Form 13614-c

Description

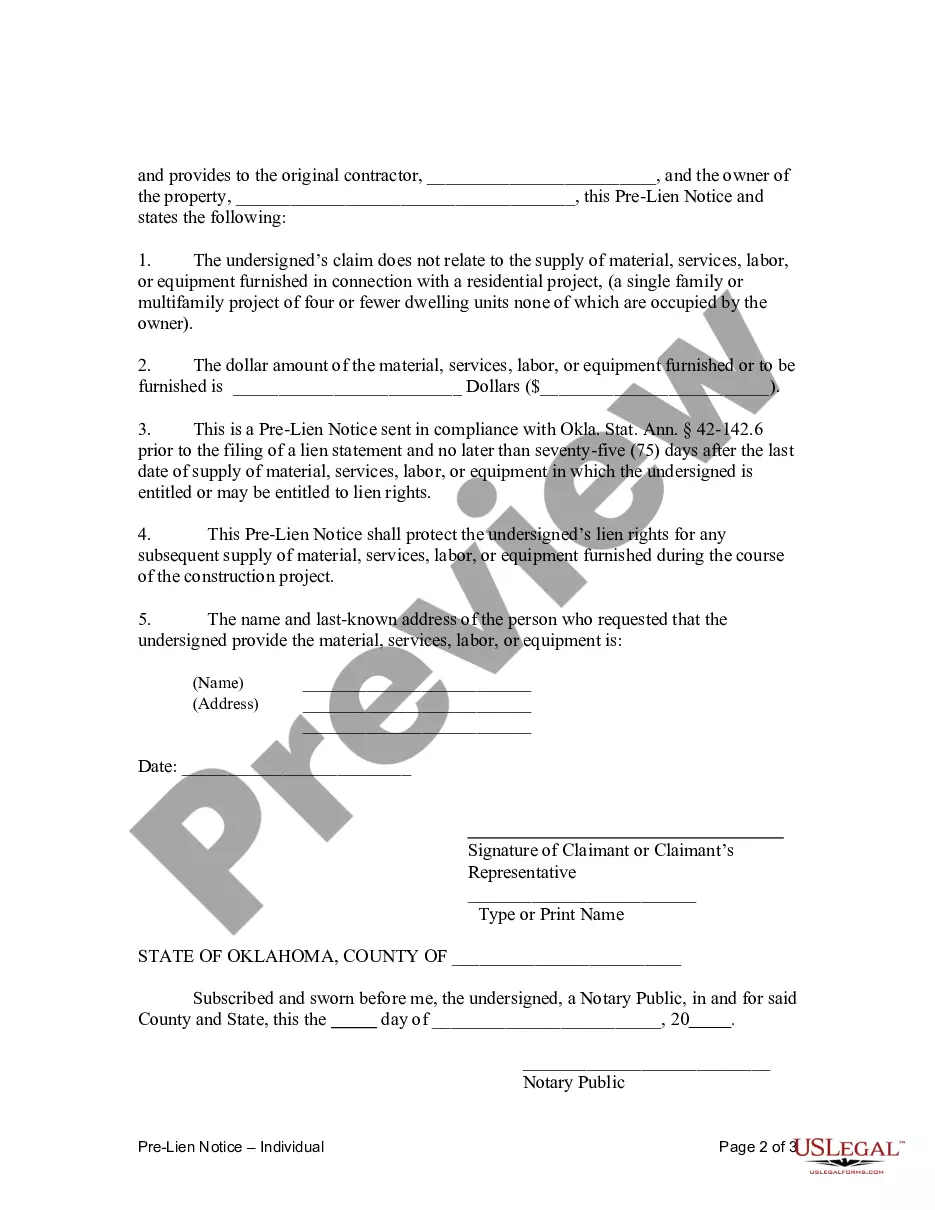

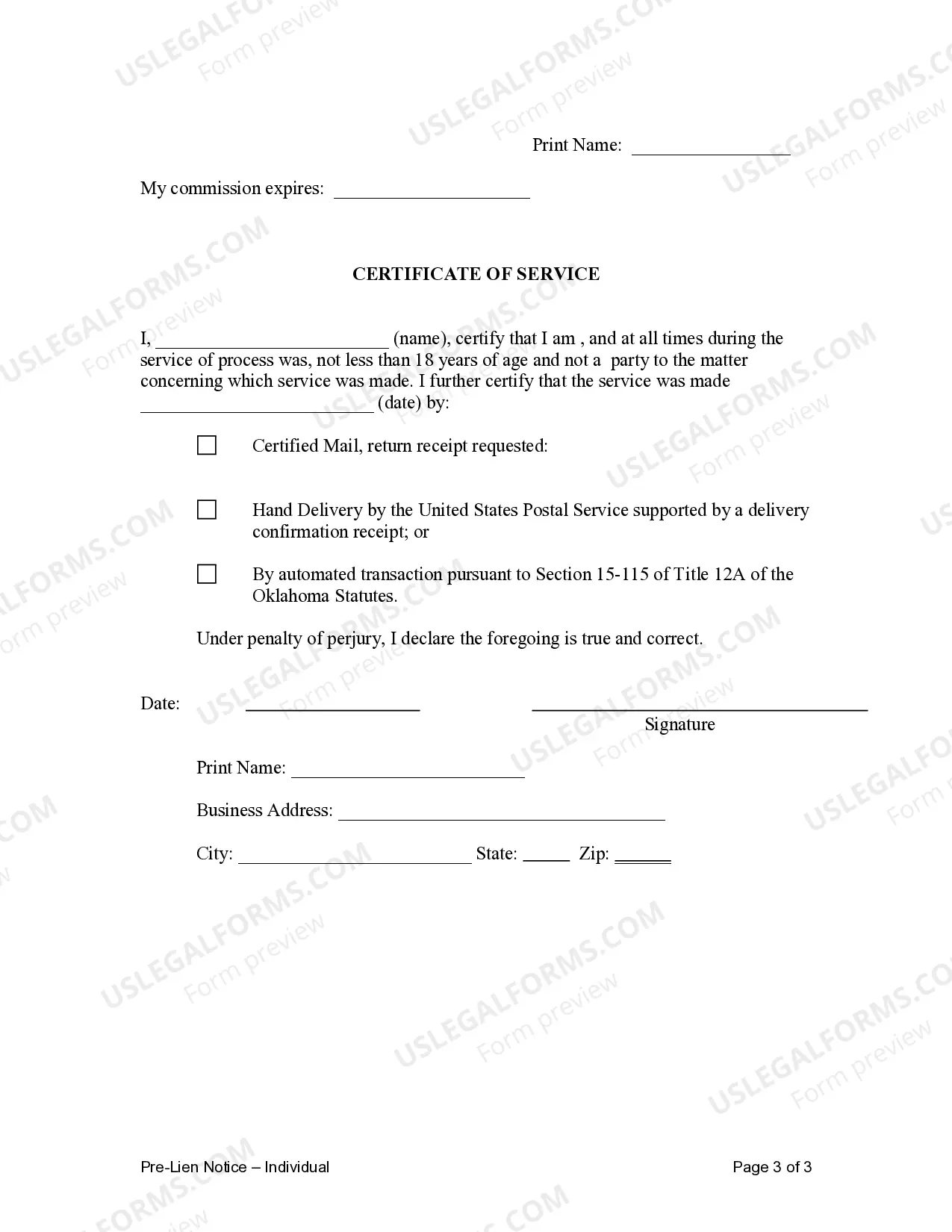

How to fill out Oklahoma Pre-Lien Notice - Individual?

- If you're a returning user, log into your account and ensure your subscription is active. Click the Download button to get your Form 13614-c on your device.

- For first-time users, start by checking the Preview mode and form description of the Form 13614-c. Make sure it aligns with your requirements and local regulations.

- Should you need a different template, utilize the Search tab to find the right form. Verify its suitability before proceeding.

- To purchase the document, click the Buy Now button. Select your preferred subscription plan and create an account for access to additional resources.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Finally, download your form. Save it to your device and access it anytime through the My Forms section of your account.

US Legal Forms offers a remarkable library with over 85,000 easily editable legal documents, empowering both individuals and attorneys to manage their legal needs effectively.

With robust resources and the ability to consult premium experts for assistance, starting your journey with Form 13614-c has never been easier. Begin simplifying your legal processes today!

Form popularity

FAQ

The purpose of Form 13614-C is to collect comprehensive taxpayer information that assists in the accurate preparation of tax returns. By providing essential details, taxpayers facilitate the filing process, allowing professionals to offer better advice and services. Thus, using Form 13614-C not only helps individuals understand their tax responsibilities but also makes it easier to navigate the complexity of tax preparation.

The project intake form serves as the first step in collecting necessary information for any new project, aiding in proper organization and planning. When utilized effectively, this form can streamline communication and expectations, ensuring that all parties are on the same page. If your project involves tax preparation using Form 13614-C, having a robust intake form can facilitate a smoother submission process.

