Name Change Form With Irs

Description

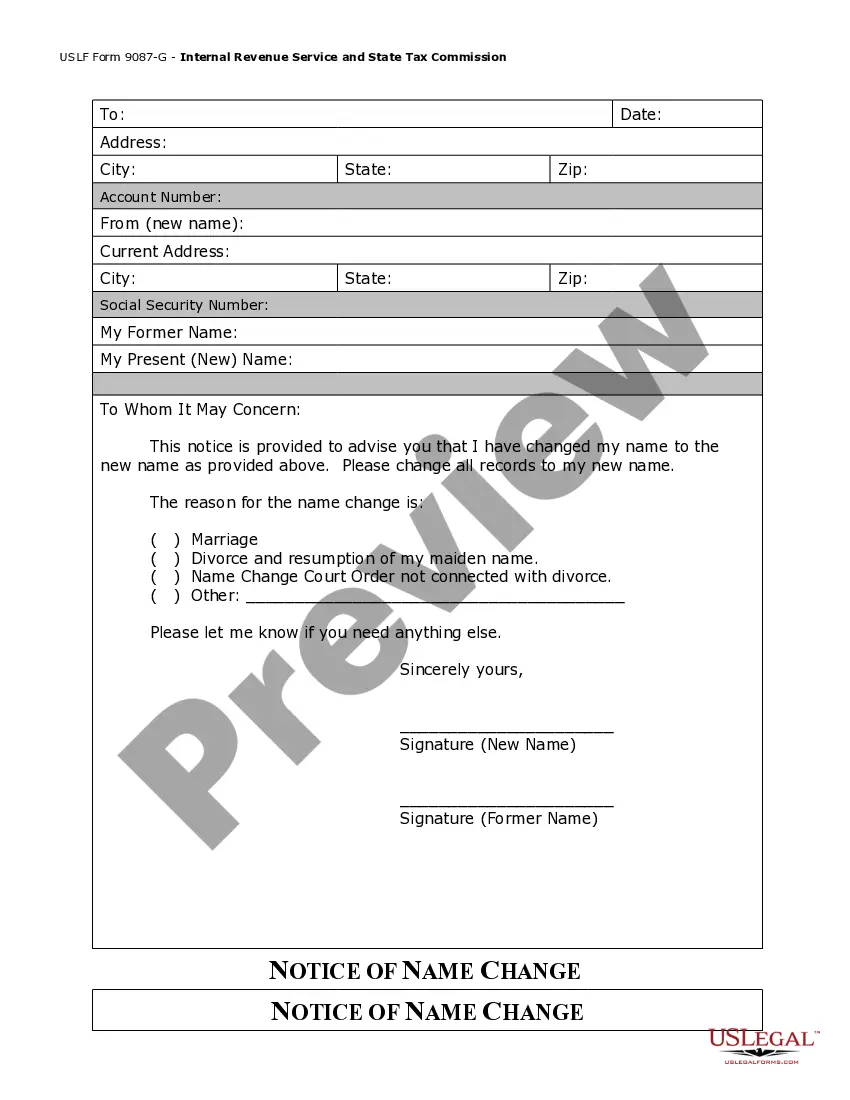

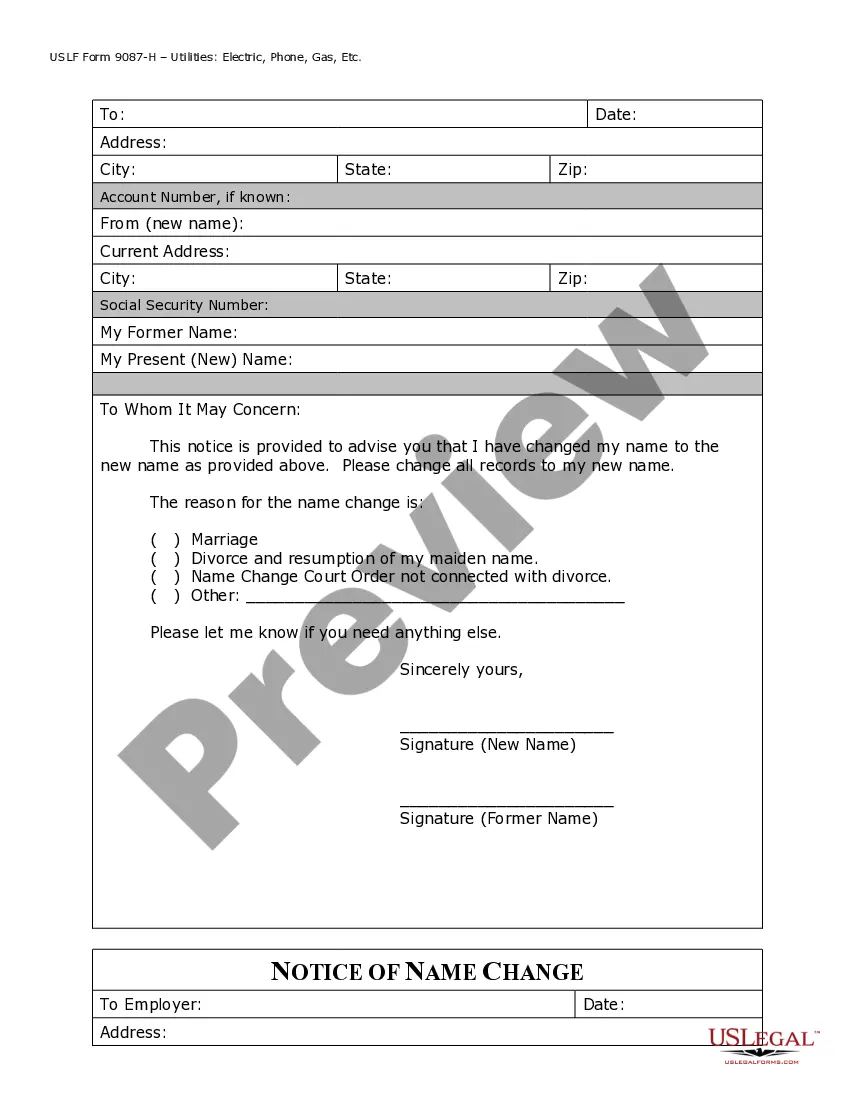

How to fill out Oklahoma Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

- If you're a returning user, log in to your account, ensure your subscription is active, and download the name change form with IRS by clicking the Download button.

