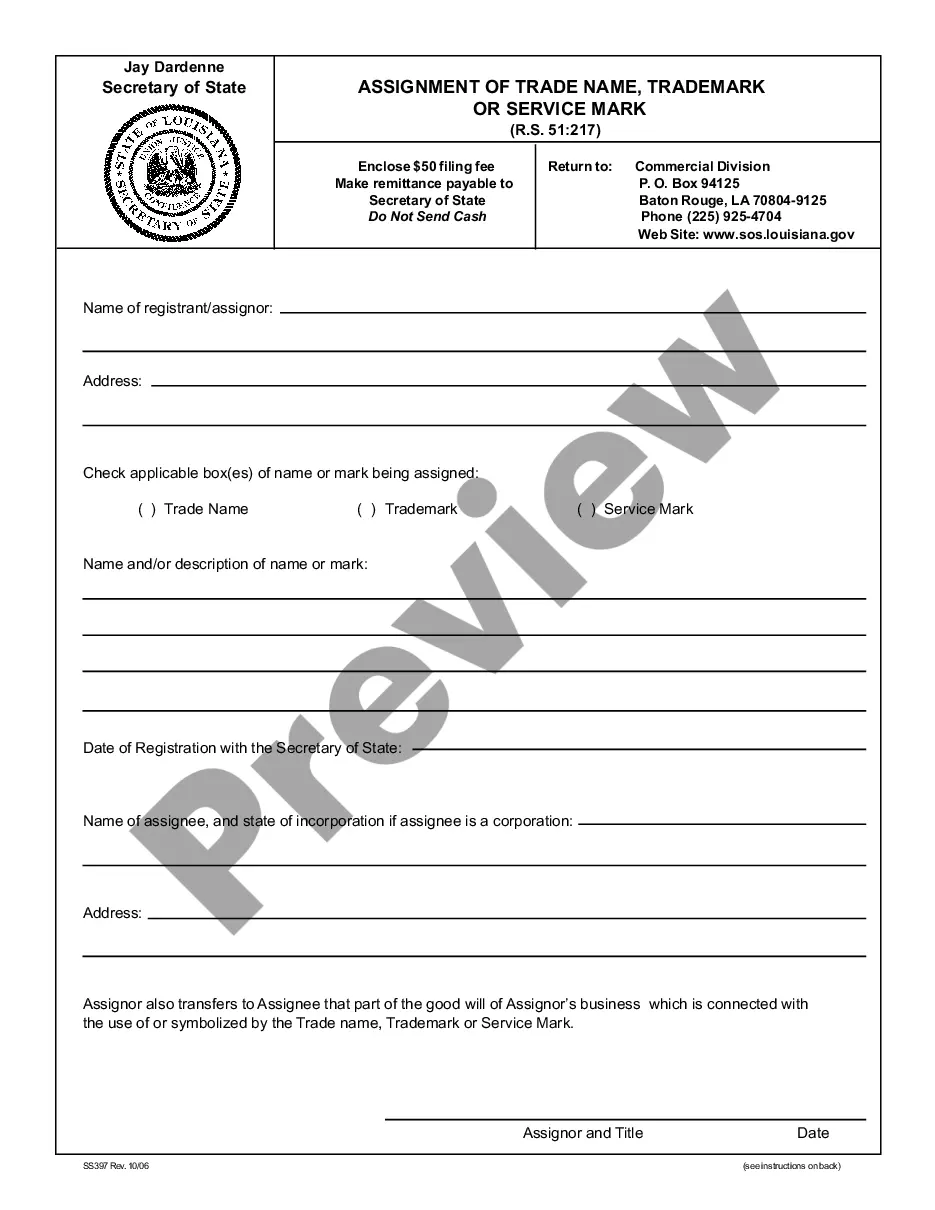

This is an official form from the Oklahoma Secretary of State, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Oklahoma statutes and law.

Oklahoma Secretary Of State Llc Renewal Withholding

Description

How to fill out Oklahoma Certificate Of Renewal, Revival, Extension And Restoration?

