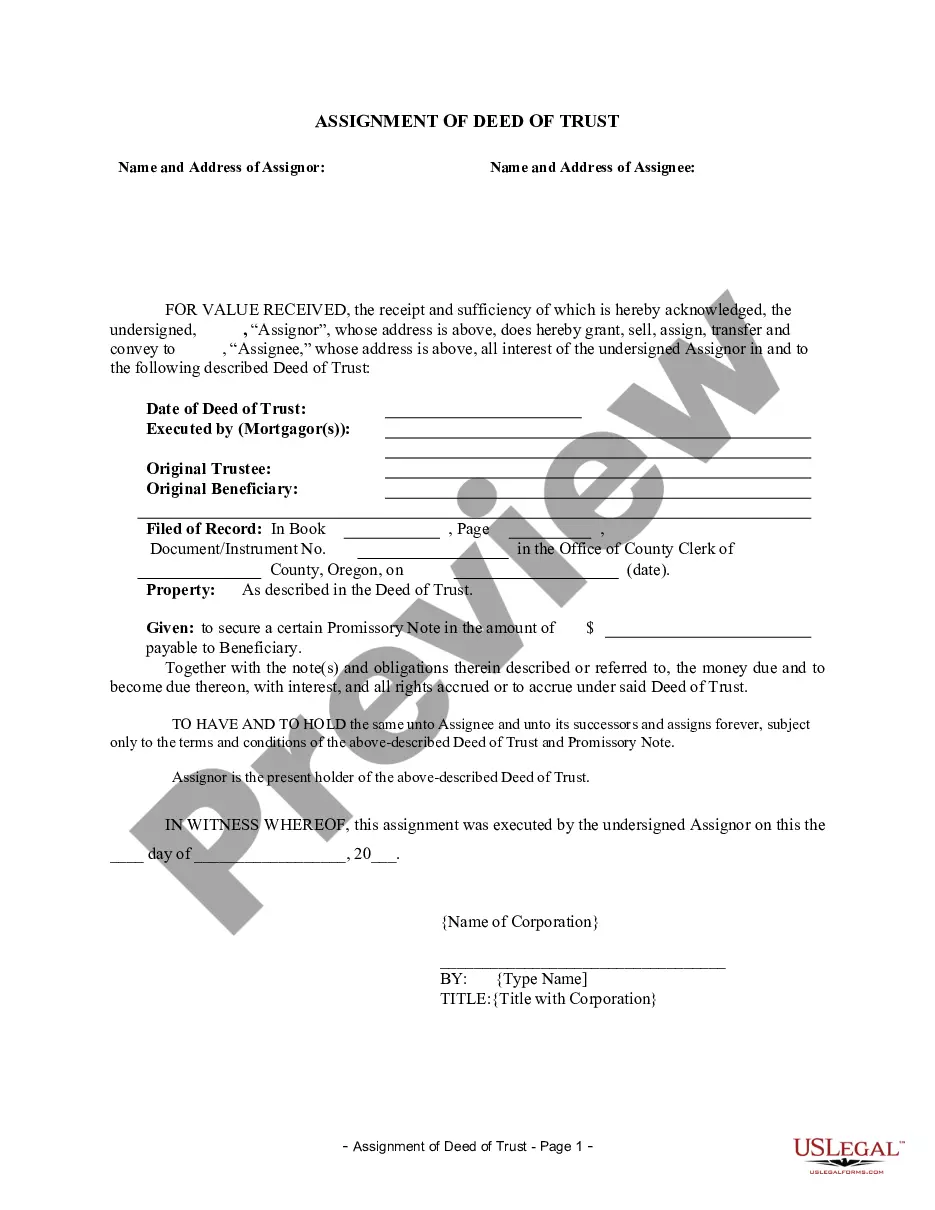

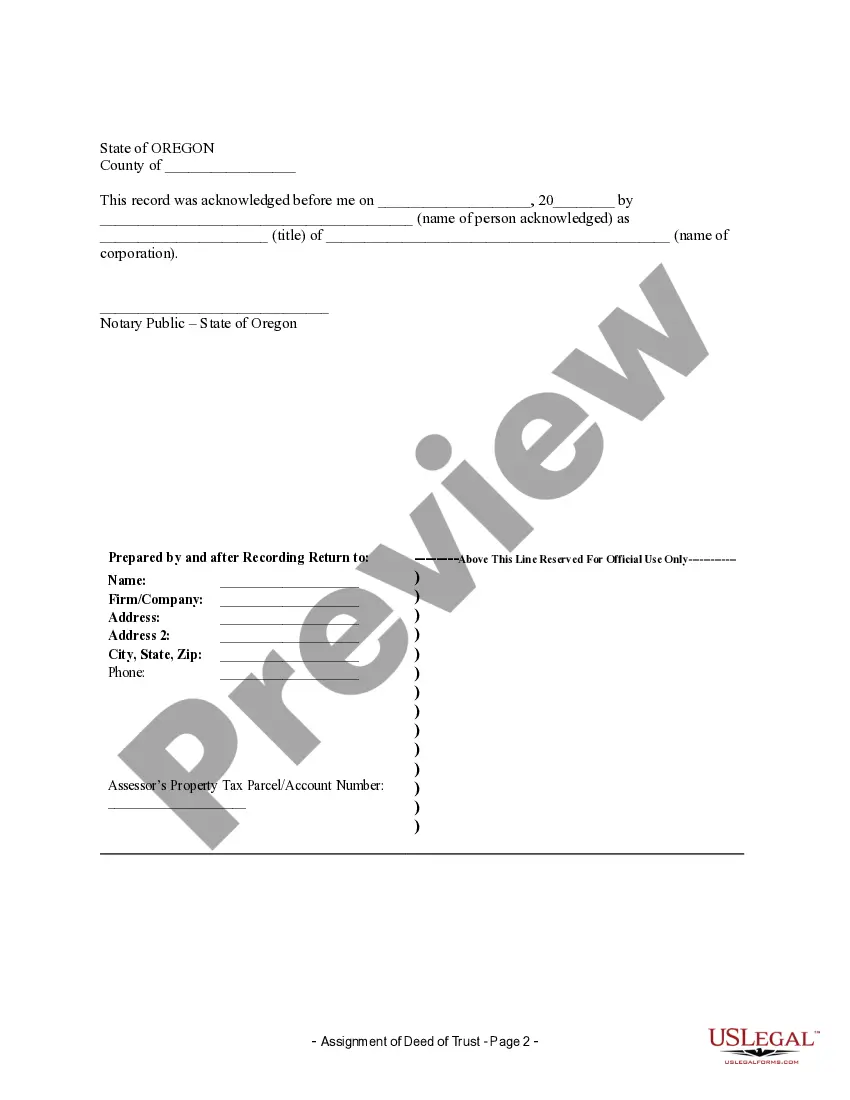

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Oregon Assignment For Benefit Of Creditors

Description

How to fill out Oregon Assignment For Benefit Of Creditors?

Maneuvering through the red tape of standard documents and forms can be challenging, particularly when one is not engaged in that professionally.

Even selecting the appropriate template for the Oregon Assignment For Benefit Of Creditors will require significant time, as it must be accurate and detailed to the last digit.

However, you will spend significantly less time finding a suitable template if it originates from a trustworthy resource.

Acquire the correct form in a few straightforward steps: Enter the document title in the search bar, find the appropriate Oregon Assignment For Benefit Of Creditors from the results list, review the description of the sample or open its preview, and if the template meets your criteria, click Buy Now. Next, choose your subscription plan, input your email and create a password to register an account with US Legal Forms, select a payment method via credit card or PayPal, and finally save the template document on your device in your preferred format. US Legal Forms will save you considerable time verifying whether the form you discovered online meets your requirements. Establish an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the process of locating the correct forms online.

