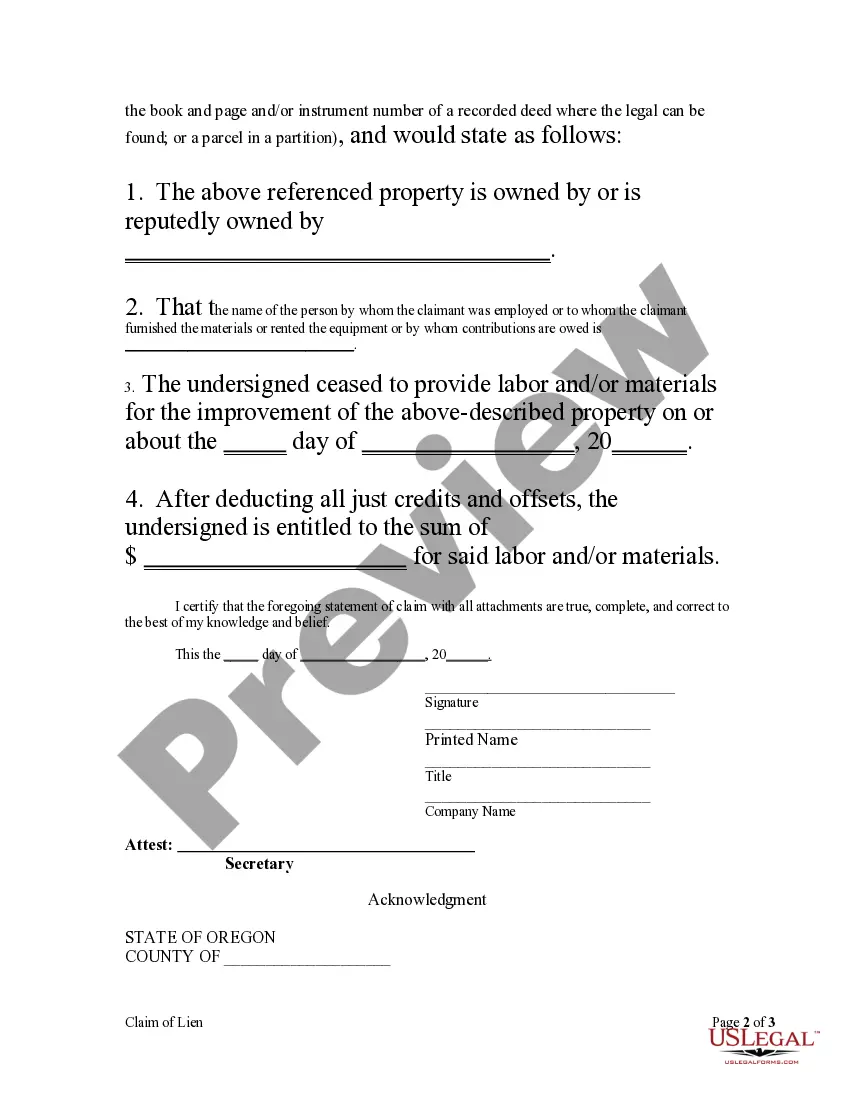

Every person claiming a lien created under ORS 87.010 (1) or (2) shall perfect the lien no later than 75 days after the person has ceased to provide labor, rent equipment or furnish materials or 75 days after completion of construction, whichever is earlier. Every other person claiming a lien created under ORS 87.010 shall perfect the lien not later than 75 days after the completion of construction. All liens claimed shall be perfected as provided by subsections (2) to (4) of this section. A lien created under ORS 87.010 shall be perfected by filing a claim of lien with the recording officer of the county or counties in which the improvement, or some part thereof, is situated.

Llc Limited Company With Sole Proprietorship

Description

How to fill out Oregon Claim Of Lien By Corporation?

- If you are an existing user, log into your account to download the required form template directly. Check your subscription status and renew if necessary.

- For first-time users, begin by reviewing the document options. Use the Preview mode to ensure that the selected form meets your specific needs and complies with your local jurisdiction.

