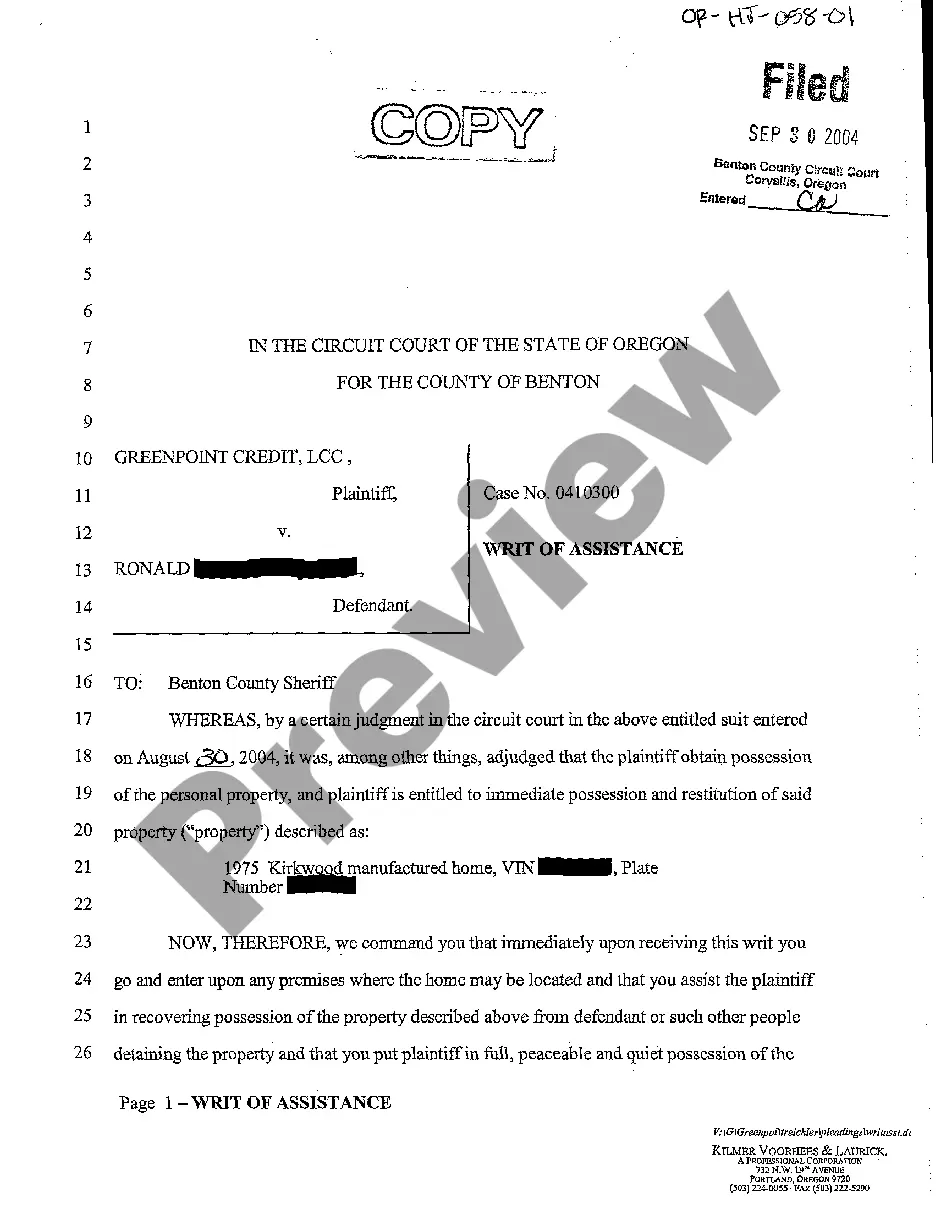

A writ of assistance in Oregon is a legal order issued by a court to allow law enforcement officials to seize and withhold property or assets from an individual or organization as part of a legal process. This writ is commonly used in cases where there is a need to collect unpaid debts, enforce court judgments, or satisfy other financial obligations. Oregon withholding refers specifically to the act of withholding income or assets from an individual or business to fulfill a legal obligation. This can include withholding wages, bank accounts, investments, or any other property that may be subject to seizure or garnishment. There are different types of writs of assistance and withholding in Oregon, each serving a distinct purpose: 1. Writ of Execution: A writ of execution is issued by a court to enforce a judgment or court order. It provides the authority for law enforcement officials to seize and withhold property or assets of a debtor to satisfy the debt owed. 2. Writ of Garnishment: A writ of garnishment is a court order that enables a creditor to withhold a portion of a debtor's wages, bank accounts, or other financial assets to satisfy a debt. 3. Writ of Attachment: A writ of attachment is commonly used to secure the property of a defendant during a legal dispute. It allows the court to seize and withhold property owned by the defendant until the final judgment is reached in the case. 4. Writ of Restitution: A writ of restitution is issued in cases of eviction or unlawful detained. It authorizes the sheriff or law enforcement officials to remove tenants from a property and withhold their possessions until certain conditions are met. 5. Writ of Sequestration: A writ of sequestration is primarily used in cases involving disputed property or assets. It allows the court to appoint a trustee or custodian to take possession and withhold the property until the dispute is resolved. These different types of writs of assistance and withholding aim to ensure compliance with the legal system, protect the rights of creditors, and enable the resolution of financial disputes and obligations in the state of Oregon.

Writ Of Assistance Oregon Withholding

Description

How to fill out Writ Of Assistance Oregon Withholding?

It’s obvious that you can’t become a legal expert overnight, nor can you grasp how to quickly draft Writ Of Assistance Oregon Withholding without having a specialized set of skills. Creating legal forms is a time-consuming process requiring a certain training and skills. So why not leave the creation of the Writ Of Assistance Oregon Withholding to the professionals?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court paperwork to templates for internal corporate communication. We know how important compliance and adherence to federal and state laws are. That’s why, on our website, all forms are location specific and up to date.

