Filing A Lien For Nonpayment

Description

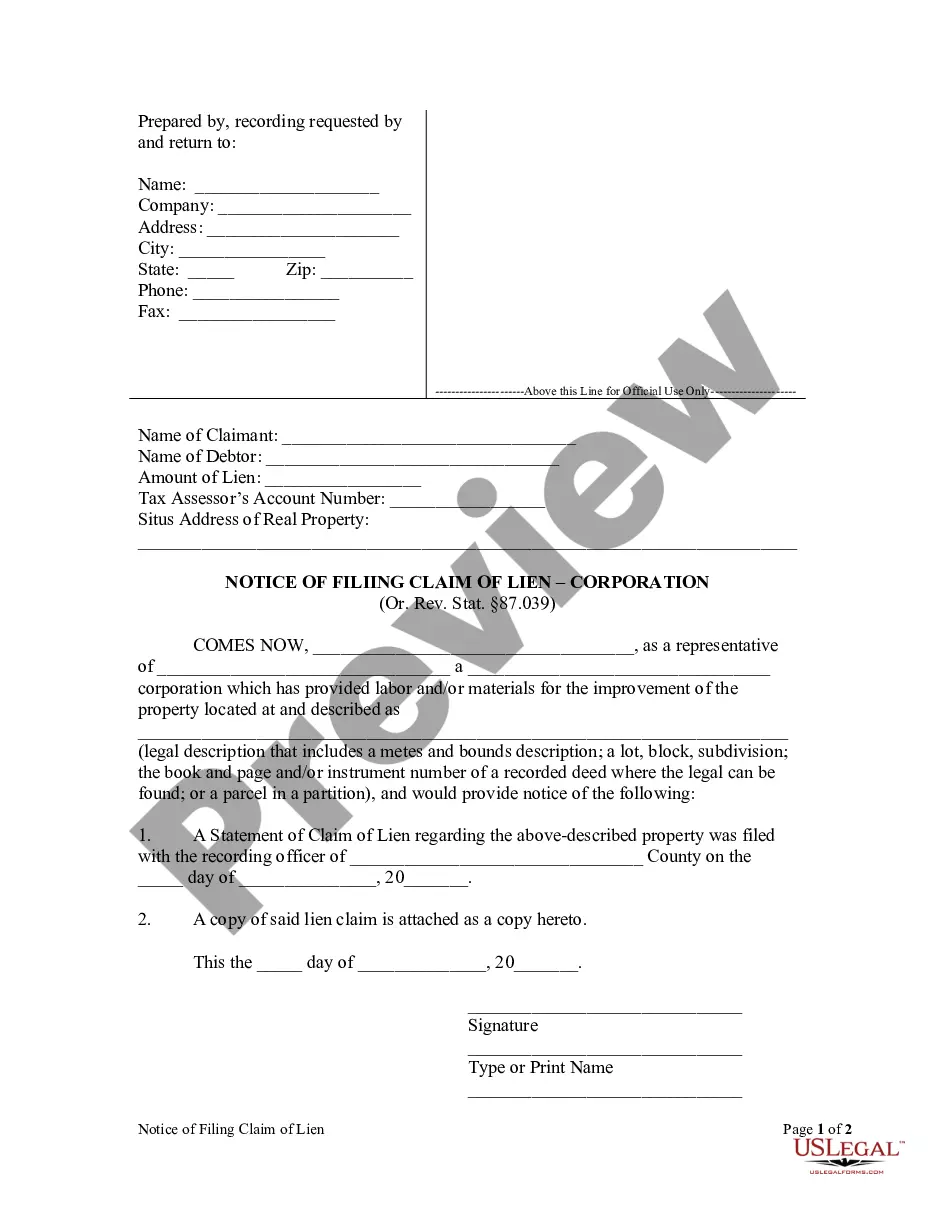

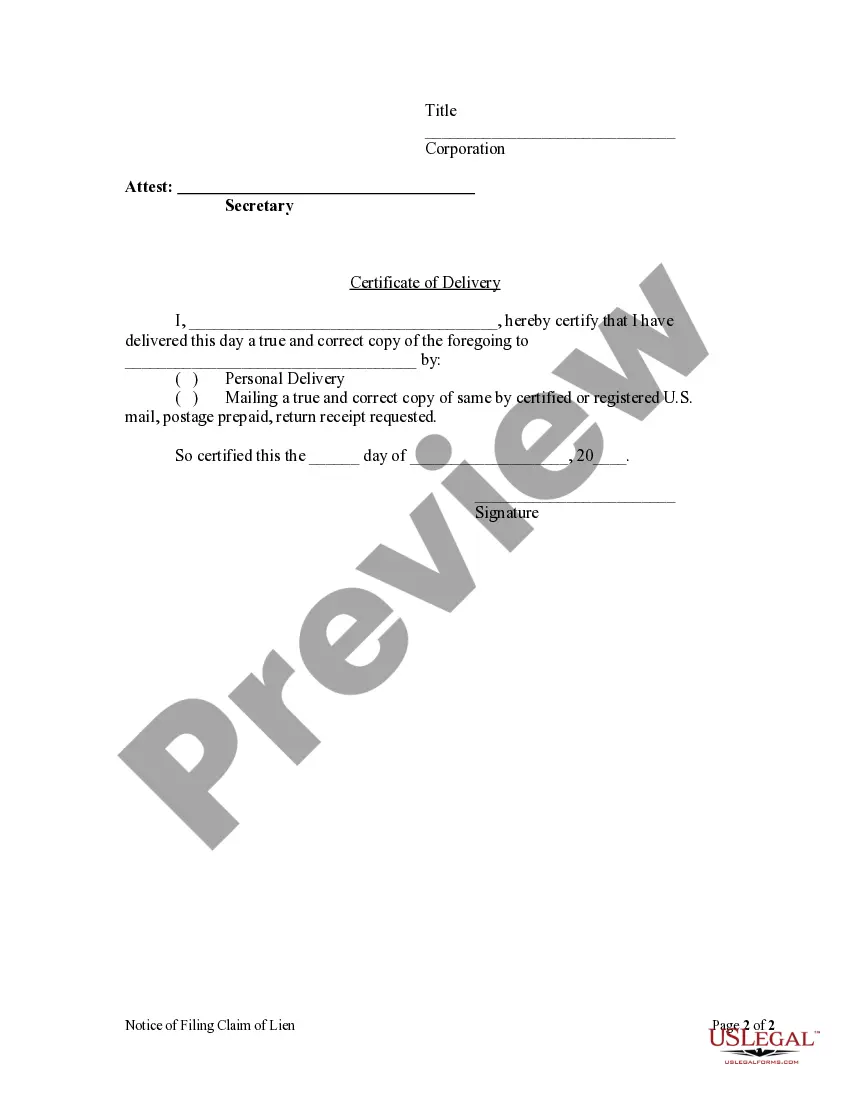

How to fill out Oregon Notice Of Filing Of Lien Claim By Corporation?

- Log in to your US Legal Forms account if you're a returning user. Verify that your subscription is active to ensure uninterrupted access to forms.

- If this is your first time, begin by checking the preview mode and descriptions of available forms. Make sure to choose one that suits your needs and complies with your local legal requirements.

- If you need a different form, utilize the search bar to find alternative templates that fit your criteria.

- Once you've located the correct document, click the 'Buy Now' button and select a suitable subscription plan. Note that you will need to create an account to gain access to the extensive library.

- Proceed to checkout by entering your payment information, either via credit card or PayPal, to complete your purchase.

- Download the completed template directly to your device. For future reference, you can access your forms anytime via the 'My Forms' section in your profile.

In conclusion, US Legal Forms offers a robust and user-friendly approach to legal document management. With over 85,000 forms at your fingertips and expert support available, you can confidently prepare your lien documents.

Start your journey towards a smoother legal process today by visiting US Legal Forms and explore the variety of options available.

Form popularity

FAQ

In Georgia, a lien typically lasts for one year from the date of filing. However, it can be renewed under certain conditions if the debt remains unpaid. Knowing the duration of a lien is crucial for both creditors and property owners. By utilizing platforms like US Legal Forms, you can stay updated on lien timelines and manage your legal obligations effectively.

Several conditions apply when filing a lien for nonpayment. Generally, the creditor must provide proof that a debt exists and that the payment remains unpaid. Additionally, the property in question should be specifically identified in the lien documentation. Understanding these conditions is essential, and you can use US Legal Forms to ensure your filing meets all requirements.

Yes, it is possible for someone to file a lien on your property without your knowledge. Creditors can file liens for nonpayment of debts, and they do not have to inform property owners beforehand. This action creates a legal claim against your property, which can affect your ability to sell or refinance it. To avoid surprises and protect your interests, it's wise to frequently check your property records.

