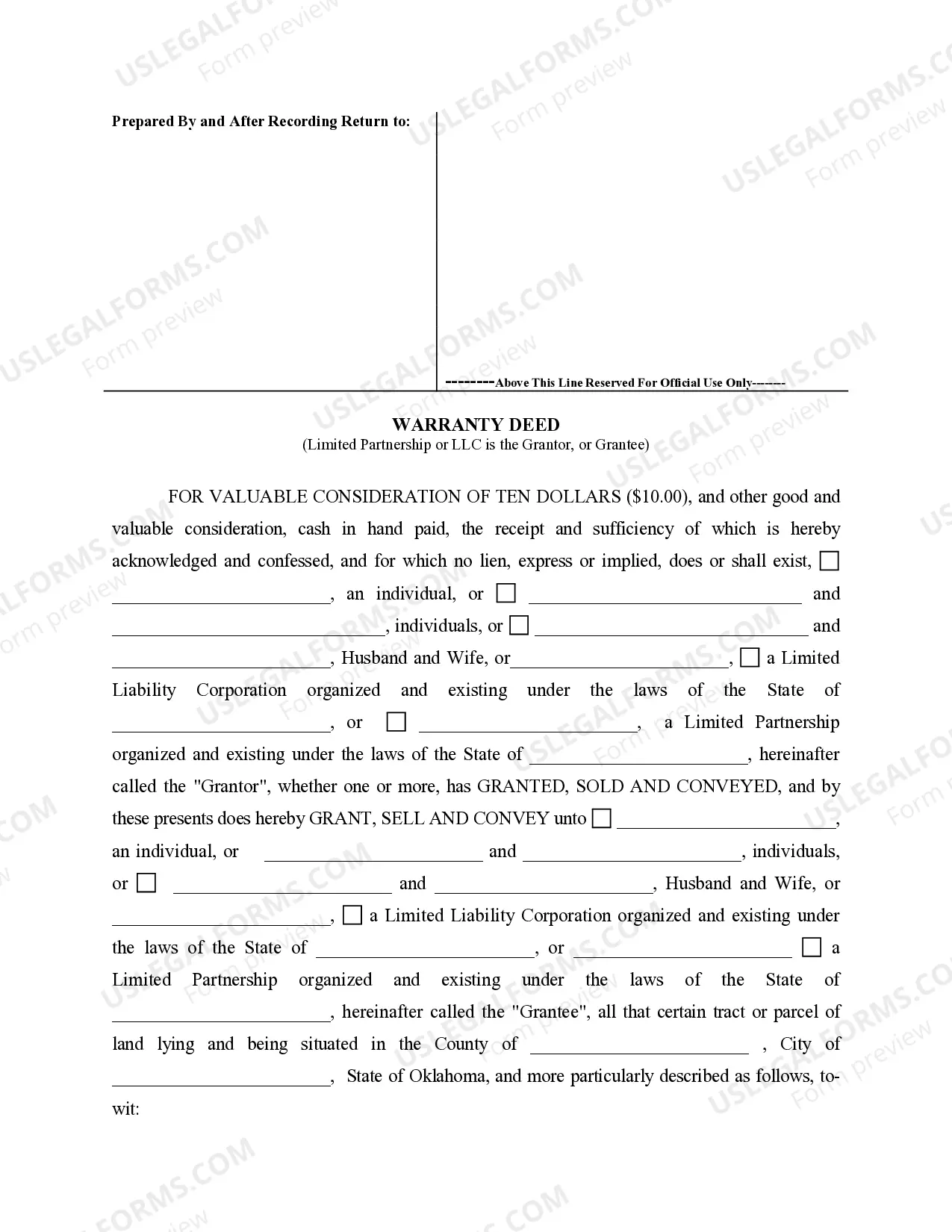

Limited Lliability

Description

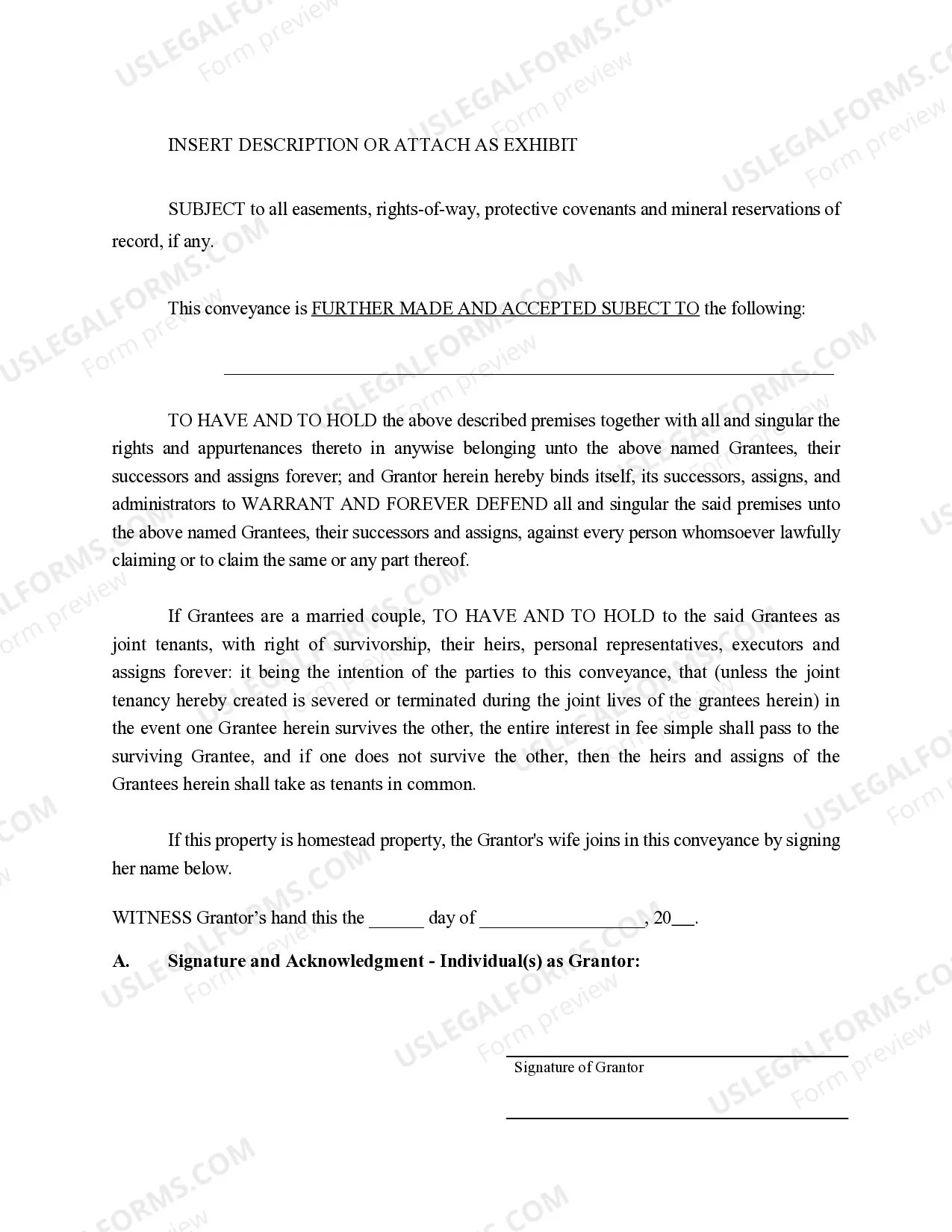

How to fill out Oklahoma Warranty Deed From Limited Partnership Or LLC Is The Grantor, Or Grantee?

- If you're a returning user, log in to your account and ensure your subscription is active. Click the Download button to retrieve your form template.

- For first-time users, start by examining the Preview mode and form descriptions to select the appropriate form that aligns with your needs and local jurisdiction requirements.

- If adjustments are needed, utilize the Search tab at the top to find alternative templates that better suit your situation.

- Once you've identified the right form, click on the Buy Now button to choose your preferred subscription plan and create an account for full access.

- Complete your purchase by entering your credit card details or using your PayPal account.

- Finally, download your selected form to your device and access it anytime through the My Forms section of your profile.

By following these straightforward steps, you can easily obtain necessary documents for establishing limited liability while benefiting from US Legal Forms' extensive resources.

Start your journey today and protect your assets with confidence by utilizing US Legal Forms!

Form popularity

FAQ

Whether an LLC files Form 1065 or Form 1120 depends on how the LLC elects to be taxed. Multi-member LLCs typically file Form 1065, while those that elect to be treated as a corporation file Form 1120. Understanding these options can help maximize the benefits of your Limited Liability Company structure.

If you operate a single-member LLC, you file your LLC income on your personal tax return using Schedule C. This combined filing simplifies the tax process. However, if your LLC has multiple owners, it files separately and issues K-1 forms to report each member's share of the income.

A Limited Liability Company files different tax forms depending on its structure. For single-member LLCs, Schedule C is commonly used. Multi-member LLCs typically file Form 1065, while those electing to be taxed as a corporation may use Form 1120 or Form 1120S, depending on their classification.

