Special Power Of Attorney With Notary

Description

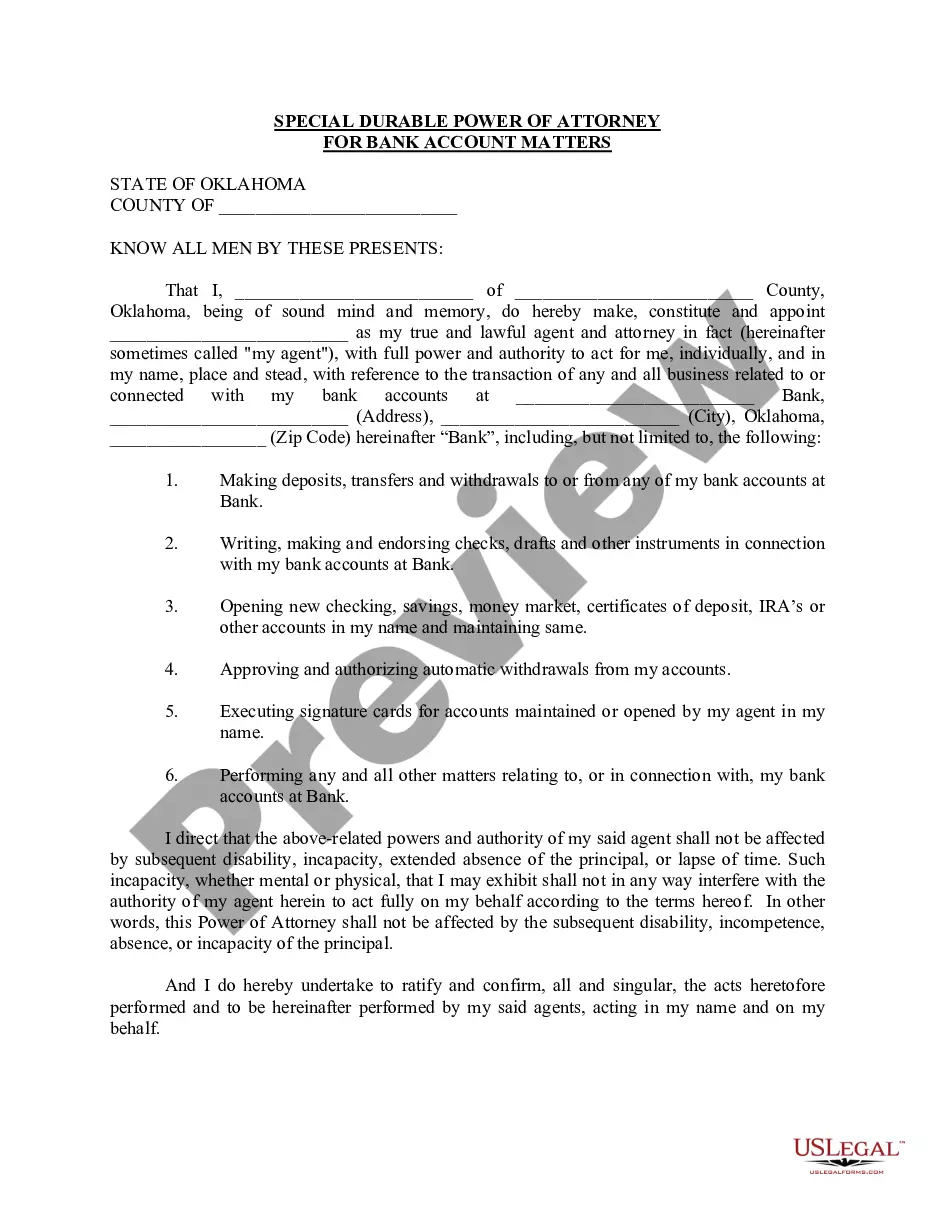

How to fill out Oklahoma Special Durable Power Of Attorney For Bank Account Matters?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active; renew it if necessary.

- Preview the special power of attorney with notary template to check it meets your specific requirements and adheres to local regulations.

- If the template isn’t suitable, utilize the search function to find another option that fits your needs better.

- Make the purchase by clicking the 'Buy Now' button and selecting your preferred subscription plan. An account registration is required for full access.

- Complete the payment using your credit card or PayPal to finalize your purchase.

- Download the completed form onto your device, ensuring you can access it anytime through the 'My Forms' section of your profile.

In conclusion, US Legal Forms simplifies the process of obtaining legal documents, empowering users with a robust library of over 85,000 customizable forms. With the added option for expert guidance, you can ensure your documents are accurate and legally binding.

Begin your journey towards seamless legal documentation today by visiting US Legal Forms.

