Oregon Foreign Llc Withdrawal

Description

Form popularity

FAQ

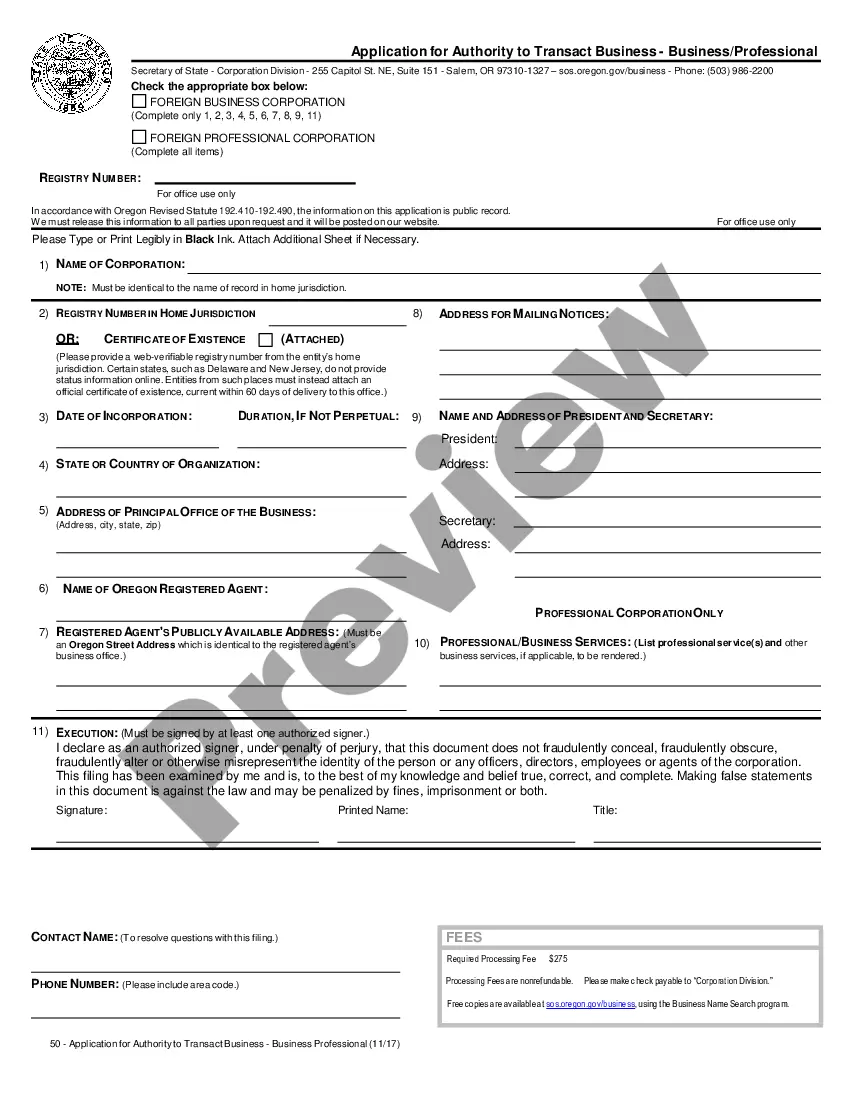

To register an out-of-state business in Oregon, first, you must gather your business's information, including its name, address, and the state of formation. Next, you will need to apply for a Certificate of Authority from the Oregon Secretary of State. This process typically requires you to provide documentation that proves your business is in good standing in its home state. Importantly, if you later decide to cease operations in Oregon, understanding the Oregon foreign LLC withdrawal process will be essential for a smooth exit.

After administrative dissolution in Oregon, your LLC no longer holds any legal rights or privileges to operate within the state. You might miss opportunities for contracts or partnerships due to this status. However, if you address the issues leading to the dissolution, you can apply for reinstatement. US Legal Forms provides resources that can guide you through the reinstatement process effectively.

Administrative dissolution in Oregon refers to the state's action of formally ending the existence of a foreign LLC that has not complied with state regulations. This could happen due to failure to file necessary documents or fees. When this occurs, your foreign LLC loses its legal status to conduct business in Oregon. Ensure you understand the implications of Oregon foreign LLC withdrawal to avoid such situations.

To withdraw your application for an Oregon foreign LLC withdrawal, you need to formally submit a request to the Oregon Secretary of State. You may need to fill out a specific form and provide relevant details about your LLC. Make sure to double-check if there are any pending obligations or fees before completing the process. Using US Legal Forms can help simplify this process by providing you with the necessary documents.

Yes, Oregon does allow LLC conversions. This means that if you have a foreign LLC and want to withdraw it, you can convert it to an Oregon LLC as part of the withdrawal process. However, it's important to understand the specific requirements and legal implications involved in this transition. For assistance with Oregon foreign LLC withdrawal and conversions, consider using US Legal Forms, which provides comprehensive resources and documents to guide you through each step.

Yes, a foreigner can register an LLC in the US, including in Oregon. Foreign individuals must comply with state-specific regulations and may need to appoint a registered agent in the respective state. Additionally, understanding the ongoing requirements, including those related to Oregon foreign LLC withdrawal, is essential for maintaining good standing. Consulting USLegalForms can provide valuable guidance throughout this process.

Registering a foreign LLC in Oregon involves submitting a foreign registration application to the Secretary of State. Make sure you provide the correct information, including your business name and address, and clear details about your registered agent. This step is vital in maintaining compliance and avoiding issues, especially if you are considering Oregon foreign LLC withdrawal in the future. Consider using USLegalForms to facilitate this process.

To register a foreign LLC in Oregon, you need to file an application for authority with the Secretary of State. This application typically requires details like your LLC's name, state of formation, and agent for service of process. It is advisable to ensure all documents are accurate and comply with Oregon laws. Utilizing resources like USLegalForms can help streamline this application process efficiently.

If you don't dissolve your LLC in Oregon, it may remain on record, accruing fees and penalties over time. Additionally, you might miss important deadlines and opportunities for filing taxes appropriately. This scenario may lead to administrative dissolution eventually. Therefore, being aware of the Oregon foreign LLC withdrawal process can help you make proactive decisions.

To register an out of state business in Oregon, you must file a foreign entity registration with the Oregon Secretary of State. This process includes providing your business name, the state of origin, and the registered agent's details. Don't forget that complying with Oregon's laws is essential for maintaining your business status. Moreover, understanding the implications of Oregon foreign LLC withdrawal can save you from future complications.