Quitclaim Deed To Add Spouse To Title With Mortgage

Description

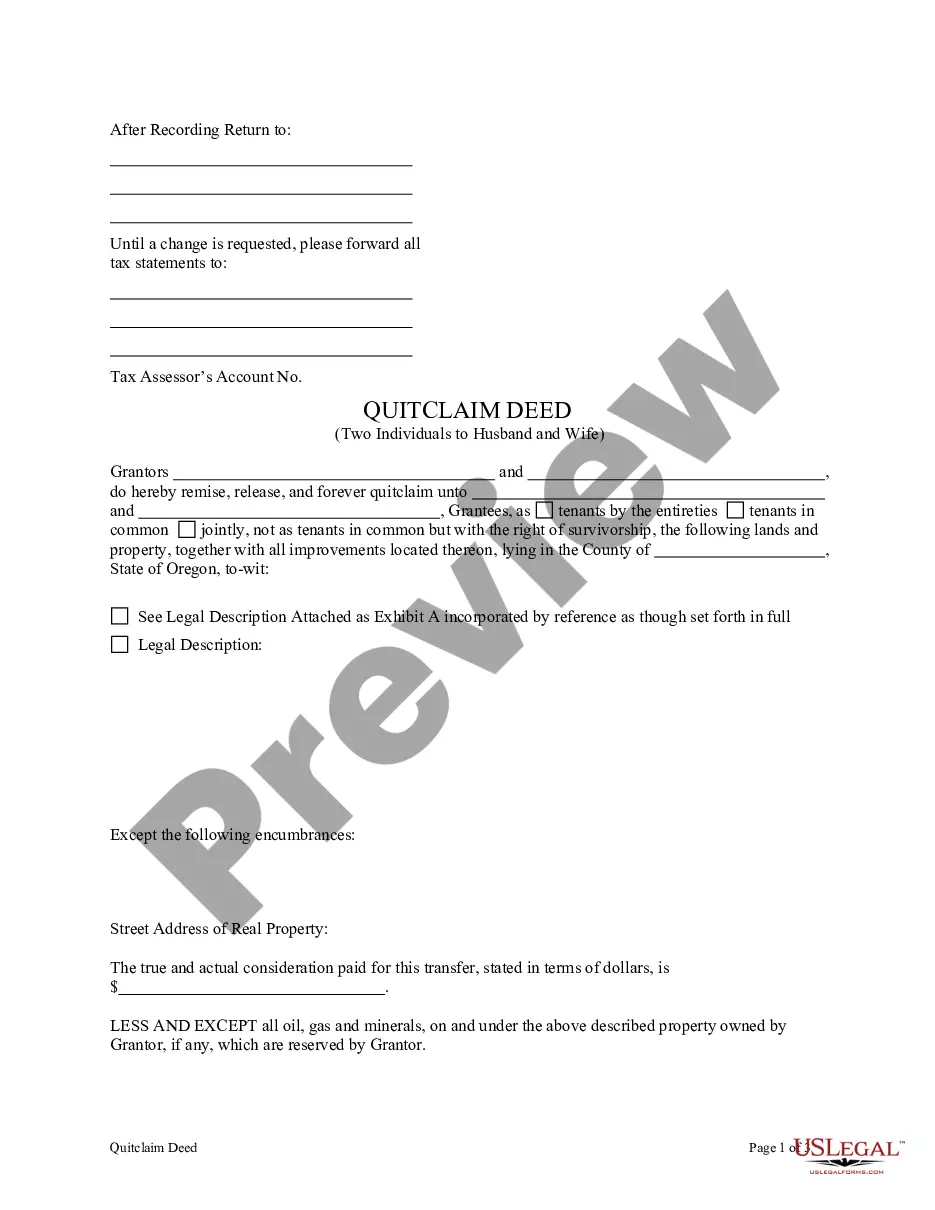

