Business Name Change Form With Irs

Description

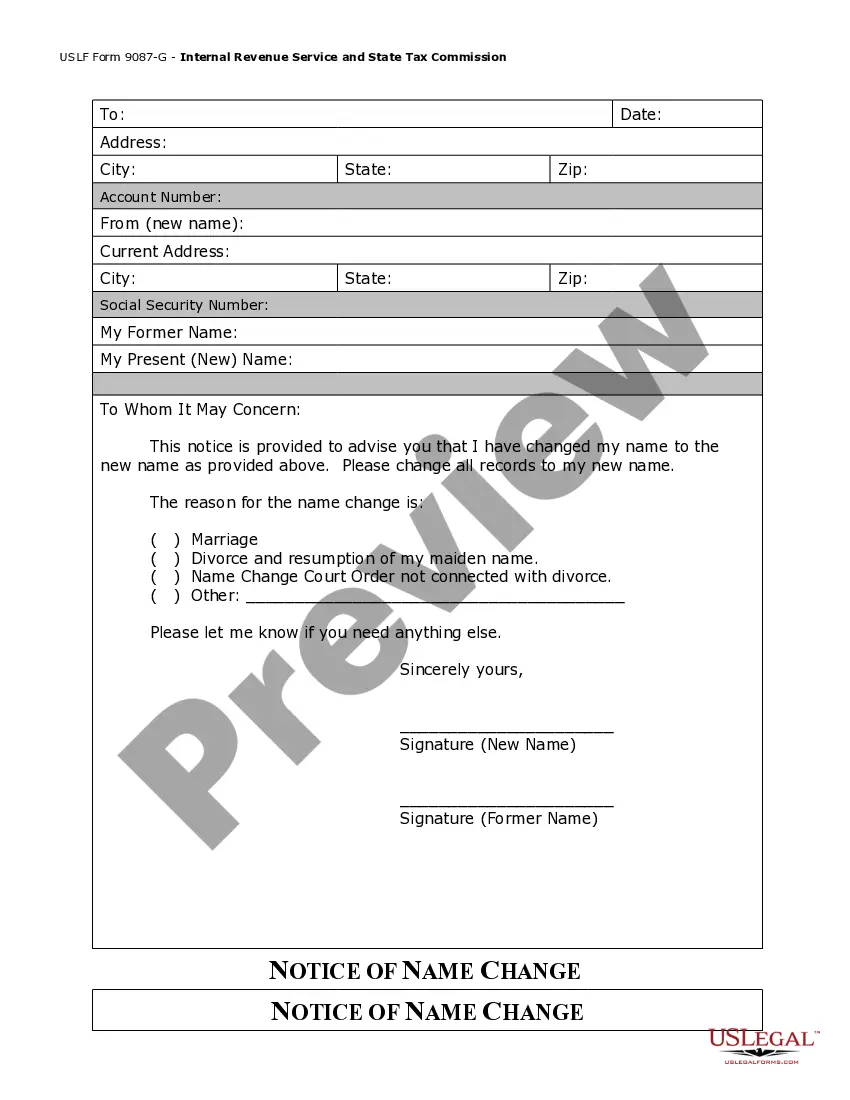

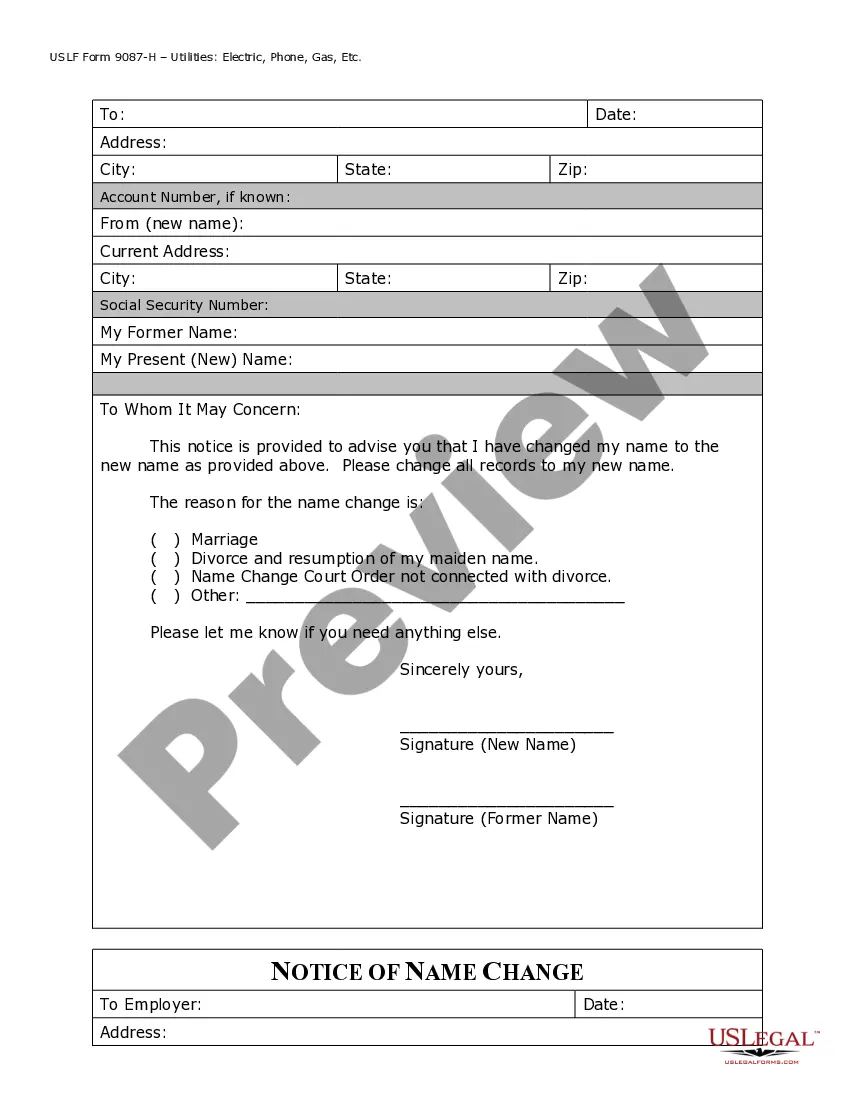

How to fill out Oklahoma Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

- If you are a returning user, log in to access your account and download the Business name change form with IRS directly to your device.

- For first-time users, start by reviewing the form description in Preview mode to confirm it aligns with your requirements and local laws.

- If you need a different document, use the search bar to locate alternatives that fit your criteria.

- Once you’ve chosen the right form, click on the Buy Now button and select your desired subscription plan, registering for an account to access the form library.

- Proceed to checkout by entering your payment information, either through credit card or PayPal.

- Complete the download process, saving the template to your device. You can revisit this form later through the My Forms section.

Utilizing US Legal Forms offers immense benefits, including a vast selection of over 85,000 legal forms, expert assistance, and cost-effective solutions that surpass competitors.

Embark on your journey of rebranding today with the right tools at your fingertips. Visit US Legal Forms now to simplify your business name change process!

Form popularity

FAQ

Yes, you can update your business name with the IRS by completing a Business Name Change Form with the IRS. This form is essential for ensuring that the IRS recognizes your new business name officially. Submitting the form correctly will help maintain your business's compliance and ensure all tax-related documentation is accurate. Make sure to keep a copy of the form for your records.

You can update your EIN information through the IRS by submitting a Business Name Change Form with the IRS if your business name has changed. If you are changing other details, different forms might be required. Always ensure that your EIN information is current to avoid issues with your taxes. Keep records of all submissions for reference.

To update your business information with the IRS, begin by identifying what information needs to change, such as your business name, address, or structure. For name changes, use the Business Name Change Form with the IRS. Complete the form accurately and submit it along with required documentation. Following up with the IRS can help confirm that your updates are reflected in their systems.

