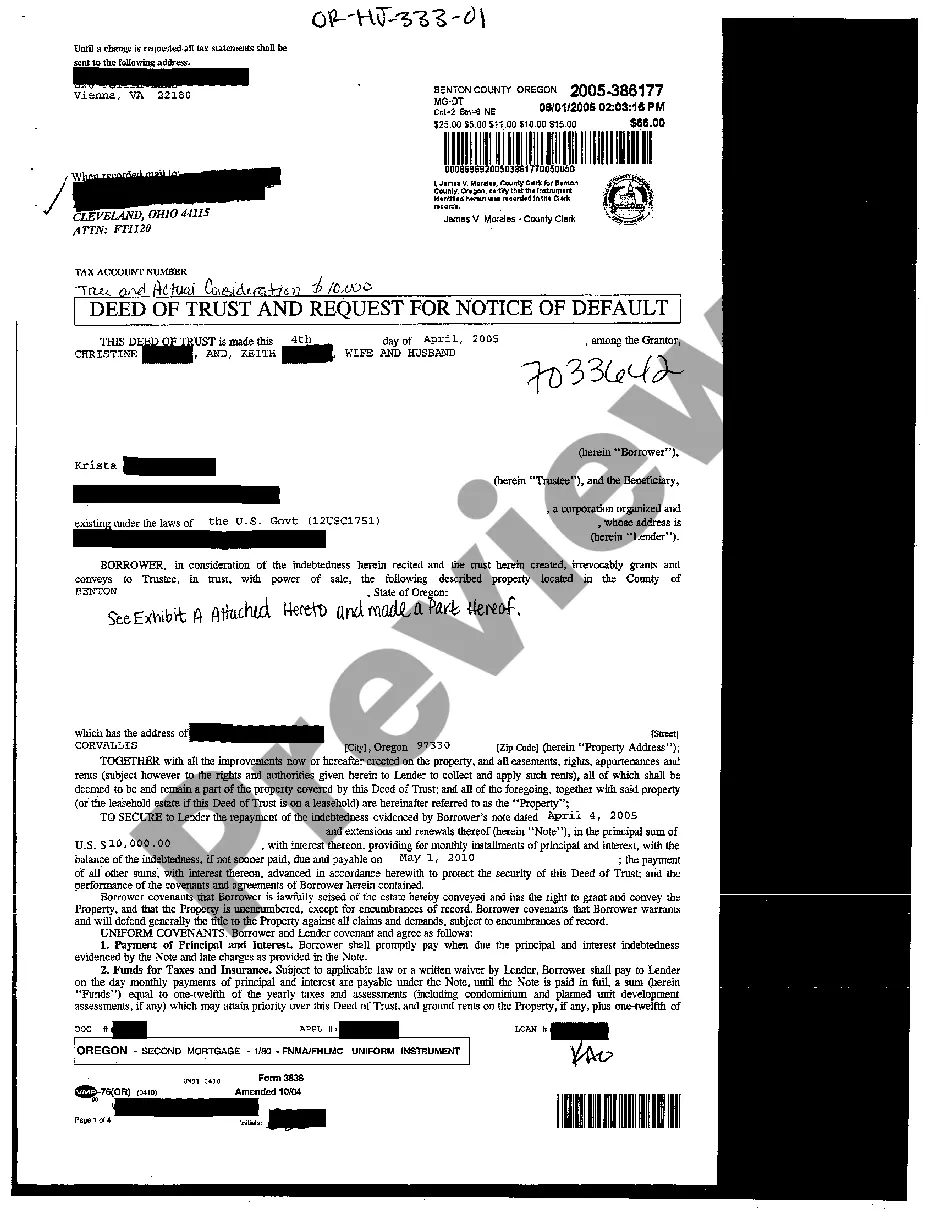

Oregon Trust Deed Act Foreclosure

