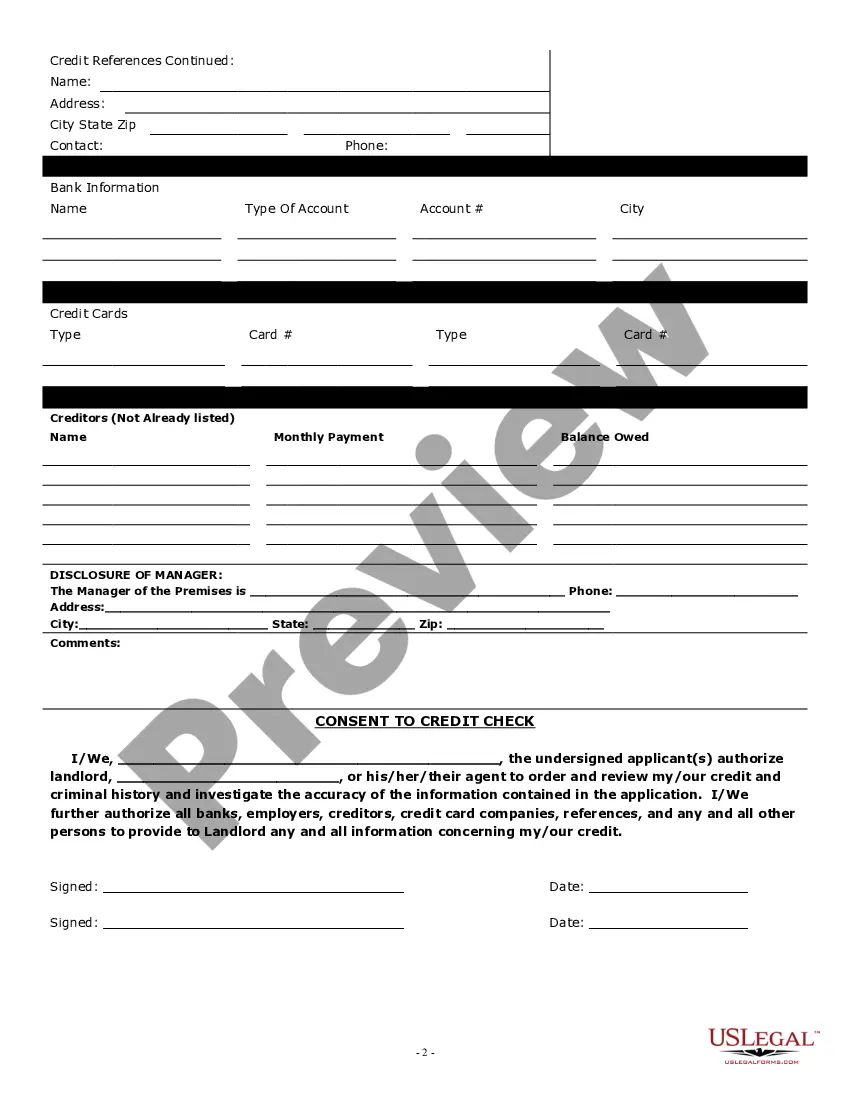

Application For Commercial Lease With Bad Credit

Description

How to fill out Oregon Commercial Rental Lease Application Questionnaire?

Obtaining legal templates that comply with federal and regional laws is essential, and the internet offers a lot of options to choose from. But what’s the point in wasting time searching for the right Application For Commercial Lease With Bad Credit sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the largest online legal library with over 85,000 fillable templates drafted by lawyers for any business and life situation. They are easy to browse with all papers grouped by state and purpose of use. Our experts stay up with legislative changes, so you can always be confident your paperwork is up to date and compliant when acquiring a Application For Commercial Lease With Bad Credit from our website.

Getting a Application For Commercial Lease With Bad Credit is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, follow the instructions below:

- Analyze the template utilizing the Preview option or via the text outline to ensure it meets your requirements.

- Look for a different sample utilizing the search tool at the top of the page if necessary.

- Click Buy Now when you’ve found the correct form and opt for a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Application For Commercial Lease With Bad Credit and download it.

All documents you locate through US Legal Forms are multi-usable. To re-download and fill out earlier obtained forms, open the My Forms tab in your profile. Benefit from the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Here are some of the most important clauses in commercial lease agreements that tenants should know about: Term. ... Description of Premises Clause. ... Rent Escalation Clause. ... Use Clauses. ... Improvements and Alterations Clause. ... Insurance Clause. ... Renewal Clause.

A lease proposal letter should be well-written and professional in tone. It should clearly state the rental amount you are willing to pay per month along with any additional costs such as maintenance fees or utility bills.

Explain Your Situation- Be extremely honest with your landlord or property manager about your credit history. Explain why your credit score may be low, whether you're dealing with medical bills, divorce, or other financial situations, and your landlord may be more lenient. Understanding the Impact of Credit Scores on Rental Applications baymgmtgroup.com ? blog ? impact-of-cre... baymgmtgroup.com ? blog ? impact-of-cre...

Here are our top 8 sections to include in your commercial property proposal: Lease Term or Lease Type: ... Rent Obligations: ... Security Deposit: ... Permitted Use or Exclusive Use Clauses: ... Maintenance and Utilities: ... Personal Guarantee: ... Amendments, Modifications, or Termination Clauses: ... Subleases: How to Write a Commercial Lease Proposal - Free RFP Template occupier.com ? blog ? commercial-lease-pro... occupier.com ? blog ? commercial-lease-pro...

As a basic rule, every proposal that you do should be about the property and the client in almost every respect. The back of the document can be reserved for details about your staff and your office. At least 75% of your proposal should be about the client and the property.