Joint Tenants With Right Of Survivorship

Description

Form popularity

FAQ

Yes, the right of survivorship typically overrides any stipulations made in a will regarding the property. This means that when one joint tenant passes away, their interest in the property passes automatically to the surviving joint tenant, regardless of any directives in a will. It is crucial to understand these implications when planning your estate to ensure your wishes are honored.

Avoiding joint ownership can prevent potential conflicts and complications, especially in cases of disagreement among owners. If one owner wants to sell while the others wish to retain the property, it can lead to legal disputes. Moreover, joint ownership may not align with your long-term estate planning goals, making individual ownership a more suitable option.

While joint tenancy with right of survivorship offers benefits, it also has downsides. One key concern is that one tenant's debts can affect the entire property, putting all owners at risk. Additionally, upon the death of one tenant, interests automatically pass to the surviving tenant, possibly disregarding estate planning wishes. Understanding these factors is crucial before choosing this property arrangement.

Certain individuals are generally prohibited from holding title as joint tenants with right of survivorship, including minors and individuals designated as mentally incompetent. Furthermore, some states impose restrictions on joint tenancy for married couples, particularly if a spouse is not included in the title. It's essential to verify the rules in your state to ensure compliance.

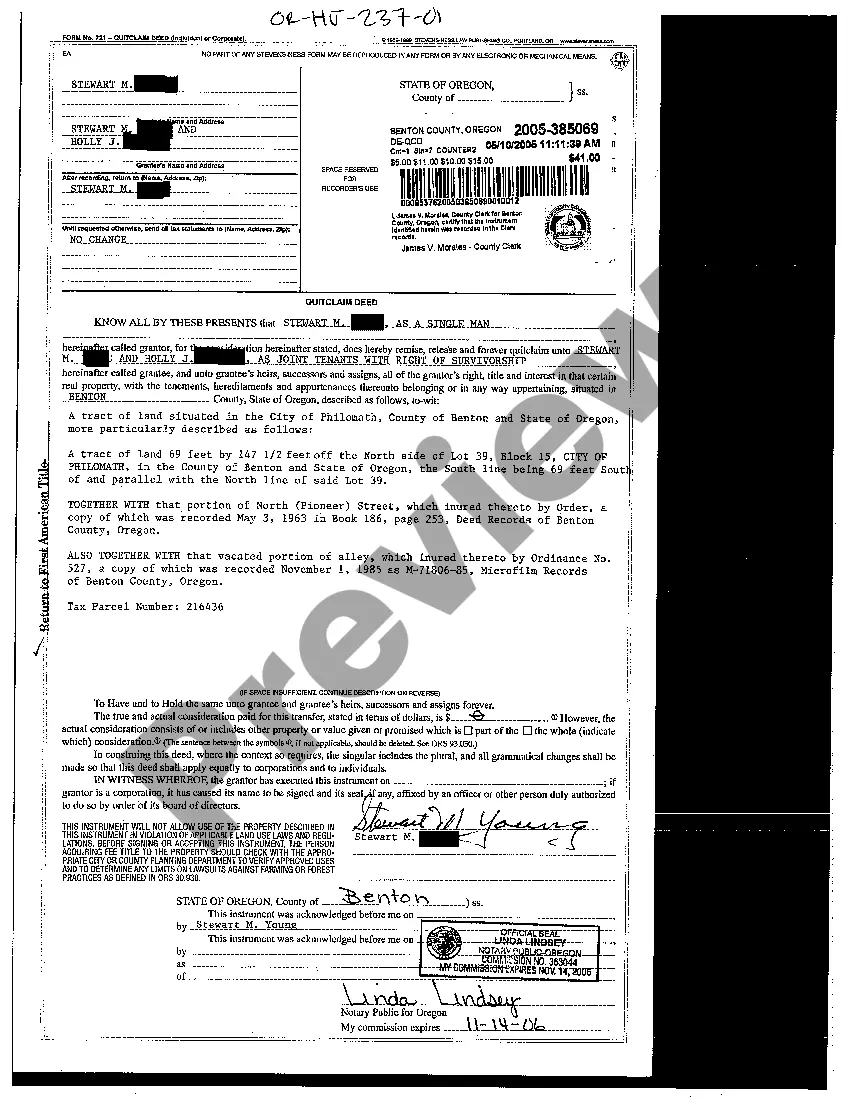

To establish joint tenancy with right of survivorship, you must ensure that all parties intend to own the property together. You will typically need to include specific language in the property deed that indicates joint tenancy. Additionally, you should consult with a legal professional to ensure the deed complies with your state laws. Utilizing platforms like USLegalForms can aid you in crafting the necessary documentation.

The tax implications for joint tenants with right of survivorship can vary based on state laws and the value of the property. Generally, when one tenant passes away, their half of the property may not be subject to probate, which can provide a tax benefit. However, it’s essential to consult with a tax professional to understand potential estate taxes or capital gain taxes when the property is sold. For more tailored advice, exploring resources from US Legal Forms can be advantageous.

An example of joint tenancy with right of survivorship is when two individuals, such as partners or family members, buy a house together. Both parties hold equal ownership, and if one person passes away, the surviving tenant automatically inherits the other’s share of the property. This arrangement ensures a smooth transition of ownership without involving probate. Such examples can often be drafted and managed with the help of US Legal Forms.

To file a joint tenancy with right of survivorship, you typically need to prepare a deed that clearly states the ownership arrangement. This deed should include the names of all joint tenants and specify that the ownership is joint with the right of survivorship. Once you've drafted the deed, you must sign it in the presence of a notary and then record it with your local county office. For additional guidance, consider using the resources available on the US Legal Forms platform.

To file for joint tenants with right of survivorship, you typically need to prepare and file a deed that explicitly states this arrangement. You'll want to consult your state laws to ensure compliance and may consider using a platform like US Legal Forms for guidance and to access the necessary paperwork. This process helps clarify ownership rights and simplifies what happens to the property upon the death of one owner.

Joint tenancy includes the concept of survivorship, but they are not synonymous. When we talk about joint tenants with right of survivorship, we emphasize that upon one owner's death, their stake automatically transfers to the surviving owner, bypassing probate. Regular joint tenancy does not guarantee this automatic transfer, which can complicate inheritance and property management.