Filing Filing

Description

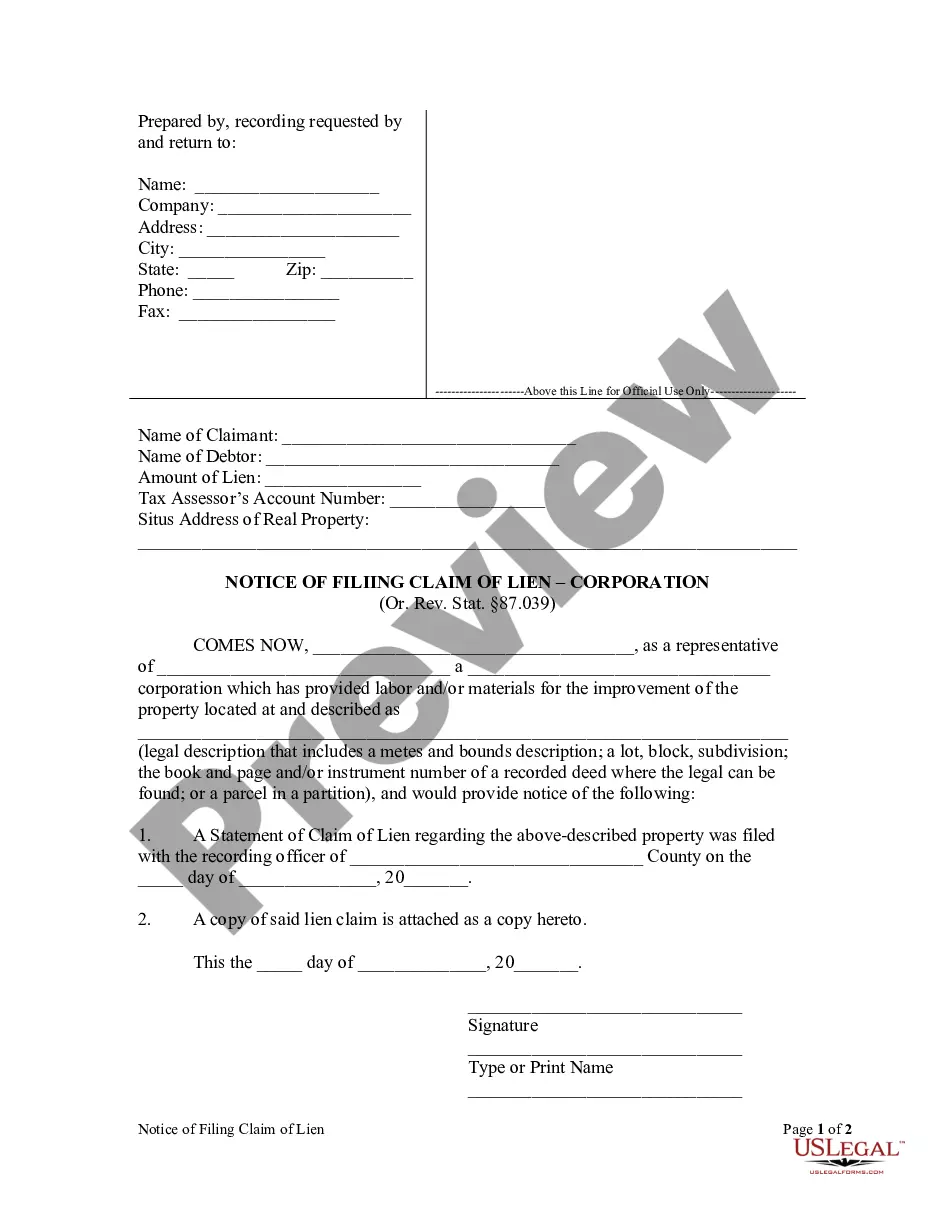

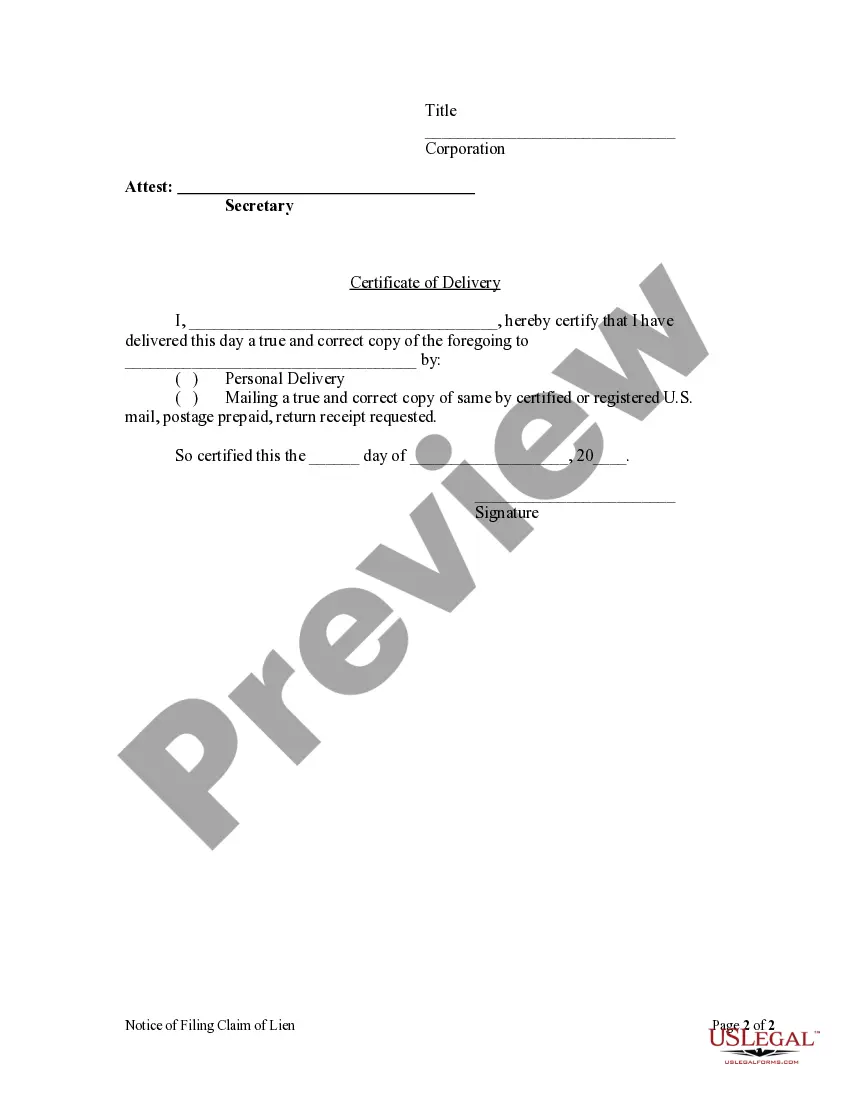

How to fill out Oregon Notice Of Filing Of Lien Claim By Corporation?

- Log in to your account if you're a returning user. Ensure your subscription is up-to-date to access your required forms.

- For new users, explore the Preview mode and form descriptions to find the correct document that meets your local jurisdiction requirements.

- If needed, utilize the Search tab to locate additional or alternative templates that suit your needs.

- Once you find the right form, click the Buy Now button and select your preferred subscription plan. You will need to create an account for access.

- Proceed to complete your purchase by entering your credit card information or using your PayPal account for payment.

- After the payment is processed, download your form and save it to your device for easy access and completion.

The extensive legal form collection of US Legal Forms, which offers more forms than competitors for a similar cost, ensures you find what you need.

Don't hesitate to reach out for assistance from premium experts to ensure your forms are completed accurately. Start your filing filing process today!

Form popularity

FAQ

The five filing statuses are Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er). Each status defines how you file and affects your tax rate and eligibility for various credits during the filing filing process. Understanding these categories will guide you in selecting the one that best fits your situation. Choosing the correct status can significantly optimize your tax outcome.

Deciding whether to file jointly or separately hinges on your unique financial situation. Typically, filing jointly can provide better tax rates and more credits. However, if one spouse has significant medical expenses or other deductions, filing separately might yield tax benefits. Analyzing both situations during your filing filing process will lead to a more informed decision that can impact your overall tax burden.

The five steps of filing your taxes are understanding your filing status, gathering necessary documents, filling out the appropriate tax forms, submitting your return, and following up with any additional requirements. First, determine the best filing status to maximize your benefits during the filing filing process. Next, compile all financial documents such as income statements and receipts. Lastly, make sure to keep a record of your submission for your future reference.

