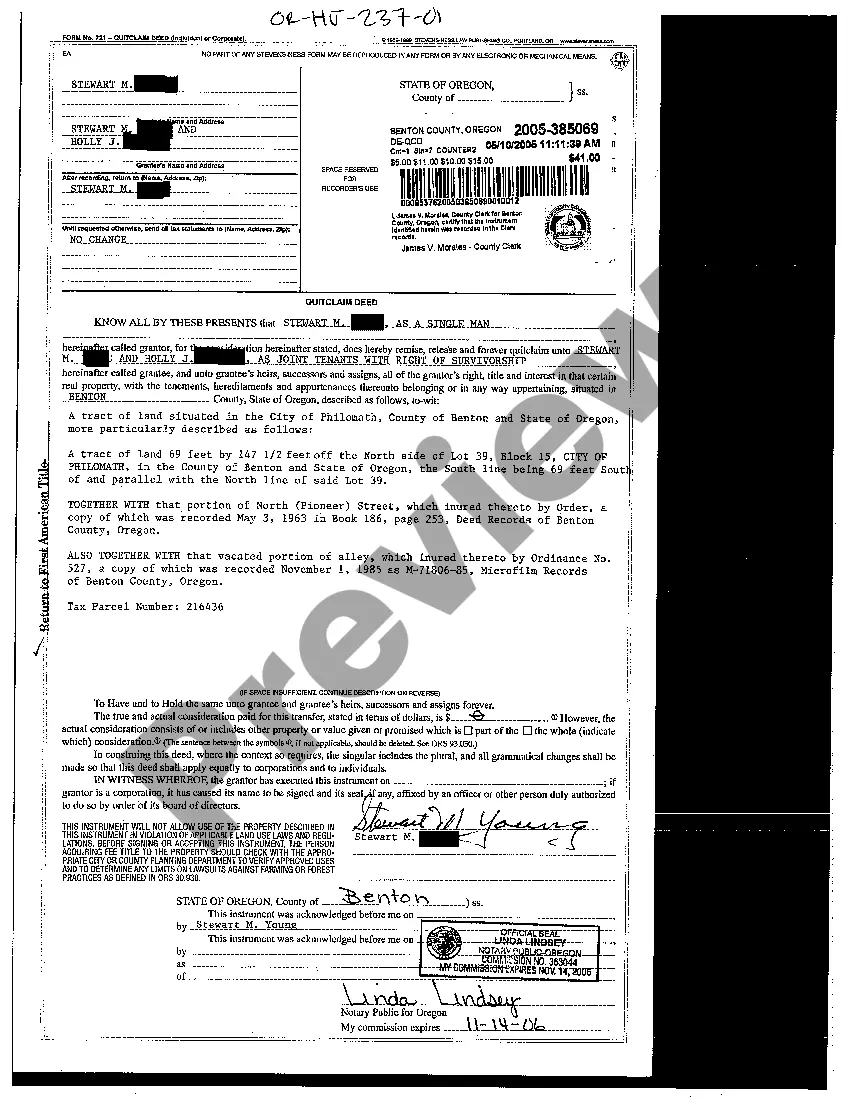

Joint Tenants With Right Of Survivorship Deed

Description

How to fill out Oregon Quitclaim Deed Individual To Joint Tenants?

Properly prepared official documents are one of the crucial assurances for evading complications and legal disputes, but acquiring them without the guidance of a lawyer may require time.

Whether you must swiftly locate a current Joint Tenants With Right Of Survivorship Deed or any other forms for work, family, or business circumstances, US Legal Forms is always available to assist.

The process is even simpler for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the selected file. Furthermore, you can retrieve the Joint Tenants With Right Of Survivorship Deed at any time, as all documents previously obtained on the platform are accessible within the My documents tab of your profile. Conserve time and money on preparing official documents. Experience US Legal Forms today!

- Ensure that the document is appropriate for your circumstances and location by reviewing the description and preview.

- Search for an additional sample (if necessary) through the Search bar in the header of the page.

- Click Buy Now once you identify the suitable template.

- Choose your pricing option, Log In to your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Choose either PDF or DOCX file format for your Joint Tenants With Right Of Survivorship Deed.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

To file a joint tenancy with right of survivorship deed, start by drafting the deed with specific language that identifies each owner as a joint tenant. You then need to sign the deed in front of a notary and file it with your local county recorder's office. Utilizing a platform like US Legal Forms can help you find the necessary forms and provide guidance throughout the process. This ensures your joint tenancy is established correctly, allowing for seamless transfer of assets.

Assets that pass by survivorship typically include real estate, bank accounts, and investment accounts, all held in a joint tenancy with right of survivorship deed. This means when one owner passes away, their share automatically transfers to the surviving owner without going through probate. Joint tenants can simplify asset transfer and provide peace of mind to families. Understanding which assets qualify is essential for effective estate planning.

The risk of joint ownership includes exposure to the actions of co-owners. If one joint tenant incurs debts or faces legal issues, creditors may pursue the property. Moreover, disagreements can arise regarding property management or decisions, creating tension among tenants. Using a joint tenancy with right of survivorship deed through a platform like USLegalForms can help clarify ownership and responsibilities, minimizing risks.

One disadvantage of a joint tenancy with right of survivorship deed is the lack of control over the property. If one joint tenant wants to sell or transfer their share, all tenants must agree. Additionally, creditors can claim the property if one joint tenant faces financial issues. These factors can complicate ownership and lead to potential disputes among tenants.

The best deed for a married couple is generally the joint tenants with right of survivorship deed. This type of deed provides significant advantages, such as shared ownership and automatic transfer of assets after one partner's death. By choosing this deed, couples can avoid delays and legal complexities during emotional times. Consider using this form to solidify your partnership while navigating the responsibilities of homeownership.

The best type of deed for a married couple is typically the joint tenants with right of survivorship deed. This deed facilitates shared ownership and ensures a smooth transfer of property upon the death of one partner. By selecting this option, couples can maintain control of their assets and avoid potential conflicts with heirs. It serves as an ideal solution for couples wanting to safeguard their financial future.

The most powerful deed for married couples is the joint tenants with right of survivorship deed. This deed not only secures both partners' interests but also allows the surviving spouse to automatically inherit the property after one partner dies. This eliminates lengthy probate processes, providing peace of mind for couples. Choosing this deed ensures that both partners remain in control of their shared assets throughout their lives.

Married couples typically use joint tenants with right of survivorship deed for property ownership. This approach allows both spouses equal rights to the property while also providing a seamless transition of ownership in case one partner passes away. This mutually beneficial setup fosters communication and cooperation between spouses, strengthening their financial partnership. Consider this option for a secure future together.

The best tenancy for a married couple is often a joint tenants with right of survivorship deed. This type of deed allows both partners to share ownership equally and ensures that, upon the death of one partner, the surviving partner automatically inherits the entire property. This arrangement can simplify the transfer of ownership and avoid potential complications in probate. Using this deed fosters financial unity and security as you build your life together.

Avoiding joint ownership may be wise if you wish to maintain full control over your property. Joint ownership can lead to complications, especially if relationships change or if disagreements arise. Furthermore, in situations involving estate planning, opting out of joint tenants with right of survivorship deeds could allow for better flexibility in distributing assets according to one’s wishes. It's essential to evaluate your personal situation and consider alternatives.