The IRS penalty payment form is used by taxpayers to make payments on penalties assessed by the IRS for various tax-related issues. This form helps individuals handle their payment obligations smoothly, reducing potential interests and additional penalties. If you encounter issues while filing with Form 13614-C, understanding the penalty process can help you stay compliant and prevent unexpected costs.

To verify information on Form 13614-C, start by reviewing the taxpayer's provided details, such as income, filing status, and deductions. Ensure that all the records are accurate and match the documentation the taxpayer has, such as W-2s or 1099s. This verification process helps guarantee that the taxpayer’s filing is correct, minimizing potential issues with the IRS.

Form 8453-C is utilized to authenticate the electronic submission of corporate income tax returns. This form allows taxpayers to sign their electronic returns and ensure compliance with IRS regulations. If you are using Form 13614-C to prepare your taxes, you may also need Form 8453-C to submit your return electronically, ensuring everything is in order.

You cannot directly download the 147C form online, as it is not available on the IRS website. Instead, you should call the IRS to request it. Alternatively, US Legal Forms provides helpful support and resources that can simplify this process for you.

Unfortunately, the IRS does not allow direct online access to your EIN letter. However, you can use services like US Legal Forms to assist in retrieving your documents more efficiently. This platform offers various resources that can guide you through the necessary steps.

The time it takes to receive your 147C form typically varies based on your request method. If you call the IRS, you may receive it quite quickly, often during the same call. However, if you submit a written request, it may take several weeks, so prepare accordingly.

You can request your IRS letter 147C or your SS-4 confirmation letter by contacting the IRS. Call their Business and Specialty Tax Line and provide them with necessary information about your business. They will guide you on how to receive your letter promptly.

To obtain the 147C form, also known as the EIN Verification Letter, you first need to contact the IRS directly. You can do this by calling their Business and Specialty Tax Line. Make sure to have your business information ready, as it helps speed up the process.