People often receive $10,000 tax refunds due to various factors, including having overpayments throughout the year or qualifying for specific tax credits. These credits, such as the Earned Income Tax Credit or Child Tax Credit, can significantly increase your refund. Maximizing deductions and credits during your filing filing allows many taxpayers to enjoy larger refunds. Understanding these components can help you plan better for future tax seasons.

The stages of the tax return process include gathering your financial documents, preparing your tax return, filing your taxes, and finally, awaiting your refund or paying any balance due. Initially, collect all necessary documents such as W-2s and 1099s to ensure accuracy in your filing. Once your return is prepared, you can file electronically or via mail. It's important to stay organized and informed throughout the entire filing filing process.

FreeTaxUSA is designed to cater to a wide range of users, making it accessible for many individuals. Whether you are filing for the first time or are a seasoned filer, this platform simplifies the filing filing process. Many find its user-friendly interface and robust features help in preparing their taxes efficiently. However, it’s important to review your specific tax situations to determine if it's the right fit for you.

To make filing simple, start by gathering all necessary documents and information. You can use tools provided by uslegalforms to help streamline this process, ensuring you include all required forms and data. After organizing everything, follow the specific instructions for the type of filing you are handling. This approach can greatly reduce the hassle and increase your confidence with your filing.

If you made $4000, whether you need to file taxes might depend on other factors such as your age and filing status. Filing filing can clarify your requirement and uncover potential tax benefits. Many people in this income range may not be required to file, but it is prudent to verify this. Platforms like US Legal Forms can assist you in understanding your specific situation and help you navigate the filing process.

The minimum income level at which you must file taxes can vary based on your filing status and age. Generally, individuals under 65 must file if their income exceeds the standard deduction amount. Filing filing ensures that you are aware of your obligations and can help you avoid penalties. Tools like US Legal Forms can guide you through what you should consider before filing.

Filing filing involves several easy steps, beginning with gathering your income documents. Next, you need to choose a filing method, which can be online or paper. After that, fill out the necessary forms accurately, claim any deductions or credits, and lastly, submit your return before the deadline. Utilizing platforms like US Legal Forms can streamline this process significantly.