Distributing Funds From A Trust

Description

Form popularity

FAQ

One of the biggest mistakes parents make when setting up a trust fund is failing to clearly define the distribution terms. Parents often overlook specific conditions or contingencies that can affect how assets are distributed. This lack of clarity can result in conflicts among beneficiaries and complications in distributing funds from a trust. To avoid such issues, consider using resources like UsLegalForms, which offer templates and guidance to ensure a well-structured trust fund.

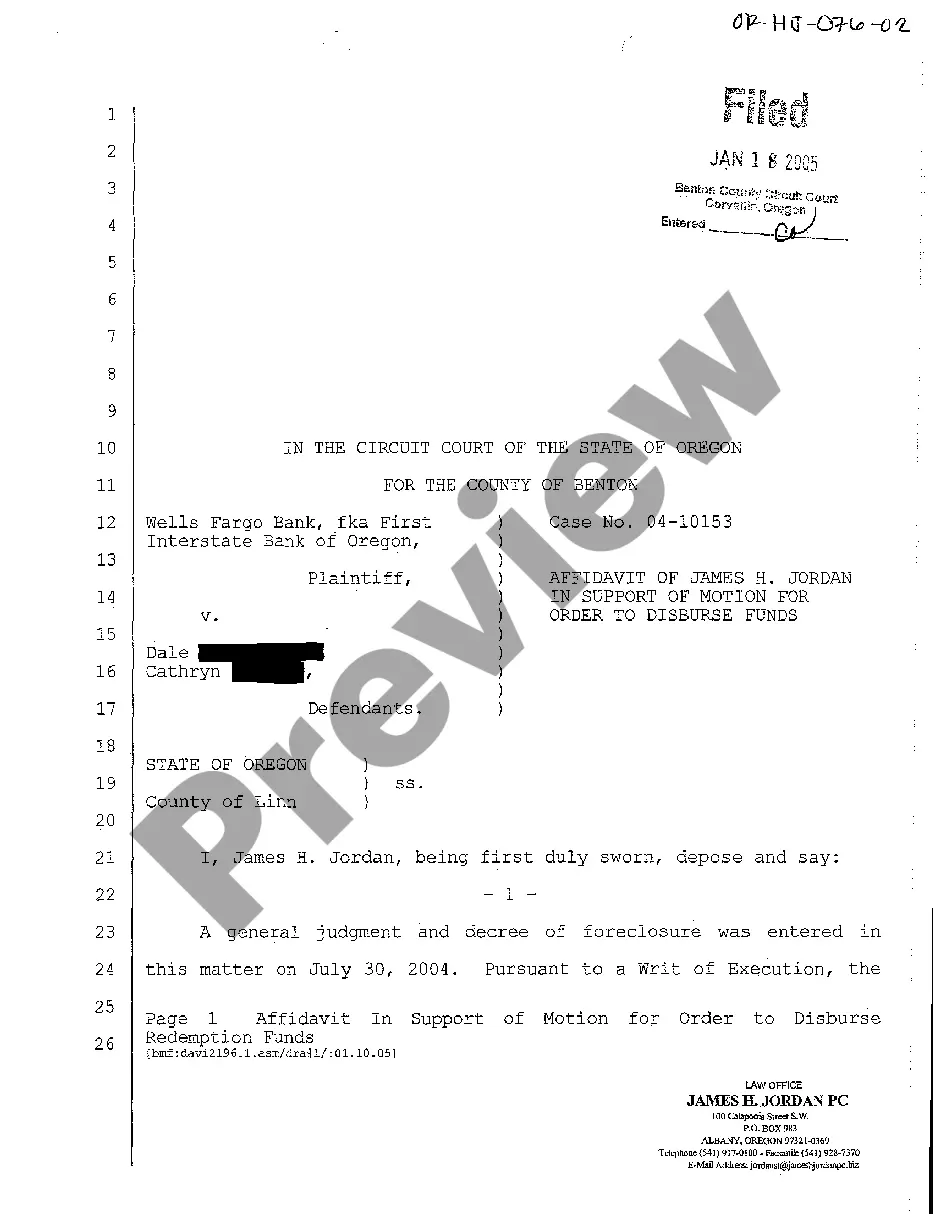

Distributing funds from a trust involves several key steps. First, the trustee must review the trust document to understand the terms and conditions for distribution. Next, the trustee collects and evaluates all trust assets, ensuring they comply with any legal obligations. Finally, the trustee disburses the funds to the beneficiaries per the trust's instructions, which can be facilitated effectively using tools available on the UsLegalForms platform.

Avoiding taxes on trust distributions is complex and often requires strategic planning. While you cannot eliminate taxes entirely, certain strategies can help minimize your tax liability. For instance, distributing funds from a trust that qualifies for specific tax exemptions may reduce taxable income. Consulting with a tax advisor can provide tailored strategies that suit your financial situation.

Distributing funds from a trust account typically involves following the trust’s terms outlined in the trust document. Begin by identifying the beneficiaries and their respective shares. Next, prepare the necessary paperwork and ensure that distributions align with both legal requirements and tax obligations. For seamless processing, consider using resources from uslegalforms to streamline the distribution process.

Yes, trust distributions must be reported to the IRS. This includes any income you receive as part of the distribution. Proper reporting helps ensure you comply with tax laws when distributing funds from a trust. You may receive a Schedule K-1 that provides details needed for reporting.

Yes, reporting is essential when distributing funds from a trust. As a beneficiary, you may need to report these distributions on your tax return. It’s crucial to understand the specific reporting requirements based on your situation. Always consult with a tax professional if you're unsure about your obligations.

Trust funds get distributed according to the specific instructions outlined in the trust document. The trustee is responsible for executing these instructions and must also consider any relevant state laws. By following proper procedures, including notifying beneficiaries, the trustee ensures that the distribution is fair and clear. For those new to the process, US Legal Forms offers resources to assist with the distribution of trust funds, ensuring compliance and smooth execution.

Distributing funds from a trust involves several steps. First, the trustee must review the trust document to understand the terms and conditions for distribution. Once this is clear, the trustee can follow the outlined instructions and ensure that all beneficiaries receive their rightful shares. Utilizing a platform like US Legal Forms can simplify this process by providing templates and guidance tailored to help you navigate trust distributions efficiently.

Distributions from a trust can be taxable, but it primarily depends on the type of trust and how the funds were generated. Generally, irrevocable trusts may have different tax implications compared to revocable trusts. To understand your specific tax obligations when distributing funds from a trust, it is advisable to consult a tax professional. Utilizing resources from US Legal Forms can help clarify these issues and guide you through the taxation process.

To release funds from a trust, the trustee typically must follow the guidelines set forth in the trust document. This document outlines the conditions for distributions, ensuring that all beneficiaries are considered. The trustee can then initiate the transfer of funds, which often involves completing necessary documentation or forms. For a seamless process in distributing funds from a trust, consider using US Legal Forms, which provides resources and templates to help trustees navigate these responsibilities.