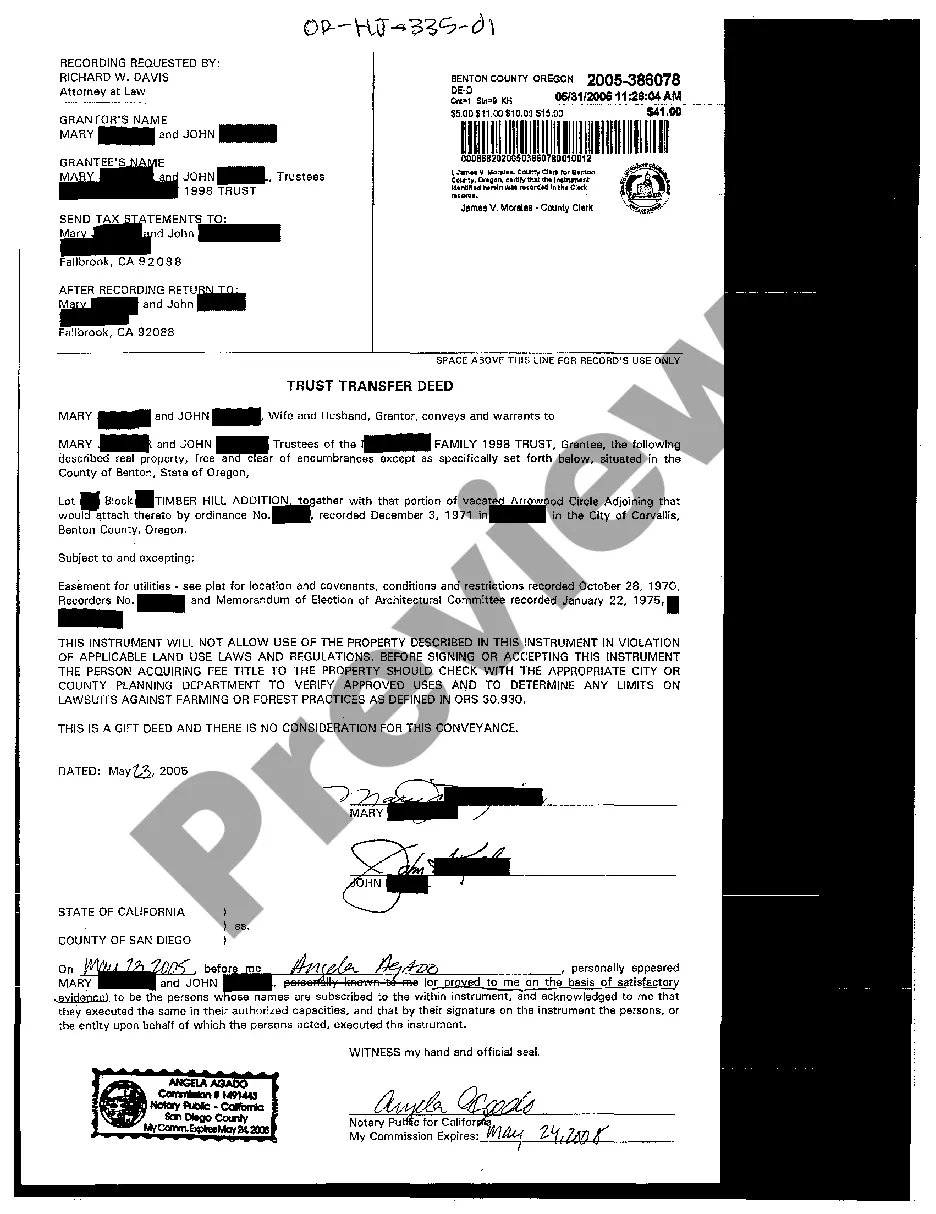

Trust Transfer Deed Without Consideration

Description

How to fill out Trust Transfer Deed Without Consideration?

When you need to finalize a Trust Transfer Deed Without Consideration in line with your local state's statutes, there can be various alternatives to choose from.

There's no necessity to inspect every form to ensure it satisfies all the legal requirements if you are a US Legal Forms member.

It is a trustworthy service that can assist you in obtaining a reusable and current template on any topic.

Acquire expert-written formal documents effortlessly with US Legal Forms. Furthermore, Premium users can also take advantage of the powerful integrated solutions for online PDF editing and signing. Give it a try today!

- US Legal Forms is the most comprehensive online catalog with a repository of over 85k ready-to-use documents for business and personal legal matters.

- All templates are verified to comply with each state's laws and regulations.

- Thus, when downloading Trust Transfer Deed Without Consideration from our platform, you can be assured that you maintain a valid and updated document.

- Acquiring the necessary sample from our platform is remarkably simple.

- If you already possess an account, simply Log In to the system, ensure your subscription is active, and save the selected file.

- In the future, you can navigate to the My documents tab in your profile and retain access to the Trust Transfer Deed Without Consideration whenever you need.

- If it's your initial experience with our library, please follow the instructions below.

- Browse the suggested page and verify it for adherence to your needs.

Form popularity

FAQ

Without consideration means that a transaction occurs without an exchange of value between parties. In the realm of legal documents, such as a trust transfer deed without consideration, this highlights an intention to transfer property without any conditions or expectations. It is essential to understand this concept, especially in estate planning, as it affects the legal standing and intentions of asset transfer.

A gift is not considered consideration because it lacks mutual exchange or a contractual obligation. In the context of a trust transfer deed without consideration, this principle highlights that the giver is not seeking any benefit or compensation in return for the transfer. This distinction is crucial in validating the legality of the gift and ensuring it fulfills the donor's intent.

Consideration of a gift involves the value exchanged in a transaction. Generally, in a gift, there is no consideration as the giver does not expect anything back. However, understanding the absence of consideration is vital in situations such as when using a trust transfer deed without consideration, as it clarifies that the transfer is purely voluntary and charitable.

A gift without consideration refers to a transfer of property or assets where the giver does not receive anything in return. With a trust transfer deed without consideration, the donor intends to bestow an asset upon the recipient, driven by generosity rather than profit. This is a common practice in estate planning, allowing individuals to manage their assets in a way that benefits their loved ones.

When someone has no consideration, it means that there is no reciprocal exchange of value for a transaction or agreement. In the context of a trust transfer deed without consideration, this indicates that one party is transferring property without expecting anything in return. This type of arrangement often signifies a gift or a charitable act, emphasizing the intent behind the transaction rather than a business exchange.

To transfer property held in a living trust after the grantor's death, the successor trustee needs to follow the directives in the trust agreement. This involves preparing and executing the necessary transfer documents, such as a trust transfer deed without consideration, to formally move ownership of the property to the beneficiaries. Utilizing a platform like UsLegalForms can simplify this process, providing templates and guidance tailored for estate management.

Yes, a trust typically becomes irrevocable upon the death of the grantor. This means that the terms of the trust cannot be altered, and the assets must be managed according to the original instructions. This feature provides certainty and protects the interests of beneficiaries, especially when dealing with trust transfer deeds without consideration.

Transfer without consideration refers to a situation where property is transferred from one individual to another without receiving anything in return. This type of transfer often occurs in family arrangements or charitable donations. Understanding trust transfer deeds without consideration is crucial for effective estate planning and avoiding gift taxes.

When a grantor of a living trust dies, the trust generally remains intact and continues to operate under the terms set forth in the trust document. The successor trustee takes over the management of the trust, ensuring that assets are distributed according to the grantor's wishes. This process avoids probate, allowing for a seamless transfer of assets, including any trust transfer deed without consideration.