- If the available forms don't suit your requirements, navigate using the Search tab at the top to find alternative templates that align with your business goals.

- Once you've selected the correct document, click the Buy Now button and choose a subscription plan that best fits your needs. Registration is required to access the document library.

- Complete your purchase by entering your payment details or signing in with your PayPal account.

- After the transaction is successful, download the form and save it on your device. You can access this document anytime from the My Forms section of your account.

US Legal Forms stands out with its extensive collection of over 85,000 customizable legal forms, giving you the advantage of robust options found nowhere else for similar costs.

Don’t miss the chance to streamline your legal documentation process. Start your LLC limited company journey today with US Legal Forms!

Form popularity

FAQ

Yes, you can convert your sole proprietorship to an LLC, and many business owners choose to do so for liability protection and tax advantages. The process involves filing the necessary paperwork with your state and obtaining any required licenses. Transitioning from a sole proprietorship to an LLC limited company can enhance your business's credibility and legal standing. The US Legal Forms platform can guide you through this process, ensuring a smooth transition.

Generally, the type of business that pays the least taxes would be a sole proprietorship. This is because it does not incur corporate taxes; profits are taxed only at the individual level. However, when comparing an LLC limited company with sole proprietorships, it is essential to consider the specific tax structure of each business as various deductions and expenses may apply differently to each form. Always consult a tax professional to understand your specific situation.

When comparing an LLC limited company with a sole proprietorship, tax benefits often favor the LLC. An LLC provides flexibility in how it is taxed, allowing you to be taxed as a corporation if beneficial. On the other hand, sole proprietorships report business income on personal tax returns, which could lead to higher self-employment taxes. Therefore, many business owners find that forming an LLC is a strategic move for better tax management.

The four main types of business ownership include sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). An LLC limited company with sole proprietorship combines the simplicity of a sole proprietorship with the liability protection of a corporation. This structure allows owners to enjoy personal asset protection while maintaining complete control over their business. Additionally, using a trusted service like US Legal Forms can help you navigate the formation process, ensuring you choose the best ownership type for your needs.

You cannot simply change your EIN number from a sole proprietorship to an LLC, as each entity needs its own EIN. When you form an LLC, you must apply for a new EIN specifically for that LLC. This is an important step to maintain compliance with IRS regulations. If you're unsure about the process, uslegalforms can provide guidance tailored to your LLC limited company with sole proprietorship.

No, you should not use your personal EIN for your LLC. An LLC is a distinct entity that requires its own Employer Identification Number for federal tax purposes. This separation helps delineate your personal and business finances, which is crucial for protecting your assets. For assistance, consider the services offered by uslegalforms as you establish your LLC limited company with sole proprietorship.

Yes, you can turn your sole proprietorship into an LLC, a process that offers advantages like limited liability and more tax flexibility. It involves filing necessary documents with your state, such as Articles of Organization. Additionally, transitioning allows you to manage risk more effectively as your business grows. If needed, consider using tools from uslegalforms to guide you in establishing your LLC limited company with sole proprietorship.

To convert your sole proprietorship to an LLC, you must first select a name for your LLC, ensuring it complies with your state's regulations. Next, you'll need to file the appropriate paperwork, including Articles of Organization, with your state's business office. After you obtain your LLC status, remember to obtain a new EIN for tax reporting. Resources like uslegalforms can simplify this transition for your LLC limited company with sole proprietorship.

Yes, you can have both an LLC and a sole proprietorship simultaneously. This arrangement can provide flexibility in managing different business ventures or aspects of your investments. Each entity type serves distinct purposes based on liability and taxation. Using uslegalforms can help you navigate the process effectively if you decide to establish an LLC limited company with sole proprietorship.

No, it is not appropriate to use the same EIN for both an LLC and a sole proprietorship. Each entity type has unique legal identities, requiring its own EIN for tax purposes. Using separate EINs helps clarify the tax responsibilities and protects your assets as you manage your LLC limited company with sole proprietorship.