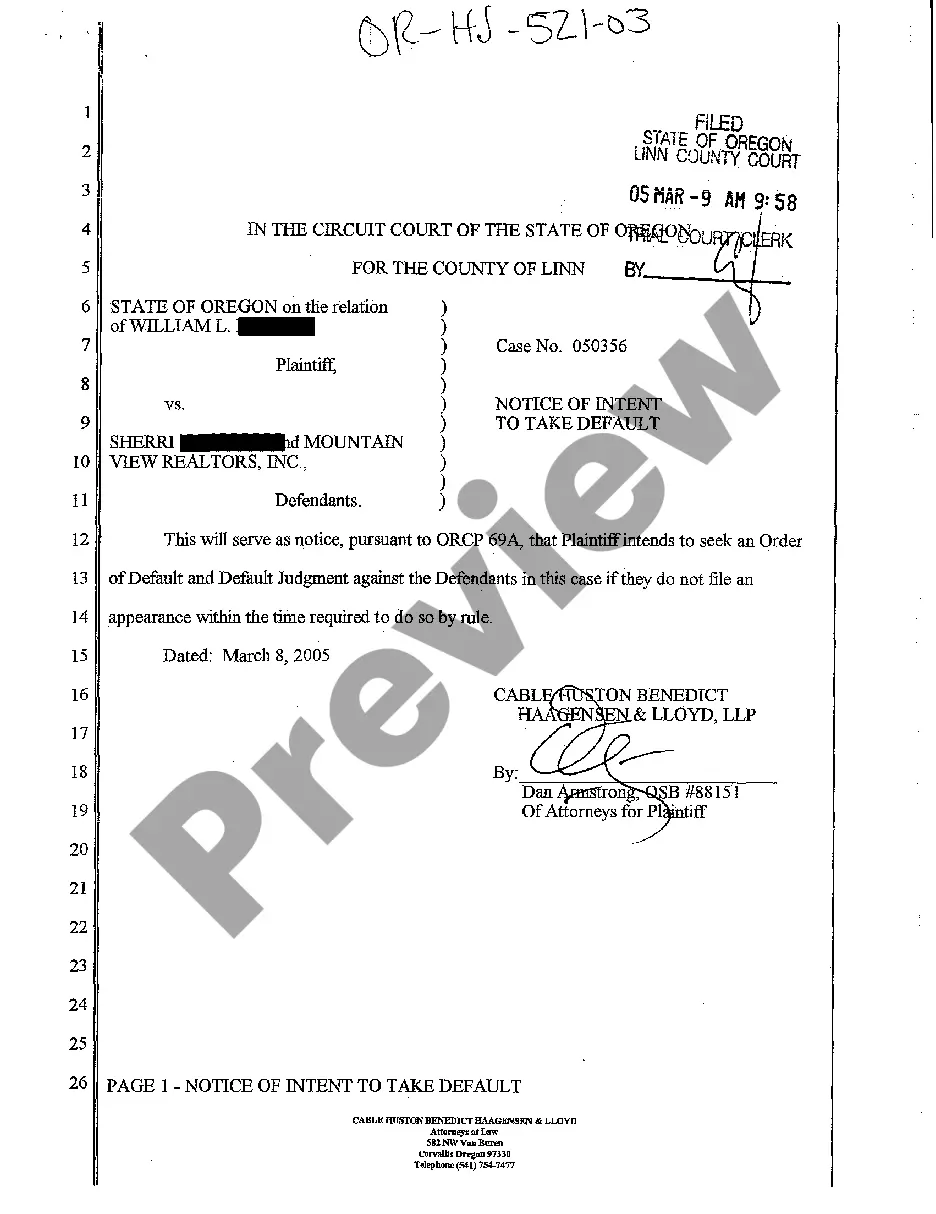

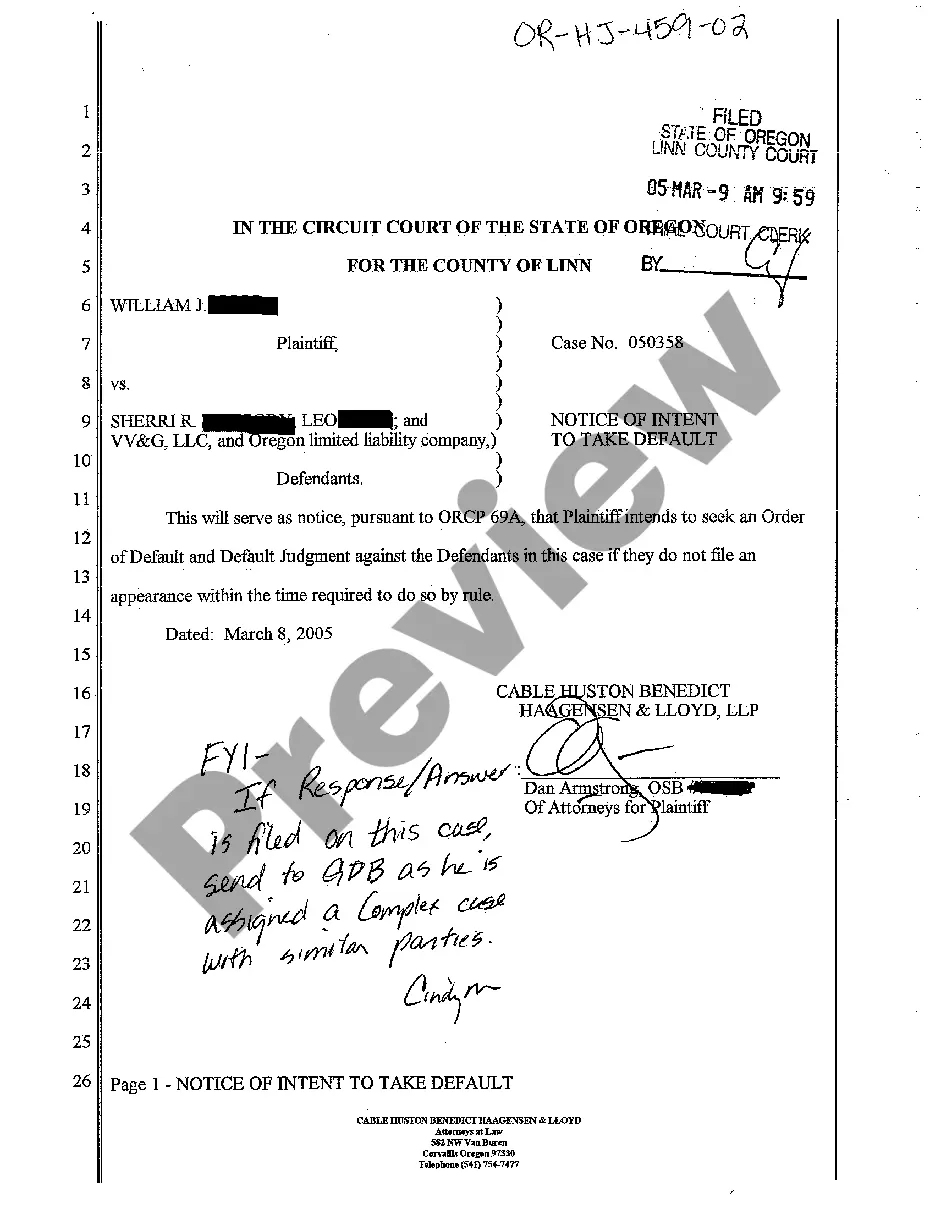

Notice Of Intent To Take Default Foreclose

Description

How to fill out Oregon Notice Of Intent To Take Default Judgment Against Defendant?

Finding a go-to place to access the most current and appropriate legal samples is half the struggle of dealing with bureaucracy. Discovering the right legal papers needs accuracy and attention to detail, which is the reason it is vital to take samples of Notice Of Intent To Take Default Foreclose only from reliable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and see all the information about the document’s use and relevance for your circumstances and in your state or region.

Consider the following steps to finish your Notice Of Intent To Take Default Foreclose:

- Use the catalog navigation or search field to find your template.

- View the form’s description to check if it suits the requirements of your state and area.

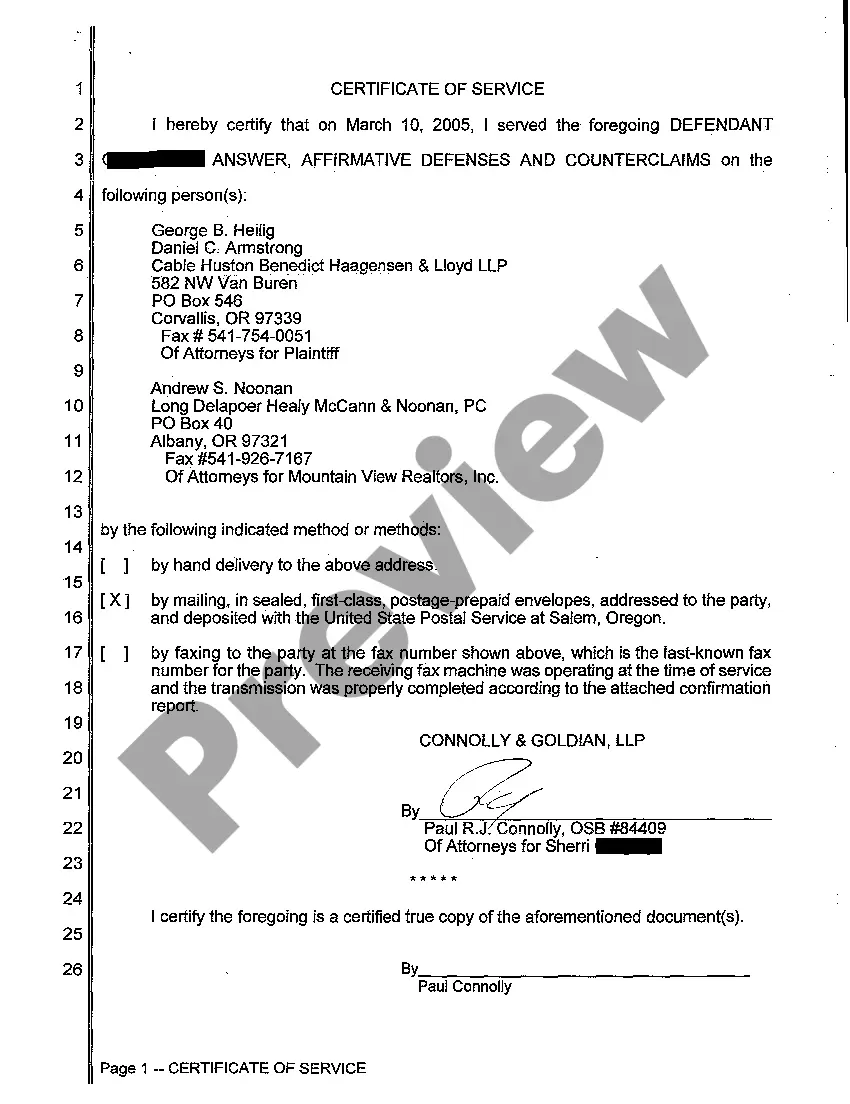

- View the form preview, if available, to make sure the template is the one you are searching for.

- Resume the search and look for the proper template if the Notice Of Intent To Take Default Foreclose does not suit your requirements.

- When you are positive regarding the form’s relevance, download it.

- When you are a registered user, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Choose the pricing plan that suits your preferences.

- Go on to the registration to complete your purchase.

- Finalize your purchase by picking a payment method (credit card or PayPal).

- Choose the document format for downloading Notice Of Intent To Take Default Foreclose.

- Once you have the form on your device, you can alter it with the editor or print it and finish it manually.

Remove the hassle that accompanies your legal documentation. Discover the comprehensive US Legal Forms library to find legal samples, examine their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

A default notice is issued to a mortgagor or borrower when they default on their interest payments for more than 120 or 180 days, depending upon the state. Some states mandate a minimum of 30 days from a missed payment before sending a notice.

Notice of intent to foreclose letters are relatively standard documents. The letter you receive from the lender will name you, the property owner, and explain that you are in serious default on your loan. The document will also explain that you have 30 days to cure your mortgage.

They payment due on ____Date____ , for $ ______________ has not been paid. Consequently, you are now in default on the said note. Please pay the amount due within the next seven days. If payment is not made within the specified period, we shall proceed to enforce our rights to collect the entire balance.

How Notices of Default Work The name and address of the borrower. The name and address of the lender. The legal address of the property. Full details on the nature of the default. What action is required to cure the default. The deadline and the intentions of the lender if the deadline is passed without a cure.

This is a letter your creditor sends to warn that you are behind on payments and your account may default. Creditors usually send a default notice after six months of missed or under payments. They will give you at least two weeks to make up missed payments. If you cannot pay in this time your account will default.