Difference Between Operating Lease And Financial Lease

Description

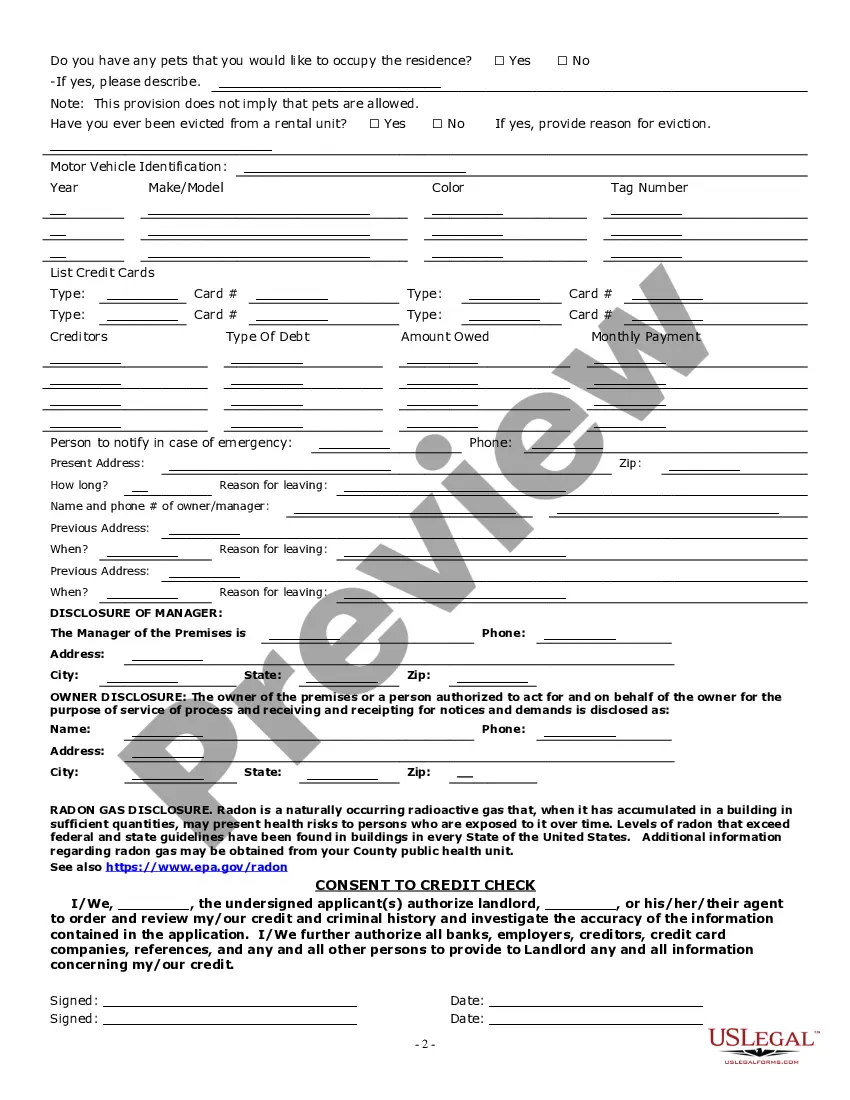

How to fill out Oregon Residential Rental Lease Application?

Legal papers management might be frustrating, even for experienced experts. When you are searching for a Difference Between Operating Lease And Financial Lease and don’t have the a chance to devote trying to find the correct and up-to-date version, the procedures may be nerve-racking. A robust online form library can be a gamechanger for anyone who wants to deal with these situations successfully. US Legal Forms is a market leader in online legal forms, with over 85,000 state-specific legal forms accessible to you at any time.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any requirements you may have, from individual to organization documents, in one place.

- Utilize advanced tools to complete and deal with your Difference Between Operating Lease And Financial Lease

- Gain access to a useful resource base of articles, tutorials and handbooks and materials relevant to your situation and requirements

Save time and effort trying to find the documents you need, and employ US Legal Forms’ advanced search and Preview tool to find Difference Between Operating Lease And Financial Lease and acquire it. For those who have a subscription, log in to the US Legal Forms profile, search for the form, and acquire it. Take a look at My Forms tab to find out the documents you previously downloaded as well as deal with your folders as you can see fit.

If it is the first time with US Legal Forms, make a free account and acquire unrestricted access to all benefits of the platform. Listed below are the steps to take after downloading the form you need:

- Validate it is the proper form by previewing it and looking at its information.

- Be sure that the sample is recognized in your state or county.

- Pick Buy Now once you are ready.

- Select a subscription plan.

- Find the formatting you need, and Download, complete, eSign, print and send out your papers.

Enjoy the US Legal Forms online library, backed with 25 years of expertise and stability. Change your everyday papers managing in to a easy and easy-to-use process right now.

Form popularity

FAQ

Similar to finance leases, operating leases under ASC 842 involve the recognition of right-of-use assets as intangible assets. However, the key distinction lies in expense recognition. Operating leases are expensed using a straight-line method, where lease payments are evenly distributed over the lease term.

By capitalizing an operating lease, a financial analyst is essentially treating the lease as debt. Both the lease and the asset acquired under the lease will appear on the balance sheet. The firm must adjust depreciation expenses to account for the asset and interest expenses to account for the debt.

For operating leases, ASC 842 requires recognition of a right-of-use asset and a corresponding lease liability upon lease commencement. With the changes introduced under ASC 842, all leases are now presented on both the balance sheet and income statement whether they are operating or finance (capital) leases.

Operating Lease Accounting can be done by considering that the lessor owns the property and the lessee only uses it for a fixed time. The lessee records rental payments as expenses in the books of accounts. In contrast, the lessor records the property as an asset and depreciates it over its useful life.

Begin with the reported operating income (EBIT). Then, add the current year's operating lease expense and subtract the depreciation on the leased asset to arrive at adjusted operating income. Finally, to adjust debt, take the reported value of debt (book value of debt) and add the debt value of the leases.