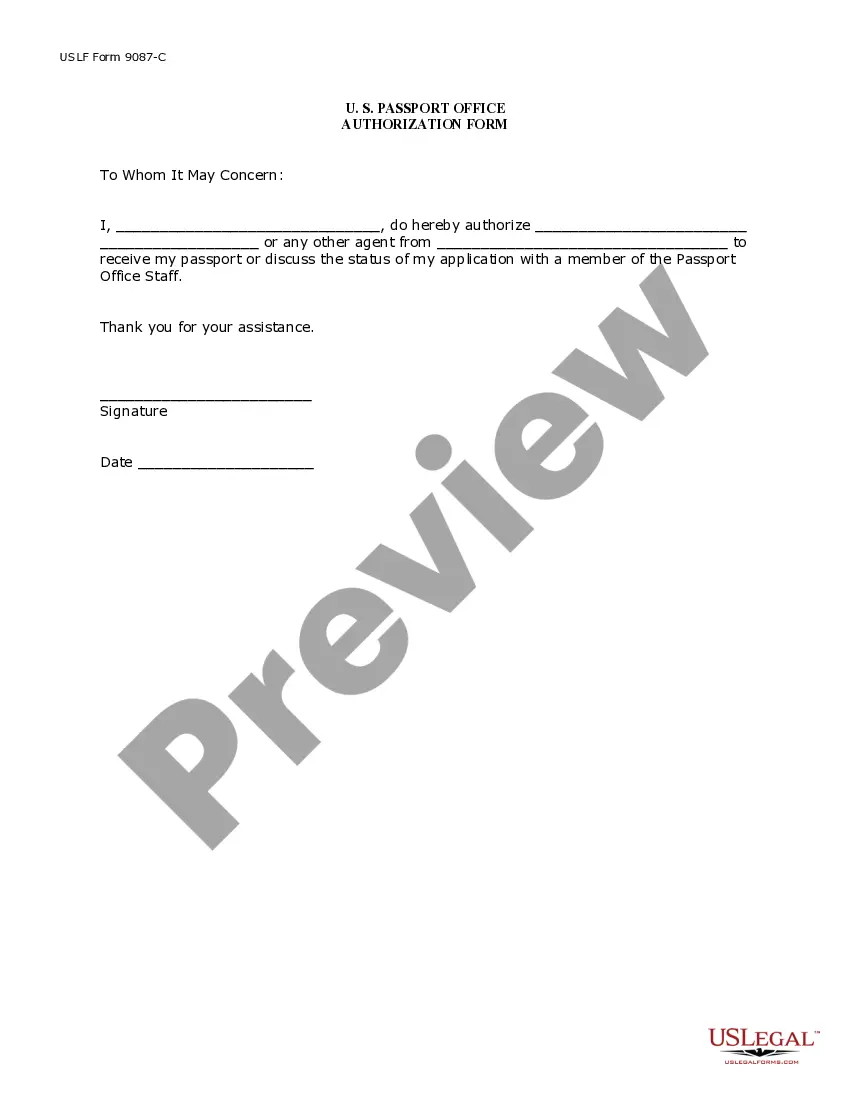

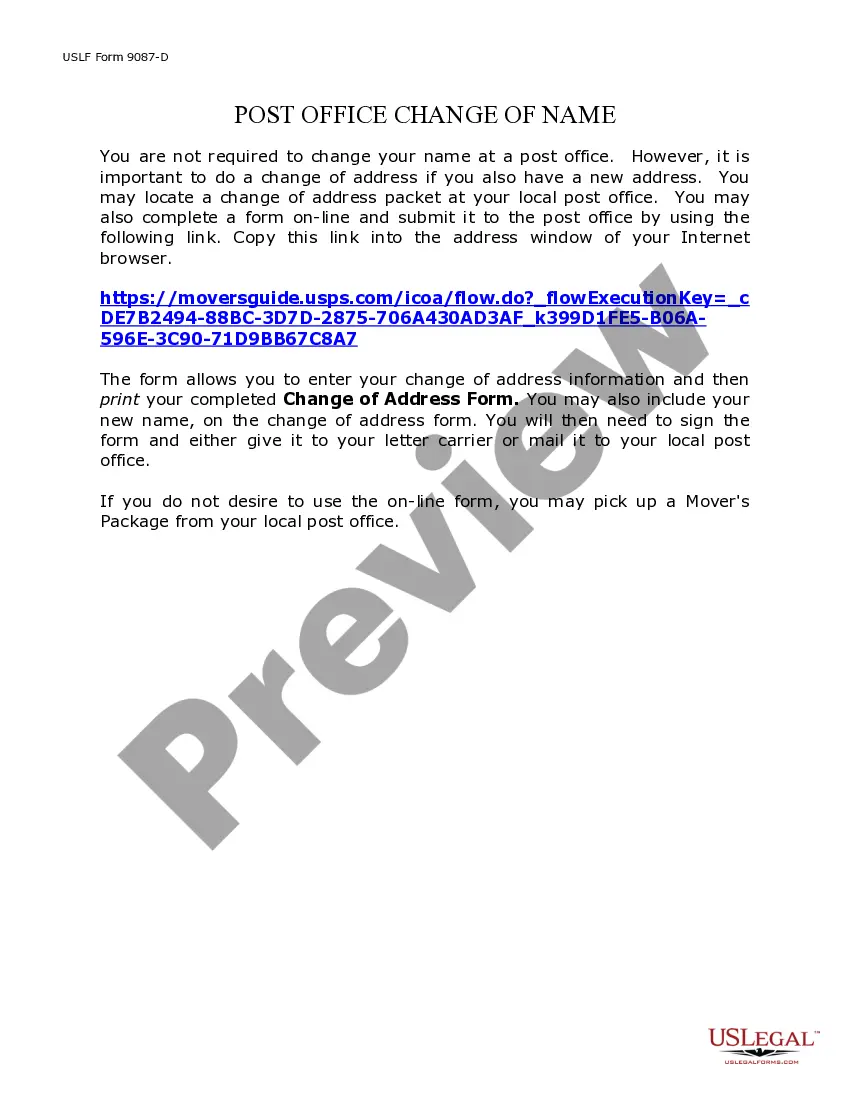

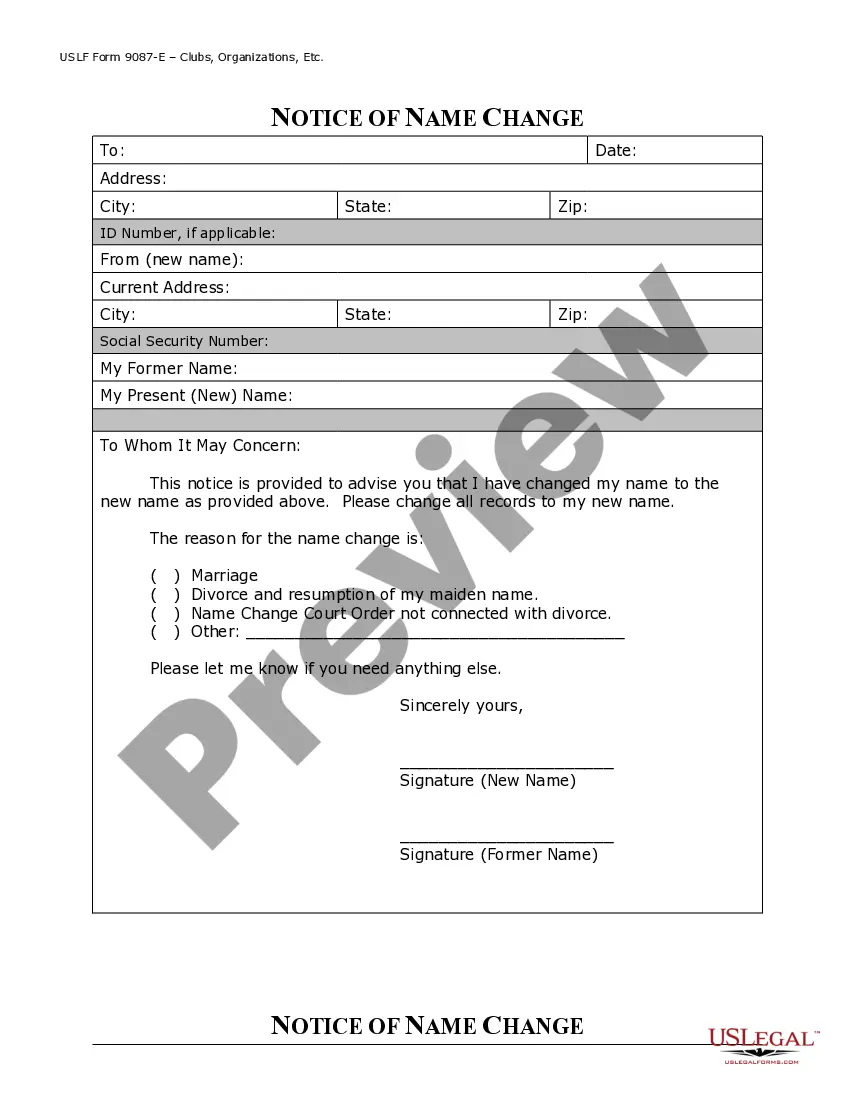

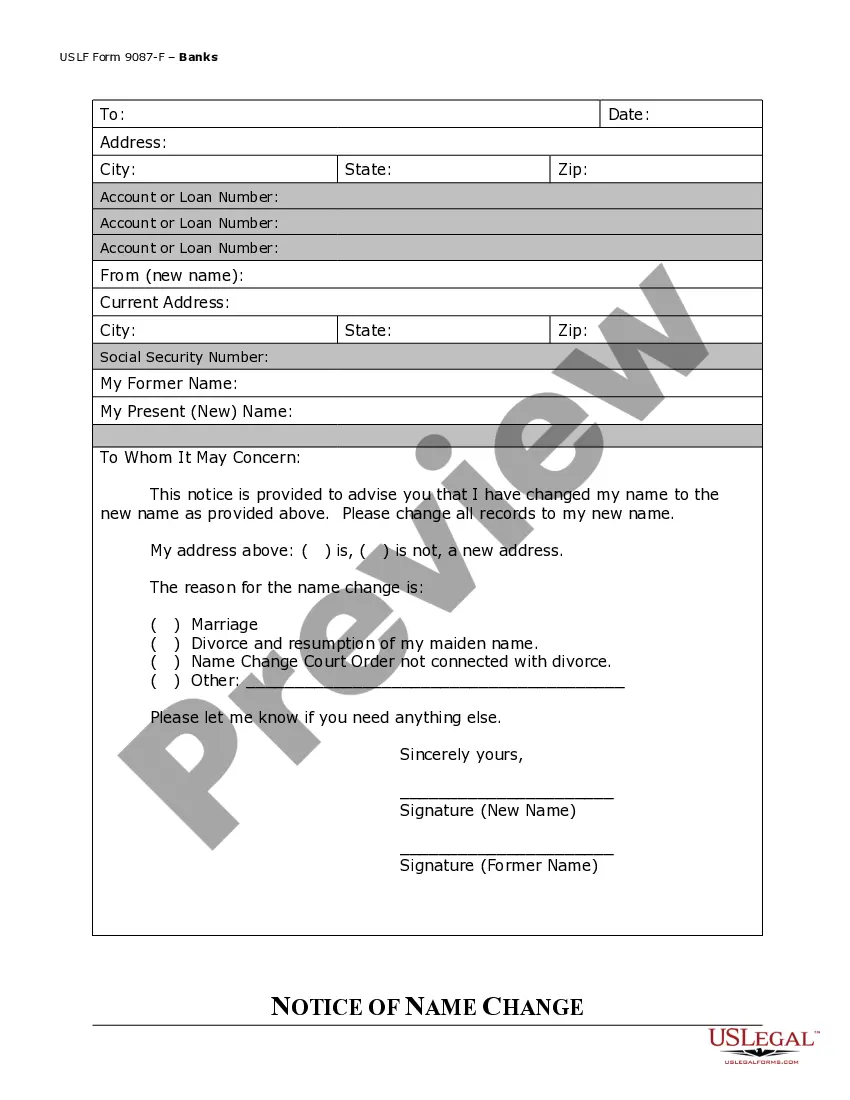

- For first-time users, start by browsing the detailed descriptions in Preview mode. Confirm that the form you select is suitable and compliant with your local jurisdiction's requirements.

- If more forms are necessary, utilize the Search tab above to find a matching document. Choose the right template and proceed.

- Purchase the selected document by clicking on the Buy Now button and selecting your preferred subscription plan. Don’t forget to create an account to unlock the full library.

- Complete your payment by providing your credit card information or using your PayPal account. Once completed, you will have full access.

- Download the name change form with IRS to your device and access it anytime from the My Forms section of your account.

By using US Legal Forms, you gain access to one of the largest collections of legal forms available online, featuring over 85,000 editable documents. This platform is designed to make legal paperwork simple and accessible for everyone.

Don't delay your necessary updates—visit US Legal Forms today and streamline your name change process!

Form popularity

FAQ

