Account Living Trust With Mortgage

Description

Form popularity

FAQ

Yes, you can place your house into an account living trust with mortgage. It's important to notify your mortgage lender about this action. Generally, transferring your home into a living trust does not trigger a due-on-sale clause, but lenders may have specific guidelines. Additionally, using a living trust can help manage your property more efficiently and ensure that your wishes are carried out after your passing.

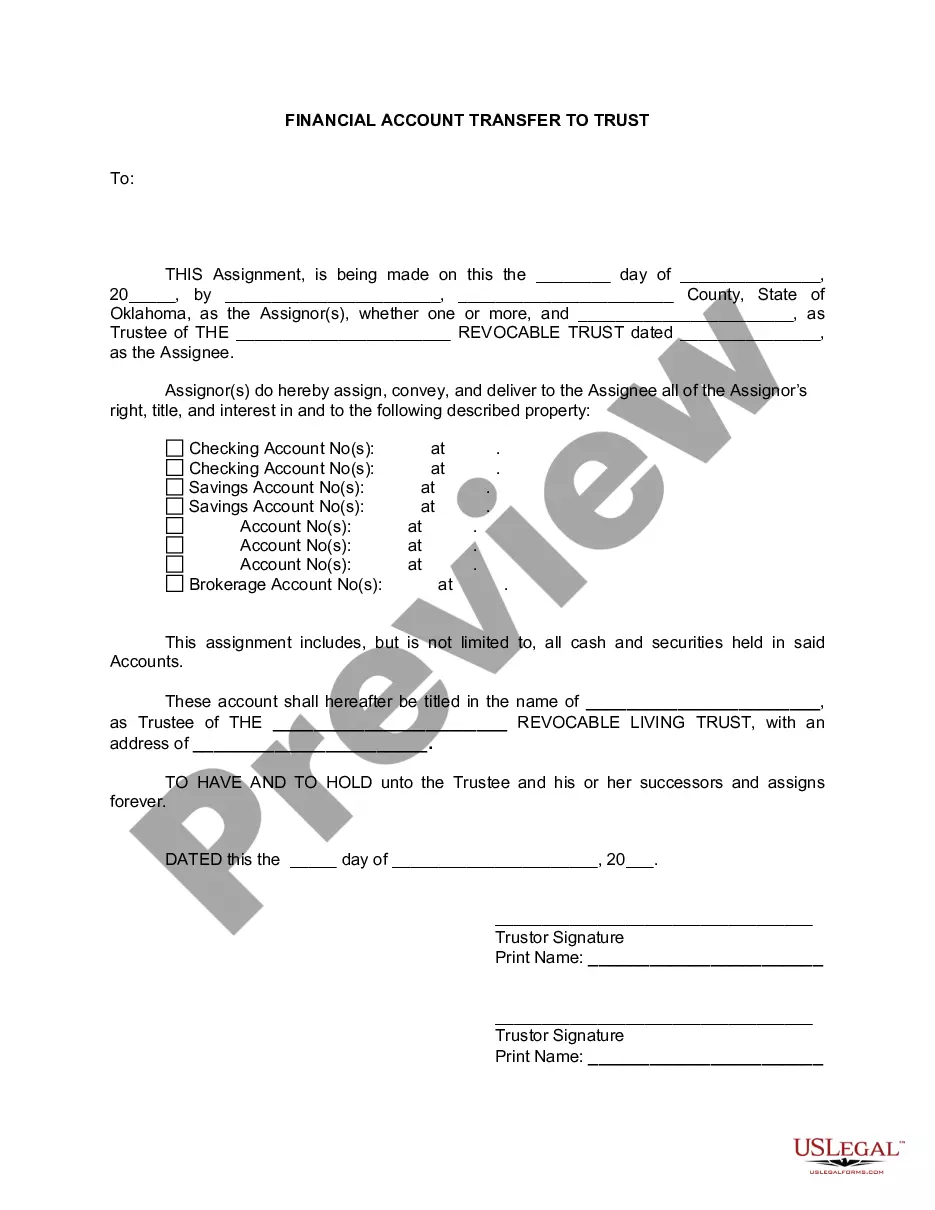

To place your bank account into your account living trust with mortgage, begin by contacting your bank. You will need to request a change of ownership or a change of account title. This process typically involves filling out specific documents and providing a copy of your living trust. Completing these steps ensures your bank account is managed according to your trust, allowing for a seamless financial transition.

When a house is inherited, the mortgage usually remains in effect. The heirs need to continue payments or negotiate with the lender. If the mortgage balance is high, selling the property might be necessary to settle the debt. Utilizing an account living trust with a mortgage can help in understanding the transition process.