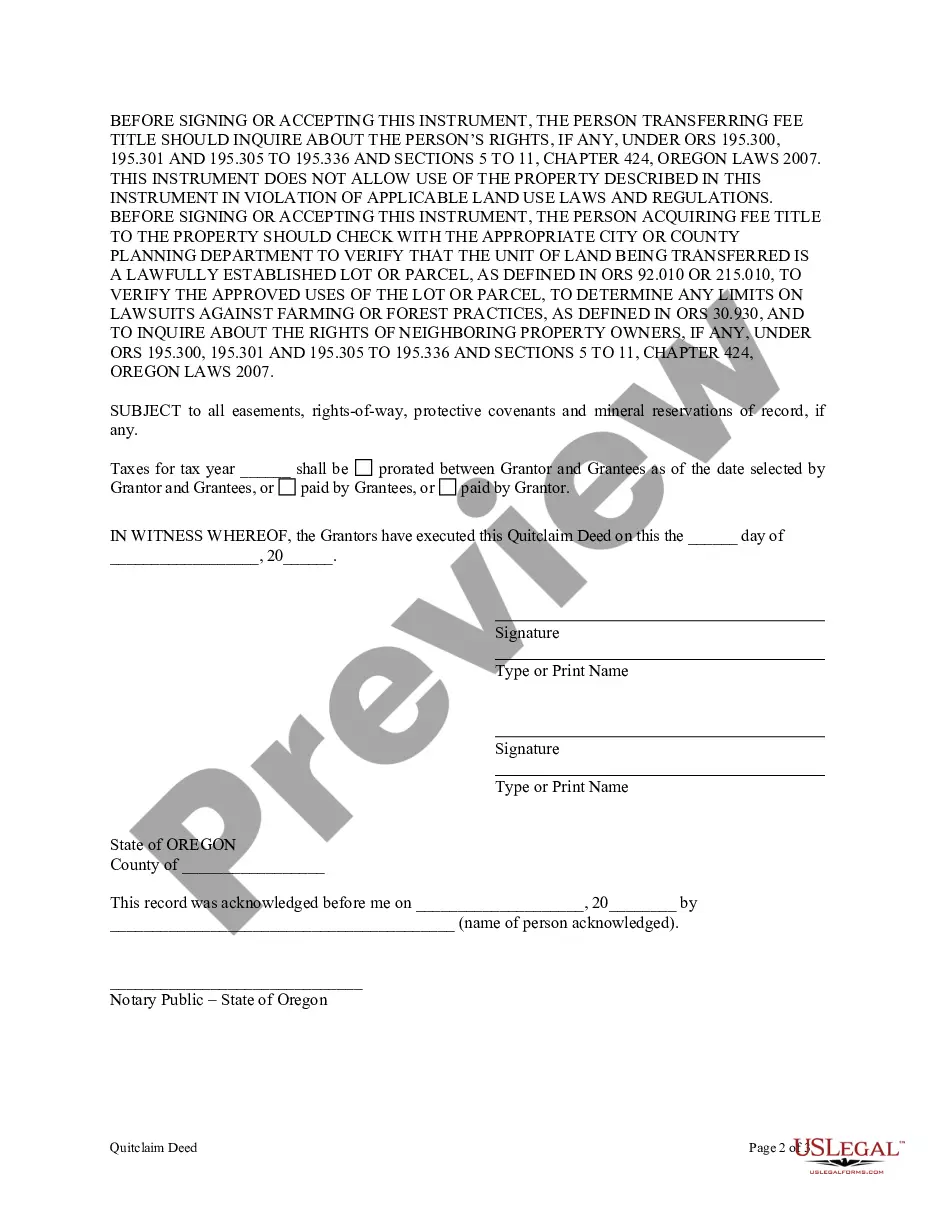

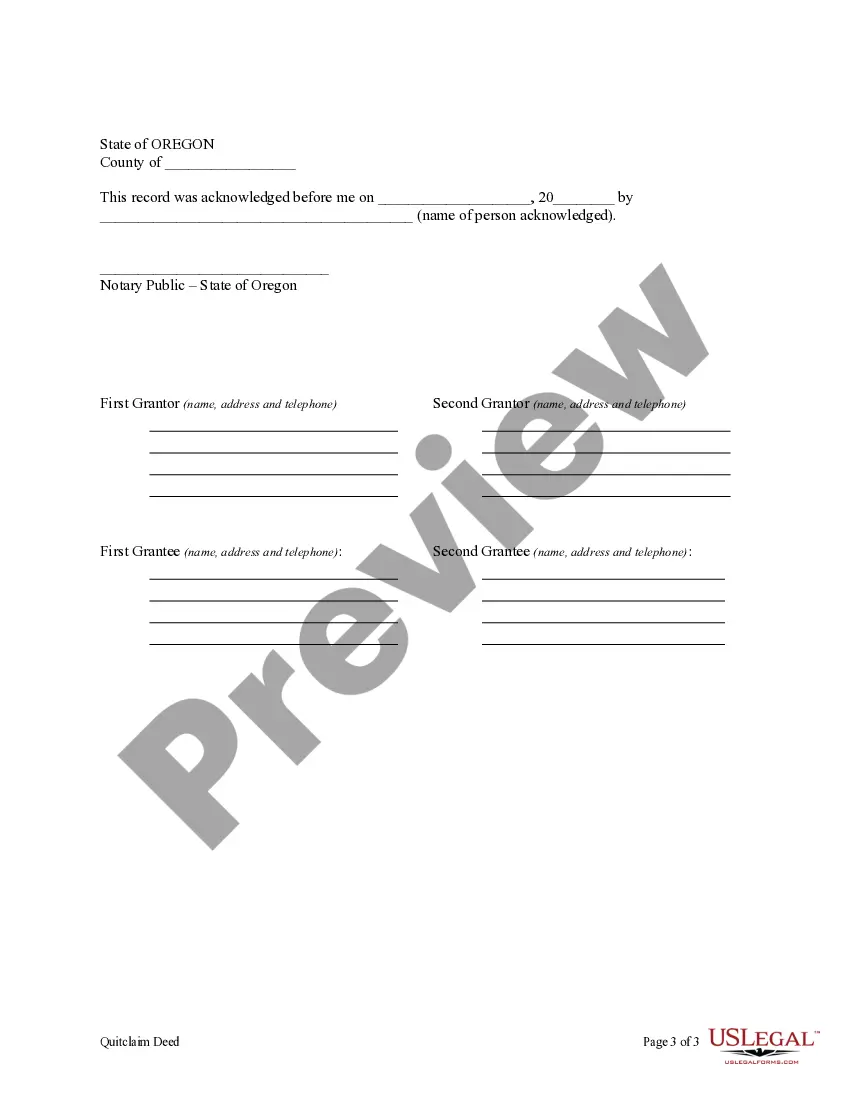

How to fill out Oregon Quitclaim Deed By Two Individuals To Husband And Wife?