Accessing legal document samples that comply with federal and state laws is a matter of necessity, and the internet offers many options to pick from. But what’s the point in wasting time searching for the appropriate Oklahoma Secretary Of State Llc Renewal Withholding sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the largest online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and personal case. They are easy to browse with all documents grouped by state and purpose of use. Our experts keep up with legislative changes, so you can always be sure your paperwork is up to date and compliant when getting a Oklahoma Secretary Of State Llc Renewal Withholding from our website.

Obtaining a Oklahoma Secretary Of State Llc Renewal Withholding is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, follow the guidelines below:

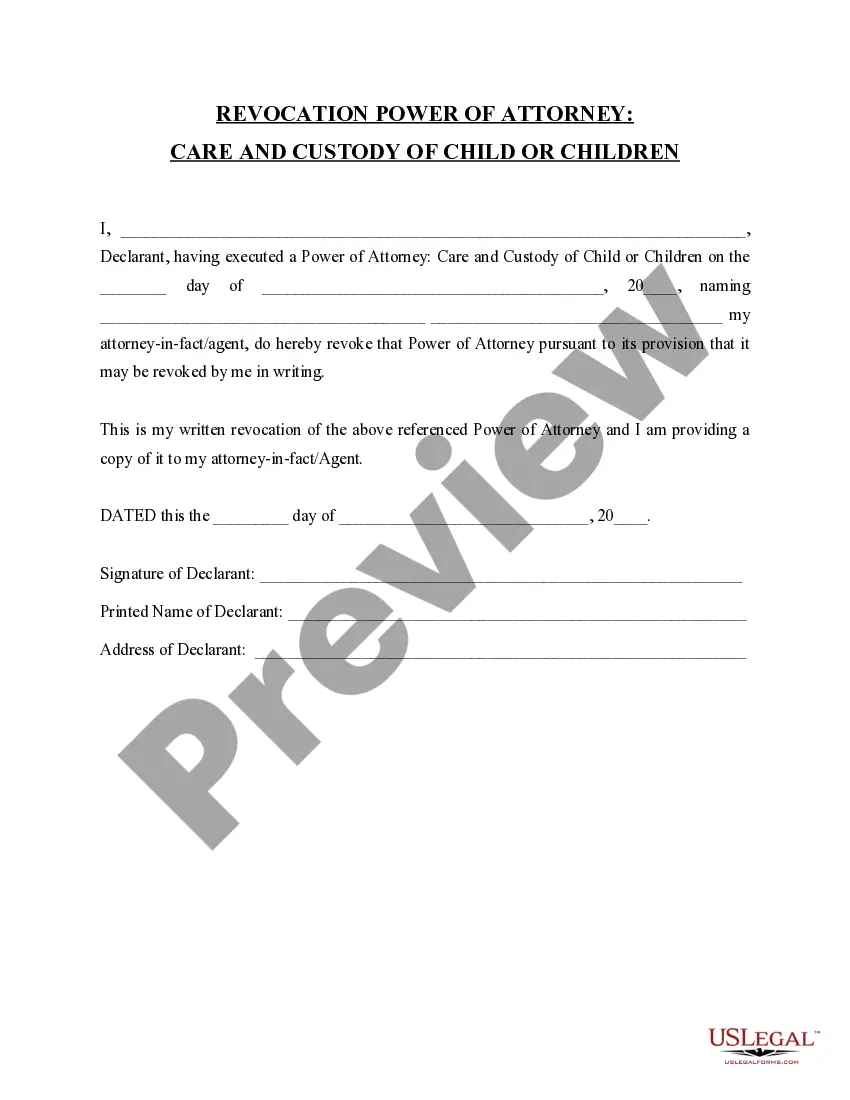

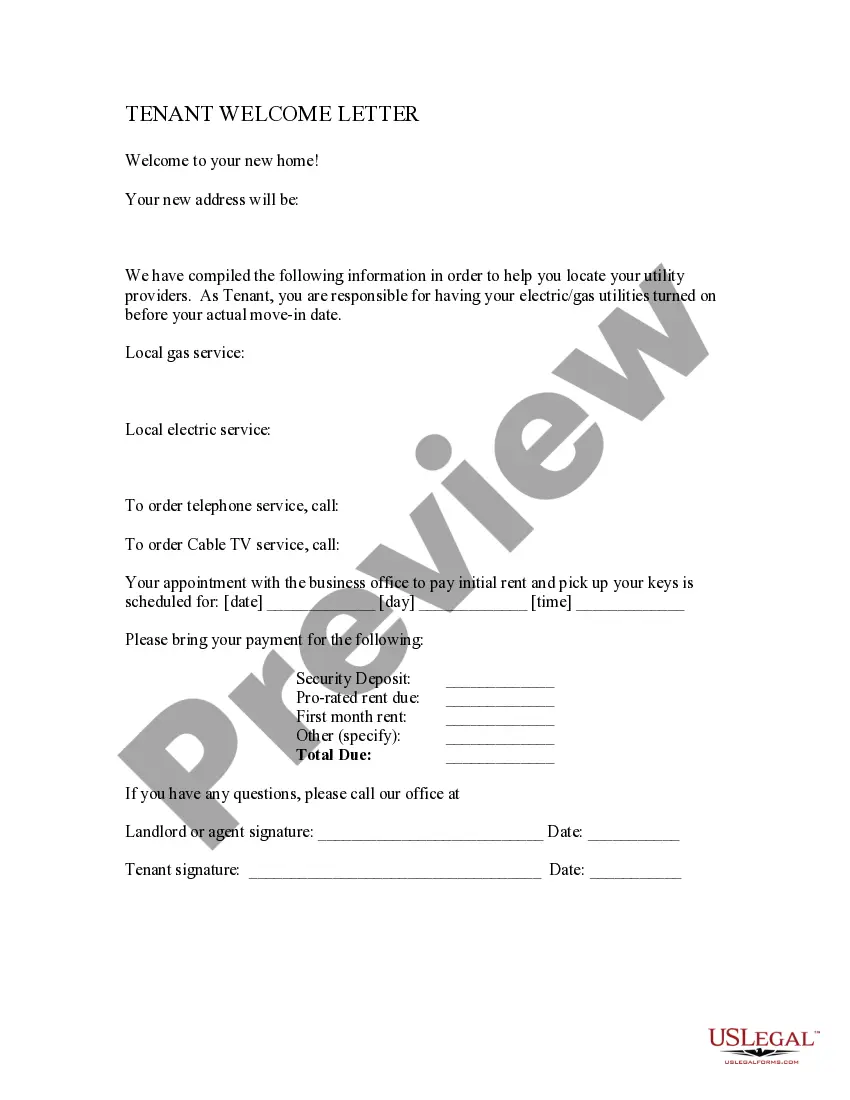