Changing your business status with the IRS requires you to evaluate the specific changes you're making. Depending on the nature of the change, you may need to fill out a Business Name Change Form with the IRS or other specific forms related to your business status. Ensure you have all necessary documentation, and track your submission for timely updates. Understanding your new status is vital for compliance.

To update your business address with the IRS, you must complete a Business Name Change Form with the IRS, indicating the new address. It is essential to provide accurate information to avoid future complications. After submitting the form, you should receive confirmation from the IRS once the change has been processed. This ensures that all correspondence reaches you without delay.

The approval time for a business name change with the IRS can vary, but it typically takes about four to six weeks. Once you submit your Business Name Change Form with the IRS, the agency processes it in the order received. During this period, it is beneficial to monitor your business records to ensure the update reflects correctly. Patience is key, so plan accordingly.

To change your business name with the federal government, you need to complete a Business Name Change Form with the IRS. This form serves as an official announcement of your new name and ensures that all records are updated. After filling it out, submit the form along with any required documentation. Keep copies of everything for your records to simplify future reference.

Writing a business name change letter involves stating your current business name, the new name, and providing your EIN. It's important to include any relevant details to clarify the reason for the change. Using a business name change form with IRS can streamline this process and ensure all necessary information is conveyed.

To notify the IRS of a name change for your business, you should submit a properly completed business name change form with IRS to their designated address. Ensure that all relevant information is included to avoid delays. This will officially update your records with the IRS.

When writing a letter to the IRS for a business name change, include your old and new business names, EIN, and a brief explanation for the change. Ensure to keep the letter professional and concise. Sending this letter along with the business name change form with IRS is crucial for proper record-keeping.