An LLC is not a Schedule C, but it can use Schedule C to report its income if it is a single-member LLC. In this case, the LLC does not file a separate tax return and is taxed as a sole proprietor. This is one of the many advantages of a Limited Liability Company structure.

The IRS tax form an LLC files often depends on its classification. For instance, if you run a single-member Limited Liability Company, you typically report your income on Schedule C of your personal tax return. Multi-member LLCs usually file Form 1065 to report income and expenses.

An LLC, or Limited Liability Company, is not strictly categorized as either an S or C corporation by the IRS. Instead, it can choose how to be taxed. This choice means your Limited Liability Company could be taxed as a sole proprietorship, partnership, S corporation, or C corporation based on your needs.

Limited liability signifies that a business owner's financial responsibility is limited to their investment in the company. This means that if the business incurs debts or faces lawsuits, your personal finances remain protected. This concept encourages more people to start businesses, knowing their personal assets are safe. Therefore, understanding limited liability is crucial for any business venture.

A limited liability company, or LLC, combines the benefits of both a corporation and a partnership. It offers protection from personal liability while allowing flexibility in management and tax treatment. Simplistically, establishing an LLC can provide you with peace of mind that your personal assets are shielded. This structure is an attractive option for many entrepreneurs.

Limited liability protects personal assets from business debts. In contrast, unlimited liability means personal assets can be used to settle business debts. So, if you're running a business, understanding these concepts is essential. Limited liability is especially vital for small business owners who want to safeguard their personal finances.

To write a limited liability company, you need to choose a name that complies with your state's regulations, typically including 'LLC' in the name. Additionally, you must draft an operating agreement that outlines your business structure and member responsibilities. Platforms like US Legal Forms can assist you in creating these documents correctly, ensuring you comply with state requirements.