Construction Lien Release Form Oregon

Description

How to fill out Oregon Release Of Construction Lien?

What is the most reliable service to obtain the Construction Lien Release Form Oregon and other updated versions of legal paperwork.

US Legal Forms is the answer! It's the finest collection of legal documents for any circumstance.

If you don't yet have an account with our repository, here are the steps you need to follow to get one.

- Every template is expertly drafted and verified for adherence to federal and local laws.

- They are classified by area and state of application, making it simple to find the one you require.

- Experienced users of the website simply need to Log In to the platform, check if their subscription is active, and click the Download button next to the Construction Lien Release Form Oregon to receive it.

- Once saved, the template is accessible for future use within the My documents section of your account.

Form popularity

FAQ

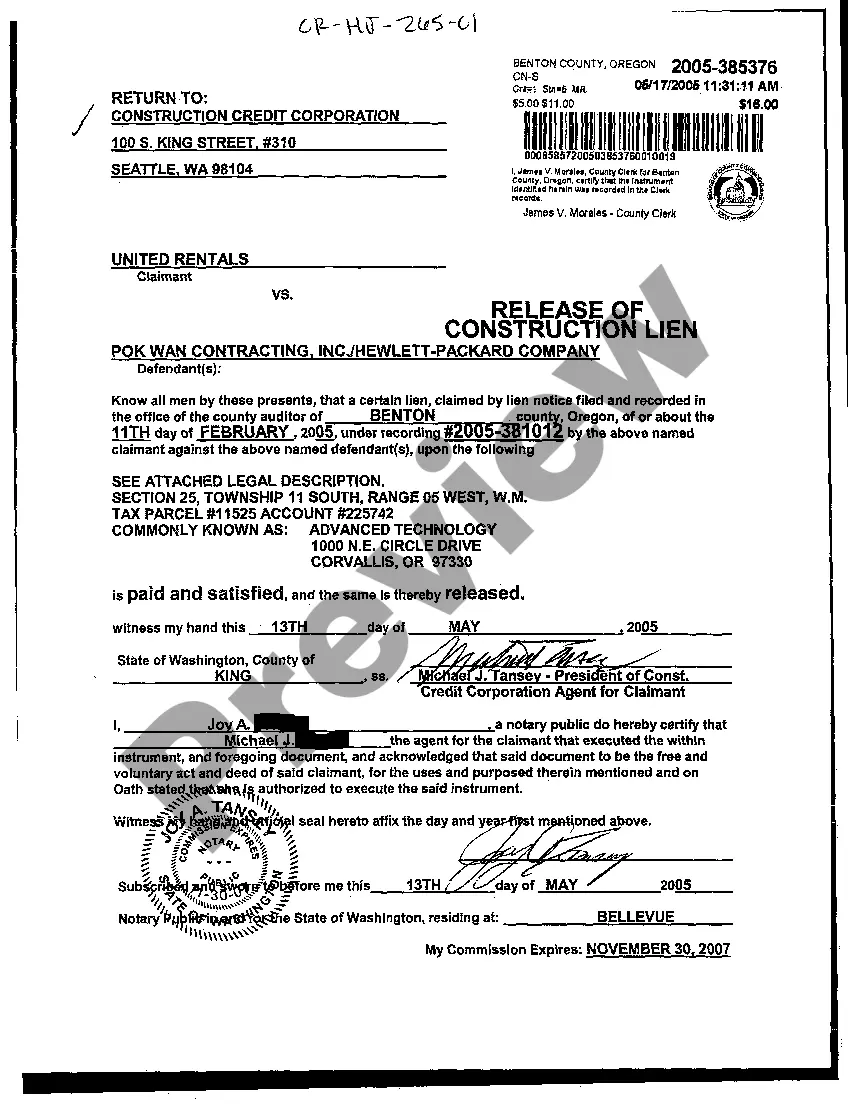

To create a construction lien release form in Oregon, start by gathering all necessary information, including details about the property, the parties involved, and the amount being released. You can use tools available on the US Legal Forms platform, which provides easy access to customizable lien release form templates specifically designed for Oregon. Once you fill out the form, ensure that all parties involved sign it to make it legally binding. Finally, file the completed form with the appropriate local authorities to officially release the lien.

While it is not mandatory for a waiver to be notarized in Oregon, having it notarized can add an extra layer of protection. Notarization can deter potential disputes and affirm the legitimacy of the document. If you are using a construction lien release form in Oregon, consider notarizing it to enhance its reliability in legal matters. It is a simple step that can safeguard your interests.

A lien waiver is a document that a contractor or subcontractor signs to confirm they have received payment and will not pursue a lien for that payment. On the other hand, a lien release is a document that formally removes any existing lien on a property. Both documents are important in construction projects, and using a construction lien release form in Oregon can streamline your processes and protect your rights. Understanding these differences can help you navigate your construction projects more effectively.

Yes, Oregon has certain statutory lien waiver forms that you can use to simplify your construction transactions. These forms meet the legal requirements, providing protection for both the payer and the payee. Utilizing a statutory construction lien release form in Oregon helps to ensure that all parties understand their obligations and protects you from potential claims. Be sure to review these forms carefully.

In Oregon, lien waivers do not typically require notarization to be valid. However, it is often recommended to have them notarized for added security and to avoid disputes. A notarized construction lien release form in Oregon can strengthen your position in case of future claims. This extra step can provide peace of mind, especially in complex projects.

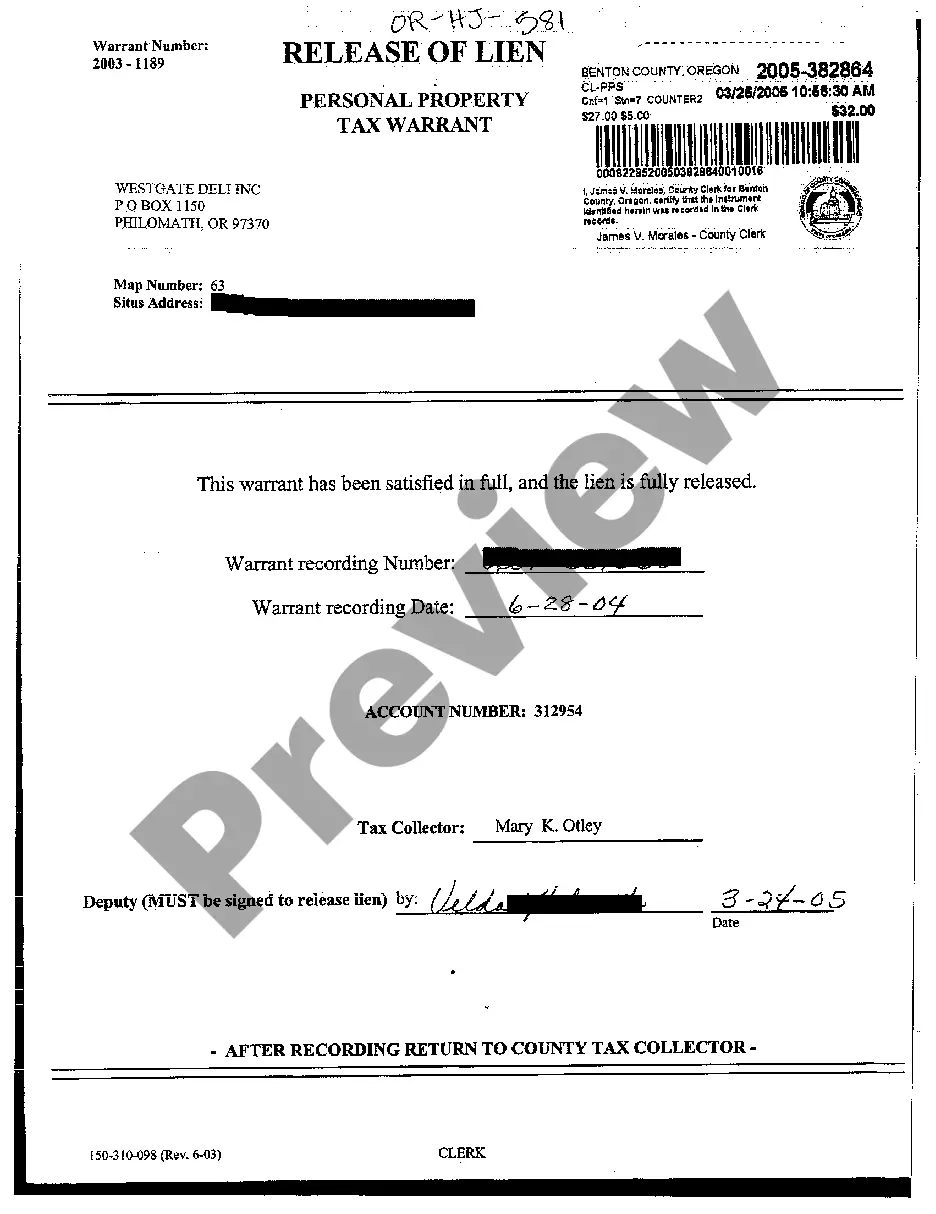

To get your lien released, you should complete the Construction lien release form oregon correctly and ensure it is signed by the lien claimant. Once the form is completed, file it with your local county clerk. This official filing will release the lien on your property and clear any claims against it.

In Oregon, lien waivers do not typically need to be notarized, but it is a good practice to get them notarized to ensure validity. When using the Construction lien release form oregon, having it notarized can provide an extra layer of protection for both parties. Always verify specific requirements, as they may vary.

In Oregon, a construction lien typically lasts for 120 days after the lien is filed, unless a lawsuit gets commenced. If you do not take further legal action within this period, the lien automatically expires. To maintain your rights, consider using the Construction lien release form oregon as soon as your obligations are met.

Releasing a lien in Oregon involves obtaining the Construction lien release form oregon and completing it accurately. After filling in the necessary details, you must have it signed by the lien claimant and possibly notarized. Finally, you'll file the completed form with the county recorder to document the release.

To release a lien in Oregon, you must fill out the Construction lien release form oregon. This form typically requires information about the original lien, the property involved, and signatures from relevant parties. Ensure you submit the completed form to the appropriate county clerk’s office to finalize the release.