Oregon Foreign Llc For State

Description

Form popularity

FAQ

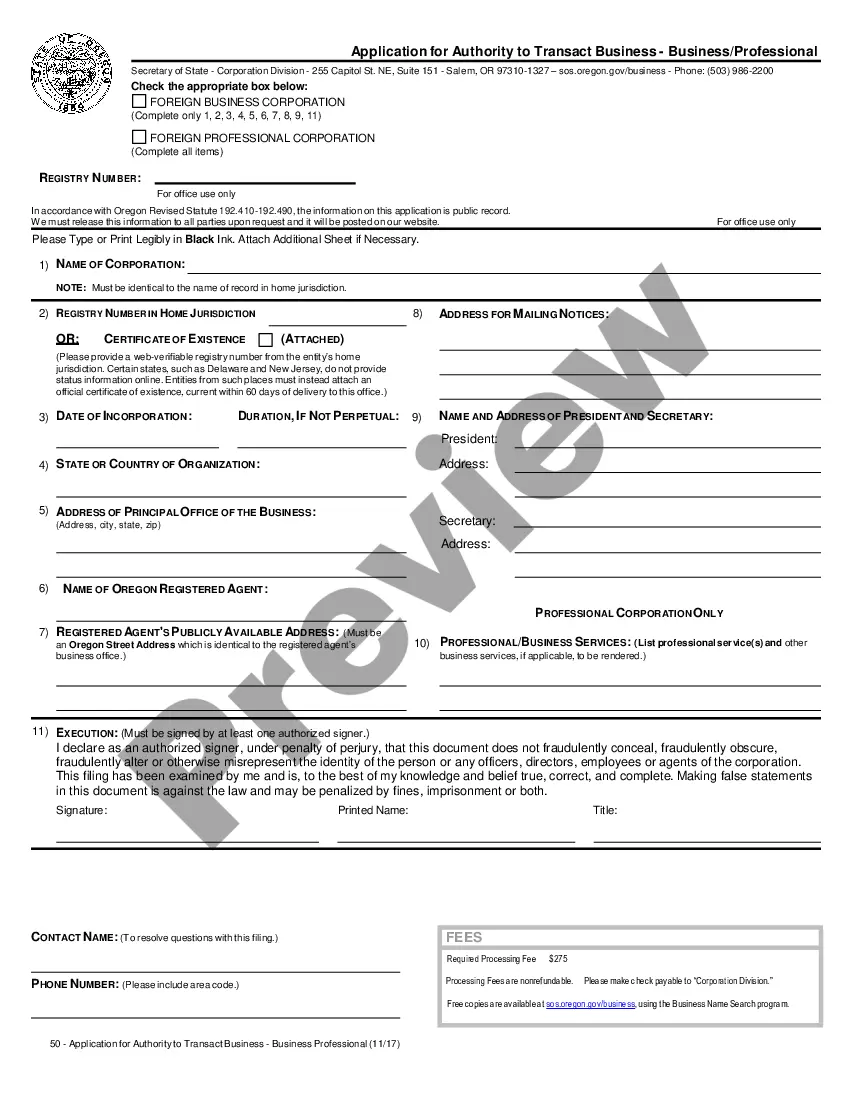

To register a foreign LLC in Oregon, you must file an Application for Authority with the Secretary of State, along with the required fees. This application includes details about your LLC, such as its name, state of formation, and a registered agent in Oregon. Ensuring all documents are prepared accurately is crucial, and uslegalforms can provide the resources you need to facilitate an Oregon foreign LLC for state registration.

To start an LLC in Oregon, you need to choose a unique name for your company, file the Articles of Organization with the Secretary of State, and appoint a registered agent. Additionally, you must obtain an Employer Identification Number (EIN) from the IRS if you plan to hire employees or open a business bank account. Using uslegalforms platform can help streamline this process for anyone interested in an Oregon foreign LLC for state.

To establish an LLC in Oregon, you must file Articles of Organization with the Secretary of State. This includes providing the name and address of your Oregon foreign LLC for state, along with the names of all members. Additionally, having an operating agreement helps define your business structure and processes, and using platforms like USLegalForms can assist you in completing the necessary paperwork.

While Oregon does not mandate an operating agreement for your LLC, it is highly recommended for your Oregon foreign LLC for state. An operating agreement serves as a roadmap for managing your business and helps avoid misunderstandings among members. Using USLegalForms can simplify the process of drafting your operating agreement, ensuring it meets legal standards.

An operating agreement is an essential document for your Oregon foreign LLC for state. It outlines the ownership structure and operational procedures of your company. While it is not legally required in Oregon, having one can prevent future disputes among members and clarify each person's role. You can create an operating agreement easily using online resources like USLegalForms.

The best way to register your LLC is to gather all necessary documents, complete the application accurately, and submit it to the appropriate state authority. Consider online platforms like U.S. Legal Forms, which provide templates and guidance tailored for your Oregon foreign LLC for state. This approach can save you time and reduce the likelihood of errors during the registration process.

While the best state can depend on various business needs, many entrepreneurs favor Oregon for its friendly business environment and straightforward registration process. It's essential to evaluate factors such as taxes, business laws, and operational costs. For those considering an Oregon foreign LLC for state, U.S. Legal Forms offers insights and resources to help you make an informed decision.

To apply for an Oregon foreign LLC, you need to file the necessary formation documents with the Secretary of State. You will require official documents from your home state verifying your LLC's formation. Using U.S. Legal Forms simplifies this process by providing step-by-step guidance and ensuring you submit the correct paperwork for your Oregon foreign LLC for state.

The approval time for an Oregon foreign LLC can vary, but generally, it takes about 1 to 2 weeks for the state to process your application. If you submit your documents online, you may receive a quicker response. Additionally, using a reputable platform like U.S. Legal Forms can streamline this process, ensuring your application meets all requirements for the Oregon foreign LLC for state.

To register an out of state business in Oregon, you must file an application for authority with the Secretary of State. This includes submitting your existing business documents and paying the required fees. You may also need to appoint a registered agent in Oregon for your Oregon foreign LLC for state.