Description

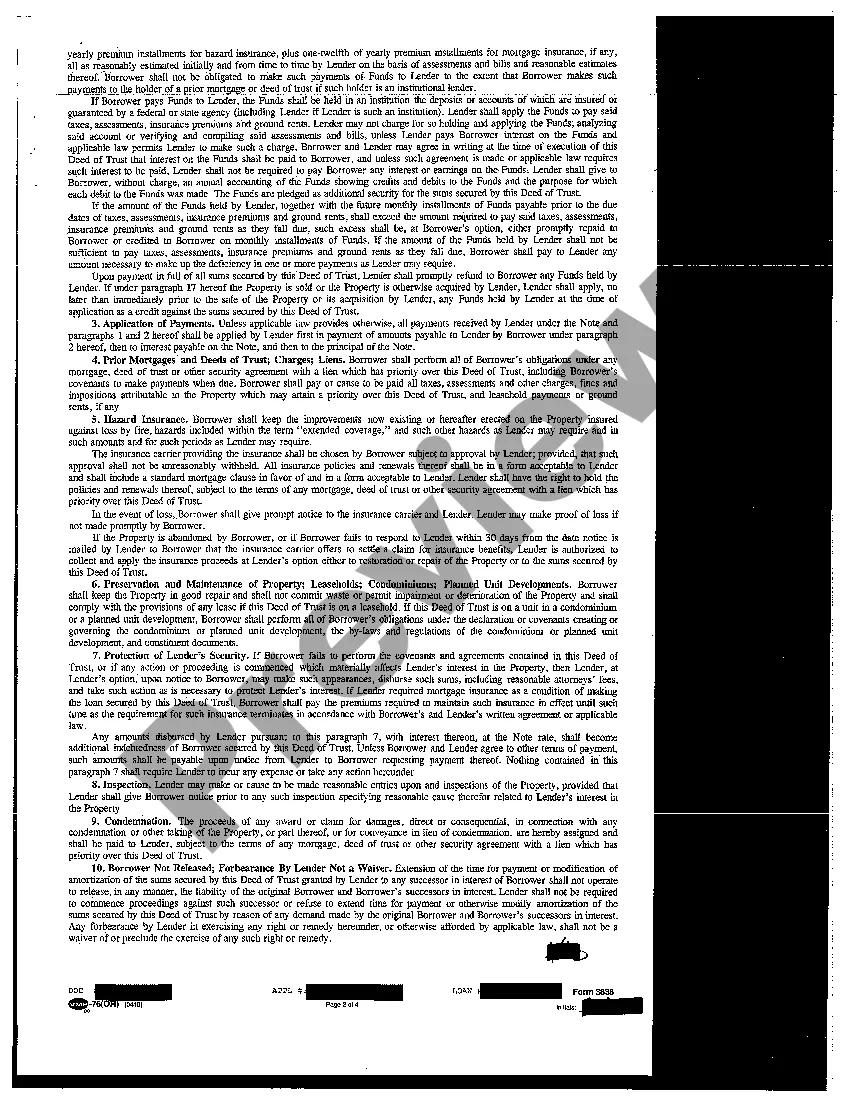

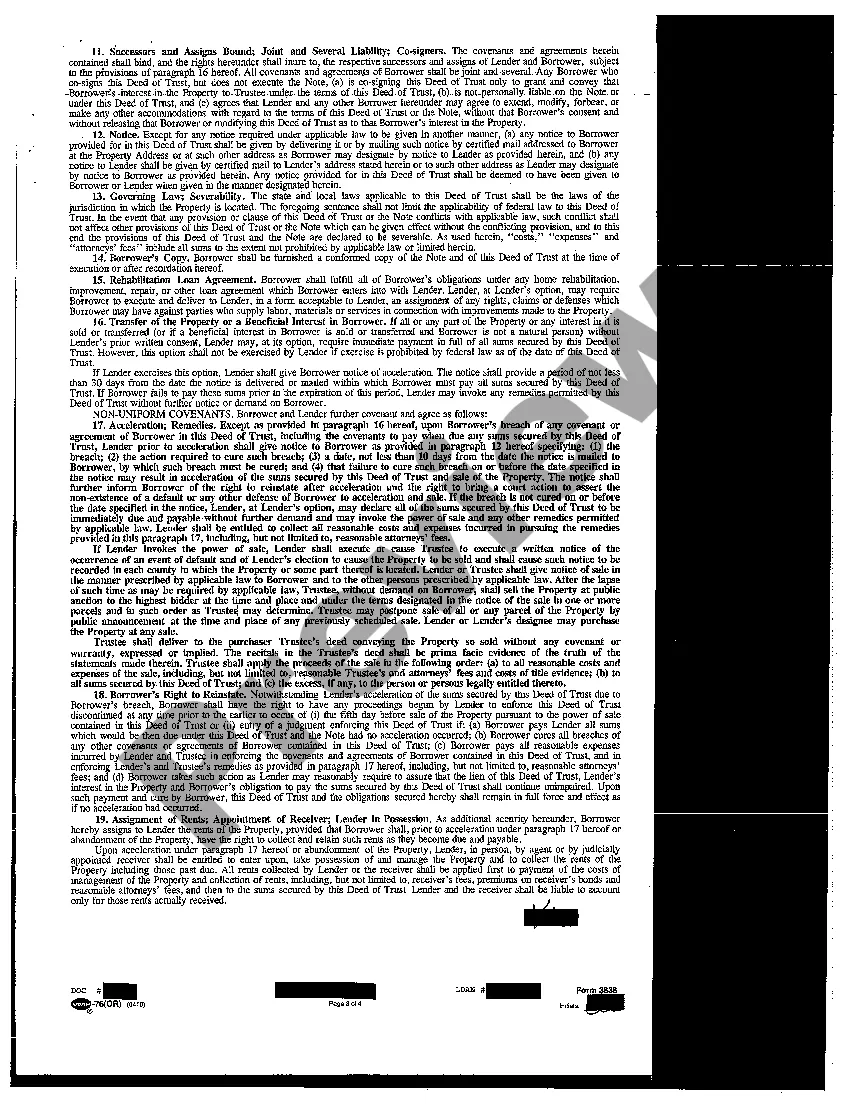

