Quitclaim Deed For Property

Description

How to fill out Oklahoma Quitclaim Deed From Husband And Wife To Five Individuals As Joint Tenants With Right Of Survivorship?

- If you're a returning user, log in to your account at US Legal Forms and click the Download button to retrieve your desired template. Ensure your subscription is valid or renew it as needed.

- For first-time users, start by exploring the Preview mode and checking the form descriptions to ensure the template fits your requirements and jurisdiction.

- If you need a different template, utilize the Search tab to find the correct document that meets your specific needs.

- Once you have the right document, click the Buy Now button, select your preferred subscription plan, and create an account for full resource access.

- Proceed to purchase by entering your payment details through card or PayPal.

- Finally, download your form and save it on your device. You can also access it anytime from the My Forms section in your account.

With US Legal Forms, you benefit from a robust collection of over 85,000 editable legal forms, surpassing competitors in both quantity and user-friendliness.

Ensure your documents are completed accurately with the support of premium experts available for assistance. Start your journey today by visiting US Legal Forms!

Form popularity

FAQ

The main purpose of a quitclaim deed for property is to convey the transfer of ownership with minimal hassle. Unlike other types of deeds, it does not provide any warranties regarding the title, making it suitable for straightforward transactions. Many individuals use it to solidify transfers among family members, resolve ownership disputes, or facilitate property sales where the buyer trusts the seller. Overall, this deed simplifies the transfer process while still allowing you to manage your property ownership effectively.

While a quitclaim deed for property can facilitate a simple transfer, it does come with certain disadvantages. This type of deed does not provide any warranties regarding the property, meaning the new owner could inherit existing liens or claims. Additionally, it may not provide the same level of legal protection as other kinds of deeds. Therefore, it's essential to weigh these factors before proceeding.

Yes, you can perform a quitclaim deed on your own, effectively transferring property ownership without professional help. By following the necessary steps and ensuring all information is correct, you can complete this task successfully. However, if you prefer more guidance or detailed instructions, US Legal Forms offers user-friendly resources that can make this process easier for you.

In Michigan, you can indeed create your own quitclaim deed for property. Like other states, Michigan offers forms that you can fill out to facilitate this process. It's important to ensure that your document is formatted in accordance with state law. If you have questions or need assistance, US Legal Forms can provide the necessary templates and expert support.

Yes, you can create a quitclaim deed for property yourself. Many states provide templates that you can fill out with property details and the names of the parties involved. However, be cautious and ensure you follow your state’s legal requirements to avoid potential issues in the future. If you're uncertain, platforms like US Legal Forms offer resources and guidance to help you complete the process correctly.

A significant disadvantage for a buyer receiving a quitclaim deed for property lies in the lack of title protection. Buyers assume the risk of unknown liens or claims that may arise after the transaction. Thus, it’s advisable for buyers to conduct thorough due diligence or work with platforms like uslegalforms to navigate this process effectively.

Using a quitclaim deed for property can be problematic because it does not protect buyers as much as a warranty deed would. Since it does not guarantee clear title, buyers may face unforeseen legal challenges after the transfer. These potential risks make quitclaim deeds less favorable for transactions where buyers need assurance about the property’s title.

Quitclaim deeds for property are often viewed with caution because they do not guarantee that the title is clear. They simply transfer whatever interest the grantor has, which may include unresolved liens or claims. This lack of certainty can be a significant risk, especially for buyers who might be unaware of these underlying issues.

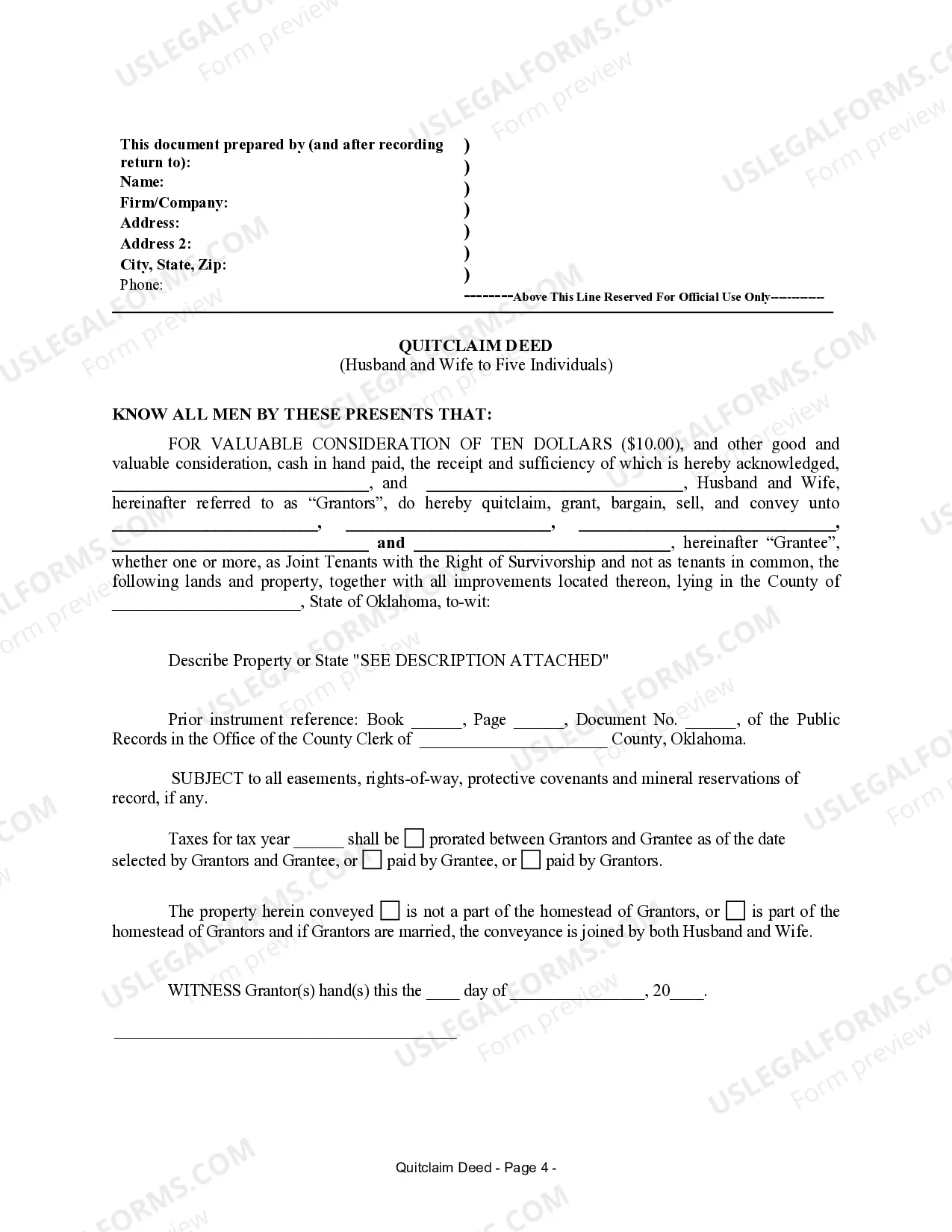

To fill out a quitclaim deed for property, start by obtaining a blank form specific to your state. Provide the names of both the grantor and grantee, the property description, and include any necessary legal language. Ensure to sign the deed in front of a notary public, as this adds a layer of legal validity to your document.

A quitclaim deed for property primarily benefits individuals transferring ownership among family members, such as parents to children or spouses. This method allows for a quick transfer without the need for a lengthy title search or legal complications. If you want to ensure a seamless transfer of property within your family, a quitclaim deed might be the right solution.