- US Legal Forms serves as a single destination to obtain the latest document samples, seek clarification on their use, and download these samples for completion.

- It is a repository containing over 85,000 forms applicable in various sectors.

- When searching for an Oregon Assignment For Benefit Of Creditors, you will have full confidence in its validity, as all forms are authenticated.

- An account with US Legal Forms ensures that all necessary templates are readily accessible.

- You can store them in your history or add them to the My documents collection.

- Access your saved documents from any device by simply clicking Log In at the library site.

- If you don’t have an account yet, you can always search again for the needed template.

Form popularity

FAQ

An assignment of credit refers to the legal transfer of a debtor's rights or benefits under a credit agreement to another party. In an Oregon assignment for benefit of creditors, this mechanism plays a key role in managing obligations effectively. It allows debtors to reorganize their finances while protecting their assets. For tailored guidance on navigating assignments of credit, visit the US Legal Forms website for helpful insights.

The Oregon assignment for benefit of creditors is a legal process where a debtor assigns their assets to a trustee for the benefit of creditors. This arrangement allows debtors to manage their debts more effectively while providing creditors a way to recover what they are owed. It is an alternative to bankruptcy that can lead to a more efficient distribution of assets. By using the uslegalforms platform, you can easily navigate the requirements of the Oregon assignment for benefit of creditors and ensure that your creditors receive their fair share.

In Oregon, the general timeline to settle an estate is typically within one year of the personal representative's appointment. However, certain circumstances may extend this time frame. Efficient estate settlement can be facilitated through processes like the Oregon assignment for benefit of creditors, helping manage debts and obligations effectively.

A general assignment for the benefit of the company's creditors involves transferring a company's assets to a third party to satisfy outstanding debts. This process often allows for a fairer distribution to creditors than proceeding through bankruptcy. It can provide a more streamlined approach to addressing financial obligations. The Oregon assignment for benefit of creditors is an essential consideration for companies facing financial difficulties.

In Oregon, the statute of limitations on garnishments is generally five years. This limitation begins from the date the judgment is entered. If creditors do not act within this time frame, they cannot enforce the garnishment. Understanding how the Oregon assignment for benefit of creditors works can help individuals and businesses manage their financial responsibilities more effectively.

Creditors in Oregon generally have four months to collect debts from an estate. This period begins from the date the personal representative is appointed. If creditors miss this deadline, they may find it challenging to recover what they are owed. Utilizing the Oregon assignment for benefit of creditors may provide an alternative route for creditors seeking repayment.

An assignment for the benefit of creditors is a voluntary arrangement where a debtor assigns their assets to an individual or entity for the purpose of settling debts. This method provides an alternative to bankruptcy, making it a useful option for those in financial distress. By engaging in this process, debtors can often achieve a more favorable outcome with their creditors. The concept is particularly relevant in Oregon assignment for benefit of creditors cases.

In Oregon, a debt typically becomes uncollectible after a period of six years. This time frame is defined by the statute of limitations. If creditors do not take action within this period, they lose the legal right to recover the amount owed. Understanding the Oregon assignment for benefit of creditors can be crucial for navigating this process.

Yes, in Washington, the assignee must publish a notice to creditors regarding the assignment. This notice informs creditors of the assignment and invites them to present their claims within a specified period. Proper notification ensures a transparent process and allows creditors to claim their due amounts. For detailed guidance on this and related procedures, consider exploring the resources available on U.S. Legal Forms, especially for situations involving an Oregon assignment for benefit of creditors.

In Washington, an assignment for the benefit of creditors allows a debtor to assign their assets to an assignee for the purpose of paying creditors. This process provides a more straightforward alternative to bankruptcy, enabling the debtor to manage their debts effectively. The assignee takes control of the debtor's assets, sells them, and distributes the proceeds to creditors according to specified priorities. If you're navigating financial issues, an Oregon assignment for benefit of creditors may also offer a viable solution.