Oregon Probate Checklist Without Will

Description

How to fill out Oregon Probate Checklist Without Will?

Individuals frequently connect legal documentation with something intricate that solely an expert can manage.

In a certain sense, this holds true, as formulating an Oregon Probate Checklist Without Will necessitates considerable comprehension of subject specifics, including regional and local statutes.

However, with US Legal Forms, matters have become simpler: pre-prepared legal documents for any personal and business scenario pertinent to state regulations are gathered in a single online repository and are now accessible to all.

Create an account or Log In to move on to the payment section. Make your payment using PayPal or your credit card. Select the format for your file and click Download. Print your document or upload it to an online editor for a more efficient fill-out. All templates in our collection are reusable: once obtained, they remain saved in your profile. You can access them anytime via the My documents tab. Discover all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85k current documents organized by state and area of use, making the search for Oregon Probate Checklist Without Will or any other specific template quick and efficient.

- Prior registered users with an active subscription must Log In to their account and click Download to obtain the form.

- New users will initially have to create an account and subscribe before they can download any documents.

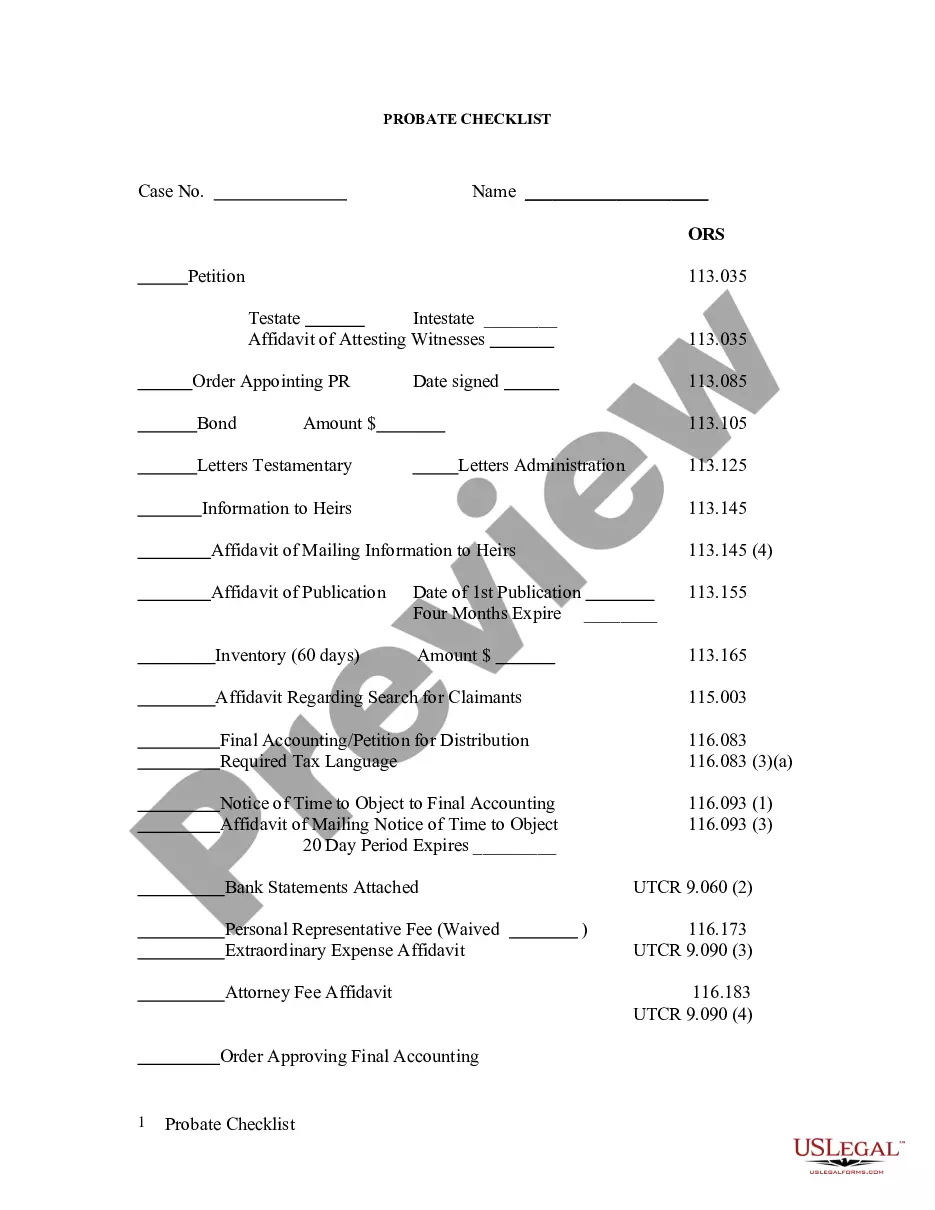

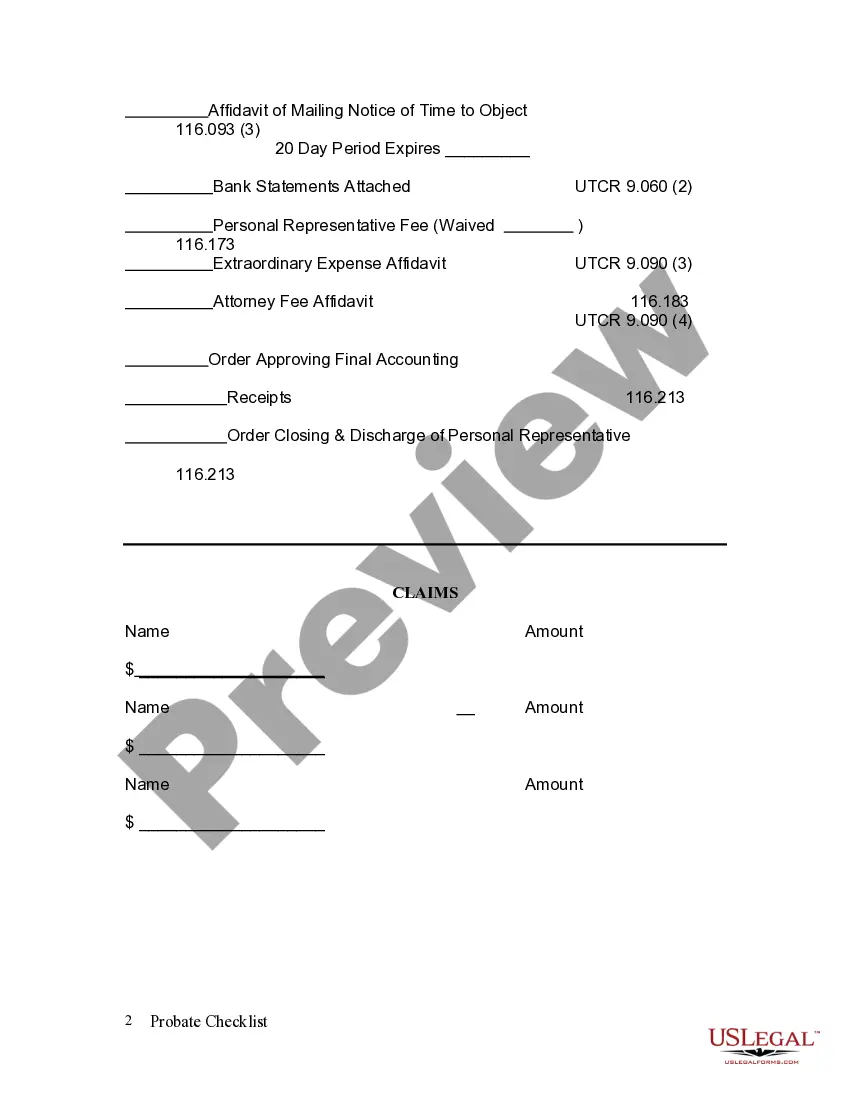

- Here is a step-by-step guide on acquiring the Oregon Probate Checklist Without Will.

- Examine the page content thoroughly to make sure it meets your requirements.

- Review the form description or examine it via the Preview feature.

- If the previous template doesn't meet your needs, find an alternate sample using the Search field above.

- When you find the suitable Oregon Probate Checklist Without Will, click Buy Now.

- Choose a subscription plan that fits your requirements and financial plan.

Form popularity

FAQ

Completing a paper probate application formYou can do this yourself or you can call the probate and inheritance tax helpline for help completing the form.

The typical amount of time is closer to 7 to 10 months depending on the nature of the assets and the backlog at the court house. I have written about the Probate Process in Oregon and created an Oregon Personal Representative Checklist to help my clients better understand the proceedings.

There is no need for probate or letters of administration unless there are other assets that are not jointly owned. The property might have a mortgage. However, if the partners are tenants in common, the surviving partner does not automatically inherit the other person's share.

If you die without a will and do not have any family, your property will go to (escheat) the state. This rarely happens because Oregon's inheritance laws are designed to get your property to your family, however remote.

Oregon has a simplified probate process for small estates. To use it, you (as an inheritor) file a written request with the local probate court asking to use the simplified procedure. The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate.