Cosigner Vs Guarantor On A Loan

Description

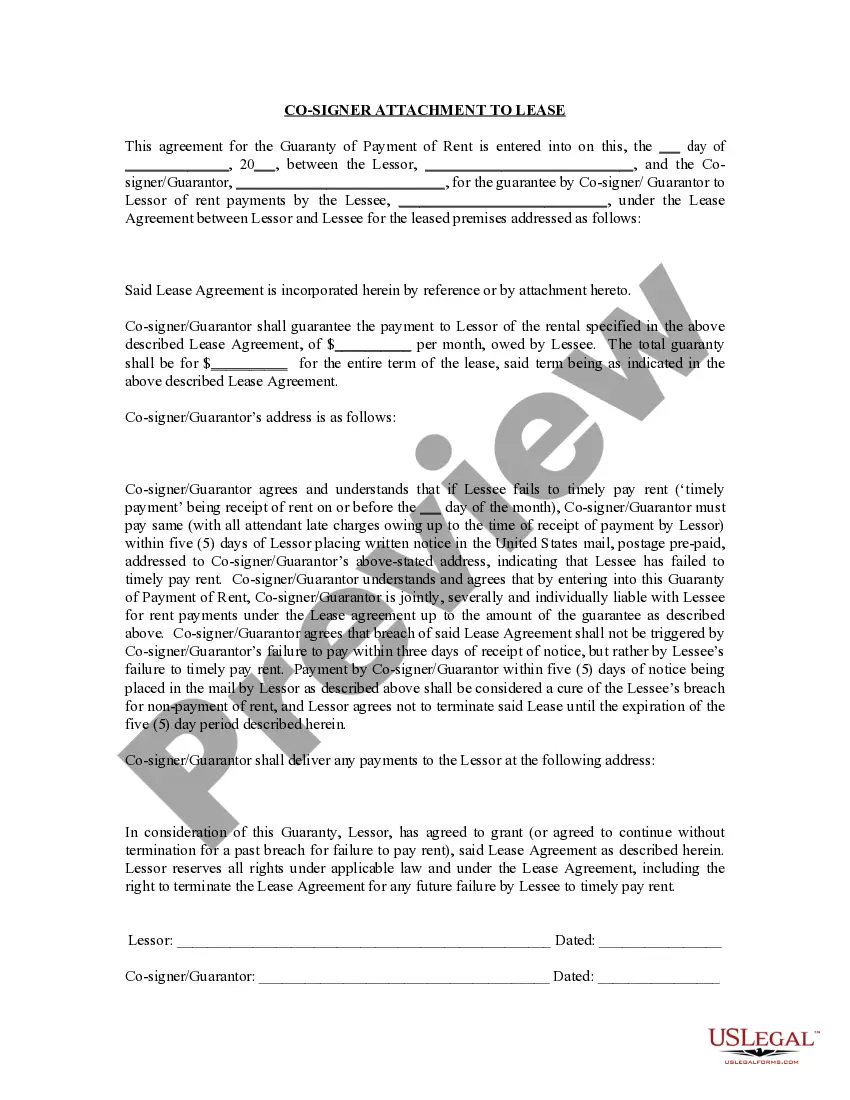

How to fill out Oregon Guaranty Attachment To Lease For Guarantor Or Cosigner?

Regardless of whether it's for corporate objectives or personal matters, everyone must encounter legal scenarios at some point in their lives. Completing legal paperwork requires meticulous attention, starting from choosing the correct form template. For example, if you select an incorrect version of the Cosigner Vs Guarantor On A Loan, it will be rejected upon submission. Thus, it's crucial to have a dependable source of legal documents like US Legal Forms.

If you need to acquire a Cosigner Vs Guarantor On A Loan template, adhere to these straightforward steps: Obtain the template you require by utilizing the search bar or catalog navigation. Review the form’s description to ensure it aligns with your situation, state, and county. Click on the form’s preview to examine it. If it is the incorrect form, return to the search function to find the Cosigner Vs Guarantor On A Loan template you need. Acquire the template once it suits your requirements. If you already possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents. In the event you do not yet have an account, you can download the form by clicking Buy now. Select the suitable pricing option. Complete the profile registration form. Choose your payment method: you can utilize a credit card or PayPal account. Select the file format you desire and download the Cosigner Vs Guarantor On A Loan. Once it is downloaded, you can fill out the form using editing software or print it and complete it manually.

- With an extensive US Legal Forms catalog available, you no longer need to waste time searching for the appropriate template online.

- Utilize the library’s simple navigation to find the suitable template for any occasion.

Form popularity

FAQ

Being a guarantor comes with certain risks. If the borrower defaults, you are responsible for the loan payments, which can strain your finances. Additionally, the loan can impact your credit score if payments are missed. Understanding these risks is crucial when considering the cosigner vs guarantor on a loan scenario, and using platforms like uslegalforms can help ensure you make an informed decision.

The choice between a cosigner and a guarantor depends on your specific situation. A cosigner shares equal responsibility for the loan, which can lead to lower interest rates and better terms. On the other hand, a guarantor's role is limited to covering payments if the borrower defaults. Weigh the pros and cons of each option to determine which is best for your needs.

Signing as a guarantor can potentially impact your credit score. While being a guarantor does not directly affect your credit, the loan may appear on your credit report. If the primary borrower fails to make payments, this can lead to negative consequences for your credit score, making it vital to choose wisely in the cosigner vs guarantor on a loan debate.

Understanding your role in a loan is crucial. If you are a co-maker, co-signer, or guarantor, you have different levels of responsibility. In the comparison of cosigner vs guarantor on a loan, a co-maker shares equal liability with the borrower, while a guarantor only pays if the borrower defaults. It's important to clarify your role to understand your financial obligations.

Yes, having a guarantor can improve your chances of loan approval. Lenders view a guarantor as an additional layer of security, which can be especially beneficial if the primary borrower has a limited credit history. In the context of cosigner vs guarantor on a loan, a guarantor can help make the loan application more appealing to lenders, leading to a higher likelihood of approval.

When considering cosigner vs guarantor on a loan, it's essential to understand the differences. A cosigner shares equal responsibility for the loan, while a guarantor only steps in if the primary borrower defaults. This means being a cosigner may carry more risk, but it can also lead to better loan terms. Ultimately, your choice depends on your relationship with the borrower and your financial situation.

No, a guarantor does not have to live with you. The key difference in the cosigner vs guarantor on a loan is their role in the loan agreement. A guarantor is responsible for the debt if you default, regardless of where they reside. This flexibility allows individuals to choose a guarantor who may not live in the same household, enabling you to secure the loan you need.