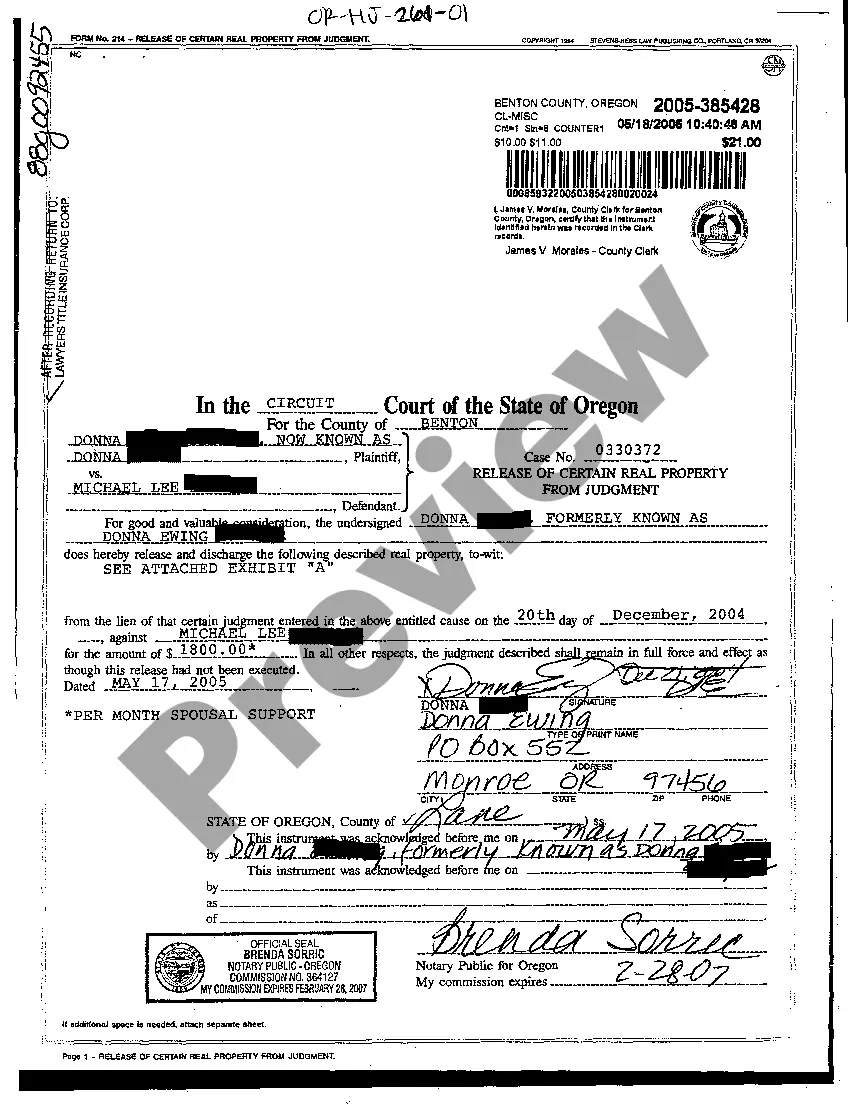

Oregon Release Of Certain Property For Residential Use

Description

How to fill out Oregon Release Of Certain Property For Residential Use?

Individuals typically link legal documentation with something intricate that only an expert can manage.

In some respects, this is accurate, since preparing the Oregon Release Of Certain Property For Residential Use requires considerable expertise in subject matters, including state and local laws.

However, with US Legal Forms, the process has become simpler: pre-prepared legal templates for various life and business events tailored to state regulations are gathered in a single online library and are now accessible to all.

Finalize your registration or Log In to progress to the payment page. Settle your subscription using PayPal or a credit card. Choose your file format and click Download. You may print your document or upload it to an online editor for faster completion. All templates in our library are reusable: once obtained, they remain saved in your profile. You can access them whenever necessary via the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe now!

- US Legal Forms provides over 85k current documents categorized by state and usage area, making the search for the Oregon Release Of Certain Property For Residential Use or any other specific template a matter of minutes.

- Previously registered users with an active subscription should Log In to their account and click Download to retrieve the form.

- New users to the platform must first register for an account and subscribe before they can save any paperwork.

- Here is the detailed guide on how to get the Oregon Release Of Certain Property For Residential Use.

- Scrutinize the page content carefully to confirm it fulfills your requirements.

- Review the form description or evaluate it using the Preview feature.

- Search for another example using the Search field above if the one before does not fulfill your needs.

- Click Buy Now when you locate the suitable Oregon Release Of Certain Property For Residential Use.

- Choose a subscription plan that aligns with your needs and budget.

Form popularity

FAQ

2020 Form OR-40. Oregon Individual Income Tax Return for Full-year Residents.

File Form OR-WR on Revenue Online at . Mail your Form OR-WR separately from your 2018 4th quarter Form OQ and 4th quarter statewide transit tax form. If you amend Form OR-WR, you will also need to amend Form OQ and 4th quarter statewide transit tax form. Make a copy for your records.

Download forms from the Oregon Department of Revenue website . Order forms by calling 1-800-356-4222. Contact your regional Oregon Department of Revenue office.

To file the Form WR electronically, as required under ORS 316.202 and ORS 314.360, you must do so using Department of Revenue's system, Revenue Online by going to this link: .

In Oregon, the kicker goes into effect when the actual state revenue exceeds the forecasted revenue by at least 2%. Then, an amount calculated by OEA is returned to the taxpayers through a credit on their tax returns. The kicker law is unique to Oregon.