Bankruptcy Forms Reaffirmation Agreement

Description

How to fill out Oregon Bankruptcy Guide And Forms Package For Chapters 7 Or 13?

Bureaucracy demands accuracy and meticulousness.

If you don't frequently handle the completion of documents like Bankruptcy Forms Reaffirmation Agreement, it may lead to some misunderstanding.

Selecting the appropriate sample from the outset will guarantee that your document submission goes smoothly and avert the hassle of re-submitting a file or starting the entire process again.

For non-subscribers, locating the necessary sample will require a few extra steps.

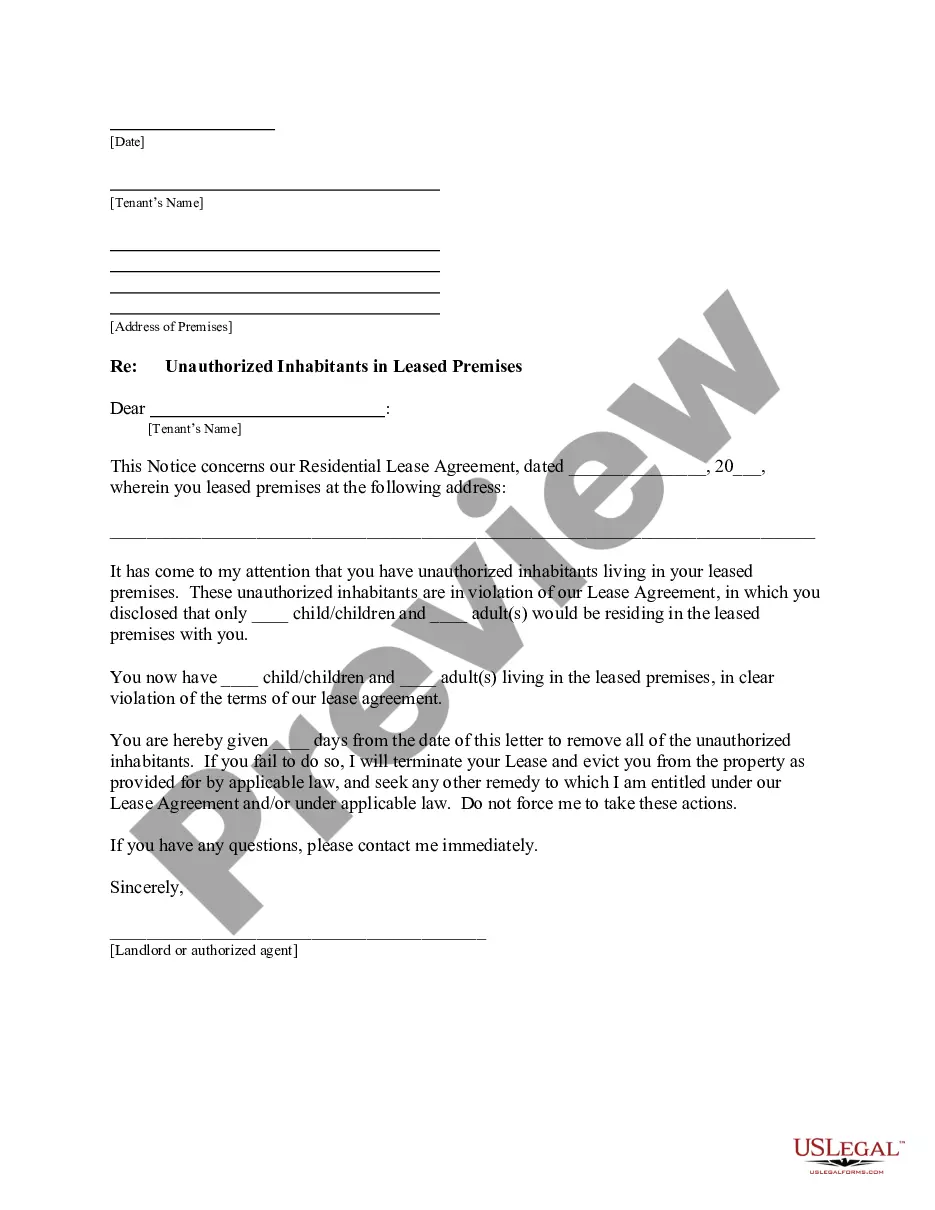

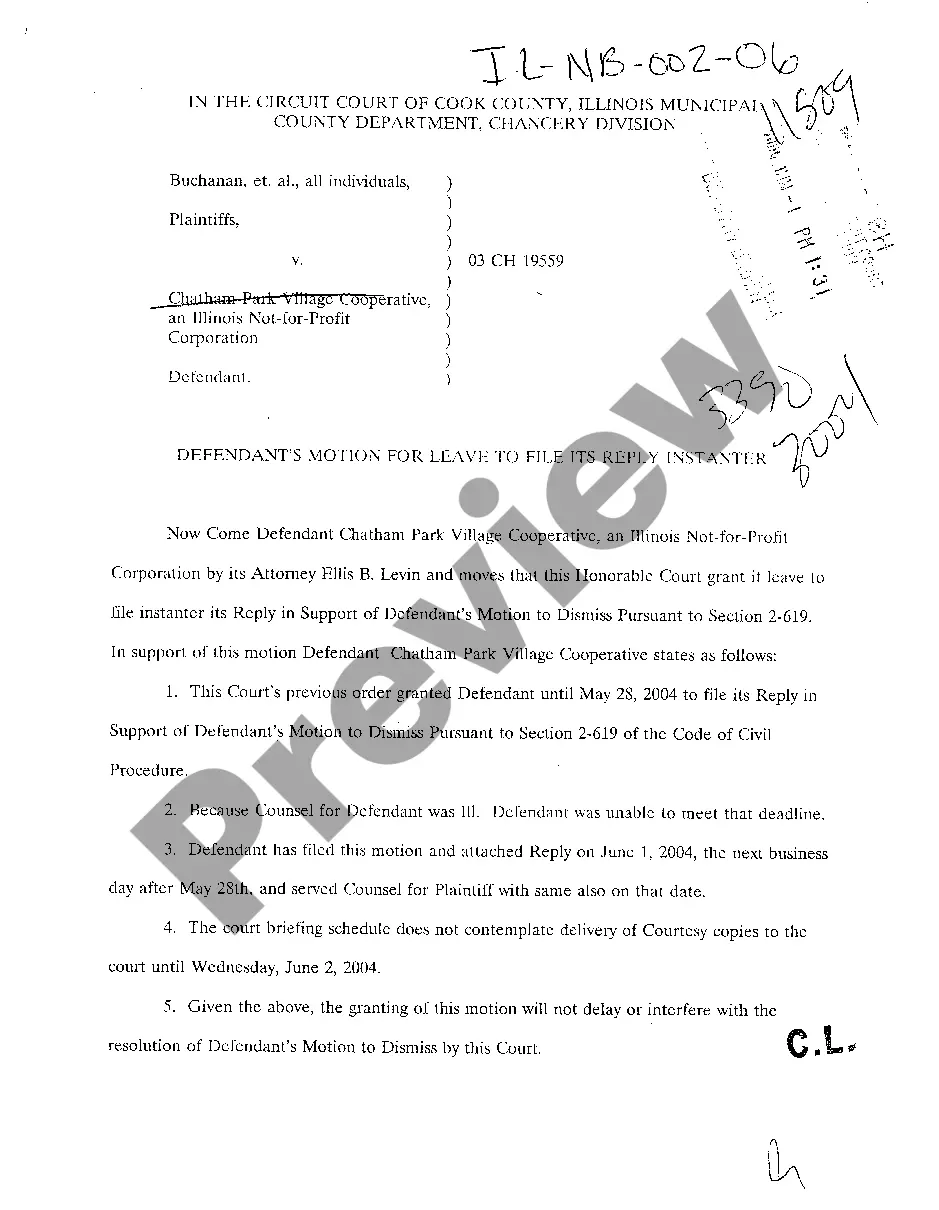

- Obtain the accurate sample for your paperwork from US Legal Forms.

- US Legal Forms is the largest online forms repository housing over 85 thousand samples across various domains.

- You can easily find the latest and most suitable version of the Bankruptcy Forms Reaffirmation Agreement by searching on the website.

- Access, store, and save templates in your account or refer to the description to confirm you have the right one.

- With a US Legal Forms account, you can gather, consolidate, and browse the templates you've saved for quick access.

- Once on the site, click the Log In button to authenticate your credentials.

- Then, navigate to the My documents section, which contains your forms list.

- Review the form descriptions and save the ones you need at any time.

Form popularity

FAQ

When you reaffirm a car loan in bankruptcy, you sign an agreement with the lender that you will continue to pay for the car as if you had not filed bankruptcy in exchange for keeping it. To reaffirm a car loan, you must be able to show the court that the vehicle is necessary and that the payment is reasonable.

In order to be able to enter into a reaffirmation agreement you need to be current on your payments, and any equity in the property must be fully protected by your exemptions. Typically reaffirmation agreements in chapter 7 cases are for a car.

A reaffirmation agreement must be entered into before the grant- ing of a discharge and filed with the clerk of the bankruptcy court for it to be valid and binding. An executed reaffirmation agree- ment may be filed by any party, including the debtor or a creditor.

If the Court denies the reaffirmation agreement, you are in technical default again. This is part of the trade2010off between Chapters 7 and 13. In exchange for a quick, efficient, inexpensive discharge of your debts, you give up control over the actions of creditors.

Reaffirmation is an agreement by a debtor, to a lender, to repay some or all of their debt. Debtors make reaffirmation agreements purely voluntarily. When a borrower reaffirms a debt, this is noted by credit reporting agencies, which then register that the person will make regular on-time payments.