Form popularity

FAQ

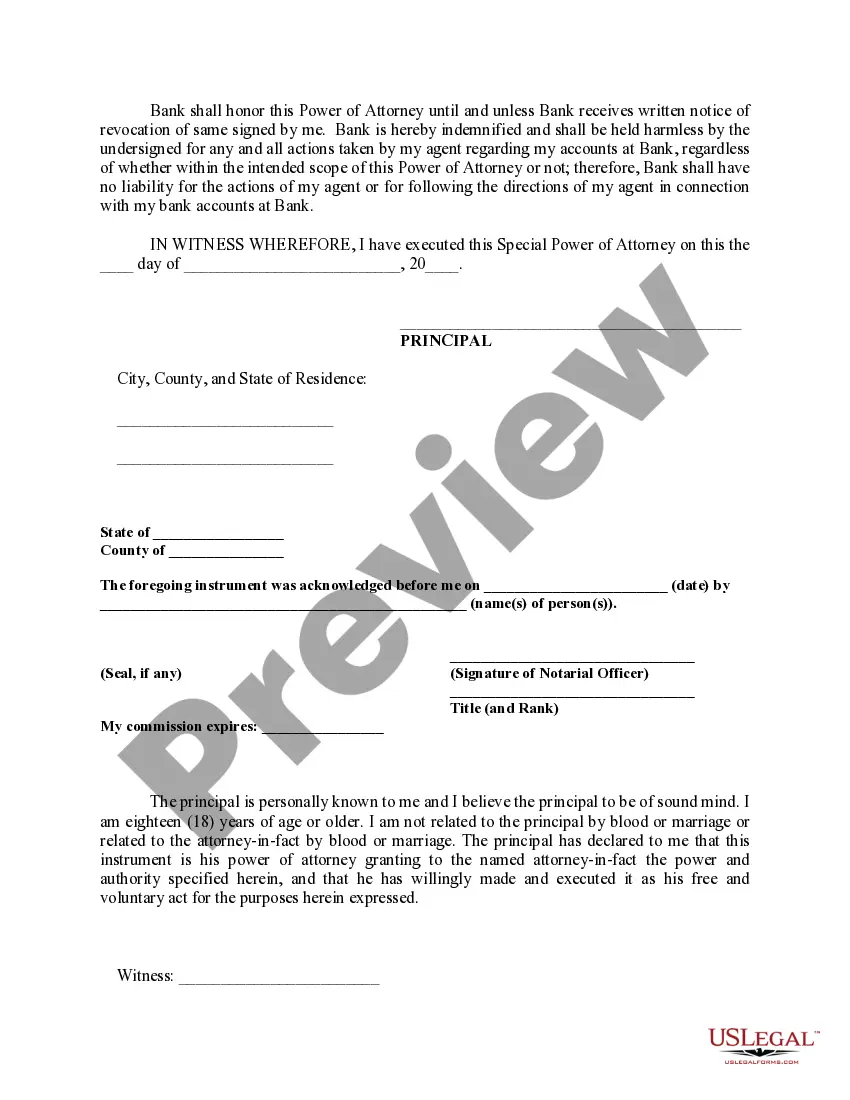

In Maryland, to create a valid special power of attorney with notary, the document must be in writing and signed by the principal. You must also have it signed by a notary public. The document should specify the powers granted and be dated to avoid any confusion. Additionally, adhering to these requirements offers clarity and helps protect the best interests of all parties involved.

When a special power of attorney is notarized, it means that a notary public has confirmed the identities of the signers and witnessed the signing process. This act enhances the document's credibility and may be required for legal recognition. Notarization also safeguards against fraud, ensuring that the document reflects the true intentions of the principal. This additional step provides peace of mind for both the principal and the agent.

The notary plays an essential role in a special power of attorney with notary by verifying the identities of the parties involved. This adds a layer of legal protection and authenticity to the document. The notary also confirms that the principal is signing voluntarily and is mentally competent to do so. Such measures help ensure the power of attorney holds up if challenged.

In New Jersey, a special power of attorney with notary must be in writing and signed by the principal. You also need to have it witnessed by one person, along with notarization. The document should clearly outline the powers granted and be dated. This clarity helps prevent misunderstandings about the authority being conveyed.

A family member can serve as a notary, but it is generally not recommended due to potential conflicts of interest. When seeking a special power of attorney with notary, impartiality is vital to ensure the legitimacy of the document. It is often better to choose a notary who is a neutral party, which helps prevent disputes later. Always check state laws for any specific requirements.

Banks will generally notarize a special power of attorney with notary if you are an account holder at that institution. They require you to provide a completed document and sign it in front of the banker serving as the notary. Always check with your local branch for specific requirements or charges associated with this service. Resources from USLegalForms can help ensure your document is ready for the bank.

Yes, many banks offer notary services and can help you notarize a special power of attorney with notary. However, it is best to call ahead to confirm that the branch offers this service, as availability can vary. Also, ensure that the document is completed before your visit, as notaries usually cannot help with filling it out. Platforms like USLegalForms can assist you in preparing your documents for notary.

You can have a special power of attorney with notary notarized at various locations, including banks, legal offices, and notary services. Many local government offices also offer notary services. Make sure to check that the notary you choose is licensed and can legally perform this service in your state. Using platforms like USLegalForms can help you locate nearby notary services more easily.

A notary cannot act as an attorney in fact unless they are also designated as such in the special power of attorney with notary. Their role is primarily to witness the signing of the document and verify identities, not to make decisions on behalf of the principal. Ensure your agent and notary are distinct roles to maintain legal clarity. Platforms like USLegalForms can help clarify these roles through their resources.

When using a special power of attorney with notary at a bank, the agent can conduct transactions on behalf of the principal. The bank will typically require a copy of the power of attorney document to verify the authority granted. It is essential to ensure that the document is correctly notarized, as banks often check for this. Understanding these requirements can help streamline your banking transactions.