To file a lien in Georgia, you need specific documentation, including a written notice of the claim, the amount owed, and details about the property. It is crucial to follow precise procedures to ensure the lien is valid. Filing a lien for nonpayment typically involves submitting these documents to the local county clerk's office. Using a reliable platform like US Legal Forms can help streamline this process and ensure compliance with local laws.

In Texas, several factors can render a lien invalid, including insufficient documentation, failure to meet filing deadlines, and missing essential information. A lien must be filed within the designated period, typically within four months of the completion of work. Additionally, any errors in the lien document can lead to invalidation. For more clarity and support on filing a valid lien for nonpayment, check out US Legal Forms.

In Georgia, you generally have one year to file a lien for nonpayment after the work is completed. Filing within this time frame is crucial to preserving your right to collect payment. To ensure that you meet all legal requirements, consider consulting resources like US Legal Forms. They can offer assistance in navigating the specifics of Georgia's lien laws.

A contractor may sue a homeowner for nonpayment even without a formal contract, usually based on an implied contract. This implies that services were provided and accepted, even if no written agreement exists. However, filing a lien for nonpayment can strengthen your case during legal proceedings. Consider using US Legal Forms to understand your rights and options for pursuing this matter.

In California, filing a lien for nonpayment involves specific procedures and deadlines. Generally, you must file a lien within 90 days of the completion of your work or service. It's crucial to ensure that you follow the proper protocol to maintain the validity of your lien. For detailed guidance on California's lien laws, you can explore resources available on US Legal Forms.

Yes, you can file a lien for nonpayment even if you do not have a written contract. Many states allow verbal agreements to support filing a lien, as long as you have proof of the work performed or services rendered. However, it is always best to document your agreement in writing to strengthen your position. If you need assistance, consider using US Legal Forms for templates and guidance.

Yes, you can file a lien online in many jurisdictions. Many states offer online portals for filing a lien for nonpayment, making the process more accessible. However, it's important to check your specific state's regulations and requirements. Utilizing resources like US Legal Forms can help you prepare the necessary documents and navigate the online filing process with ease.