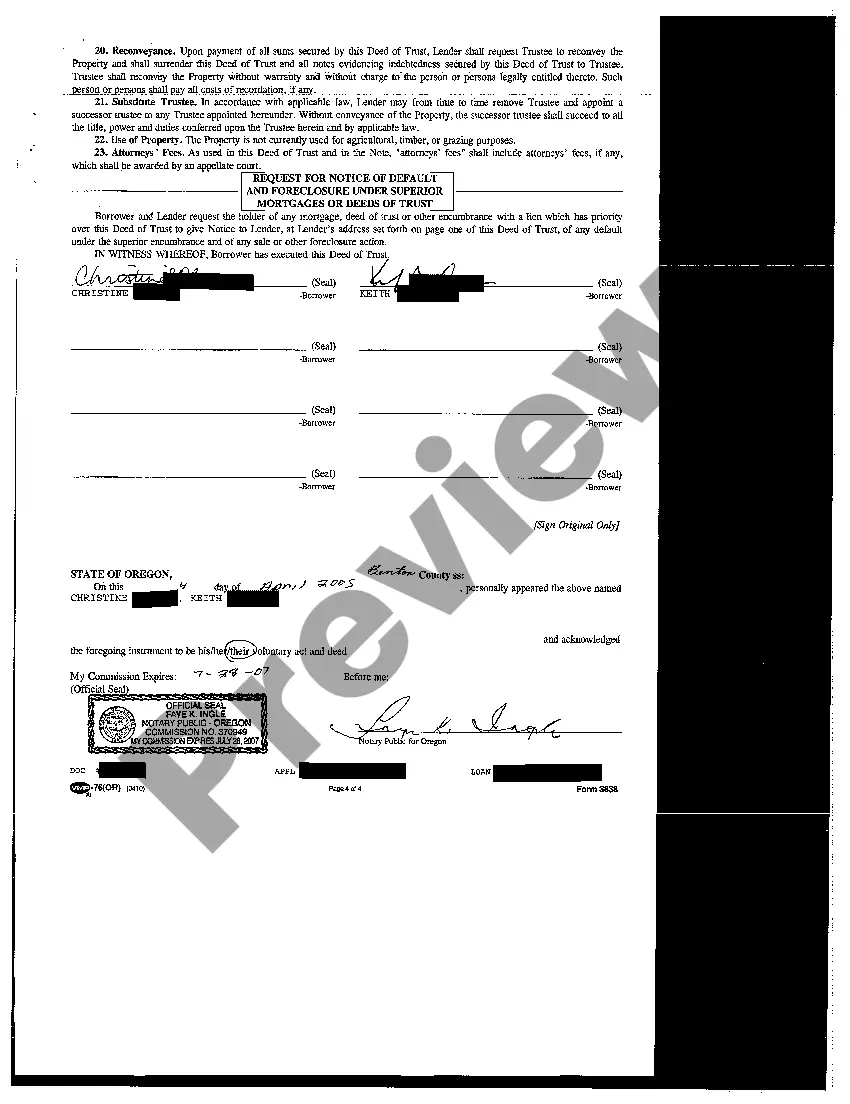

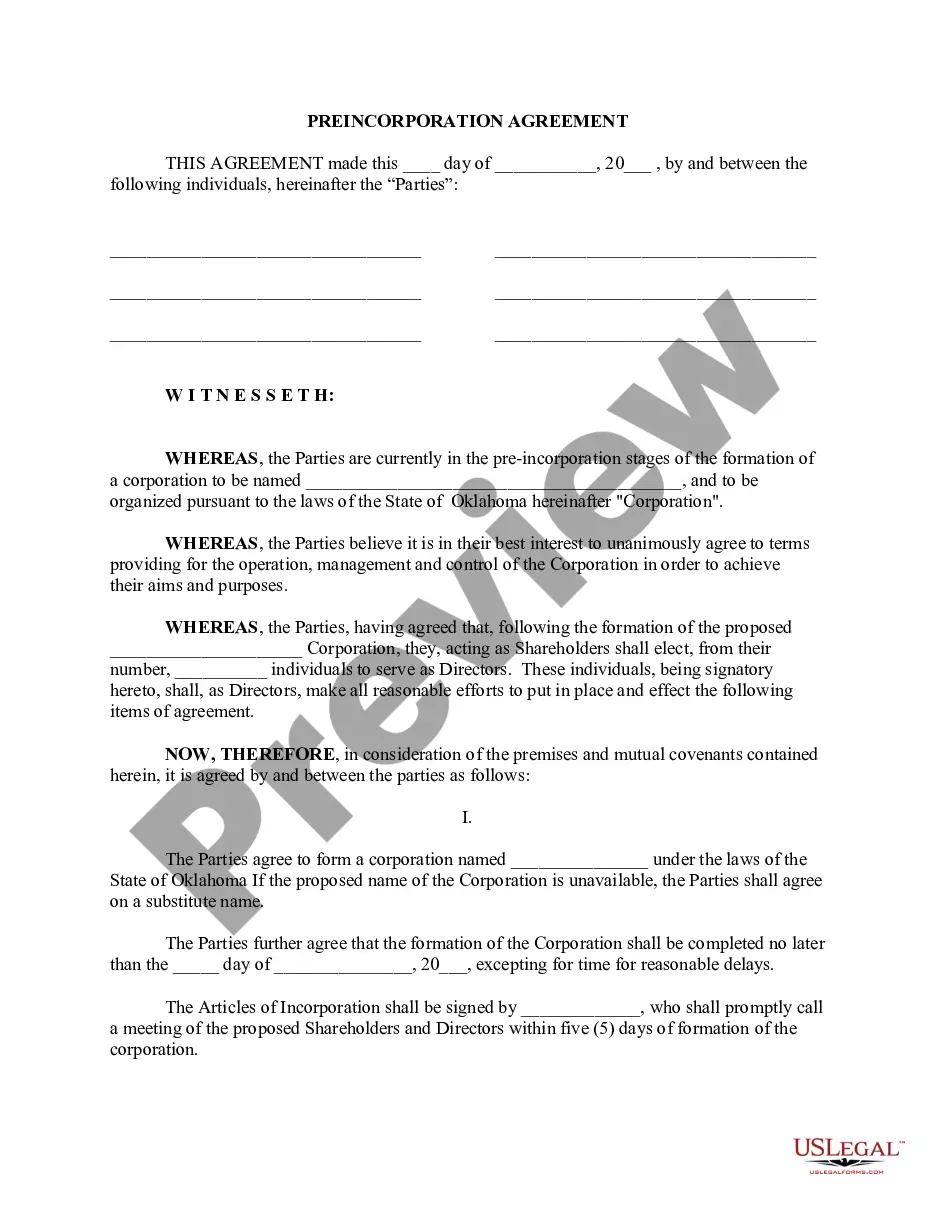

How to fill out Oregon Deed Of Trust And Request For Notice Of Default?

