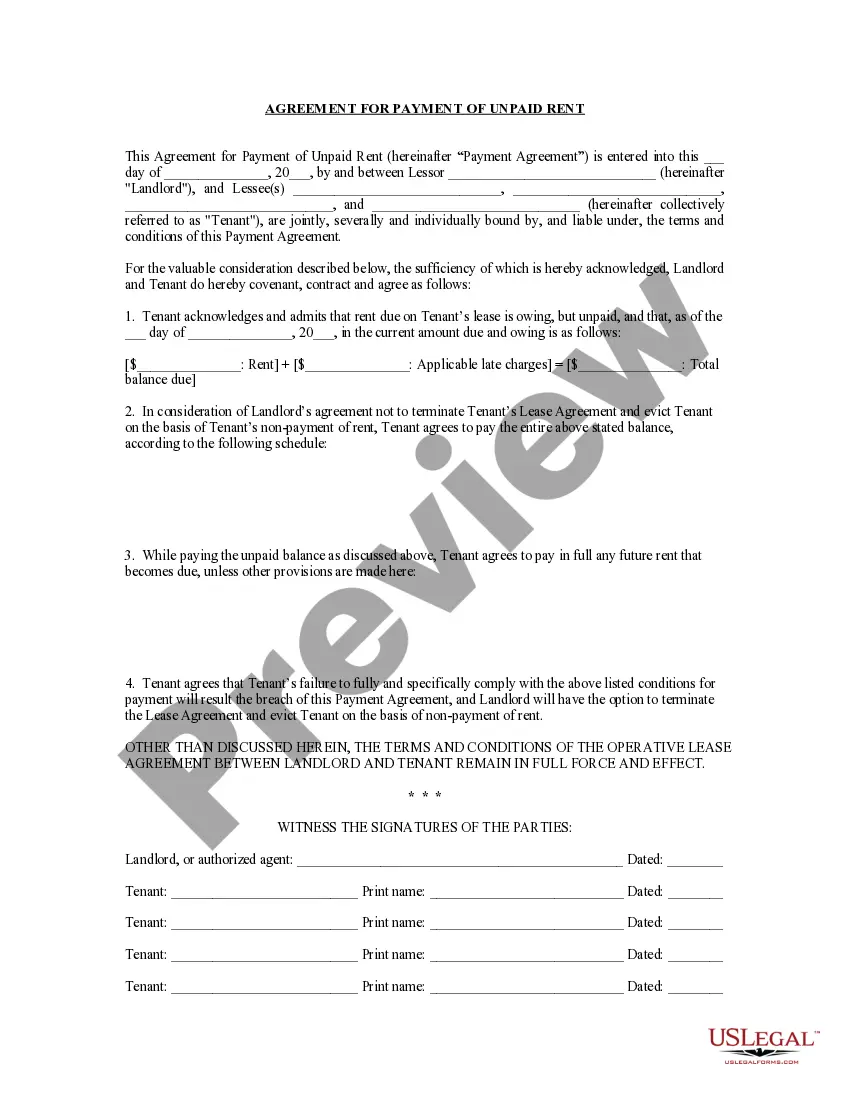

Oklahoma Agreement Form Withholding

Description

How to fill out Oklahoma Agreement For Payment Of Unpaid Rent?

How to obtain professional legal documents compliant with your state regulations and complete the Oklahoma Agreement Form Withholding without hiring a lawyer.

Numerous services online offer templates to address various legal needs and formalities. However, it may require time to discern which of the available samples meet both the intended use and legal standards for you.

US Legal Forms is a reliable platform that aids you in finding official documents drafted in line with the most recent updates to state laws, while also helping you save on legal fees.

If you do not have an account with US Legal Forms, follow the guide below: Review the webpage you’ve opened and confirm if the form aligns with your requirements.

- US Legal Forms is not an ordinary online library.

- It is a compilation of over 85,000 verified templates for diverse business and personal scenarios.

- All documents are categorized by area and state, expediting your search process and making it more convenient.

- Additionally, it integrates with robust PDF editing and eSignature solutions, enabling users with a Premium subscription to swiftly complete their paperwork online.

- It requires minimal time and effort to acquire the needed documents.

- If you already possess an account, Log In and verify that your subscription is active.

- Download the Oklahoma Agreement Form Withholding by clicking the appropriate button next to the file name.

Form popularity

FAQ

You set up your account by registering your business with the OTC either online or on paper. To register online, go to the Online Business Registration section of the OTC website. (A link will take you to the Oklahoma Taxpayer Access Point (OkTAP).) Processing of an online application takes a minimum of 5 days.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

How to file a W-4 form in 5 StepsStep 1: Enter your personal information. The first step is filling out your name, address and Social Security number.Step 2: Multiple jobs or spouse works.Step 3: Claim dependents.Step 4: Factor in additional income and deductions.Step 5: Sign and file with your employer.

How to file a W-4 form in 5 StepsStep 1: Enter your personal information. The first step is filling out your name, address and Social Security number.Step 2: Multiple jobs or spouse works.Step 3: Claim dependents.Step 4: Factor in additional income and deductions.Step 5: Sign and file with your employer.

For example, a withholding allowance could be based on whether you can claim the child tax credit for a qualifying child (or a dependent who is not a qualifying child), and whether you itemize your personal deductions instead of claiming the standard deduction, whether you or your spouse have more than one job, and