Here’s start off with our website and get the document you require in mere minutes:

- Find the document you need with the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to figure out whether Writ Of Assistance Oregon Withholding is what you’re looking for.

- Start your search over if you need any other form.

- Set up a free account and choose a subscription option to purchase the form.

- Choose Buy now. Once the transaction is through, you can download the Writ Of Assistance Oregon Withholding, complete it, print it, and send or mail it to the designated people or organizations.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your paperwork-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Register the trade name with the Louisiana Secretary of State. You may contact the Louisiana Secretary of State Office at (225) 925-4704 to obtain the necessary forms. You may also submit the application electronically on the Louisiana Secretary of State website.

All Louisiana corporations, LLCs, and nonprofits must file a Louisiana Annual Report each year. These reports must be filed with the Louisiana Secretary of State.

How much does a DBA filing cost in Louisiana? The cost of registering a business name in Louisiana varies depending on whether you file online or by mail. The filing fee for a Trade Name Registration form (the actual DBA form) is $50 if completed online and $75 if filed by mail as of May 2023.

How much does a Louisiana LLC cost per year? All Louisiana LLCs need to pay $35 per year for the Annual Report. These state fees are paid to the Secretary of State. And this is the only state-required annual fee.

The filing fees for Louisiana annual reports are $30 for any business that operates for a profit. For nonprofits, the filing fee will be $10 while charities will pay $25 as a renewal fee. Companies that pay with a credit card will also have a $5 convenience fee added to their costs.

$30 for the most current annual report, plus $30 for each annual report not filed between the last annual report and reinstatement (the prior annual report forms ?

The filing fees for Louisiana annual reports are $30 for any business that operates for a profit. For nonprofits, the filing fee will be $10 while charities will pay $25 as a renewal fee. Companies that pay with a credit card will also have a $5 convenience fee added to their costs.