What is the most dependable service to obtain the Oregon Trust Deed Act Foreclosure and other current versions of legal documents? US Legal Forms is the solution!

It boasts the largest collection of legal materials for any situation. Each example is meticulously crafted and validated for adherence to national and local laws.

Form compliance assessment. Prior to acquiring any form, you need to ensure it meets your specific use case requirements and the laws of your state or county. Review the form description and use the Preview feature if available.

- They are organized by area and state of application, making it easy to find the document you need.

- Experienced users of the platform need only to Log In to the site, verify their subscription status, and click the Download button next to the Oregon Trust Deed Act Foreclosure to obtain it.

- Once downloaded, the document stays accessible for future use within the My documents section of your profile.

- If you currently do not have an account with our library, here are the steps to create one.

Form popularity

FAQ

New Jersey generally has the longest foreclosure process in the United States, often taking over two years to complete. This lengthy duration contrasts with states like Oregon, which is governed by the Oregon trust deed act foreclosure. Understanding each state's laws can provide clarity and help you prepare if you face financial difficulties. Using resources like those offered by US Legal Forms can empower you to handle your specific state’s procedures with confidence.

In Oregon, the timeline for a bank to foreclose on your home can vary, but it typically takes several months. This process follows the Oregon trust deed act foreclosure rules, which allow banks to act if you fall behind on payments. The entire procedure may take anywhere from 120 to 210 days, depending on court schedules and your specific situation. To protect your rights, consider consulting with experts or utilizing platforms like US Legal Forms to navigate your options effectively.

In Oregon, the foreclosure process typically takes about 6 to 12 months from the time the lender files a notice of default. However, this timeline can vary based on specific circumstances and the actions taken by the homeowner. It’s beneficial to seek assistance from services like USLegalForms to get accurate timelines and documents relevant to the Oregon trust deed act foreclosure.

Yes, Oregon is a deed of trust state. In Oregon, lenders often use a deed of trust to secure loans, which involves three parties: the borrower, the lender, and a trustee. Understanding how this impacts your rights and obligations is essential, especially in relation to the Oregon trust deed act foreclosure.

Foreclosure auctions in Oregon occur after the foreclosure process has been completed through the courts. Once the property is up for auction, the highest bidder purchases the property, often at a significant discount. Understanding the Oregon trust deed act foreclosure will help you navigate this process and know your rights as a borrower or bidder.

A deed in lieu of foreclosure in Oregon allows a homeowner to voluntarily transfer ownership of their property to the lender, avoiding the formal foreclosure process. This option can be a simpler and less stressful way to resolve a mortgage issue under the Oregon trust deed act foreclosure. Homeowners should discuss this option with their lender and seek legal advice.

The Oregon foreclosure avoidance program assists homeowners in managing their mortgage challenges. This program provides resources and guidance in line with the Oregon trust deed act foreclosure. It encourages homeowners to work with certified housing counselors to pursue alternatives to foreclosure.

A notice of intent to foreclose in Oregon is a formal notification that a lender intends to initiate foreclosure proceedings. This notice is often sent after multiple missed payments and is required under the Oregon trust deed act foreclosure. It serves as an important step for borrowers to understand their rights and options moving forward.

In Oregon, you can face foreclosure after just one missed payment, but the process usually begins after three missed payments. The Oregon trust deed act foreclosure requires lenders to provide notice before initiating proceedings. Homeowners should stay in communication with their lenders to explore options and avoid escalation.

The foreclosure process in Oregon typically takes about 6 to 12 months. This timeframe can vary depending on factors such as court schedules and specific circumstances related to the Oregon trust deed act foreclosure. It’s important for homeowners to understand this timeline and take proactive steps to address their situation.