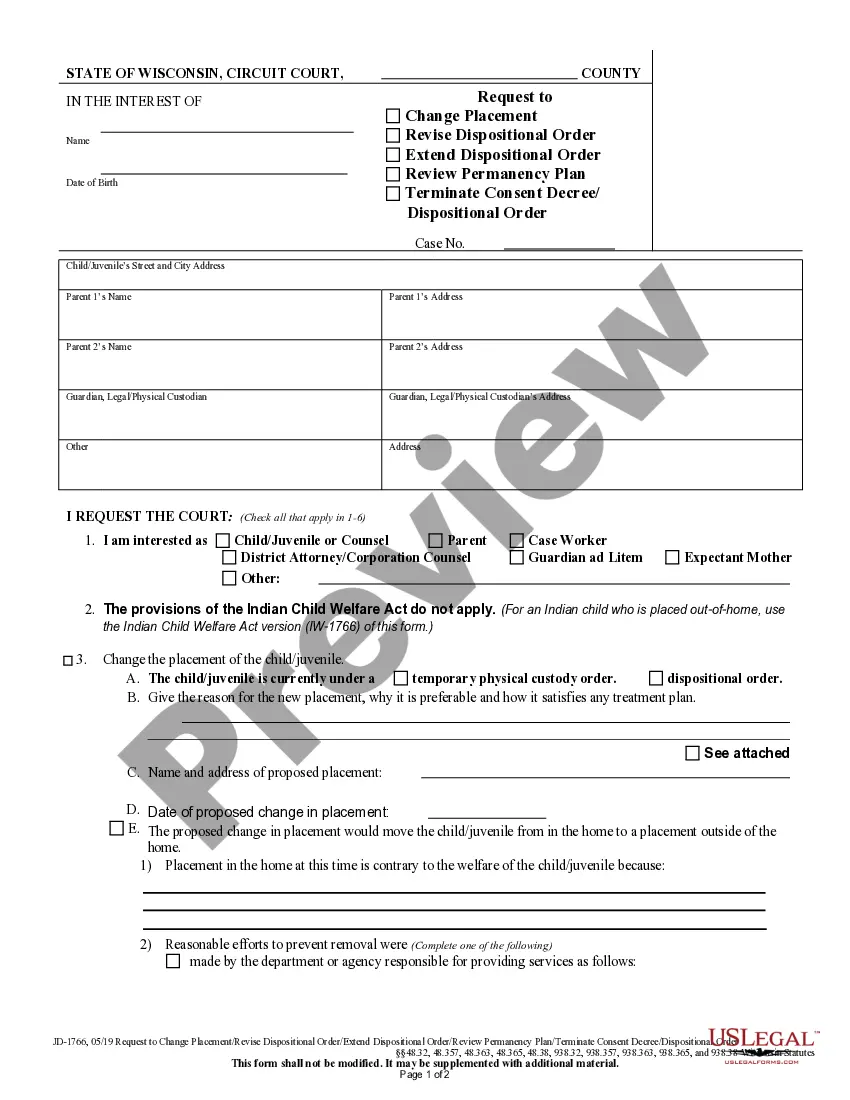

Accessing legal document samples that comply with federal and regional regulations is crucial, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the appropriate Quitclaim Deed To Add Spouse To Title With Mortgage sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the largest online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and personal scenario. They are simple to browse with all files collected by state and purpose of use. Our professionals stay up with legislative changes, so you can always be sure your paperwork is up to date and compliant when getting a Quitclaim Deed To Add Spouse To Title With Mortgage from our website.

Obtaining a Quitclaim Deed To Add Spouse To Title With Mortgage is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the preferred format. If you are new to our website, adhere to the steps below:

- Analyze the template using the Preview option or through the text outline to make certain it meets your needs.

- Browse for a different sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve located the suitable form and choose a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Quitclaim Deed To Add Spouse To Title With Mortgage and download it.

All templates you locate through US Legal Forms are reusable. To re-download and complete earlier purchased forms, open the My Forms tab in your profile. Take advantage of the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

By adding another person to a deed, you are essentially gifting them a portion of the property's value, which may trigger the gift tax. Gift tax is a federal levy on transfers of money or property to another person while getting nothing, or less than full value, in return.

Yes, you can put your spouse on the title without putting them on the mortgage. This would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

Quitclaim deeds can be used in a number of different situations, though they are most common when transferring property between family members or spouses. For example, after a divorce one spouse may sign a quitclaim deed to officially sign over ownership of the home.

Your mortgage loan will most likely need to be fully refinanced. Adding a new person to your mortgage loan changes the loan's terms. You won't be able to change these terms unless a lender creates a new loan for you through a mortgage refinance.

Your parents can put your name on the deed to their house. Many people might see this as a simple method of estate planning. However, it may be a bad idea. Should Elderly Parents Sign Over Their House? Pros & Cons trustworthy.com ? blog ? should-elderly-par... trustworthy.com ? blog ? should-elderly-par...