Oregon And Living Trust And Assignment Of Property With Right Of Survivorship

Description

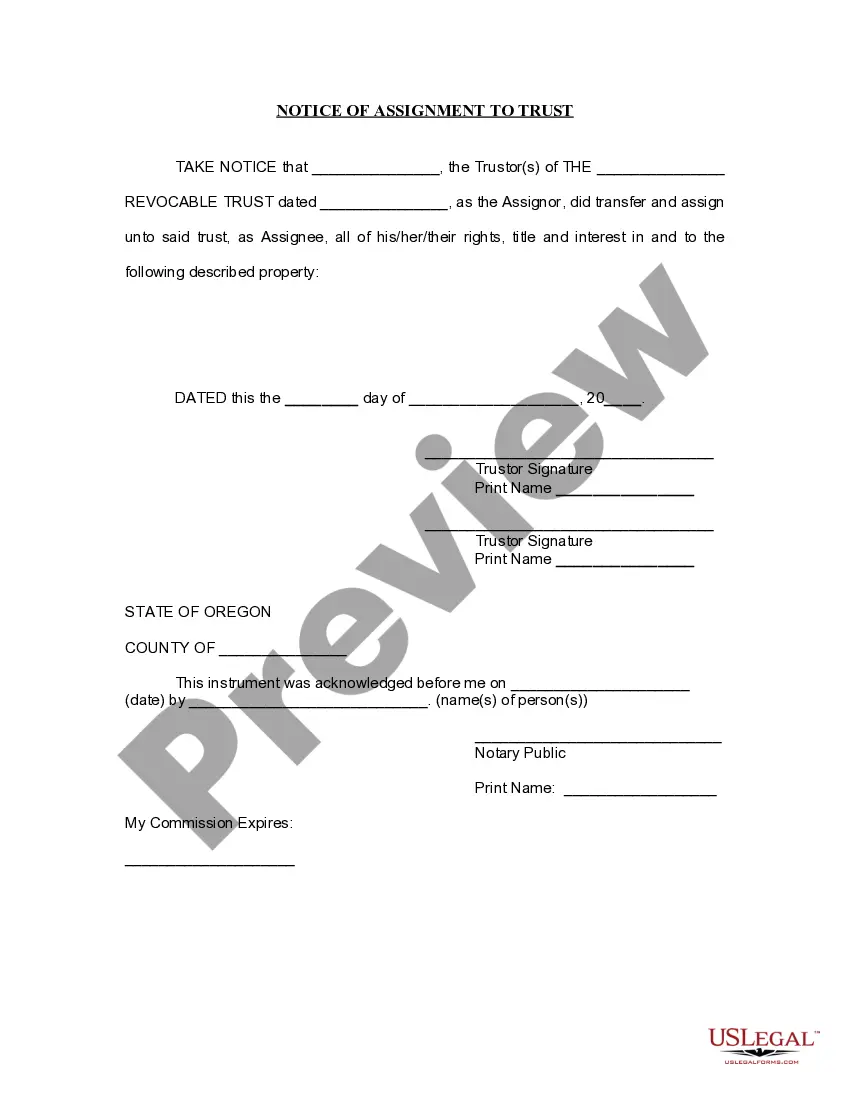

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Form popularity

FAQ

The right of survivorship in Oregon is a legal principle that allows joint property owners to automatically inherit each other's share of the property upon death. This arrangement ensures that the property does not enter probate, simplifying the transfer process. It is often used in conjunction with a living trust and can be a powerful tool in estate planning. Establishing these rights can enhance your estate's clarity, helping loved ones avoid disputes.

In most cases, the right of survivorship does override a will in Oregon. When property is held jointly with right of survivorship, it automatically transfers to the surviving owner upon death, regardless of what the will states. This feature can simplify estate planning but may lead to unintended consequences if not clearly outlined in a living trust. It is beneficial to consider these factors when defining your estate's future.

Yes, you can create your own living trust in Oregon without an attorney, but it requires careful consideration of legal requirements. DIY trust forms are available, but ensure they meet state laws to avoid future issues. A well-drafted living trust can provide peace of mind, especially when it comes to assigning property with right of survivorship. For added assurance, uslegalforms offers resources that guide you in creating a legally sound living trust.

In Oregon, the order of next of kin typically follows a hierarchy starting with the spouse and children. If there is no spouse or children, parents are next in line, followed by siblings, then extended family such as grandparents and aunts or uncles. This order can significantly influence how your estate is distributed. Establishing a living trust and assignment of property with right of survivorship can help you direct your estate according to your wishes, bypassing potential complications.

In Oregon, a spouse does not automatically inherit everything unless there is no will. The law provides for community property, which means that property acquired during the marriage is jointly owned. Upon the death of one spouse, the surviving spouse retains their half of the community property. If there are children from the marriage or previous relationships, the distribution may vary, making it wise to consider a living trust for clarity and security.

In most cases, the right of survivorship takes precedence over the terms of a trust. If property is jointly owned with a right of survivorship, it typically passes directly to the surviving owner outside the trust’s provisions. Therefore, it's crucial to consider how these two estate planning tools interact when setting up a living trust and assigning property to ensure your wishes are honored.

The risks of a trust fund can include the mismanagement of assets and potential misuse by trustees. If not carefully constructed, the trust can create conflicts among beneficiaries. Furthermore, changes in law or circumstances can also affect the trust’s effectiveness, highlighting the importance of regular reviews and updates to the living trust and assignment of property.

Yes, a living trust in Oregon can help avoid the probate process. Since assets held in a living trust are not considered part of the deceased's estate, they can pass directly to beneficiaries without court intervention. This can save time and maintain privacy during asset distribution.

Your parents might benefit from putting their assets in a trust, particularly if they want to avoid probate and ensure a direct asset transfer. A living trust in Oregon provides flexibility and control while protecting the family's wealth. However, it's essential to consider individual circumstances and consult with a legal expert to see if this option aligns with their goals.

Yes, Oregon recognizes the right of survivorship. This means that when one co-owner of a property passes away, the surviving owner automatically receives full ownership of the property. Combining a right of survivorship with a living trust can create effective estate planning, ensuring a smooth transition of property.