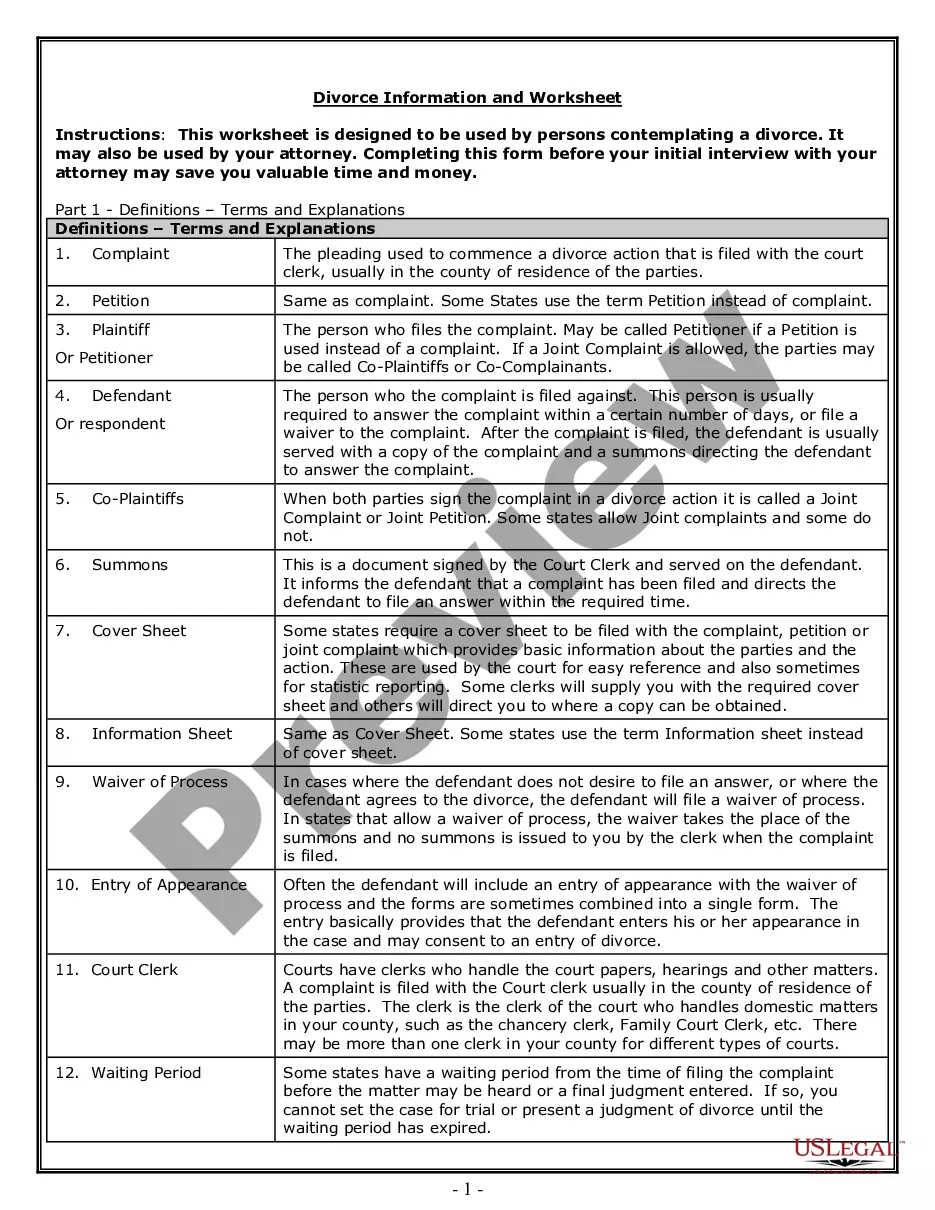

- Examine the template utilizing the Preview option or through the text outline to make certain it meets your requirements.

- Browse for a different sample utilizing the search tool at the top of the page if needed.

- Click Buy Now when you’ve located the suitable form and choose a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Oklahoma Secretary Of State Llc Renewal Withholding and download it.

All documents you find through US Legal Forms are multi-usable. To re-download and fill out earlier purchased forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Limited liability companies (LLCs) must file an annual certificate by mail or online by the anniversary of the company's establishment date. The fee is $25. No late fee is charged, but the LLC loses good standing after 60 days and can be dissolved or revoked if the filing is not made for three years.

You can file your Oklahoma LLC's Annual Certificate by mail or online. The state filing fee is $25 in both cases. The Oklahoma Secretary of State prefers electronic filings, so that is what we recommend. However, if you're not very comfortable on the computer, we recommend filing by mail.

LLCs in Oklahoma must complete a yearly certificate renewal form, which gets submitted to the Secretary of State's office. The paperwork is due annually on the anniversary date of your LLC's registration.

In Oklahoma, LLCs are taxed as pass-through entities by default, meaning the LLC passes its revenues and losses on to its members. Then members pay the state's graduated personal income tax rate ranging from 0.25% to 4.75% and the state's Pass-Through Entity Tax of 4%.

To revive an Oklahoma LLC, you'll need to file the Application for Reinstatement with the Oklahoma Secretary of State. You'll also have to file all missing annual certificates.