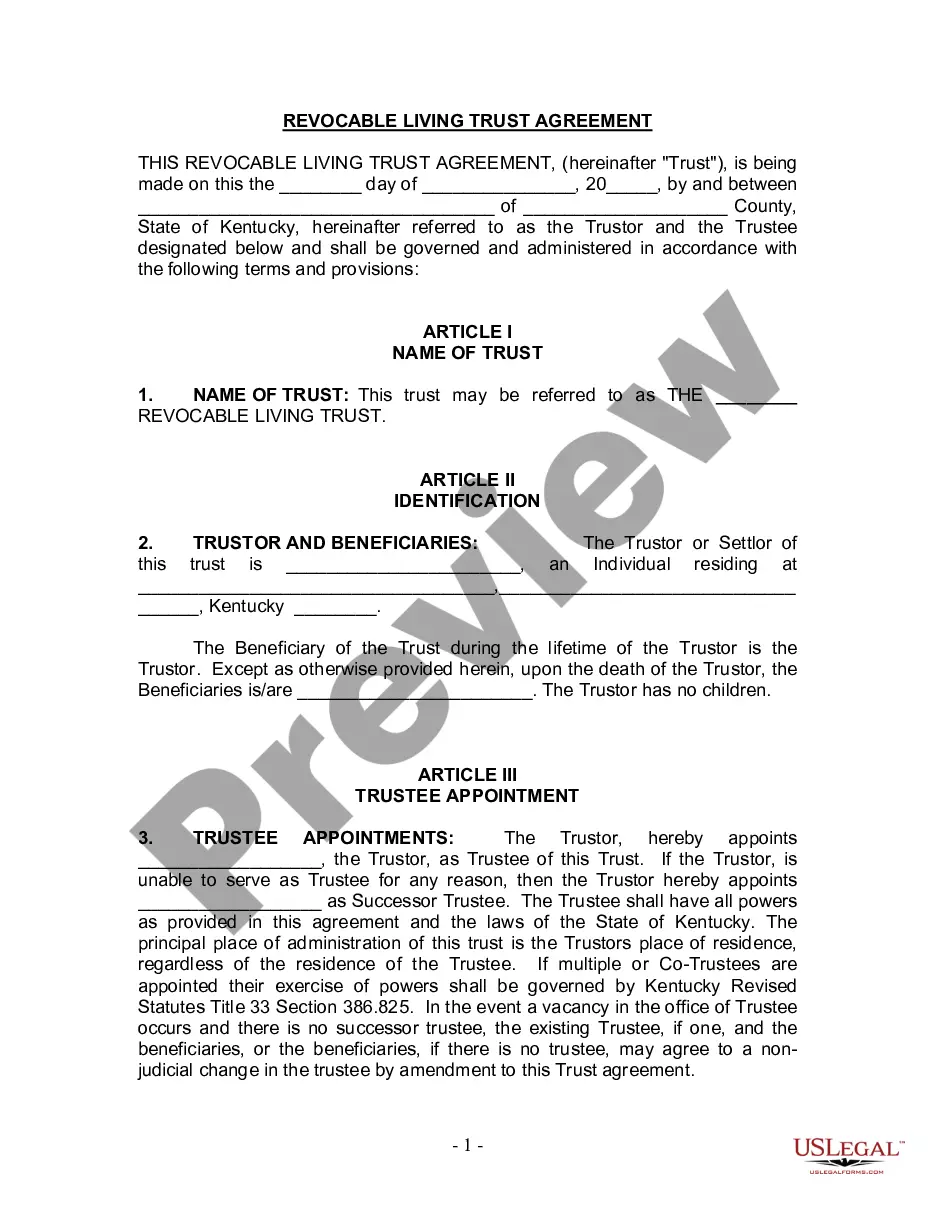

One significant mistake parents make is not properly funding their trust. They may overlook assets like real estate or investment accounts, which can lead to complications later. Additionally, failing to communicate with heirs about the trust can create misunderstandings. Setting up an account living trust with a mortgage ensures all relevant assets are included.

Placing assets in a trust can provide your parents with peace of mind and simplify the distribution process after their passing. It helps protect their assets from probate, which can be a lengthy ordeal. However, they should carefully consider whether establishing an account living trust with mortgage aligns with their financial goals and circumstances before proceeding.

Setting up a trust involves numerous steps that can be overwhelming without proper guidance. Common pitfalls include not clearly defining the terms of the trust, failing to fund the trust properly, and overlooking tax implications. If you are considering an account living trust with mortgage, taking advantage of user-friendly platforms like uslegalforms can help you avoid these mistakes.

A family trust can protect your assets, but it may come with management responsibilities that require your attention. Some family members may feel confused or excluded, leading to disputes about family dynamics. When considering an account living trust with mortgage, be sure all family members understand the structure to promote transparency.

Yes, you can establish a living trust even if your property has a mortgage. However, it's essential to ensure that your lender is informed, as this could alter the terms of your mortgage agreement. Creating an account living trust with mortgage can actually simplify estate management while still allowing you to fulfill your mortgage obligations.

Putting your house in a trust can lead to potential complications, especially when it comes to refinancing or selling the property. If you hold a mortgage, the lender may have specific requirements or restrictions. Be mindful that an account living trust with mortgage might complicate access to home equity, should you need those funds in emergencies.

Trust funds can appear complicated and may seem intimidating for some individuals. Additionally, they often require careful management and may involve costs, including fees for setting up and maintaining the trust. Furthermore, an account living trust with mortgage could limit your flexibility in managing your assets, especially if not structured correctly.