Changing your name back through the IRS can take a similar timeframe of four to six weeks, depending on various factors. Again, submitting the name change form with IRS correctly is essential for a smooth process. If you need assistance, using platforms like US Legal Forms can simplify this process by providing easy access to the necessary forms and guidance. Staying informed and following the steps ensures a timely update.

An IRS name change typically takes about four to six weeks after you submit the name change form with IRS. This timeline depends on the volume of applications the IRS is handling at the time. To avoid unnecessary delays, ensure that the form is completed accurately and all supporting documents are included. Being proactive can make a significant difference in your experience.

The IRS generally updates its records within a few weeks after processing your name change form with IRS. However, delays can occur due to various factors, including seasonal workloads or incomplete submissions. To expedite the process, ensure that all required information is submitted correctly. Checking the status regularly can also help you stay informed.

Yes, the name on your W-2 must match the name on your Social Security card. This ensures that the IRS can accurately track your earnings and taxes. If you have recently changed your name, it is crucial to submit the name change form with IRS promptly. Failure to match these names may result in tax processing delays and complications.

To inform the IRS that you have changed your name, complete and submit Form 8822, which is the name change form with IRS. Be sure to provide accurate information, including your previous name and the new name. Mailing this form promptly helps ensure that your tax records remain accurate and up-to-date. Services like USLegalForms can simplify this process, helping you navigate the necessary steps with ease.

Yes, you can submit a change of address to the IRS online if you are filing your tax return electronically. However, if you have already submitted a name change form with IRS, be aware that the address change must be submitted separately. Utilize the IRS e-file options for convenience when reporting updates. Always confirm that your address and name are current to avoid miscommunication with the IRS.

Yes, the IRS provides Form 8822, which serves as the official name change form with IRS. This form allows individuals to notify the IRS about changes to their legal name after alterations like marriage or divorce. Filling out this form accurately ensures that the IRS updates its records to match your current name. You can easily find and download this form on the IRS website or use platforms like USLegalForms for added convenience.

Not all IRS forms can be submitted electronically. While many forms are available for electronic filing, others, such as the name change form with IRS, require mail submission. You need to confirm the electronic filing status of each form on the IRS website. Always verify the submission method in order to ensure you are using the correct procedure for your situation.

Certain forms, including Form 8822, cannot be filed electronically. Common non-electronic forms include those related to specific circumstances or changes. Check the IRS website to find an updated list of forms that require paper submission. Using the name change form with IRS properly will help you maintain accurate records, which is always beneficial.

As of now, you cannot electronically file Form 8822, which is specifically for notifying the IRS of a name change. You must print and mail the form instead. This requirement may change in the future, so it is wise to check the IRS website regularly for updates. Proper submission of the name change form with IRS is essential for ensuring your tax records correctly reflect your identity.